by David from The Future of Everything on (#6Y5A9)

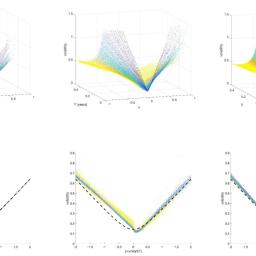

As seen in QEF15, stock market data follows q-variance and the q-distribution. Q-variance refers to the property that the expected variance of log returns x, corrected for drift, over a period T follows to good approximation the formula V(z)=^2+z^2/2 where z=xT. This property follows because we model price change as the displacement of a quantum [...]