World economic forecasts are for US to double growth to about 3.6% per year and China to gradually slow from 6.7 to 6.1%

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#28NDQ)

President-elect Donald Trump's policies have the potential to trigger a new age in U.S. economic growth that could serve as a global template, according to a Deutsche Bank forecast.

Gross domestic product growth would be double its current level under an agenda that cuts regulations across a broad swath of critical sectors, enacts tax reform that slashes personal and corporate taxes, and calls for at least $1 trillion in improvements for bridges, roads and other public projects.

"This policy mix has the potential of reigniting productivity growth and raising U.S. growth potential," David Folkerts-Landau, chief economist at Deutsche Bank, said in a report for clients. "While Trump introduces higher uncertainty, this is better than the near certainty of the continuation of a mediocre status quo."

The impact may not be felt immediately, but once the new agenda kicks in it will serve as a "game changer for the U.S. economy," Folkerts-Landau added.

In raw numbers, that would push 2017 growth to 2.4 percent and 2018 up to 3.6 percent. By way of comparison, the economy has grown an average of about 1.6 percent a year under President Barack Obama, the worst recovery since the Great Depression. Obama is the first president since Herbert Hoover not to see at least 3 percent growth for a calendar year.

U.S. growth will bleed into the world economy, according to Deutsche, which pushed its 2017 global GDP forecast from 3 percent to 3.4 percent.

One of the broad keys for the Trump economy will be a shift from one that relies on aggressive monetary policy - zero interest rates, trillions in Fed money-printing - to fiscal policies focused on more broad-based growth that will stretch from Wall Street to Main Street.

There are downside risks. The most notable is that Trump simply disappoints in terms of how well his plans are enacted. Others are escalation of geopolitical risks, instability in China, trade wars, the Fed having to hike interest rates too quickly and a crisis in emerging markets

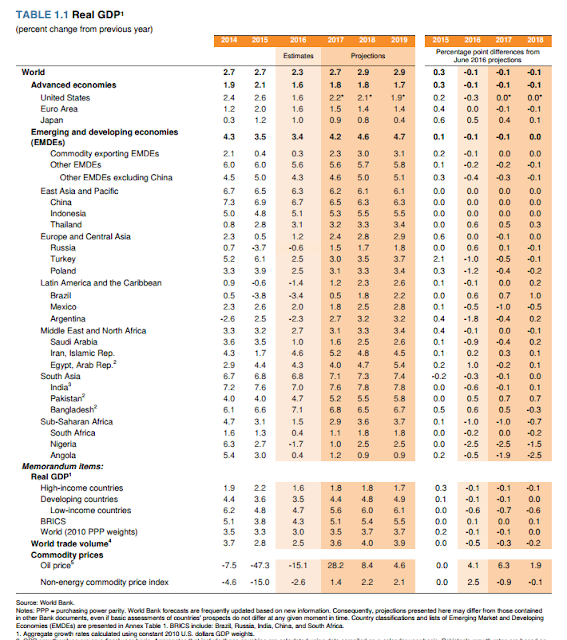

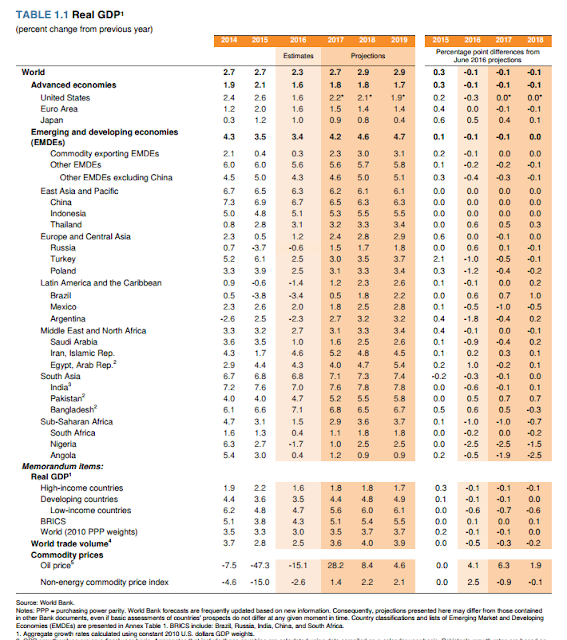

Last year was another year of stagnant global trade, subdued investment and heightened policy uncertainty. The World Bank expects a "moderate recovery" with receding obstacles to activity, especially for commodity exporters in 2017. The report also cited "solid domestic demand" in the economies of commodity importers like India. World trade volumes are seen rising 3.6% this year, followed by 4.0% in 2018, and crude oil prices are expected to average $55 per barrel.

According to the World Bank, a 1% increase in U.S. GDP next year translates into an additional 0.6% growth rate for emerging markets. Brazil, for example, will be lucky to grow 0.5% next year at current estimates. A better U.S., therefore, is better for Brazil.

The expectation of fiscal stimulus in the U.S. is the main driver behind the World Bank's growth forecast for 2017, though continually weak investment and productivity growth outside of the U.S. will weigh on medium-term prospects for poorer countries.

The World Bank has published its Global Economic Prospects report (276 pages)

The U.S. forecasts do not incorporate the effect of policy proposals by the new U.S. administration. The expectation is a 1.5% boost in GDP growth per year.

The U.S. forecasts do not incorporate the effect of policy proposals by the new U.S. administration. The expectation is a 1.5% boost in GDP growth per year.

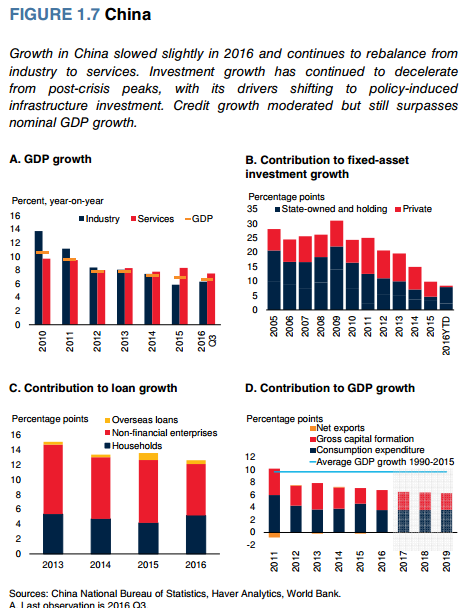

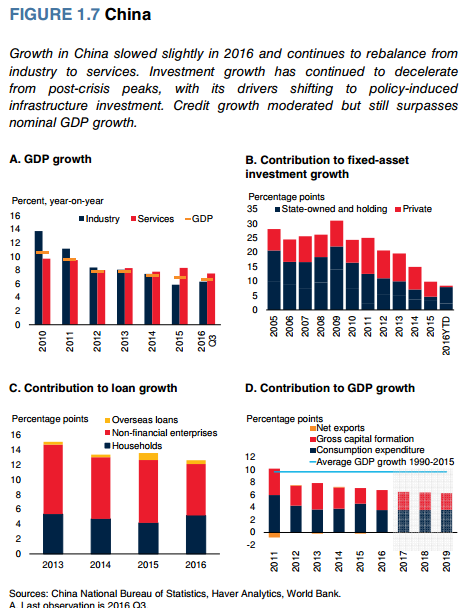

China, the world's second largest economy, today revised the size of its economy in 2015 to 68.91 trillion yuan (9.96 trillion US dollars), up 354.6 billion yuan from its preliminary figure.

The National Bureau of Statistics (NBS) said economic growth for 2015 was unchanged at 6.9 per cent but the size of China's economy in 2015 has been revised to 68.91 trillion yuan (9.96 trillion U.S. dollars), up 354.6 billion yuan from its preliminary figure.

China's gross domestic product is estimated to have expanded around 6.7 percent in 2016 and is projected to grow 6.5% in 2017

China's GDP is expected to grow by 6.1% in 2018

India is projected to grow at about 7 - 7.5% each year

Pakistan is projected to grow at 5 to 5.5% each year

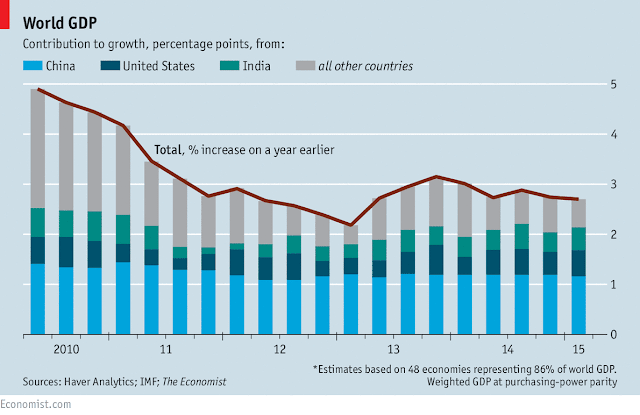

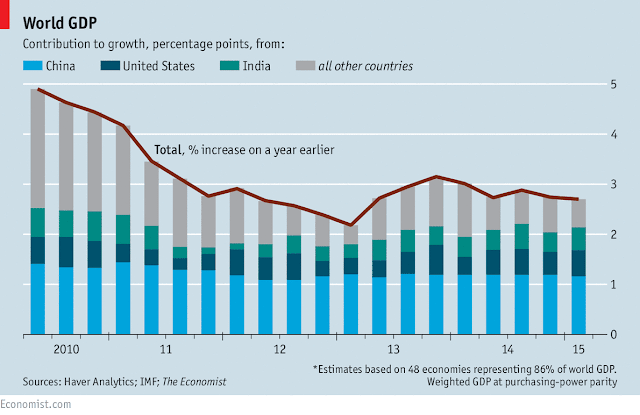

If the forecasts hold true then US contribution to world growth would be nearly as much as China's.

If the forecasts hold true then US contribution to world growth would be nearly as much as China's.

On a purchasing power parity GDP basis, the United State and China combine to represent about 33% of the world economy.

The world is about $120 trillion in PPP GDP in 2016. China is $21 trillion in PPP GDP and the USA is $18.5 trillion.

Read more

Gross domestic product growth would be double its current level under an agenda that cuts regulations across a broad swath of critical sectors, enacts tax reform that slashes personal and corporate taxes, and calls for at least $1 trillion in improvements for bridges, roads and other public projects.

"This policy mix has the potential of reigniting productivity growth and raising U.S. growth potential," David Folkerts-Landau, chief economist at Deutsche Bank, said in a report for clients. "While Trump introduces higher uncertainty, this is better than the near certainty of the continuation of a mediocre status quo."

The impact may not be felt immediately, but once the new agenda kicks in it will serve as a "game changer for the U.S. economy," Folkerts-Landau added.

In raw numbers, that would push 2017 growth to 2.4 percent and 2018 up to 3.6 percent. By way of comparison, the economy has grown an average of about 1.6 percent a year under President Barack Obama, the worst recovery since the Great Depression. Obama is the first president since Herbert Hoover not to see at least 3 percent growth for a calendar year.

U.S. growth will bleed into the world economy, according to Deutsche, which pushed its 2017 global GDP forecast from 3 percent to 3.4 percent.

One of the broad keys for the Trump economy will be a shift from one that relies on aggressive monetary policy - zero interest rates, trillions in Fed money-printing - to fiscal policies focused on more broad-based growth that will stretch from Wall Street to Main Street.

There are downside risks. The most notable is that Trump simply disappoints in terms of how well his plans are enacted. Others are escalation of geopolitical risks, instability in China, trade wars, the Fed having to hike interest rates too quickly and a crisis in emerging markets

Last year was another year of stagnant global trade, subdued investment and heightened policy uncertainty. The World Bank expects a "moderate recovery" with receding obstacles to activity, especially for commodity exporters in 2017. The report also cited "solid domestic demand" in the economies of commodity importers like India. World trade volumes are seen rising 3.6% this year, followed by 4.0% in 2018, and crude oil prices are expected to average $55 per barrel.

According to the World Bank, a 1% increase in U.S. GDP next year translates into an additional 0.6% growth rate for emerging markets. Brazil, for example, will be lucky to grow 0.5% next year at current estimates. A better U.S., therefore, is better for Brazil.

The expectation of fiscal stimulus in the U.S. is the main driver behind the World Bank's growth forecast for 2017, though continually weak investment and productivity growth outside of the U.S. will weigh on medium-term prospects for poorer countries.

The World Bank has published its Global Economic Prospects report (276 pages)

The U.S. forecasts do not incorporate the effect of policy proposals by the new U.S. administration. The expectation is a 1.5% boost in GDP growth per year.

The U.S. forecasts do not incorporate the effect of policy proposals by the new U.S. administration. The expectation is a 1.5% boost in GDP growth per year.China, the world's second largest economy, today revised the size of its economy in 2015 to 68.91 trillion yuan (9.96 trillion US dollars), up 354.6 billion yuan from its preliminary figure.

The National Bureau of Statistics (NBS) said economic growth for 2015 was unchanged at 6.9 per cent but the size of China's economy in 2015 has been revised to 68.91 trillion yuan (9.96 trillion U.S. dollars), up 354.6 billion yuan from its preliminary figure.

China's gross domestic product is estimated to have expanded around 6.7 percent in 2016 and is projected to grow 6.5% in 2017

China's GDP is expected to grow by 6.1% in 2018

India is projected to grow at about 7 - 7.5% each year

Pakistan is projected to grow at 5 to 5.5% each year

If the forecasts hold true then US contribution to world growth would be nearly as much as China's.

If the forecasts hold true then US contribution to world growth would be nearly as much as China's.On a purchasing power parity GDP basis, the United State and China combine to represent about 33% of the world economy.

The world is about $120 trillion in PPP GDP in 2016. China is $21 trillion in PPP GDP and the USA is $18.5 trillion.

Read more