High Frequency Financial Traders can now have 20 nanosecond latency down from 200 nanoseconds

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#2A4E1)

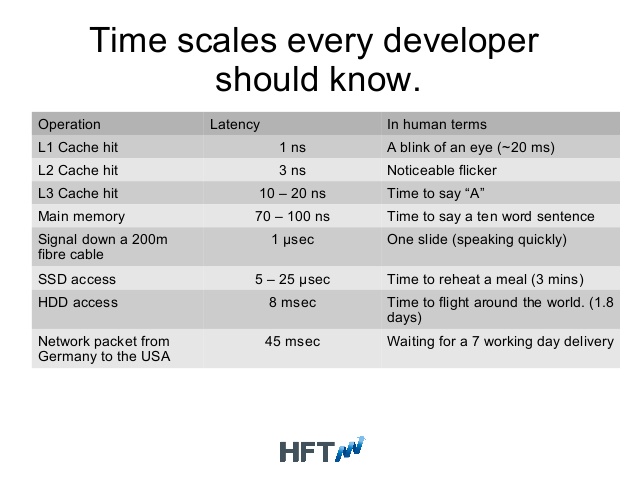

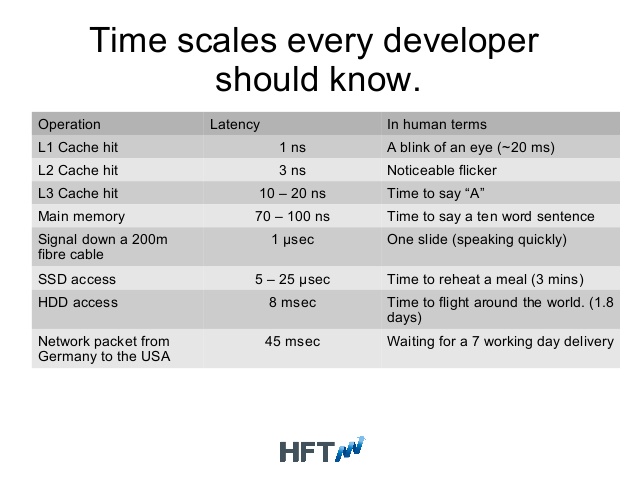

In high frequency trading, the latency gold standard is 200 nanoseconds. If you're an equity trader using a Bloomberg Terminal or Thomson Reuters Eikon, latency of more than 200 nanoseconds is considered to be shockingly pedestrian, putting you at risk of buying or selling a stock at a higher or lower price than the one you saw quoted. Now, with its announcement of TCPDirect, Solarflare said it has cut latency by 10X, to 20-30 nanoseconds.

High frequency trading occurs because it is highly profitable. It would have to be a regulatory step to have all orders execute precisely say at the top of each second. No inter-second trading. This would get rid of the advantages of sub-second racing. Until then it is profitable

Solarflare Communications is an unheralded soldier in the eternal war on latency. With its founding in 2001, Solarflare took on the daunting raison d'itre of grinding down latency from one product generation to the next for the most latency-sensitive use cases, such as high frequency trading. Today, the company has more than 1,400 customers using its networking I/O software and hardware to cut the time between decision and action.

Solarflare offers customers the lowest latency networking solutions for electronic/high frequency trading and other financial services applications with its high-performance 10GbE server adapters and Onloada application acceleration middleware. These products enable customers to leverage their existing Ethernet and IP infrastructures while achieving the absolute lowest latency with no need to modify applications.

The CTO of an equity trading firm, who agreed to talk with HPCwire's sister pub EnterpriseTech anonymously, said his company has been a Solarflare customer for four years and that its IT department has validated Solarflare's claims for TCPDirect of 20-30 nanoseconds latency.

Financial traders are in a race to make transactions ever faster. In today's high-tech exchanges, firms can execute more than 100,000 trades in a second for a single customer. This summer, London and New York's financial centres will become able to communicate 2.6 milliseconds (about 10%) faster after the opening of a transatlantic fibre-optic line dubbed the Hibernia Express, costing US$300 million. As technology advances, trading speed is increasingly limited only by fundamental physics, and the ultimate barrier - the speed of light.

Through glass optical fibres, information travels at two-thirds of the speed of light in a vacuum (300,000 kilometres per second). To go faster, data must travel through the air. Next up may be hollow-core fibre cables, through which light would travel in a tiny air gap at light speed.

High-frequency trading relies on fast computers, algorithms for deciding what and when to buy or sell, and live feeds of financial data from exchanges. Every microsecond of advantage counts. Faster data links between exchanges minimize the time it takes to make a trade; firms fight over whose computer can be placed closest; traders jockey to sit closer to the pipe. It all costs money - renting fast links costs around $10,000 per month.

Colocation beats the speed of light

Locating servers at major exchanges and as close as possible the actual computers that commit the trades.

Locating servers at major exchanges and as close as possible the actual computers that commit the trades.

A group of computers colocated with the exchange servers is optimal. Solarflare further shaves the trading latency

Solarflare is regarded as a partner that allows high frequency trading firms to focus on core competencies, rather than devoting in-house time and resources to lowering latency.

"It used to be the case that there weren't a lot of commercial, off-the-shelf products applicable to this space," he said. "If one of our competitors wanted to do something like this for competitive advantage, Solarflare can do it better, faster, cheaper, so they're basically disincentivized from doing so. In a sense this is leveling the playing field in our industry, and we like that because we want to do what we're good at, rather than spending our time working on hardware. We're pleased when external vendors provide state-of-the-art technology that we can leverage."

TCPDirect is a user-space, kernel bypass application library that implements Transmission Control Protocol (TCP) and User Datagram Protocol (UDP), the industry standards for network data exchange, over Internet Protocol (IP). It's as part of Onload, Solarflare's application acceleration middleware designed to reduce CPU utilization and increase message rates.

The latency through any TCP/IP stack, even written to be low-latency, is a function of the number of processor and memory operations that must be performed between the application sending/receiving and the network adapter serving it. According to Ahmet Houssein, Solarflare VP/marketing and strategic development, TCP/IP's feature-richness and complexity means implementation trade-offs must be made between scalability, feature support and latency. Independently of the stack implementation, going via the kernel imposes system calls, context switches and, in most cases, interrupts that increase latency.

Read more

High frequency trading occurs because it is highly profitable. It would have to be a regulatory step to have all orders execute precisely say at the top of each second. No inter-second trading. This would get rid of the advantages of sub-second racing. Until then it is profitable

Solarflare Communications is an unheralded soldier in the eternal war on latency. With its founding in 2001, Solarflare took on the daunting raison d'itre of grinding down latency from one product generation to the next for the most latency-sensitive use cases, such as high frequency trading. Today, the company has more than 1,400 customers using its networking I/O software and hardware to cut the time between decision and action.

Solarflare offers customers the lowest latency networking solutions for electronic/high frequency trading and other financial services applications with its high-performance 10GbE server adapters and Onloada application acceleration middleware. These products enable customers to leverage their existing Ethernet and IP infrastructures while achieving the absolute lowest latency with no need to modify applications.

The CTO of an equity trading firm, who agreed to talk with HPCwire's sister pub EnterpriseTech anonymously, said his company has been a Solarflare customer for four years and that its IT department has validated Solarflare's claims for TCPDirect of 20-30 nanoseconds latency.

Financial traders are in a race to make transactions ever faster. In today's high-tech exchanges, firms can execute more than 100,000 trades in a second for a single customer. This summer, London and New York's financial centres will become able to communicate 2.6 milliseconds (about 10%) faster after the opening of a transatlantic fibre-optic line dubbed the Hibernia Express, costing US$300 million. As technology advances, trading speed is increasingly limited only by fundamental physics, and the ultimate barrier - the speed of light.

Through glass optical fibres, information travels at two-thirds of the speed of light in a vacuum (300,000 kilometres per second). To go faster, data must travel through the air. Next up may be hollow-core fibre cables, through which light would travel in a tiny air gap at light speed.

High-frequency trading relies on fast computers, algorithms for deciding what and when to buy or sell, and live feeds of financial data from exchanges. Every microsecond of advantage counts. Faster data links between exchanges minimize the time it takes to make a trade; firms fight over whose computer can be placed closest; traders jockey to sit closer to the pipe. It all costs money - renting fast links costs around $10,000 per month.

Colocation beats the speed of light

Locating servers at major exchanges and as close as possible the actual computers that commit the trades.

Locating servers at major exchanges and as close as possible the actual computers that commit the trades.A group of computers colocated with the exchange servers is optimal. Solarflare further shaves the trading latency

Solarflare is regarded as a partner that allows high frequency trading firms to focus on core competencies, rather than devoting in-house time and resources to lowering latency.

"It used to be the case that there weren't a lot of commercial, off-the-shelf products applicable to this space," he said. "If one of our competitors wanted to do something like this for competitive advantage, Solarflare can do it better, faster, cheaper, so they're basically disincentivized from doing so. In a sense this is leveling the playing field in our industry, and we like that because we want to do what we're good at, rather than spending our time working on hardware. We're pleased when external vendors provide state-of-the-art technology that we can leverage."

TCPDirect is a user-space, kernel bypass application library that implements Transmission Control Protocol (TCP) and User Datagram Protocol (UDP), the industry standards for network data exchange, over Internet Protocol (IP). It's as part of Onload, Solarflare's application acceleration middleware designed to reduce CPU utilization and increase message rates.

The latency through any TCP/IP stack, even written to be low-latency, is a function of the number of processor and memory operations that must be performed between the application sending/receiving and the network adapter serving it. According to Ahmet Houssein, Solarflare VP/marketing and strategic development, TCP/IP's feature-richness and complexity means implementation trade-offs must be made between scalability, feature support and latency. Independently of the stack implementation, going via the kernel imposes system calls, context switches and, in most cases, interrupts that increase latency.

Read more