US Shale oil strength and world oil prices and production predictions

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#2GACB)

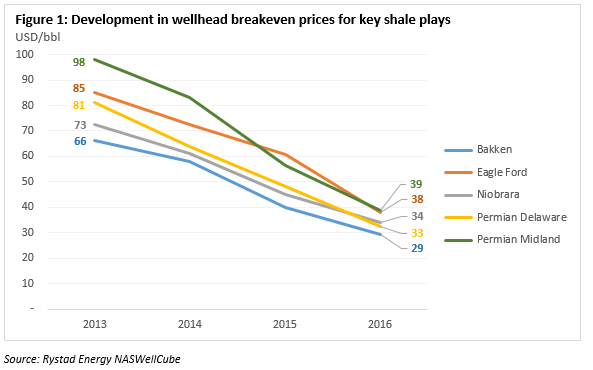

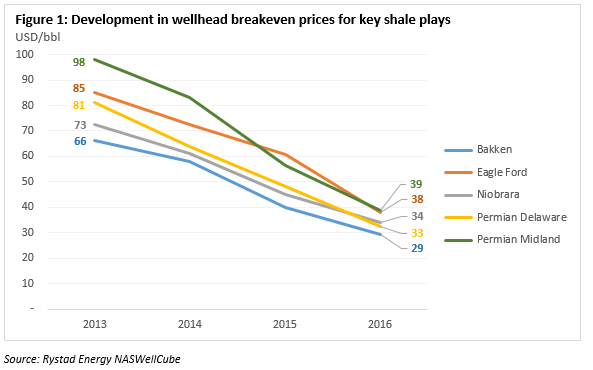

Wellhead breakeven prices have dropped significantly among all shale plays over recent years and since 2014, the average decrease has been around 46% within the main shale oil plays. The main cause has been a reduction in unit prices, which represented approximately 57% of the total decrease. However, acreage high grading and efficiency improvements have also played their part, contributing approximately 19% and 26% respectively.

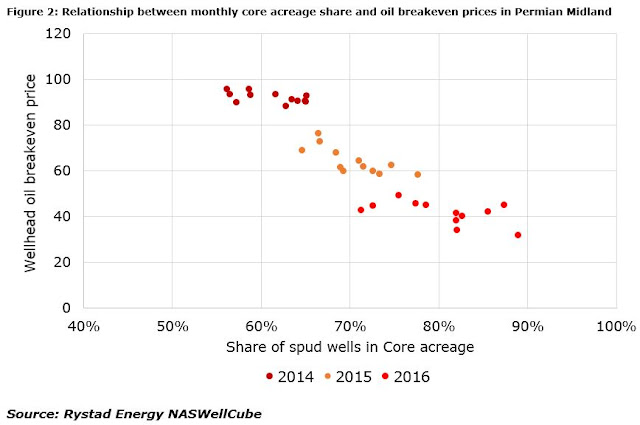

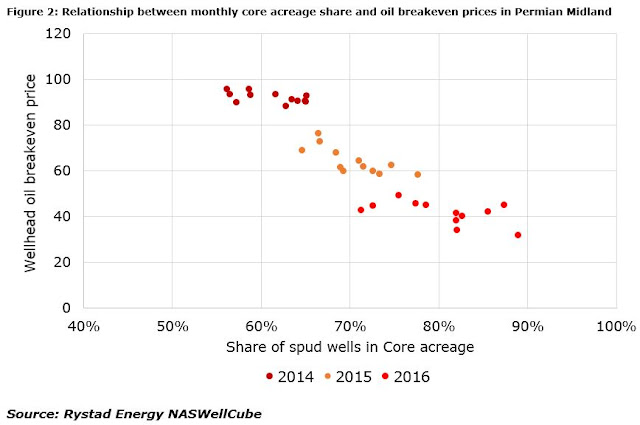

Among the main shale oil plays, Permian Midland has moved from averaging a wellhead breakeven price of 71 USD/b in 2014, to 36 USD/b in 2016. Effectively realizing a 49% decrease, this is the highest among all main shale oil plays.

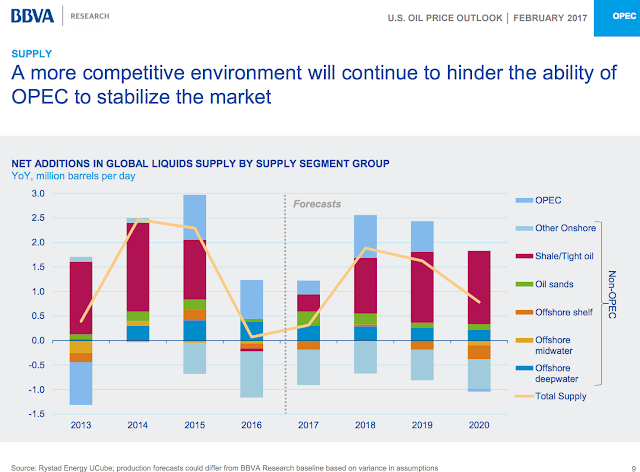

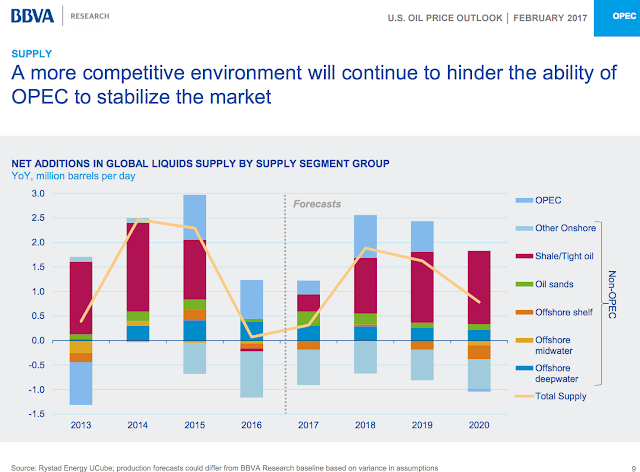

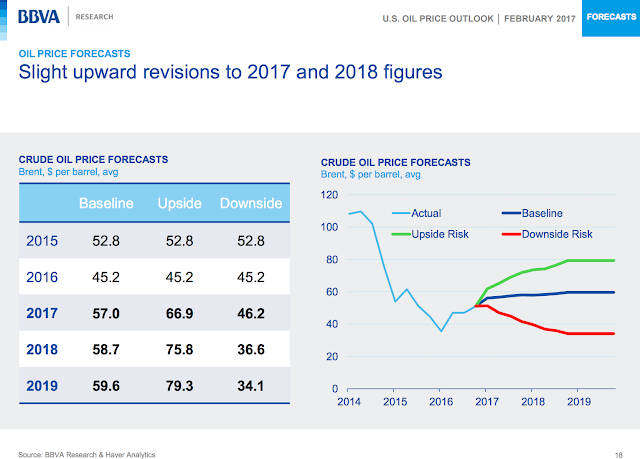

In order for the U.S. shale to start thinking of idling rigs en masse again, oil prices would have to drop and stay at even lower for longer, at below $40. The leaner, meaner and more resilient U.S. shale is basically wiping out OPEC's efforts to achieve higher oil prices with the output deal. The cartel seems to be caught between a rock and a hard place -- extending and/or deepening cuts and losing precious market share to U.S. shale, or ditching the price-fixing policy and letting the next oil price war begin.

There are several reasons behind the observed drop in breakeven prices (BEP). A part of it is attributable to the structural changes, such as improved well performance (which can be measured by improvements in the EUR); and the improved efficiency gains (which can be measured by the effect of lower drilling and completion cost, a result of more effective operations).

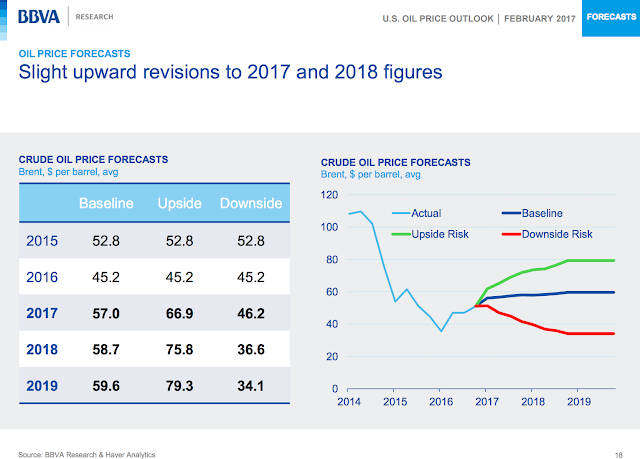

Even though the BEPs have fallen across the shale plays due to the factors described above, the most important question to answer is how much of this change is sustainable. Rystad Energy studied and quantified the different cyclical and structural drivers of the changing BEP and arrived to a conclusion that if all of the cyclical effects are reverted when the oil price starts recovering, the BEP might grow by 62% over the next couple of years for U.S. shale plays. As we enter 2017, it is important to look into whether the shale operators are ready for a growth in the current year. Activity-wise, in the main shale oil plays (EFS, Bakken, Permians and Niobrara), there are ~335 horizontal rigs drilling currently. This represents a nearly 100% increase compared to the bottom rig count in May 2016 at 168 Hz rigs for the same plays.

Read more

Among the main shale oil plays, Permian Midland has moved from averaging a wellhead breakeven price of 71 USD/b in 2014, to 36 USD/b in 2016. Effectively realizing a 49% decrease, this is the highest among all main shale oil plays.

In order for the U.S. shale to start thinking of idling rigs en masse again, oil prices would have to drop and stay at even lower for longer, at below $40. The leaner, meaner and more resilient U.S. shale is basically wiping out OPEC's efforts to achieve higher oil prices with the output deal. The cartel seems to be caught between a rock and a hard place -- extending and/or deepening cuts and losing precious market share to U.S. shale, or ditching the price-fixing policy and letting the next oil price war begin.

There are several reasons behind the observed drop in breakeven prices (BEP). A part of it is attributable to the structural changes, such as improved well performance (which can be measured by improvements in the EUR); and the improved efficiency gains (which can be measured by the effect of lower drilling and completion cost, a result of more effective operations).

Even though the BEPs have fallen across the shale plays due to the factors described above, the most important question to answer is how much of this change is sustainable. Rystad Energy studied and quantified the different cyclical and structural drivers of the changing BEP and arrived to a conclusion that if all of the cyclical effects are reverted when the oil price starts recovering, the BEP might grow by 62% over the next couple of years for U.S. shale plays. As we enter 2017, it is important to look into whether the shale operators are ready for a growth in the current year. Activity-wise, in the main shale oil plays (EFS, Bakken, Permians and Niobrara), there are ~335 horizontal rigs drilling currently. This represents a nearly 100% increase compared to the bottom rig count in May 2016 at 168 Hz rigs for the same plays.

Read more