Tough battery-sourcing requirement for EV tax credit may be relaxed

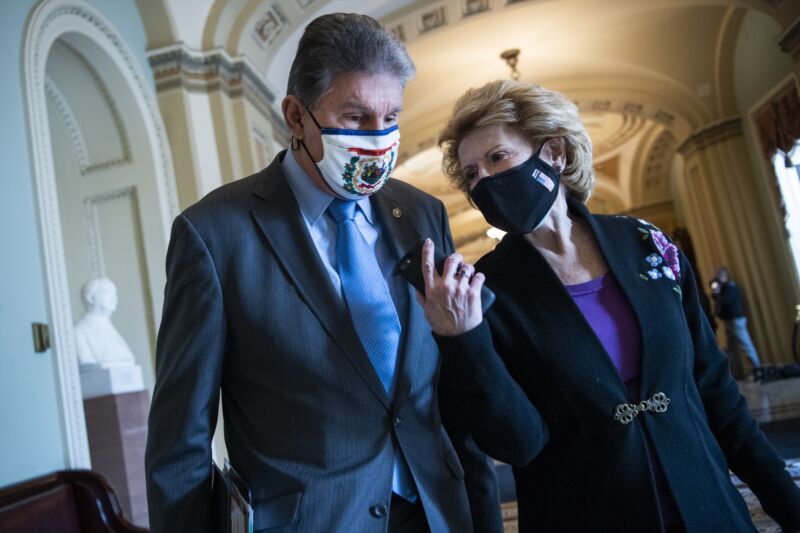

Enlarge / Democratic Senators Joe Manchin (Left) and Debbie Stabenow (Right) don't exactly see eye to eye on the auto industry's transition to electric vehicles. (credit: Tom Williams/CQ-Roll Call, Inc via Getty Images)

The new and somewhat-complicated rules governing which cars do or don't qualify for the new clean vehicle tax credit look like they might get tweaked a little in the near future.

Before, the tax credit was linked to the battery-storage capacity of a plug-in hybrid or battery-electric vehicle. But the Inflation Reduction Act changed that-now a range of conditions must be met, including final assembly in North America and an annually increasing percentage of locally sourced minerals and components within that battery pack.

On the one hand, the domestic sourcing requirements are beneficial because they are stimulating the development of local battery mineral refining and manufacturing here in the United States, adding well-paying jobs in the process. But the new rules have also significantly reduced the number of EVs that qualify.