Tesla Model 3 may lose $7,500 tax credit in 2024 under new battery rules

Enlarge (credit: Jonathan Gitlin)

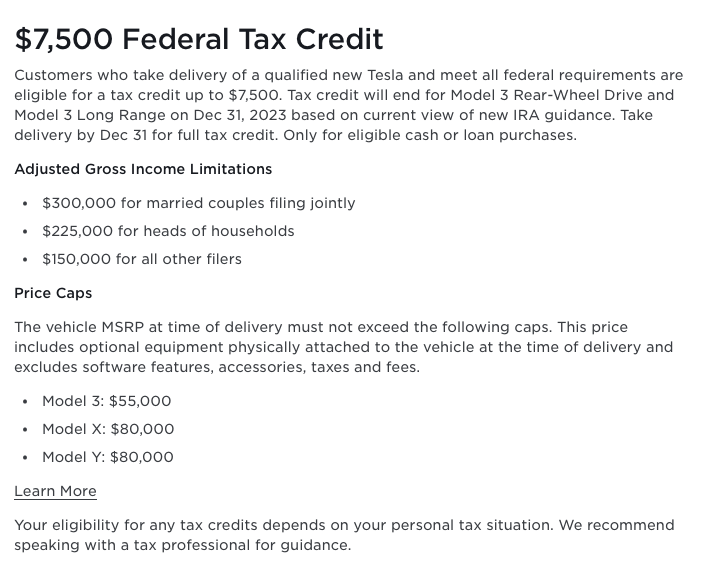

Tesla has engaged in a series of price cuts over the past year or so, but it might soon want to think about making some more for the Model 3 sedan. According to the automaker's website, the Tesla Model 3 Long Range and Tesla Model 3 Rear Wheel Drive will both lose eligibility for the $7,500 IRS clean vehicle tax credit at the start of 2024. (The Model 3 Performance may retain its eligibility.)

From Tesla's website. (credit: Tesla)

The beginning of 2023 saw the start of a new IRS clean vehicle tax credit meant to incentivize people by offsetting some of the higher purchase cost of an electric vehicle. The maximum credit is still $7,500-just like the program it replaced-but with a range of new conditions including income and MSRP caps, plus requirements for increasing the amount of each battery that must be refined and produced in North America.

A new hiccup appeared at the start of December 2023, though-in the form of new guidance from the US Treasury Department regarding "foreign entities of concern."