Low Gas Prices a Welcome But Volatile Windfall for Metro

Ryerson Base (Sounder Bruce)

Usually a booming local economy comes with high fuel prices, as fuel demand rises commensurately with demand for housing and other commodities. But despite a strong local economy, weak global demand and purposeful oversupply from OPEC have given us historically low fuel prices. There are a number of reasons why low fuel prices are a policy and environmental disaster, including exacerbating climate change via induced demand, reducing the competitiveness of renewables, and incentivizing sprawl and new vehicle purchases. Low fuel prices are also not having the full stimulatory effect that we'd expect, with oil-dependent economies in the Midwest and South suffering as they idle their suddenly uncompetitive shale fields.

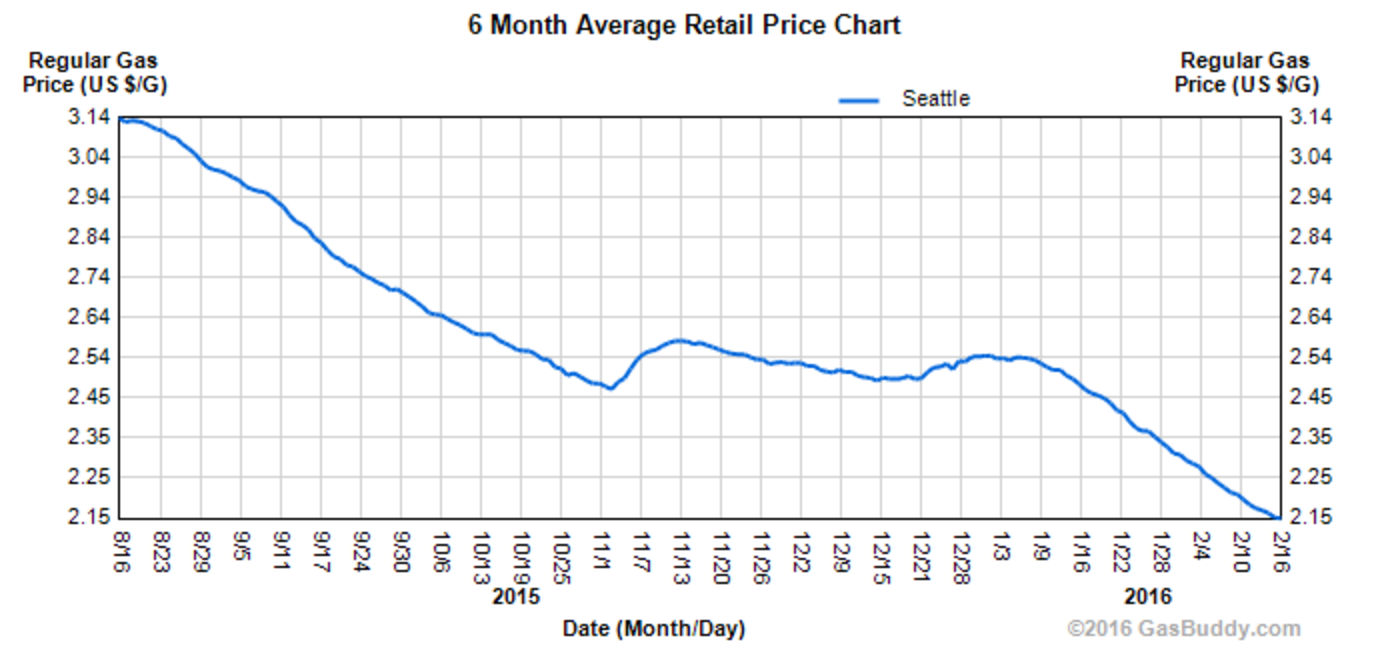

But for local transit operations, where diesel is still the workhorse of our transit network, the low fuel prices are an unexpected and welcome windfall. I reached out to Metro to ask about their fuel purchasing practices and budget estimation, and the savings are indeed significant. Unlike airlines, Metro does not hedge their fuel purchases, but purchases fuel on a daily basis under the state fuel contract. Currently, Metro is paying just over $1/gallon for diesel, an unprecedented low. Metro GM Kevin Desmond told the blog that "every $.10 drop saves us $1m per year," and the 2015 budget assumed $3 per gallon, creating a potential $20m in additional revenue. As fuel prices came in lower than expected, Metro revised its budget estimate downward to $2.25/gallon, so costs are still coming in below budget.

Metro's Jeff Switzer said that Metro has reinvested some of the savings in 70,000 bus hours (roughly $10m), spread over the September 2015 and March 2016 service changes. On the ground, this has meant boosting E-Line frequency from 12 minutes to 10 minutes, boosting I-90 peak service, and other improvements.

Metro also stresses that any fuel-related windfall is inherently volatile, and that a conservative deployment of unexpected resources is the wisest course. And they're right of course, as the windfall could evaporate at the whim of OPEC.