China's Manufacturing cost advantage is eroding so China will spend trillions for automation, robotics, 3D manufacturing and research

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#2B891)

While the USA has been extremely concerned about losing jobs (particularly manufacturing jobs to China), China performed a survey of businesses in the American Chamber of Commerce in Beijing and found that 25% had moved or were planning to move their businesses out of China. Half were going to other Asian countries and 40% to America, Canada or Mexico.

China's worker wages are rising about 7-8% each year and they have a shrinking working age population as the people age.

China is making big moves in automation and large scale deployment of robotics. In 2014, President Xi Jinping talked about a robotics revolution. China has been the number one buyer of industrial robots since 2013. However, China lags other nations in terms of robots per worker.

This more than the occasional story of one fully automated factory in 2015 that got rid of 90% of its 600 workers or Foxconn automating their iPhone factories with thousands of workers. Roughly 100 million people work in the Chinese manufacturing sector, which contributes nearly 36% of China's gross domestic product, but IDC's Zhang believes Beijing is prepared to manage the transition.

There will be about 1.3 million industrial robots in the world in 2018.

If China were to become a top ten country in industrial robot density in 2025 then they would need about 13-15 million robots (if they maintained the 100 million workforce). If the manufacturing workforce were halved to 50 million then China would need 7 to 10 million robots by 2025.

The automation could boost production and revenue from manufacturing by 25%.

China's 13th five year plan includes a made in China 2025 plan. The plan is to make China an advanced manufacturing power within a decade.

The current global leader in industrial robotic automation is South Korea. South Korea's robotic density exceeds the global average by a good seven-fold (478 units), followed by Japan (314 units) and Germany (292 units). At 164 units, the USA currently occupies seventh place in the world.

At 36 units per 100,000 employees or about half the global average figure, China is currently in 28th place. Within the overall global statistics, this is roughly on a par with Portugal (42 units), or Indonesia (39 units). However, about five years ago, China embarked on a historically unparalleled game of catch-up aimed at changing the status quo, and already today it is the world's largest sales and growth market for industrial robots.

Never before have so many robot units been sold in one year as were sold in China in 2014 (57,100 units). The boom is continuing unabated in line with the forecasts: In 2018, China will account for more than one-third of the industrial robots installed worldwide.

Progress toward automation is moving at a good clip in both the public and private spheres. In 2015, Guangdong province, long China's top manufacturing hub, pledged to spend $ 150 billion to install industrial robots in its factories and establish new advanced automation centers.

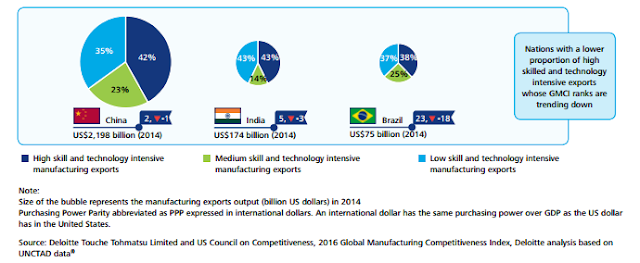

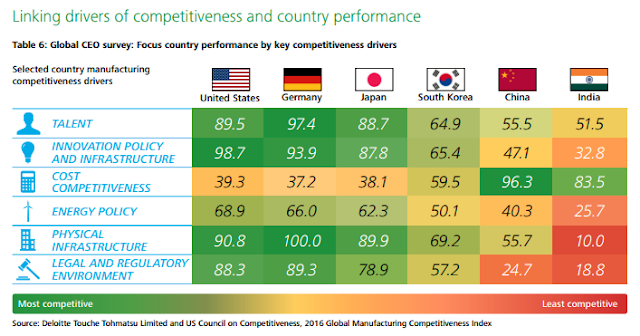

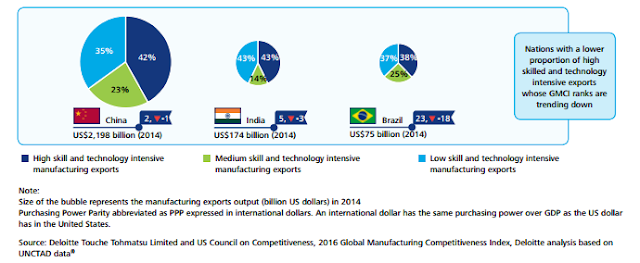

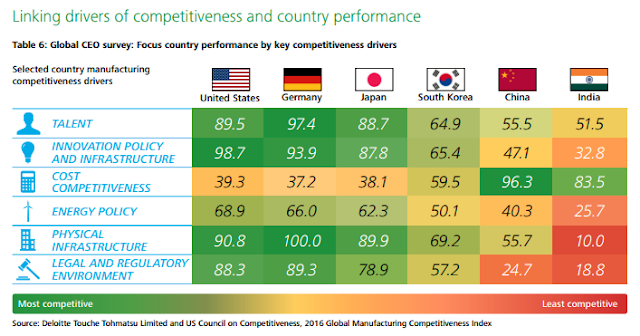

Global Manufacturing competitiveness was analyzed by Deloitte

By 2030, China's share of younger population, i.e. those in the age group of 15-39 years, will likely drop to 28 percent of the population from 38 percent in 2013.

Read more

China's worker wages are rising about 7-8% each year and they have a shrinking working age population as the people age.

China is making big moves in automation and large scale deployment of robotics. In 2014, President Xi Jinping talked about a robotics revolution. China has been the number one buyer of industrial robots since 2013. However, China lags other nations in terms of robots per worker.

This more than the occasional story of one fully automated factory in 2015 that got rid of 90% of its 600 workers or Foxconn automating their iPhone factories with thousands of workers. Roughly 100 million people work in the Chinese manufacturing sector, which contributes nearly 36% of China's gross domestic product, but IDC's Zhang believes Beijing is prepared to manage the transition.

There will be about 1.3 million industrial robots in the world in 2018.

If China were to become a top ten country in industrial robot density in 2025 then they would need about 13-15 million robots (if they maintained the 100 million workforce). If the manufacturing workforce were halved to 50 million then China would need 7 to 10 million robots by 2025.

The automation could boost production and revenue from manufacturing by 25%.

China's 13th five year plan includes a made in China 2025 plan. The plan is to make China an advanced manufacturing power within a decade.

The current global leader in industrial robotic automation is South Korea. South Korea's robotic density exceeds the global average by a good seven-fold (478 units), followed by Japan (314 units) and Germany (292 units). At 164 units, the USA currently occupies seventh place in the world.

At 36 units per 100,000 employees or about half the global average figure, China is currently in 28th place. Within the overall global statistics, this is roughly on a par with Portugal (42 units), or Indonesia (39 units). However, about five years ago, China embarked on a historically unparalleled game of catch-up aimed at changing the status quo, and already today it is the world's largest sales and growth market for industrial robots.

Never before have so many robot units been sold in one year as were sold in China in 2014 (57,100 units). The boom is continuing unabated in line with the forecasts: In 2018, China will account for more than one-third of the industrial robots installed worldwide.

Progress toward automation is moving at a good clip in both the public and private spheres. In 2015, Guangdong province, long China's top manufacturing hub, pledged to spend $ 150 billion to install industrial robots in its factories and establish new advanced automation centers.

Global Manufacturing competitiveness was analyzed by Deloitte

By 2030, China's share of younger population, i.e. those in the age group of 15-39 years, will likely drop to 28 percent of the population from 38 percent in 2013.

Read more