Can Africa become the next big economic success ?

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#2BKF2)

Africa is urbanizing at an alarmingly fast rate, nearly twice the rate of China. According to the African Development Bank, over five hundred million people will move into Africa's cities in the next thirty-five years. Nigeria's commercial capital, Lagos, is urbanizing at a rate quadruple the global average. Urbanization has had a tremendous effect on increased productivity. It has reduced transaction costs and increased access to more educational, medical and sanitation facilities.

Can Africa become the next big economic success ?

* Africa needs infrastructure development to match urbanization rates

* Africa needs education to increase and match its growing population

* Africa needs to leverage new technology that can enable it to leapfrog over gaps

Rapid Urbanization + insufficient infrastructure investment = Giant urban slums

In 2009, a World Bank Analysis indicates that Africa needed $93 billion per year to fill the infrastructure gap In 2015, a study tracked a surge in funding for Africa. The key finding is that, despite the progress in raising fiscal revenues, sub-Saharan African countries need to raise more domestic finance-and more generally create fiscal space-to meet the infrastructure gap. While tax revenues to GDP have increased across sub-Saharan Africa to over 20 percent more recently, this increase is mainly attributable to the resource-rich countries. However, tax revenue to GDP varies across the board-ranging from 25 percent in South Africa to 2.8 percent in the Democratic Republic of the Congo. In addition to raising tax revenues, sub-Saharan African countries have increasingly accessed international capital markets with 13 countries issuing $15 billion worth of international sovereign bonds since 2006.

While financing flows seem to be relatively well-distributed across countries and sectors, infrastructure needs and financing options at the sub-national level, especially for growing urban areas, have been largely ignored in the various studies and reports. This lack of discussion was a weakness in the 2009 World Bank Report, and it remains a substantial blind spot in the infrastructure dialogue in sub-Saharan Africa. Compared to other regions, sub-Saharan Africa is still predominantly rural, but that is changing rapidly, with some estimates noting that by 2035 50 percent of the population will live in urban areas. In many cities, the challenge of urbanization and the need for critical infrastructure is already evident. One-third of urban residents in sub-Saharan Africa are located in 36 cities, each with more than a million inhabitants. The United Nations estimates that by 2025, the population in Lagos and Kinshasa will reach 18.9 million and 14.5 million, respectively

The overall numbers indicate four significant trends:

* All major sources of external financing have appreciably increased their annual commitments. From $5 billion in 2003, commitments have risen to almost $30 billion per year in 2012.

* ODF (Official Development Finance) investments, though not as dominant a source of infrastructure financing in sub-Saharan Africa as in the 1990s, have grown appreciably since 2007 and represents 35 percent of external financing.

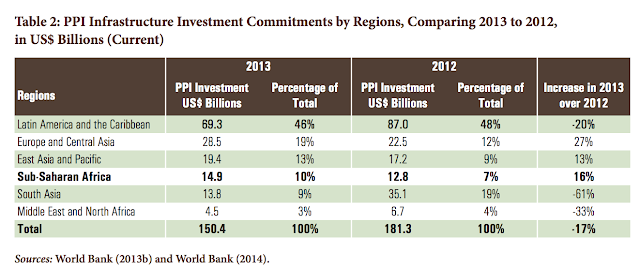

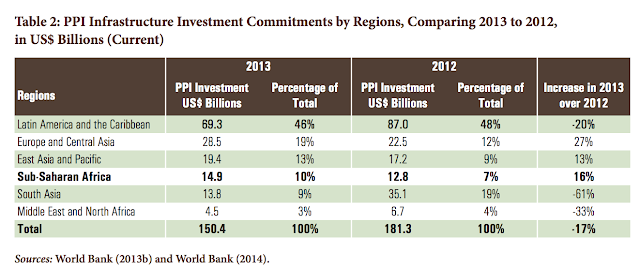

* PPI has been the largest financing source since 1999-accounting for more than 50 percent of all external financing. Its overall level has remained remarkably stable and unaffected by the recession in 2008.

* Official investments from China have increased from what was virtually insignificant to about 20 percent of these three main sources of external finance

Read more

Can Africa become the next big economic success ?

* Africa needs infrastructure development to match urbanization rates

* Africa needs education to increase and match its growing population

* Africa needs to leverage new technology that can enable it to leapfrog over gaps

Rapid Urbanization + insufficient infrastructure investment = Giant urban slums

In 2009, a World Bank Analysis indicates that Africa needed $93 billion per year to fill the infrastructure gap In 2015, a study tracked a surge in funding for Africa. The key finding is that, despite the progress in raising fiscal revenues, sub-Saharan African countries need to raise more domestic finance-and more generally create fiscal space-to meet the infrastructure gap. While tax revenues to GDP have increased across sub-Saharan Africa to over 20 percent more recently, this increase is mainly attributable to the resource-rich countries. However, tax revenue to GDP varies across the board-ranging from 25 percent in South Africa to 2.8 percent in the Democratic Republic of the Congo. In addition to raising tax revenues, sub-Saharan African countries have increasingly accessed international capital markets with 13 countries issuing $15 billion worth of international sovereign bonds since 2006.

While financing flows seem to be relatively well-distributed across countries and sectors, infrastructure needs and financing options at the sub-national level, especially for growing urban areas, have been largely ignored in the various studies and reports. This lack of discussion was a weakness in the 2009 World Bank Report, and it remains a substantial blind spot in the infrastructure dialogue in sub-Saharan Africa. Compared to other regions, sub-Saharan Africa is still predominantly rural, but that is changing rapidly, with some estimates noting that by 2035 50 percent of the population will live in urban areas. In many cities, the challenge of urbanization and the need for critical infrastructure is already evident. One-third of urban residents in sub-Saharan Africa are located in 36 cities, each with more than a million inhabitants. The United Nations estimates that by 2025, the population in Lagos and Kinshasa will reach 18.9 million and 14.5 million, respectively

The overall numbers indicate four significant trends:

* All major sources of external financing have appreciably increased their annual commitments. From $5 billion in 2003, commitments have risen to almost $30 billion per year in 2012.

* ODF (Official Development Finance) investments, though not as dominant a source of infrastructure financing in sub-Saharan Africa as in the 1990s, have grown appreciably since 2007 and represents 35 percent of external financing.

* PPI has been the largest financing source since 1999-accounting for more than 50 percent of all external financing. Its overall level has remained remarkably stable and unaffected by the recession in 2008.

* Official investments from China have increased from what was virtually insignificant to about 20 percent of these three main sources of external finance

Read more