Will Uber mirror Yahoo, If its China Rival Didi becomes globally dominant

by noreply@blogger.com (brian wang) from NextBigFuture.com on (#2H57M)

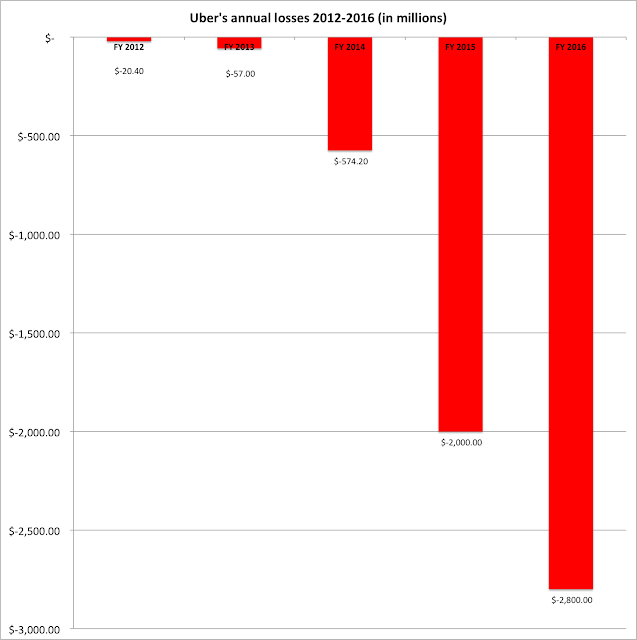

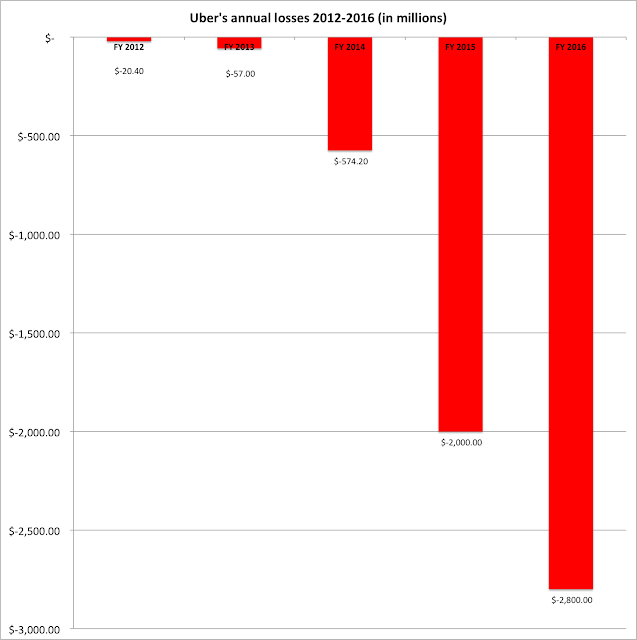

Uber has taken $12 billion over 15 rounds of investment, and has a reported valuation of nearly $70 billion. There have been several different leaks of Uber's financial data over the years, covering income from 2012 through Q4 2016.

Uber incoe statement numbers were from Bloomberg, The Information, Valleywag, Gawker, AllThingsD, TechCrunch, The New York Times, and Naked Capitalism.

Published financial data shows that Uber is losing more money than any startup in history and that its ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual investor subsidies.

Net revenues reached $1.7 billion in Q4 2016.

Gross bookings were $5.4 billion last year.

Uber's costs and expenses are much more than its revenues

The Atlantic thinks that if Uber fails that it will not set off a bubble-popping chain reaction.

Didi Chuxing is the world's largest ride-sharing company. It provided transportation services for close to 400 million users across over 400 cities in China. Its headquarters is located in Beijing. It provides services including, taxi hailing, private car hailing, Hitch (social ride-sharing), DiDi Chauffeur, DiDi Bus, DiDi Test Drive, DiDi Car Rental and DiDi Enterprise Solutions to users in China via a smartphone application. Formed from the merger of rival firms Didi Dache and Kuaidi Dache (backed by the two largest Chinese Internet companies, Tencent and Alibaba respectively), it was valued (as of June 2016) at approximately US$28 billion. DiDi announced that it acquired Uber's China unit on August 1, 2016. Following this acquisition, Didi Chuxing is estimated to be worth US$35 billion and it is the only company to have all of China's three Internet giants-Alibaba, Tencent, and Baidu-as its investors.

Didi Chuxing completed 1.4 billion rides milestone in just 2015 alone, as well as clocking over 200 million rides in December 2016 alone (one month), making it the most dominant ride-sharing company in the world. This far surpassed Uber which completed only 1 billion rides in 6 years' time since its founding in 2009.

In mid-2016, China's largest ride-hailing company, Didi Chuxing Technology, said it was profitable in more than half of the 400 cities in which it operates.

In 2017, Didi made an investment in 99 (formerly 99Taxis), an Uber competitor in Brazil and self-proclaimed market leader in Sao Paulo and Rio de Janeiro. Didi will provide guidance and support for 99, including in "technology, product development, operations and business planning." Didi said specifically that it will share "data-driven algorithmic capabilities" too.

Uber's sale of its Chinese business included taking a 5.89 percent stake in Didi. Didi plans to expand its service beyond China for the first time in 2017, but Zhang wouldn't reveal where they're headed next specifically in terms of target markets. "It's a secret," he said, though any launch in another country could potentially bring it back into direct competition with Uber.

A partnership with Avis announced in November will give them some kind of international presence, but definitely doesn't represent the full scope of their ambitions outside China.

Will Didi become globally dominant ? Didi appears to be financially stronger than Uber. Will there be other smaller ride sharing services with models similar to RideAustin ?

RideAustin is a non-profit ride sharing service. It charges $2 off the top, and the driver keeps the entire fare - including tip. This isn't a model Uber can compete with, even though rides are competitively priced. The RideAusting approach would give municipalities all the control to operate a safe and efficient service, while minimizing financial incentive and providing drivers with a stable, and competitive, income. Cities also have the ability to run the program as they see fit, including regulating the number of drivers on the road, safety and licensing requirements for said drivers, and ensuring quality of service for all those that use it.

Meituan-Dianping is China's largest food delivery app service. In Jan 2016, they raised $3.3 billion and were valued at $18 billion. They began ridesharing services recently and are competing with Didi. Didi had to go to high end rides and cut its workforce in Shanghai and Beijing.

A combined food, retail delivery, package delivery and ride sharing service could end up being the most efficient and globally dominant model.

Read more

Uber incoe statement numbers were from Bloomberg, The Information, Valleywag, Gawker, AllThingsD, TechCrunch, The New York Times, and Naked Capitalism.

Published financial data shows that Uber is losing more money than any startup in history and that its ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual investor subsidies.

Net revenues reached $1.7 billion in Q4 2016.

Gross bookings were $5.4 billion last year.

Uber's costs and expenses are much more than its revenues

The Atlantic thinks that if Uber fails that it will not set off a bubble-popping chain reaction.

Didi Chuxing is the world's largest ride-sharing company. It provided transportation services for close to 400 million users across over 400 cities in China. Its headquarters is located in Beijing. It provides services including, taxi hailing, private car hailing, Hitch (social ride-sharing), DiDi Chauffeur, DiDi Bus, DiDi Test Drive, DiDi Car Rental and DiDi Enterprise Solutions to users in China via a smartphone application. Formed from the merger of rival firms Didi Dache and Kuaidi Dache (backed by the two largest Chinese Internet companies, Tencent and Alibaba respectively), it was valued (as of June 2016) at approximately US$28 billion. DiDi announced that it acquired Uber's China unit on August 1, 2016. Following this acquisition, Didi Chuxing is estimated to be worth US$35 billion and it is the only company to have all of China's three Internet giants-Alibaba, Tencent, and Baidu-as its investors.

Didi Chuxing completed 1.4 billion rides milestone in just 2015 alone, as well as clocking over 200 million rides in December 2016 alone (one month), making it the most dominant ride-sharing company in the world. This far surpassed Uber which completed only 1 billion rides in 6 years' time since its founding in 2009.

In mid-2016, China's largest ride-hailing company, Didi Chuxing Technology, said it was profitable in more than half of the 400 cities in which it operates.

In 2017, Didi made an investment in 99 (formerly 99Taxis), an Uber competitor in Brazil and self-proclaimed market leader in Sao Paulo and Rio de Janeiro. Didi will provide guidance and support for 99, including in "technology, product development, operations and business planning." Didi said specifically that it will share "data-driven algorithmic capabilities" too.

Uber's sale of its Chinese business included taking a 5.89 percent stake in Didi. Didi plans to expand its service beyond China for the first time in 2017, but Zhang wouldn't reveal where they're headed next specifically in terms of target markets. "It's a secret," he said, though any launch in another country could potentially bring it back into direct competition with Uber.

A partnership with Avis announced in November will give them some kind of international presence, but definitely doesn't represent the full scope of their ambitions outside China.

Will Didi become globally dominant ? Didi appears to be financially stronger than Uber. Will there be other smaller ride sharing services with models similar to RideAustin ?

RideAustin is a non-profit ride sharing service. It charges $2 off the top, and the driver keeps the entire fare - including tip. This isn't a model Uber can compete with, even though rides are competitively priced. The RideAusting approach would give municipalities all the control to operate a safe and efficient service, while minimizing financial incentive and providing drivers with a stable, and competitive, income. Cities also have the ability to run the program as they see fit, including regulating the number of drivers on the road, safety and licensing requirements for said drivers, and ensuring quality of service for all those that use it.

Meituan-Dianping is China's largest food delivery app service. In Jan 2016, they raised $3.3 billion and were valued at $18 billion. They began ridesharing services recently and are competing with Didi. Didi had to go to high end rides and cut its workforce in Shanghai and Beijing.

A combined food, retail delivery, package delivery and ride sharing service could end up being the most efficient and globally dominant model.

Read more