Apple debuts its own credit card with a physical version to complement the app

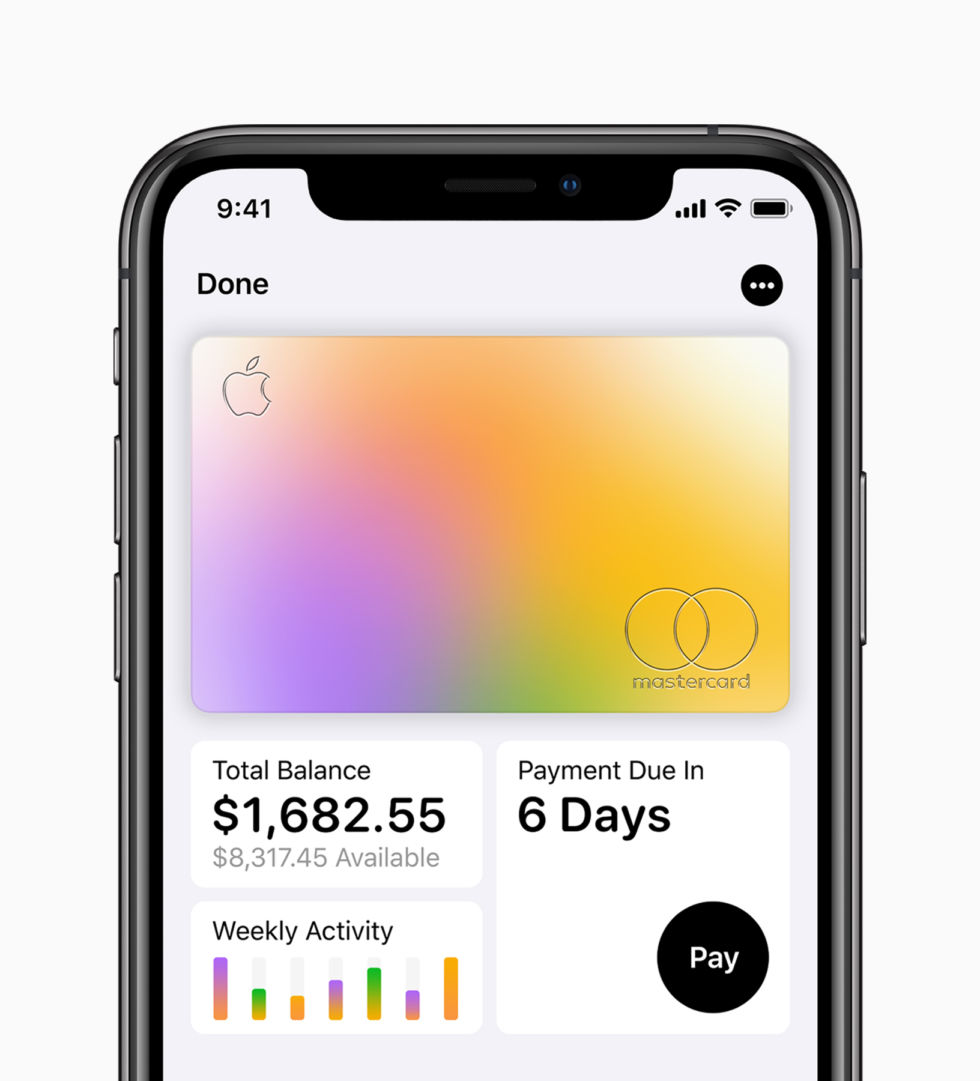

The app also gives you an overview of your spending and balance. [credit: Apple ]

At Apple's event on Monday, the company announced that it would partner with Goldman Sachs and MasterCard to offer its own credit card, not only within the Apple Wallet app but also as a physical metal credit card that can be used wherever Apple Pay isn't accepted.

The Apple Card will come without any late fees, annual fees, over-limit fees, or international fees. The company promised a low interest rate, but that rate does not seem to have been made public yet. Instead of offering points, Apple's card will apply cash to the customer's card. Customers receive 2 percent cash back on purchases made with Apple Pay and 3 percent cash back on purchases made on Apple products.

On pure economics, Ted Rossman, industry analyst at CreditCards.com, said that Apple's cash back terms were OK but not great. Rossman pointed to Citi's Double Cash card, which offers 2 percent cash back on every purchase (not just purchases made with Apple Pay) or US Bank's Altitude Reserve Visa Infinite card, which "gives three points per dollar on mobile wallet spending (worth 3 percent cash back or 4.5 percent off travel)."

Read 10 remaining paragraphs | Comments