$12.8 billion Juul investment broke the law, FTC suit says

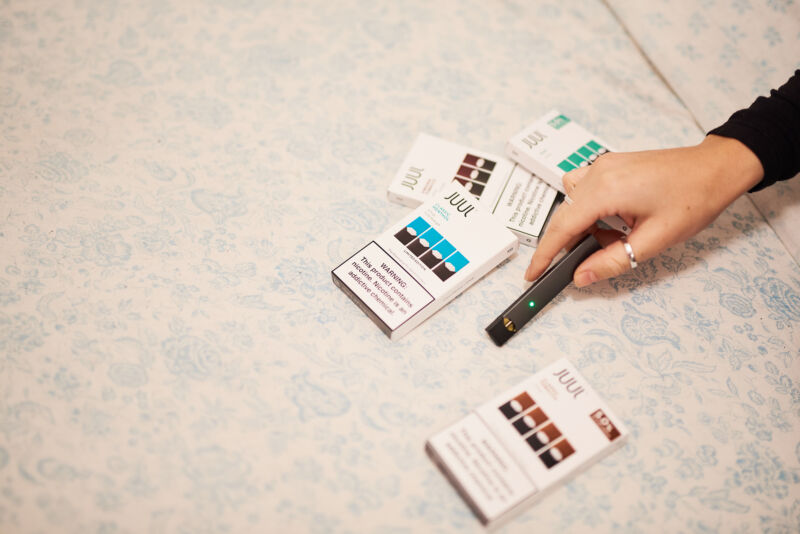

Enlarge / A person holds a Juul Labs Inc. e-cigarette next to packages of flavored pods on Thursday, Dec. 20, 2018. (credit: Gabby Jones | Bloomberg | Getty Images)

Back in 2018, cigarette maker Altria-formerly known as Philip Morris- apparently saw the writing on the wall for the tobacco industry's future. In December of that year, the company dropped a cool $12.8 billion to gain a 35 percent minority stake in e-cigarette firm Juul. The Juul deal seemed like a particularly clever way to gain a massive toehold in the vaping market as traditional tobacco cigarette use waned-too clever, it seems, as now the Federal Trade Commission is suing to unwind the deal.

The transaction "eliminated competition in violation of federal antitrust laws," the FTC said yesterday, announcing the unanimous vote to move forward with the suit.

At the time of the acquisition, Juul was the leading US e-cigarette brand, the FTC alleges, but Altria's own MarkTen product was already the second most popular brand by market share. Instead of continuing to compete, however, Altria arranged to reap the benefits of its competitor without outright acquiring it.

Read 6 remaining paragraphs | Comments