Robinhood’s plan to “democratize finance” hit a GameStop-shaped speed bump [Updated]

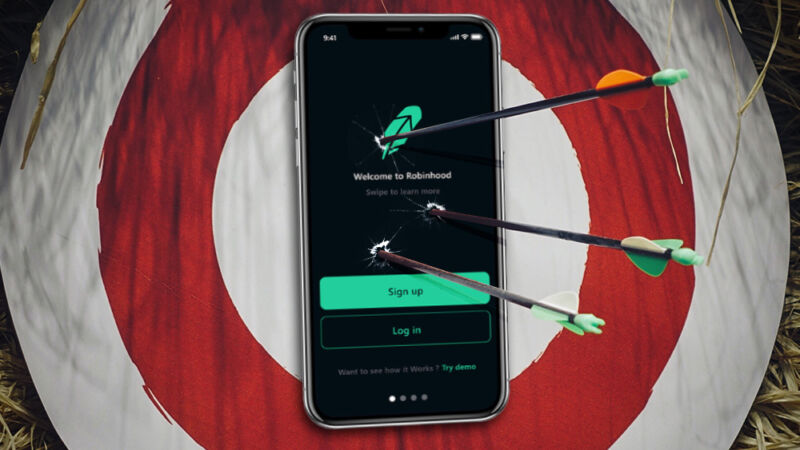

Enlarge / Ready, take aim, and let fly... (credit: Aurich Lawson / Getty Images)

As the price of heavily shorted stocks like GameStop has shot up in recent days, so, too, has interest in retail trading apps like Robinhood. That app, launched in 2013 with a promise to "democratize finance for all," offers so-called retail investors simple, zero-fee trades as an easy way to gamble on quick movement of individual stocks.

But that smooth path to playing the market hit a bump Thursday morning, when Robinhood announced that it was suspending the ability to purchase 13 extremely volatile stocks, including GameStop.

In the hours following the announcement, GameStop's stock price first shot up to a high of nearly $470, then cratered to a low of about $126 by 11:20am. The price then turned back upward and has currently stabilized around $310 as of this writing.

Read 23 remaining paragraphs | Comments