Robinhood says GameStop volatility was a “1 in 3.5 million” black swan

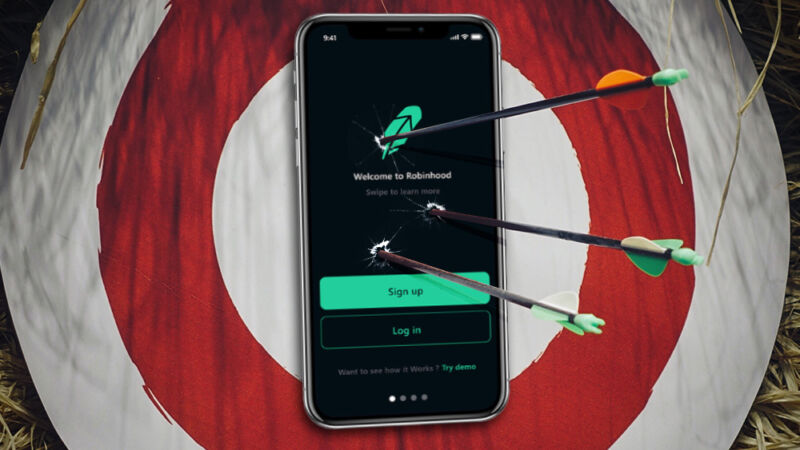

Enlarge / Ready, take aim, and let fly... (credit: Aurich Lawson / Getty Images)

Robinhood's move to temporarily limit purchases of GameStop and other highly volatile stocks in late January was the overwhelming focus of today's House Committee on Financial Services hearing.

At the hearing, Robinhood CEO Vlad Tenev said that extreme stock volatility that led to Robinhood's restriction was a "five sigma" event with a "1 in 3.5 million" chance of happening. That made the situation practically impossible for the company to plan for, Tenev said. "In the context of tens of thousands of days in the history of US stock market, a 1 in 3.5 million event is basically unmodelable."

As we've covered previously, the high volatility of GameStop and other so-called "meme stocks" last month meant Robinhood was suddenly forced to provide much more collateral to the stock clearing houses that actually process its trades. Tenev said Thursday that these collateral obligations increased tenfold between January 25 and January 28, as GameStop rose from $76 a share to over $347, then back down to $193.

Read 20 remaining paragraphs | Comments