by Patrick Wintour Political editor on (#89T1)

Permanent secretary to Treasury, Sir Nicholas Macpherson, contradicts Tory pre-election claims, saying financial crisis was ‘a banking crisis pure and simple’

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-02-06 10:45 |

|

by Guardian Staff on (#89E4)

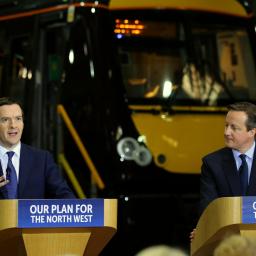

The Tory election narrative of an economy safe in their hands may be undermined by some disturbing trends already evident in the GDP dataUntil the moment when David Cameron whipped up a froth of confected passion at a campaign event last week, the Conservatives’ appeal to the electorate was based on a carefully constructed case about the economy.Vote Labour, the narrative went, and you’ll put Britain’s hard-won recovery at risk. Yet last week’s GDP figures, showing the growth rate halving to 0.3% in the first three months of 2015, suggest the upturn of which the Tories are so proud may already be starting to fade. Continue reading...

|

|

by William Keegan on (#89E6)

A Whitehall official once observed that it was his job to help government do foolish things properly. How apposite those words seem once againIn a review of my book Mr Osborne’s Economic Experiment in last weekend’s Financial Times, the former editor of the Economist, Bill Emmott, re-quoted the following remark once made to me by a Whitehall official: “Governments do foolish things. My job is to make sure they do foolish things properly.â€Emmott speculated that this quote was “possibly apocryphalâ€, but I can assure him it was not. What it was, however, was a typical example of the sense of humour never far from the surface in the civil service, and immortalised in Yes, Minister, the celebrated BBC comedy series, which was based on serious research. Some of my best Whitehall friends helped the writers, although I could not possibly comment on who they were.People are going to look back on this period and conclude that this country has been afflicted by a kind of madness Continue reading...

|

|

by Heather Stewart Economics editor on (#899F)

UK stock markets could suffer if coalition negotiations become protracted, say City analystsCity investors are bracing themselves for a tumultuous week in the financial markets as they ponder the risk of a “dead heat†election, followed by weeks of political horse trading.Related: The Tory economic plan is NOT working, at all - sadly, their PR war is Continue reading...

|

|

by Daniel Boffey on (#899D)

Health, welfare and the economy, plus education, transport and housing: we look at what the parties are promising in each areaNHS Continue reading...

|

|

by Andrew Rawnsley on (#8950)

If there is another hung parliament, weary party leaders will have little chance to rest as questions over alliances and coalitions multiplyIt is breakfast time on 8 May. The people have spoken – and for the second successive election they have denied a Commons majority to any single party. As the polls suggested and most of the pundits predicted, we have another hung parliament.Ministers remain ministers until a new government is formed and do so even if they are no longer MPs Continue reading...

|

|

by Observer editorial on (#8952)

Only Ed Miliband offers a vision for a fairer Britain. His party deserves to form the next governmentThe gap between the richest and the rest was never wider, spectacular mergers produced giant companies that paid minimal taxes, and a democratic stalemate exposed the shortcomings of a political system creaking at the seams. No, not a retrospective look at 2015, but an account of late 19th-century America, a context that gave rise to the emergence of the radical new politics ushered in by Republican President Theodore “Teddy†Roosevelt.In a country increasingly divided and impoverished, he brokered a different kind of relationship between government and the people. The state intervened in a rampant market – driven by rapacious oligarchs – that advantaged big business at the expense of ordinary working men and women. Roosevelt pledged to curb the power of business, support organised labour and spoke out in support of the “common welfareâ€, and “a square deal†for all. Heaven knows what the early 21st-century press in Britain would have made of Red Ted. Continue reading...

|

|

by Reuters on (#8954)

The billionaire admits surprise that low rates have not caused inflation and tells shareholders the dollar will still be the world’s reserve currency in half a centuryWarren Buffett has warned that stock prices will appear expensive if interest rates increase from their current ultra-low levels.

|

|

by Guardian Staff on (#8956)

Outside the eurozone, governments have no problem funding their deficitsHeather Stewart is correct that in Simon Wren-Lewis’s article for the New Statesman he argues that the purpose of government policy should be “to increase the welfare of the public†(“Let us applaud Sturgeon and Bennett – but not vote for themâ€, Business).However, she failed to point out that Wren-Lewis also gave lie to the argument that the government can run out of money to do what is necessary and thereby perpetuates the myth started by Liam Byrne, the former Treasury chief secretary who left a note for his successor, David Laws, saying: “I’m afraid to tell you there’s no money left.†Continue reading...

|

|

by Helena Smith in Athens on (#88YJ)

Appeal to Greece’s millions of tourists comes as government plans higher VAT rate on islands most popular with visitorsGreece’s tourism chief has appealed to the millions of Britons planning to visit the crisis-hit country this year to use credit cards as much as possible.The move comes as the government in Athens has signalled that it plans to raise VAT rates on some holiday islands. Continue reading...

|

|

by Rupert Neate in New York on (#88ND)

New British CEO Steve Easterbrook set to unveil turnaround plan to bring back lost customers and profits as rivals muscle in on burger marketLast weekend Steve Easterbrook, the new British chief executive of McDonald’s and lifelong fan of the less-than-glamorous Watford Football Club, celebrated as his team secured promotion back to the Premier League after an eight-year absence. “Incredible achievement. Great run-in under pressure. Faultless,†he tweeted before turning back to his own personal challenge: How to resurrect the world’s biggest burger chain.Related: How McDonald's took over the world: in picturesRelated: McDonald's: a brief history in 15 facts Continue reading...

|

|

by Katie Allen on (#86EX)

Downbeat Markit/Cips report adds evidence to claims that economy is losing momentum with factory orders far weaker than forecastThe Conservatives have suffered another blow to their track record on the economy from a surprise slowdown in manufacturing and fresh evidence that consumers are being relied on to drive the flagging recovery.With less than a week to go till the general election, a closely watched survey of Britain’s manufacturers compounded fears the economy has run out of steam in recent months. The pound tumbled as the first snapshot of factory activity in April showed companies were forced to cut their prices to eke out new orders.Related: UK manufacturing growth slows sharply in setback for economy - live updates Continue reading...

|

|

by Angela Monaghan (until 2.45) and Nick Fletcher on (#867S)

|

|

by Ian Traynor Brussels on (#86X3)

Countries such as Latvia and member states in eastern Europe have been some of Greece’s most trenchant critics, after having to take part in the world’s biggest ever bailoutYanis Varoufakis could not resist bragging. Shortly after Greece’s new leftist government struck a deal with creditors to extend the country’s bailout to the end of next month, the finance minister and glamour boy for the Syriza radicals waxed triumphalist about how he had outfoxed the eurozone.“We no longer have this unified group against Greece,†he declared in a lengthy radio interview. “We now have a side that has broken down into many different sides, some of which are very open to our proposals. This by itself is a great success.â€Related: Eurozone recovery defies the odds but long-term problems remainFDR, 1936: "They are unanimous in their hate for me; and I welcome their hatred." A quotation close to my heart (& reality) these days Continue reading...

|

|

by Editorial on (#86SE)

Election 2015 poses some profound questions for this country. Ed Miliband has better answers than his rivals, and so deserves a chance to governThe campaign is nearly over and it is time to choose. We believe Britain needs a new direction. At home, the economic recovery is only fragile, while social cohesion is threatened by the unequal impact of the financial crisis and the continuing attempt to shrink the postwar state. Abroad, Britain remains traumatised by its wars, and, like our neighbours, is spooked by Vladimir Putin, the rise of jihadist terrorism and by mounting migratory pressures. In parts of Britain, nationalist and religious identities are threatening older solidarities, while privacy and freedom sometimes feel under siege, even as we mark 800 years since Magna Carta. More people in Britain are leading longer, healthier and more satisfying lives than ever before – yet too many of those lives feel stressed in ways to which politics struggles to respond, much less to shape.This is the context in which we must judge the record of the outgoing coalition and the choices on offer to voters on 7 May. Five years ago, Labour was exhausted and conflicted, amid disenchantment over war, recession and Gordon Brown’s leadership. The country was ready for a change, one we hoped would see a greatly strengthened Liberal Democrat presence in parliament combine with the core Labour tradition to reform politics after the expenses scandal. That did not happen. Instead the Conservatives and the Liberal Democrats have governed together for five difficult years. Continue reading...

|

|

by Larry Elliott on (#86H4)

Slowing GDP growth and now shockingly weak PMI data show UK economy is fading fast from the housing market sugar-rush and all despite cheap oil and ultra-low interest rates. Not a good week to choose the economy as an election platformShockingly weak. That’s the only way to describe news highlighting the continuing struggles of Britain’s manufacturers last month.It’s easy to see why the health check of industry from Markit/CIPS raised eyebrows. The snapshots of the three most important sectors of the economy – manufacturing, construction and services – are closely watched because they are the first evidence of the state of the economy in the month and they look forward rather than backward.Related: UK manufacturing slowdown deals blow to Conservatives Continue reading...

|

|

by Gavin McCrea on (#86AN)

To speak about money, work, class or government is to use the tools that Karl Marx gave us – despite his lifestyle conflicting with his ideasEvery year, on May Day, a spectre comes to haunt us. The spectre of Karl Marx. He’s been coming since 1889, when the Second International first chose 1 May as the date for International Workers’ Day. And although we understand that he’s the brains behind the show, we don’t like him hanging around. His presence makes us uncomfortable. He reminds us of difficult things.Over the years, we’ve done our best to exorcise him. Hitler buried him under the Day of National Work. Khrushchev engulfed him in elaborate parades. The Catholic church disguised him as Joseph, the patron saint of workers. Franco outlawed him altogether. Some countries appeased him with a public holiday; others, like Britain and Ireland, preferred to confuse him with the first Monday of the month. It’s time we faced up to the ghost: May Day is Marx Day, whether we like it or not.Marx – and I’m not saying anything radical here – was a capitalistRelated: May Day 2015: share your photos and videosRelated: May Day is not about maypoles: the history of international workers' day | Richard Seymour Continue reading...

|

|

by Heather Stewart on (#854V)

Spanish growth highlights contrast with Greece where fears about cash crisis remain high

|

|

by Phillip Inman on (#84X5)

Spain’s economy is going like a rocket but unemployment is still the dark cloud that hangs over the euro areaPerhaps it was the warmer winter that spurred economic activity in the eurozone, or maybe confidence was boosted by a financial firewall being erected around Greece to protect against a messy default.Related: Eurozone recovery hopes boosted as Spain announces GDP rise Continue reading...

|

|

by Polly Toynbee on (#84FE)

Such is the UK’s skewed perspective of welfare, millions are unaware that £12bn of Tory cuts would hit them, not just ‘scroungers’Is there a secret plan to cut tax credits, child benefit and disability pay for middle- to low-earners? Absolutely not, says David Cameron, hot denials flying through the air today. And indeed there isn’t, there really, really isn’t. George Osborne has deliberately refused to write one, so it doesn’t exist. So £12bn will be cut from the welfare bill, but there is no plan in any drawer.Danny Alexander has helpfully “lifted the lid†on Iain Duncan Smith’s plan, which was presented to senior ministers back in 2012, showing what £8bn cuts would look like. Even cutting a third less than the £12bn in cuts now planned, a working family with three children would have lost £3,500. To cut £12bn from working-age benefits is to inflict huge amounts of pain on very large numbers of people, says Jonathan Portes of the National Institute of Economic and Social Research, once chief economist at the Department for Work and Pensions (DWP).The Tories reckon people don’t much care – but they’d care if they knew these 'welfare' cuts would hit themRelated: Poverty – and child poverty in particular – is rising Continue reading...

|

|

by Dominic Rushe in New York on (#831H)

|

|

by Nick Fletcher and Helena Smith on (#82NS)

Yannis Dragasakis suggests deal will unlock delayed funds country needs to avoid default as an interim solution onlyGreece could seal a deal with its creditors in early May, its deputy prime minister said on Wednesday, as the country prepared a new list of reforms and the European Central Bank provided more support to its beleaguered banks.

|

|

by Julia Kollewe,Graeme Wearden and Nick Fletcher on (#81RS)

All the latest economic and financial news, as US recovery almost grinds to a halt and Greece’s government scrambles to raise funds to meet debt repayments

|

|

by Larry Elliott Economics editor on (#826X)

On day Federal Reserve is meeting to discuss borrowing costs, figures show growth has slowed to annual rate of just 0.2% in first quarterFears of an early rise in US interest rates dwindled on Wednesday after the Federal Reserve responded to news that growth had come to a virtual standstill by saying it would need to see a stronger economic performance before sanctioning an increase in borrowing costs.Announcing its decision to leave interest rates on hold just hours after official data showed the world’s largest economy barely grew in the first three months of the year, the US central bank said only some of the weakness was due to one-off factors. Continue reading...

|

|

by Lain Hensley on (#7XHQ)

Cancer taught Lain Hensley an important lesson: sometimes a business leader must let others carry the burden in order to make an impact that lastsI was on my way to catch a 7am flight to Milwaukee, where I was scheduled to make a speech about leadership and life, when I felt a strange lump on the right side of my throat. I immediately knew that something was wrong.

|

|

by Paul Krugman on (#81RV)

The case for cuts was a lie. Why does Britain still believe it? Continue reading...

|

|

by Phoebe Greenwood on (#81NK)

The coalition government came to power in 2010 promising to deliver a stable economy and reduce Britain's deficit. Its chosen method was austerity, a mix of higher taxes and deep spending cuts. But rather than unleashing growth, the UK economy stalled – just as many Keynesian economists predicted it would. But with most major parties committed to degrees of austerity, Phoebe Greenwood asks whether anyone has learned the lesson of the past five years Continue reading...

|

|

by Nicholas Watt Chief political correspondent on (#8182)

David Cameron to pledge that income tax, VAT or national insurance will not rise in the next parliament; ‘it’s a desperate gimmick,’ says Labour

|

|

by Helena Smith in Athens on (#80TW)

The economist is likely to be methodical, detail-oriented and tenacious in his new role – the polar opposite of his maverick predecessor Yanis VaroufakisEuclid Tsakalotos, the Oxford University-educated economist elevated to the top post of bailout negotiations coordinator, is the polar opposite of the Greek finance minister, Yanis Varoufakis. Diffident and soft-spoken, the 55-year-old’s wow factor is limited to a wardrobe of colourful corduroys and a trademark yellow and black scarf.In person he is amiable, low-key and professorial, the embodiment of the academic he has been for the past 30 years. It is a world away from untrammelled narcissism, of which the maverick finance minister has been accused. Continue reading...

|

|

by Helena Smith in Athens and Ian Traynor in Brussels on (#80RF)

Yanis Varoufakis renews outspoken attack on eurozone partners despite being replaced as leader of bailout negotiating teamThe Greek finance minister has denied that he has been sidelined from talks with Greece’s creditors on Tuesday as he resumed outspoken attacks on the country’s eurozone partners.Related: Greece tries to ease tensions with lenders by reshuffling negotiating team Continue reading...

|

|

by Letters on (#80S0)

The latest figures indicate that UK economic growth has halved in the three months to the end of March, continuing a slowdown that began six months ago (Report, theguardian.com, 28 April). This is further evidence of how unsustainable the recovery – which is heavily reliant on consumer spending and levels of household debt relative to income – actually is.The general election campaign has, however, been dominated by the major UK political parties looking at how they can impose further austerity, cutting the deficit and the debt through public spending cuts, rather than doing so by investing in the economy to stimulate economic growth.He is the Daffy Duck of politics – confident and self-satisfied, leading to calamity; then he pops up again, unabashed Continue reading...

|

|

by Graeme Wearden (until 2.45) and Nick Fletcher on (#7ZDJ)

All the latest economic and financial news, including reaction to Alexis Tsipras’s late-night interview

|

|

by Heather Stewart on (#80AZ)

During the election campaign, the Institute for Fiscal Studies’ genuine impartiality has become a major asset in scrutinising claims and counterclaims

|

|

by Larry Elliott Economics editor on (#7ZVS)

Being upfront with voters about social security cuts that would be necessary to finance tax cuts is not seen as an election-winning strategyBe afraid. Be very afraid. That was the message from the Institute for Fiscal Studies as it dissected the tax and benefit proposals of what are for now the three main Westminster parties.The IFS said the Conservatives, Labour and the Liberal Democrats were as one in trying to hoodwink voters. Despite what is being said on the campaign trail, there is no magic money tree for the politicians to shake. Promises now will be followed by hard choices later.Related: Election 2015: taxpayers worse off under every party, experts sayRelated: Do the parties’ sums add up? How the IFS became the ultimate arbiter Continue reading...

|

|

by Nicholas Watt and Angela Monaghan on (#7ZJ8)

Prime minister uses worse-than-expected GDP figures to warn that a Labour government would put economic recovery at riskBritain’s economic recovery slowed far more sharply than expected in the first quarter, dealing a major blow to the government’s track record on the economy with a little more than a week to go until the general election.The prime minister David Cameron said the recovery could not be taken for granted after the latest official figures showed that the economy grew by just 0.3% between January and March, half the rate of the previous quarter. Economists were expecting growth of 0.5%.Related: GDP figures: a blow for Osborne's growth and austerity mantraRelated: Election 2015: UK GDP growth slows to 0.3% - liveRelated: Drop in UK's economic growth: what the experts say Continue reading...

|

|

by Graeme Wearden on (#7ZPB)

Economists’ opinions are split between those alarmed by ‘dramatic’ slowdown and others confident the figures will soon be revised upwardsBritain’s economic growth rate halved in the first quarter of the year, from 0.6% to 0.3% – dealing a blow to the government’s election hopes.Jeremy Cook, chief economist at the international payments company World First, says Britain has suffered a “dramatic†slowdown:Q1 2015 was the slowest three-month period of growth in the UK since the last quarter of 2012.Industrial and manufacturing numbers from the UK economy through January and February have been poor and, for once, the services sector has not been able to make up that deficit. That, in itself, is worrying.Given that the Conservatives and Liberal Democrats are hoping that many undecided voters will ultimately decide to vote for them due to their management of the economy, this marked slowdown in growth is particularly unwelcome news coming just over a week before the general election.However, the Conservatives and Liberal Democrats can probably argue with some justification that increased uncertainty ahead of the general election has hampered growth, likely leading to business caution – particularly on investment.Related: UK economic growth slows ahead of general electionThis is a sharp drop in GDP growth that few economists saw coming. Our research suggests that businesses have hit pause amid growing political uncertainty over what the next government may look like, and ongoing malaise in the eurozone. The fall in construction is worrying, although the all-party pledge to build more homes after the election may be the shot in the arm that the sector needs.Today’s data is disappointing but unsurprising, with the UK moving from being one of the fastest growing developed economies to posting the weakest rate of expansion in over two years.Given that we’d already seen signs of weakening output earlier this year, the maths was always going to point to a slowdown. Nevertheless, manufacturing has held up with the sector, now seeing eight quarters of growth. And with surveys suggesting industry sentiment is looking reasonably firm, the sector should continue to contribute to growth in the months ahead.Although we expected a slowdown in GDP growth, following weak construction and production figures, the scale of the decline estimated by the ONS understates the true momentum in the economy.It is likely that the services sector rose by more than 0.5% – in particular we are sceptical that business and financial services output was broadly flat in the quarter. It would not be surprising if this estimate was upgraded in due course.Today's disappointing GDP figures will make this look even worse. Unprecedentedly slow growth performance in recovery pic.twitter.com/bInPWjHf91Weak GDP + strong employment = dreadful productivity (compared to pre-crisis trend or internationally). pic.twitter.com/3obZMFJ1vq Continue reading...

|

|

by Heather Stewart on (#7ZPD)

Institute for Fiscal Studies issues scathing analysis of tax and spending policies, including Labour’s 10p tax rate and Tories’ personal allowance riseBritish taxpayers should expect to feel worse off under whichever party wins the general election next week, according to the Institute for Fiscal Studies.In a scathing analysis of tax and benefits policies in the runup to the poll, the IFS issued a series of tough criticisms of the parties’ manifestos, with Paul Johnson, its director, saying, “There’s nothing in any of the parties’ proposals that we think will help the good functioning of the economyâ€.Related: Do the parties’ sums add up? How the IFS became the ultimate arbiter Continue reading...

|

|

by Aditya Chakrabortty on (#7Z9D)

In the latest of our pre-election series, Aditya Chakrabortty goes back to Edmonton, another suburb failed by the national economy‘You work at the Guardian, but you’re from Edmonton?†That but, and the genuine wonderment packed into it, made me laugh. This was Kate Osamor speaking! Come next Thursday, she will almost certainly be elected as the Labour MP for my old home of Edmonton, in north London. She’ll move into the Palace of Westminster and take up one of the 650 most elite positions in Britain. But before that process of dessication, she can still be impressed by more humble achievements.I’ve heard that tone before: you’re from here? The first temptation is to laugh it off – it’s a newspaper, mate, not a space mission. But soon the questions behind the question start to weigh you down. From outside the Guardian’s offices, a bus runs all the way to Edmonton Green shopping centre. The journey takes less than an hour. The idea of anyone actually making it seems to me as plausible as a fairy handing out coins for fallen teeth.Related: Recession rich: Britain's wealthiest double net worth since crisisDrug-dealers colonise the doorstep of her constituency office, and prostitution goes on behind itThe local Labour-led council has done some heroic work, most notably on building social housing Continue reading...

|

|

by Larry Elliott on (#7YV4)

Trades Union Congress says 2010-2014 unique in seeing drop in real household disposable incomes, which combine wages, benefits, taxes and inflationThe coalition government has presided over the worst five-year period for living standards since modern records began more than half a century ago, according to the Trades Union Congress.In an analysis based on data from the Office for National Statistics, the TUC said the 2010-2014 period was unique in seeing a drop in real household disposable incomes.Conservative plans for extreme austerity after the election risk killing off the recovery again Continue reading...

|

|

by Katie Allen on (#7YJ0)

Report from thinktank warns ‘another recession is a matter of when, not if’ ahead of Tuesday’s GDP figures, which are expected to show slowing economic growthWhatever Tuesday’s first quarter GDP figures show, the next government should brace itself for a hard landing, according to an economics thinktank.A report produced by the New Policy Institute (NPI) has described Britain’s economy as “unbalanced†and warns that another recession is inevitable unless various issues are addressed.If the UK economy can be likened to a four cylinder car, then actually not one of its four cylinders is firing as smoothly as it should. Productivity is in the doldrums. Employment is artificially high due to self-employment. Household income growth has been non-existent. Trade deficits are frighteningly high. Look beneath the bonnet and we find the UK economy both weak and unbalanced.â€Labour productivity, a measure of what is produced for every hour worked, grew strongly after the recessions in the 70s, 80s and 90s whereas it has barely grown at all since the recession ended in mid-2009, says the NPI report. “Without productivity growth, real wages cannot grow,†it adds.The total number in work and the employment rate are at record levels but the NPI says this is down to the rise in self-employment, income from which has fallen. “The level of zero-hours contracts points to further weakness behind the headlines,†it adds.Instead of rebounding as it did after each of the last three recessions, real household disposable income is barely up on where it was in 2009, the NPI says. “This makes sustainable growth, let alone growth that feeds through to good living standards, far from assured,†adds the report.Britain has “a huge balance of payments deficit, a too low level of corporate investment and households spending to the hilt,†the NPI report says.The thinktank says the deficit, 4.8% of GDP in the latest financial year, has not come down by as much as the coalition had planned at the outset. “The coalition followed its own plan for about two and half years but then switched tack after two and a half years of low or no growth,†the report says. Continue reading...

|

|

by Helena Smith in Athens on (#7YER)

Syriza-led coalition appoints economics professor in leading role to overcome mounting European opposition to his controversial colleagueGreece moved to inject fresh momentum into problem-plagued talks with creditors on Monday, reshuffling its negotiating team to try and defuse tensions over its outspoken finance minister.

|