|

by Willa Rubin on (#739W7)

Planet Money went to the annual meeting of the American Economics Association, and we saw some fascinating papers presented there.

|

NPR: Planet Money

NPR: Planet Money

| Link | https://www.npr.org/templates/story/story.php?storyId=93559255 |

| Feed | http://www.npr.org/rss/rss.php?id=93559255 |

| Copyright | Copyright 2024 NPR - For Personal Use Only |

| Updated | 2026-02-06 12:33 |

|

by Greg Rosalsky on (#72MCF)

Economists may have a pretty dismal record with predictions. But we're still interested in what they see in their non-existent crystal balls.

|

|

by Greg Rosalsky on (#726RQ)

Warner Bros. has a history of disastrous mergers and acquisitions. Can they avoid another bad sequel as Netflix and Paramount battle to buy it?

|

|

by Greg Rosalsky on (#721FG)

Demand for professional Santas and other seasonal workers seems to have cooled. Could that be a sign we're in a recession?

|

|

by Greg Rosalsky on (#71QDB)

For this Thanksgiving, Planet Money and The Indicator staffers offer economic insights they're grateful for.

|

|

by Greg Rosalsky on (#71J1D)

Last week, the internet piled on President Trump's proposal for a 50-year mortgage. But maybe it's not as crazy as it sounds.

|

|

by Greg Rosalsky on (#71CRR)

A new book by the Nobel-winning pioneer of behavioral economics offers some advice we can all use.

|

|

by Greg Rosalsky on (#717F0)

The Planet Money newsletter rounds up some new economic studies.

|

|

by Greg Rosalsky on (#712AC)

America's immigration crackdown might have serious financial consequences for a range of countries.

|

|

by Greg Rosalsky on (#70X4B)

A new book diagnoses a sickness affecting some of America's biggest companies.

|

|

by Alex Goldmark on (#70KR8)

Special gifts. Great stories. And economics too!? Can it be true? The Planet Money book is available for preorder.

|

|

on (#70GKA)

Join us Saturday, November 1st for a virtual hang-and-play of the Planet Money game. Co-hosts Kenny Malone and Erika Beras will be joined by Exploding Kittens co-founder Elan Lee to talk about our game, the decisions that went into it, and to answer your questions

|

|

on (#70FVJ)

We're teaming up with Exploding Kittens to make a board game. It needs to be fun and also about economics. This is hard. You can help. Sign up to be notified when it goes on sale, about pre-sale discounts and other updates, like invitations to play along with PM hosts. Download the print-at-home prototype and tell us how we can make it better. Send us a voice memo and you may appear in a future episode...

|

|

by Greg Rosalsky on (#70DHT)

The export-led industrial model that Germany has pursued for decades is now at a crossroads.

|

|

by Alex Mayyasi on (#7088D)

What even is the business of the S&P 500, and how does it make so much money?

|

|

by Alex Mayyasi on (#6ZX5M)

What makes rents go down and neighborhood diversity go up? Corporate landlords. But they also make it harder to own for yourself.

|

|

by Greg Rosalsky on (#6ZRHK)

Why evil histories sell. A visit to Hitler's bunker, and a deep dive into the economics and ethical quandaries of "dark tourism."

|

|

by Alex Mayyasi on (#6ZJKS)

Fungi and plants have something to teach humans about global trade and cooperation

|

|

by Darian Woods on (#6ZE8F)

There's been an era-defining race underway between two types of batteries used in electric vehicles: lithium batteries that use cobalt, and ones that use iron phosphate. Cobalt, a metal with a checkered human rights record, has been in the lead. Until recently.Henry Sanderson's book on the elements that build electric vehicles is Volt Rush: The Winners and Losers in the Race to Go Green.Related episodes:The race to produce lithiumHow batteries are already changing the gridHow batteries are riding the free market rodeo in TexasHow EV batteries tore apart Michigan (Update)Batteries are catching fire at seaFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Adrian Ma on (#6ZDEQ)

Social media has birthed an entire lexicon replicated by millions online - even if these words don't actually mean skibidi. On today's show, we talk to author Adam Aleksic about how TikTok and Instagram's engagement metrics, and viral memes, are rewiring our brains and transforming language at warp speed.Adam Aleksic's book is Algospeak: How Social Media is Transforming the Future of LanguageRelated episodes:What we're reading on the beach this summer For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6ZCP0)

Innovation is crucial for long-term economic prosperity. One area where that's happening aplenty: medical technology. From a cancer vaccine to an Alzheimer's blood test to a life-changing exoskeleton, we take you on a tour of the economics of health technology.Related episodes:The hidden costs of healthcare churn (Apple / Spotify)More for Palantir, less for mRNA, and a disaster database redemption arc (Apple / Spotify)It's actually really hard to make a robot, guys (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Voice-over by Greg Hardes. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Kenny Malone on (#6ZBP3)

For most Americans, we just lived through the highest period of inflation in our lives. And we are reminded of this every time we go grocery shopping. All over TikTok, tons of people have posted videos of how little they got for... $20. $40. $100. Most upsetting to us: an $8 box of Cinnamon Toast Crunch.Food prices are almost 30% higher than they were five years ago. It's bad. And those new, higher prices aren't going away.At the same time, prices are no longer inflating at a wild pace. For the last two years, the rate of inflation has slowed way down. And yet, our fears or feelings that things will spiral out of control again? Those have not slowed down.This mismatch has been giving us all the... feelings. Inflation feelings. Infeelings.On our latest show: we sort through our infeeltions. We talk to the economists who have studied us. We learn why our personal inflation calculators don't always match the professional ones.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Support Planet Money, get bonus episodes and sponsor-free listening and now Summer School episodes one week early by subscribing to Planet Money+in Apple Podcastsor atplus.npr.org/planetmoney.

|

|

by Angel Carreras on (#6ZB6R)

It's ... Indicators of the Week! Our rapid run through the numbers you need to know.On today's episode: John Legend croons; CPI inflation soothes; Same job as mom? You'll earn more, dude; Apple vs. Apple, a courtroom feud.Related episodes:Why every A-lister also has a side hustleThe DOJ's case against AppleThe Intergenerational Transmission of Employers and the Earnings of Young WorkersGenerational Wealth: How High Earners Help Their Children's CareersFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Wailin Wong on (#6ZACW)

Seemingly every celebrity has their own brand these days, whether it's booze (Cameron Diaz, Matthew McConaughey) or cosmetics (Selena Gomez, Lady Gaga) or squeezy food pouches (Jennifer Garner). Today on the show, what is fueling the celebrity business bonanza? We hear from two legendary singers, Lisa Loeb AND John Legend, who are pursuing ventures outside of show business. Related episodes: The celebrity crypto nexus The Olympian to influencer pipeline (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Robert Smith on (#6ZE8H)

Tariffs are the favorite tool of our current president, but there are lots of other ways that governments insert themselves into the free exchange of goods and services. Some of these trade barriers are so insidious and have been going on for so long that it may surprise you that they even exist.We bring you the classic story of what happens when you try to protect an American industry and end up hurting another American industry. Well intentioned plans turn into trade barriers that make our lives more expensive.Check out our Summer School video cheat sheet TikTok.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney. Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter. The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford.

|

|

by Robert Smith on (#6ZE8G)

Tariffs are the favorite tool of our current president, but there are lots of other ways that governments insert themselves into the free exchange of goods and services. Some of these trade barriers are so insidious and have been going on for so long that it may surprise you that they even exist.We bring you the classic story of what happens when you try to protect an American industry and end up hurting another American industry. Well intentioned plans turn into trade barriers that make our lives more expensive.Check out our Summer School video cheat sheet TikTok. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney. Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter. The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford.

|

|

by Stephan Bisaha on (#6Z9QW)

Trump's tax and spending law makes the largest cut in history to one of the nation's biggest safety net programs. Today on the show, we explore how cuts to the Supplemental Nutrition Assistance Program, also known as SNAP, impacts families and grocery stores alike.Based on the digital story: Independent grocery stores have had a tough five years. SNAP cuts will make it harderRelated episodes:Do work requirements help SNAP people out of government aid? When SNAP Gets Squeezed The trouble with water discountsFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Robert Smith on (#6Z9TH)

In economics, a market is a place (even virtual) where buyers and sellers meet to exchange goods or services. Economists love markets. It's like all of our supply and demand graphs have come to life. Almost everything you buy goes through some sort of marketplace-your cup of coffee came from trading in the bean markets. Your spouse might have come from the dating marketplace on the apps. Even kids will tell you one Snickers is worth at least two Twix.But sometimes, as we'll see today, markets can go terribly wrong; greed can run out of control; lives can be at risk. That's when the government often steps in and gives the market a little nudge to work better. Today's episode: Market Design.The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.

|

|

by Robert Smith on (#6Z9QX)

In economics, a market is a place (even virtual) where buyers and sellers interact to exchange goods or services. Economists love markets. It's like all of our supply and demand graphs have come to life. Everything you buy goes through some sort of marketplace-your cup of coffee came from trading in the bean markets. Your spouse might have come from the dating marketplace on the apps. Even kids will tell you one Snickers is worth at least two Twix. But sometimes, as we'll see today, markets can go terribly wrong; greed can run out of control; lives can be at risk. That's when the government often steps in and gives the market a little nudge to work better. Today's episode: Market Design. Check out our Summer School video cheat sheet on the origins of money at the Planet Money TikTok. The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.

|

|

by Emily Crawford on (#6Z93Q)

Cutting Medicaid can seem like an easy way to slash the budget. But, the costs can spread to all of us.

|

|

by Wailin Wong on (#6Z8TS)

Insulin needles. Sleeping bags. Nutella. These are items Arwa Damon's charity -International Network for Aid, Relief and Assistance-has tried to send to Gaza and Israel has rejected. It's a glimpse into the harsh reality of a humanitarian crisis with no end in sight. Today on the show, we talk to Damon about the economics of running a humanitarian nonprofit and what's stopping more aid from reaching Gaza.Related episodes:Why Israel uses diaspora bondsWhy the U.S. helps pay for Israel's militaryWhat could convince Egypt to take Gaza's refugees?For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6Z81W)

It's time for our annual beach reading recs. Today we bring you three books, with a little economic learning to boot. Our recs: Who is Government? The Untold Story of Public Service edited by Michael Lewis El Dorado Drive by Megan Abbott Algospeak: How Social Media is Transforming the Future of Language by Adam Aleksic Related episodes: Beach reading with a side of economics How to beach on a budget For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Mary Childs on (#6Z74G)

After President Trump fired the head of the Bureau of Labor Statistics, economists and statisticians across the board were horrified. Because the firing raises the spectre of potential manipulation - and it raises the worry that, in the future, the numbers won't be as trustworthy.So: we looked at two countries that have some experience with data manipulation. To ask what happens when governments get tempted to cook the books. And...once they cook the books... how hard is it to UN-cook them?It's two statistical historical cautionary tales. First, we learn how Argentina tried to mask its true inflation rate, and how that effort backfired. Then, we hear about the difficult process of cleaning up the post-cooked-book mess, in Greece. For more: - Can we just change how we measure GDP? - The price of lettuce in Brooklyn - What really goes on at the Bureau of Labor Statistics (Update) - Can we still trust the monthly jobs report? (Update) - How office politics could take down Europe - The amazing shrinking economy might stop shrinkingListen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Support Planet Money, get bonus episodes and sponsor-free listening and now Summer School episodes one week early by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Darian Woods on (#6Z6F6)

It's ... Indicators of the Week! Our weekly look at some of the most fascinating economic numbers from the news. On today's episode: Palantir crosses a billion dollars in quarterly revenue (what do they actually do again?); mRNA vaccine research gets a big cut in RFK Jr's health department; and a climate disaster database gets a new lease on life.Related episodes:How Palantir, the secretive tech company, is rising in the Trump eraAn indicator lost: big disaster costsMoonshot in the armFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez and Cooper Katz McKim. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Scott Horsley on (#6Z5ME)

President Trump's new round of tariffs took effect today. It will bring in billions of dollars to the government, in part paid for by U.S. importers who can decide whether to pass that cost onto American families. But are these tariffs legal?Today on the show, the arguments for and against the president's tariffs and what happens to that tariff revenue if Trump loses.Related episodes:Trump's tariff role modelDealmaker Don v. Tariff Man TrumpAre Trump's tariffs legal? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6Z4S3)

Why do revisions to the jobs report happen? Today on the show, we speak with a former Commissioner of the Bureau of Labor Statistics about why revisions occur and how we should interpret the monthly report's actual message. Related episodes:Can we still trust the monthly jobs report? (Update)What really goes on at the Bureau of Labor Statistics (Update)How you're using AI at workFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Robert Smith on (#6Z4JA)

LIVE SHOW: August 18th in Brooklyn. Tickets here. Traditional economics says the market is guided by the forces of supply and demand. Customers decide what they want to buy, and private enterprise responds to that need. So what makes government think that it's smarter than capitalism? Why offer tax breaks to Hollywood or incentives to build silicon chip factories in Arizona? Why those industries and not others? And when does the free market fail and need government to step in? Today, we discuss what happens when the government really wants to get its hands dirty and shape the direction of the economy, even decide which companies should prosper and which ones should fail, through industrial policy.The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.

|

|

by Robert Smith on (#6Z4J9)

LIVE SHOW: August 18th in Brooklyn. Tickets here. Traditional economics says the market is guided by the forces of supply and demand. Customers decide what they want to buy, and private enterprise responds to that need. So what makes government think that it's smarter than capitalism? Why offer tax breaks to Hollywood or incentives to build silicon chip factories in Arizona? Why those industries and not others? And when does the free market fail and need government to step in? Today, we discuss what happens when the government really wants to get its hands dirty and shape the direction of the economy, even decide which companies should prosper and which ones should fail, through industrial policy.Check out our Summer School video cheat sheet on the origins of money at the Planet Money TikTok.The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Emily Crawford. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Always free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.

|

|

by Ella Feldman on (#6ZEFF)

Software engineers, teachers, a wedding photographer and more on how AI is changing their jobs.

|

|

by Wailin Wong on (#6Z3YF)

Since his return to office, President Trump has waged something of a pressure campaign on economic data and the people in charge of delivering it. His firing of the Bureau of Labor Statistics commissioner following a weak jobs report now has some wondering: can we still trust the official numbers? Today on the show, we're resharing our conversation with former BLS commissioner, Erica Groshen on her current fears for the integrity of government data. The original version of this story aired March 7, 2025. Related: What really goes on at the Bureau of Labor Statistics? (Update) (Apple / Spotify) Would you trust an economist with your economy? (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6Z333)

On Friday, we reported on the latest jobs numbers from the Bureau of Labor Statistics, which showed weaker than expected growth. On Friday afternoon, President Trump fired the person in charge of those numbers. The monthly jobs report is a critical tool for the economy, used by businesses to make decisions and the Federal Reserve to set rates. So how exactly are those figures collected? Today, we're re-airing our behind-the-scenes look at how the BLS puts together the jobs report ... one call at a time. This show originally aired June 6, 2022. Related: Can we trust the monthly jobs report? Would you trust an economist with your economy? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez and Corey Bridges. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Amanda Aronczyk on (#6Z27M)

Trust in experts is down. In all kinds of institutions and professions - in government, in media, in medical science... and lately, economists are feeling the burn acutely. In fact, President Trump just fired the economist who ran the Bureau of Labor Statistics, accusing her - with no evidence - of faking a jobs report that showed fewer gains than expected.In decades past, economists whispered in the ears of presidents. Now, many politicians and voters are disenchanted with the field.On today's show, we speak with economists about how distrust is messing with their minds and interfering with their work. Can they build up trust again?Today's episode was hosted by Amanda Aronczyk. It was produced by Sam Yellowhorse Kesler and edited by Marianne McCune with help from Jess Jiang. It was engineered by Robert Rodriguez and fact-checked by Sierra Juarez. Alex Goldmark is Planet Money's executive producer.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Support Planet Money, get bonus episodes and sponsor-free listening and now Summer School episodes one week early by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Adrian Ma on (#6Z1WV)

AI is a hot topic for both employers and employees in the workforce. That's why we wanted to hear from our listeners about how they are using AI at work. Today on the show, we explore the good, the bad and the ugly of AI in the workplace. Related episodes:Is AI overrated?Is AI underrated?For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6Z0P1)

The Fed is on the hook for an estimated one-and-a-half trillion dollars. Despite the recent headlines, that's not because of building renovations. It's a much larger cost blowout caused by big actions taken during the pandemic to help the economy: quantitative easing. Today on the show, we talk to both a critic of these actions and someone who helped put those those actions in play.

|

|

by Darian Woods on (#6YZVB)

Private equity is a risky business. There are high-highs and low-lows. A retirement plan, on the other hand, is meant to be a reliable beast. But President Trump believes your 401(k) can handle it! On today's show, the president's expected executive order could help offer some legal cover for fund managers who include private equity in your retirement portfolio. What are the risks and benefits?Related episodes:The Prudent Man Rule (Apple / Spotify)Carried interest wormhole (Apple / Spotify)Let's party like it's NVIDIA earnings report day! (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Robert Smith on (#6YZWS)

LIVE SHOW: August 18th in Brooklyn. Tickets here. There are occasional incentives in business that make it very profitable to do bad things; maybe cheat at the game and steal other people's ideas, or cut some corners on safety. In theory, the government as referee steps in to make the rules and enforce them, and manage competition in a way that hopefully makes things better for us all. But you have to ask... When is the government protecting you and when is it protecting the already rich and powerful?We'll meet a man trying to corner the market for frozen meat, with the help of patents. And then we'll head to the salon, and ask - Should the government really require dozens of hours of training for a license to braid hair? Get tickets to our August 18th live show and graduation ceremony at The Bell House, in Brooklyn. (Planet Money+ supporters get a 10 percent discount off their tickets. Listen to the July 8th bonus episode to get the code!) The series is hosted by Robert Smith and produced by Eric Mennel. Our project manager is Devin Mellor. This episode was edited by Planet Money Executive Producer Alex Goldmark and fact-checked by Sofia Shchukina. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Greg Rosalsky on (#6ZEFG)

We at PlanetMoney and The Indicator are always reading for our stories (and also for fun), and so today we're sharing some favorite recommendations that fit the summer vibe.

|

|

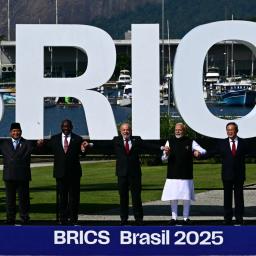

by Darian Woods on (#6YYZF)

BRICS is an economic alliance of countries that includes Brazil, Russia, India, China, South Africa and several other nations. They met earlier this month to discuss everything from international law to global health. President Trump, however, is not a fan of BRICS and threatened members with increased tariffs. So why has this alliance generated so much animosity from the President? Today on the show, we talk to the economist who coined the term "BRICs" about the origins of the group and why the international economic organizations have been western dominated for so long. Related episodes: China's trade war perspective Is the US pushing countries towards China?For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Wailin Wong on (#6YY6A)

Baby bond fever is catching on. In recent years, states like Connecticut have been experimenting with giving newborns government-seeded accounts that grow tax-free until they are 18. Now, President Trump's signature tax and spending bill will give a thousand dollars to every U.S.-born baby through 2028. On today's show, what are baby bonds and could they help tackle wealth inequality? Related: Baby bonds, proportional representation, and no left turns Could cash payments ease recessions? Building generational wealth in rural America For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Cooper Katz McKim. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Erika Beras on (#6YX5C)

LIVE SHOW ALERT: August 18th, NYC. Get your tickets here. When news broke that a Japanese company, Nippon Steel, was buying the storied American steel company U.S. Steel, it was still 2023, just before an election. And right away, politicians from both sides of the aisle came out forcefully against the deal, saying the company should remain American. Before leaving office, President Biden even blocked the sale. But in a dramatic twist a few weeks ago, President Trump approved it. With a caveat: the U.S. would get what Trump called 'a golden share' in U.S. Steel.On our latest show: what even is a "golden share"? When has it been used before, and why? And, could deals like this be a good way to get foreign investment in American manufacturing...or is it government overreach? Related episodes:- When Uncle Sam owned banks and factories- How Big Steel in the U.S. fellThis episode was produced by Willa Rubin and edited by Marianne McCune. Research help from Emily Crawford and Emma Peaslee. It was fact-checked by Sierra Juarez and engineered by Robert Rodriguez. Alex Goldmark is our executive producer.Support Planet Money, get bonus episodes, sponsor-free listening and now Summer School episodes one week early by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.

|