|

by Robert Smith on (#6XX77)

There's something interesting happening at the Port of Baltimore. On today's show, we explore the hidden world of bonded warehouses, where you can stash your imported Latvian vodka or Dutch beer tariff free (for a while). Related episodes: Tariffied! We check in on businesses (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

NPR: Planet Money

NPR: Planet Money

| Link | https://www.npr.org/templates/story/story.php?storyId=93559255 |

| Feed | http://www.npr.org/rss/rss.php?id=93559255 |

| Copyright | Copyright 2024 NPR - For Personal Use Only |

| Updated | 2025-12-24 02:31 |

|

by Greg Rosalsky on (#6XWD9)

For generations, people have looked for small, informal signs that a recession is coming or already here. This phenomenon recently exploded on social media, often in joke form.

|

|

by Alexi Horowitz-Ghazi on (#6XTCR)

Over the past decade, politicians from both parties have courted American voters with an enticing economic prospect - the dream of bringing manufacturing and manufacturing jobs back to America. They've pushed for that dream with tariffs and tax breaks and subsidies. But what happens when one multinational company actually responds to those incentives, and tries to set up shop in Small Town, USA?Today on the show - how a battery factory ignited a political firestorm over what kind of factories we actually want in our backyard. And what happens when the global economy meets town hall democracy. This episode of Planet Money was produced by Emma Peaslee and Sylvie Douglis. It was edited by Marianne McCune and Jess Jiang. It was fact-checked by Sierra Juarez. It was engineered by Robert Rodriguez. Alex Goldmark is our executive producer.Read Viola Zhou's reporting on the Gotion battery factory.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Music: NPR Source Audio - "Collectible Kicks," "Arturo's Revenge," and "Liquid Courage"

|

|

by Wailin Wong on (#6XT4M)

For the last couple of years, U.S. labor productivity has been on the rise. And economists don't know exactly why. So today on the show, the president of the Federal Reserve Bank of Chicago plays economic detective and helps us investigate some different theories about why U.S. workers seem to be more productive than in prior decades. Related episodes:What keeps a Fed president up at night (Apple / Spotify)Productivity and workforce whiplash (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Adrian Ma on (#6XRYQ)

To hear President Trump tell it, the late 1800s, i.e. the Gilded Age, were a period of unparalleled wealth and prosperity in the U.S. But this era was also marked by corruption and wealth inequality. Sound familiar? On today's show, is history repeating itself? Related episodes: Trump's tariff role model (Apple / Spotify) Worst. Tariffs. Ever. (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6XQYT)

Today on the show - our crypto president. Just before President Donald Trump began his second administration in January, he and his business partners launched the $TRUMP coin. It's a memecoin that quickly raked in hundreds of millions of dollars. And there's a lot of earning potential still left on the table. Is that even legal?We bring you two stories from our daily show, The Indicator about President Trump and his ties to crypto. First, the Trump coin. We explain what it is, how the real Donald Trump profits from it, and yes, whether this whole crypto scheme is within the law. Then we take a look at Stablecoins: how they work, how they make money, and for whom.The original episodes from The Indicator were produced by Cooper Katz McKim and Corey Bridges. They were engineered by Harry Paul and Robert Rodriguez. They were fact-checked by Sierra Juarez. Kate Concannon edits the show. This episode of Planet Money was produced by James Sneed and edited by Emma Peaslee. Alex Goldmark is Planet Money's executive producer.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Wailin Wong on (#6XQYS)

The U.S. government has tallied the economic impact of major natural disasters going back to 1980. State and local governments used this data for budgeting and planning. But last month, the administration retired its Billion-Dollar Weather and Climate Disasters disaster database. Today on the show, we speak to Adam Smith, the architect of the program, on the work he did and what might be next. Related episodes:How much is a weather forecast worth? (Update) (Apple / Spotify)How ski resorts are (economically) adjusting to climate change (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Greg Rosalsky on (#6XQ66)

In recent decades, America has seen economic opportunities concentrated in superstar cities. Manufacturing boosters hope reshoring factories could help change that. We look at the theory and evidence.

|

|

by Sally Herships on (#6XQ37)

By 2048, more than $100 trillion is expected to be inherited, or passed down from one family member to another. But a lot of the time, the money doesn't end up where it's intended. On today's show, we navigate the thornier questions in estate planning. Related episodes: What women want (to invest in) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6XP87)

A significant portion of young people feel like they aren't on solid financial footing. And yet, the numbers show Gen Z adults on average actually earn more and have more wealth than previous generations did at their age. This phenomenon has been dubbed (by the internet) as 'money dysmorphia'. Today on the show, we chat with a neuroscientist who co-wrote a book, Look Again, that helps explain this phenomenon. Related episodes: Relax, Millennials! You're Doing Great.Gen Z's dream job in the influencer industry (Apple / Spotify) There Is Growing Segregation In Millennial Wealth For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Keith Romer on (#6XN76)

Over the last few months U.S.-China trade relations have been pretty hard to make sense of - unless you look at what's happening through the lens of game theory. Game theory is all about how decisions are made, based not just on one side's options and payoffs, but on the choices and incentives of others.So, are Donald Trump and Xi Jinping competing in a simple game of chicken? Or is the game more like the prisoner's dilemma? On today's show, we try to decide which of four possibilities might be the best model for this incredibly high-stakes game. And we take a look at who is playing well and who might need to adjust their strategy.For more on the U.S.-China trade war: - The 145% tariff already did its damage - What happened to U.S. farmers during the last trade war - What "Made in China" actually meansThis show was hosted by Keith Romer and Amanda Aronczyk. It was produced by Sam Yellowhorse Kesler. It was edited by Jess Jiang, fact-checked by Sierra Juarez and engineered by Kwesi Lee with help from Robert Rodriguez and Cena Lofreddo. Additional production help from Sylvie Douglis. Alex Goldmark is Planet Money's executive producer. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Wailin Wong on (#6XKSX)

Top Trump advisers have been boasting about 'awesome' trade deals the administration is negotiating with other countries. But are these deals real? Today on the show, we ask a former U.S. trade negotiator whether these agreements hold up. Related episodes: Dealmaker Don v. Tariff Man Trump (Apple / Spotify) Why there's no referee for the trade war (Apple / Spotify) Is this a bank? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Erika Beras on (#6XKND)

American universities are where people go to learn and teach. They're also where research and development happens. Over the past eight decades, universities have received billions in federal dollars to help that happen. Those dollars have contributed to innovations like: Drone technology. Inhalable Covid vaccines. Google search code.The Trump administration is cutting or threatening to cut federal funding for research. Federal funding for all kinds of science is at its lowest level in decades.Today on the show: when did the government start funding research at universities? And will massive cuts mean the end of universities as we know them?We hear from the man who first pushed the government to fund university research and we talk to the chancellor of a big research school, Washington University in St. Louis. He opens up his books to show us how his school gets funded and what it would mean if that funding went away.This episode is part of our series Pax Americana, about how the Trump administration and others are challenging a set of post-World War II policies that placed the U.S. at the center of the economic universe. Listen to our episode about the reign of the dollar.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Darian Woods on (#6XJYT)

If you had to guess, would you say the president of a university usually makes more money than the football coach? Well, you may be wrong. A college's football coach is often their highest paid employee. The University of Alabama pays its football coach on average close to $11 million. Today on the show, why are college football coaches paid so much? Do their salaries really make economic sense? Related episodes:Why the Olympics cost so much (Apple / Spotify)Want to get ahead in youth sports? Try staying back a year (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Greg Rosalsky on (#6XJ98)

More than half of American workers don't have a college degree. Is manufacturing a ticket for them to the middle class?

|

|

by Darian Woods on (#6XJ63)

Why is building affordable housing so hard these days? We talk to author Derek Thompson about his new book with Ezra Klein, Abundance, about what they believe is keeping affordable housing out of reach in high-income cities. Related: How big is the US housing shortage? (Apple / Spotify) How California's speed rail was always going to blow out (Apple / Spotify) Why building public transit costs so much For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by P.J. Vogt on (#6XGFS)

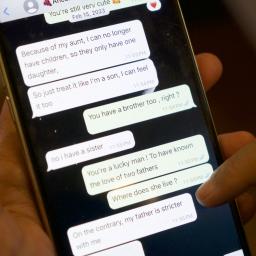

You might have seen these texts before. The scam starts innocently enough. Maybe it's a "Long time no see" or "Hello" or "How are you." For investigative reporter Zeke Faux it was - "Hi David, I'm Vicky Ho. Don't you remember me?" Many people ignore them. But Zeke responded. He wanted to get scammed. This led him on a journey halfway around the world to find out who is sending him random wrong number texts and why. After you hear this story, you'll never look at these messages the same way again.To hear the full episode check out Search Engine's website. Search Engine was created by P.J. Vogt and Sruthi Pinnamaneni. This episode was produced by Garrott Graham and Noah John. It was fact-checked by Sean Merchant. Theme, original composition, and mixing by Armin Bazarian. Search Engine's executive producers are Jenna Weiss-Berman and Leah Reis-Dennis.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Wailin Wong on (#6XFYY)

Can you tell me how to get... how to get to Indicators of the Week? This week's econ roundup looks at Target's sagging sales, Klarna's pay-later problem, and Sesame Street's new streaming address. Related: When do boycotts work? (Apple / Spotify) Buy now, pay dearly? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6XF36)

Just before Trump began his second administration in January, he and his business partners launched the $TRUMP coin. It's a meme coin that quickly raked in hundreds of millions of dollars. And there's a lot of earning potential still left on the table. Is any of this legal? Today on the show, we examine how the $TRUMP coin works and talk to an expert about how the president's meme coin gambit interacts with the Foreign Emoluments Clause of the Constitution. Related episodes: How the memecoin game is played Did Trump enable insider trading? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Kenny Malone on (#6XEVB)

Lately we've noticed that something we think about all the time here at Planet Money is having a viral moment: recession indicators!From the more practical (like sales for lipstick going up and men's underwear going down) to the absurd and nonsensical (like babysitter buns coming back into style?) - people are posting to social media every little sign they see that a recession is coming. And we LOVE it. Because between the trade war and the tariffs and the stock market, there has been a lot of economic uncertainty over the last few months and we want to talk about it, too.Today on the show - we dig into the slightly wonkier indicators that economists look at when they're trying to answer the question behind the viral internet trend: Is a recession coming?This episode of Planet Money was produced by James Sneed. It was edited by Marianne McCune, fact-checked by Sarah McClure, and engineered by Cena Loffredo. Alex Goldmark is our executive producer.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Music: Source Audio - "The Shirt Still Fits," "Chameleon Panther Style," and "Nighthawk."

|

|

by Stephan Bisaha on (#6XE78)

President Donald Trump wants more products made in America, and he's not afraid of a few trade wars to make it happen. Back in the 80s, a different trade dispute brought new manufacturing to the U.S. Today on the show, how former President Ronald Reagan used the threat of trade protectionism to bring car-making stateside, and why the same strategy might not work today.Related episodes:The tensions behind the sale of U.S. Steel (Apple / Spotify)Tariffs: What are they good for? (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Wailin Wong on (#6XD9C)

We are back to answer your questions, listeners. Today on the show, we tackle three big questions: Are airport lounges worth it for credit card companies? How effective have carbon taxes been for Canada? Why is gasoline getting more expensive over the last few months as the price of crude oil has sunk? If you want to submit your OWN question to be considered in a future episode, send us a message at indicator@npr.org. Related episodes:Can cap and trade work in the US? (Apple / Spotify) A Quick History Of Slow Credit Cards Breaking down the price of gasoline (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.

|

|

by Darian Woods on (#6XCE1)

All of us negotiate - whether it's accepting a job offer, buying a house or working out who does the dishes. Economist Daryl Fairweather has a new book out: Hate the Game: Economic Cheat Codes for Life, Love, and Work. It's all about the negotiation lessons she's learned through the research, her own career and Destiny's Child. Related episodes: What women want (to invest in)A conversation with Nobel laureate Claudia Goldin (Update) Summer School 7: Negotiating and the empathetic nibble For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Sarah Gonzalez on (#6XBER)

Even though the 145% tariff on Chinese imports only lasted a month, it already inflicted its scars on the economy. Global trade is just not something you can turn off and on like that. Some companies got really unlucky. Like those whose goods arrived at U.S. ports before the pause. If a medium size company had a million dollars worth of goods imported, they had to pay an extra million and a half dollars on top of that - just for the tariff. Today we are bringing you a portrait of this unfathomably high tariff. What a month of 145% tariffs looked like and felt like for three people in the global economy whose lives were all affected and still will be. The ones who got lucky and the ones who got really unlucky. This episode of Planet Money was produced by Emma Peaslee and edited by Jess Jiang. It was engineered by Jimmy Keeley and fact-checked by Willa Rubin. Alex Goldmark is our executive producer. Check out the live cargo map here. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter. Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts. Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney. Music: NPR Source Audio - "Bass Talks," "Bassline Motion," and "What Da Funk"

|

|

by Darian Woods on (#6XASP)

It's ... Indicators of the Week! Our weekly look at some of the most fascinating economic numbers from the news. On today's episode: Japanese asset buyers make it rain, an iPhone ... powered by the brain?! And, how are we going to pay for these Trump tax cuts? We explain! Related episodes:What's going to happen to the Trump tax cuts? (Apple / Spotify) Slender Starbucks, Medicaid at risk, and the gold card visa (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Wailin Wong on (#6X9XJ)

In early April, the bond market gave people a scare. Investors began selling off their historically secure U.S. Treasuries in large quantities. It reportedly encouraged President Trump to pause his flurry of liberation day tariffs. These jitters offered a glimpse into what could go wrong for U.S. Treasuries if economic uncertainty gets worse. On today's show, we take a peek at some nightmare scenarios for the bond market.Related episodes:Who's advising Trump on trade (Apple / Spotify)IRS information sharing, bonds bust, and a chorebot future (Apple / Spotify)Bond vigilantes. Who they are, what they want, and how you'll know they're coming (Apple / Spotify)Is the reign of the dollar over? (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Amanda Aronczyk on (#6X9Q6)

The U.S. exports billions of dollars worth of agricultural products each year - things like soybeans, corn and pork. And over the last month, these exports have been caught up in a trade war. U.S. farmers have been collateral damage in a trade war before. In 2018, President Trump put tariffs on a bunch of Chinese products including flatscreen TVs, medical devices and batteries. But China matched those tariffs with their own retaliatory tariffs. They put tariffs on a lot of U.S. agricultural products they'd been buying, like soybeans, sorghum, and livestock. That choice looked strategic. Hitting these products with tariffs hurt Trump's voter base and might help China in a negotiation. And in some cases, China could find affordable alternative options from other countries.Today on the show: what happened in 2018, how the government prevented some U.S. farms from going bankrupt, and what was lost even after the trade war ended.This episode was produced by Sylvie Douglis and edited by Jess Jiang. It was engineered by Robert Rodriguez and fact-checked by Sierra Juarez. Alex Goldmark is our executive producer. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Adrian Ma on (#6X921)

The U.S. is known around the world for its problem with gun violence. The vast majority of murders in the U.S. are committed using guns. But what leads one person to shoot another? The "conventional wisdom" says gun violence is usually the act of calculated criminals or people acting out of desperate economic circumstances. But economist Jens Ludwig believes the conventional wisdom is wrong. Today on the show, he explains why he believes many of us fundamentally misunderstand the problem of gun violence and how behavioral economics reveals some potential solutions. Jens's new book detailing his research into gun violence is called "Unforgiving Places: The Unexpected Origins of American Gun Violence".Related episodes:Can credit card codes help address gun violence? The money going into and out of gun stocksGuns and The Trump SlumpFor sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Greg Rosalsky on (#6X87H)

Leaders from both major political parties have been working to bring back manufacturing. But American manufacturers say they are struggling to fill the manufacturing jobs we already have.

|

|

by Darian Woods on (#6X843)

Where does NPR get its funding? Today on the show, we open our books and share a brief history of public radio. And we learn what's at stake with President Trump's executive order to cut off federal funding to NPR. Under NPR's protocol for reporting on itself, no corporate official or news executive reviewed this story before it was posted publicly. For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Geoff Brumfiel on (#6X7A9)

Robots have been a thing for a long time, but they've never quite met expectations. While AI has changed the game for chatbots, it's not quite so clear for robots. NPR science desk correspondent Geoff Brumfiel spoke to our colleagues over on our science podcast Short Wave on how humanoid robots are actually developing with the help of artificial intelligence. It was a fascinating discussion and so we are sharing that conversation with you today on the Indicator. Related episodes: Is AI underrated? (Apple / Spotify) Is AI overrated? (Apple / Spotify) Dial M for Mechanization (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Mary Childs on (#6X6AX)

For decades, dollars have been the world's common financial language. Central banks everywhere hold dollars as a way to safely store their wealth. Countries, businesses, and people use it to trade; around 90% of all foreign exchange transactions involve dollars. It's the world's money, the world's "reserve currency."But what if that is changing? What if the world stops seeing the dollar as safe? Today on the show, what is a "reserve currency"? Why is it the dollar? And if the dollar falls from favor, what will replace it?This episode of Planet Money was produced by Emma Peaslee with help from James Sneed. It was edited by Marianne McCune with fact checking help from Sierra Juarez. It was engineered by Kwesi Lee. Alex Goldmark is our executive producer. The Dollar Trap by Eswar PrasadExorbitant Privilege by Barry EichengreenOur Dollar. Your Problem by Ken RogoffFind more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Music: NPR Source Audio - "Virtual Machine," "Fake Blood" and "Successful Secrets"

|

|

by Wailin Wong on (#6X5QQ)

It's ... Indicators of the Week! Our weekly look at some of the most fascinating economic numbers from the news. On today's episode: China bulks up for a financial chill, how much Americans should save for a rainy day, and the price of used cars goes up.Related episodes:America's small GDP bump, China's big stimulus dispersal, and a Monkey King (Apple / Spotify)How nonprofits get cash from your clunker (Apple / Spotify)IRS information sharing, bonds bust, and a chorebot future (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Wailin Wong on (#6X4WC)

President Trump has flirted with firing Federal Reserve Chair Jerome Powell since returning to office, but can he legally do that? Not without good cause. Today on the show, the danger of Trump's amped up attacks on Powell and the Fed's independence. Follow Chris Hughes on Substack. Related listening: A primer on the Federal Reserve's Independence (Apple / Spotify) Arthur Burns: shorthand for Fed failure? For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Jeff Guo on (#6X4ME)

Virtually every product brought into the United States must have a so-called "country of origin." Think of it as the official place it comes from. And this is the country that counts for calculating tariffs.But what does it really mean when something is a "Product of China"? How much of it actually comes from China? And how do customs officials draw the line?Here in the U.S., the rules are delightfully counterintuitive. A product's country of origin is not necessarily where that product got on the container ship to come here. It's not necessarily where most of its ingredients are from or even where most of the manufacturing happened.Our system is much stranger. The answers can be surprisingly philosophical - and at times, even poetic.This episode of Planet Money was produced by James Sneed with help from Sylvie Douglis. It was edited by Jess Jiang, fact-checked by Sierra Juarez, and engineered by Kwesi Lee. Alex Goldmark is our executive producer.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Stephan Bisaha on (#6X419)

Many businesses are scared of what President Trump's tariffs will mean for their industry. However, the shrimping industry is one that doesn't seem to be worried. In fact, shrimpers say they welcome them. On today's episode, why shrimpers are embracing the tariffs and whether economists agree that this tariff is good for Americans.Related episodes:Tariffied! We check in on businesses (Apple / Spotify)Go ask ALICE about grocery prices (Apple / Spotify)What the cluck is happening with egg prices? (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Adrian Ma on (#6X363)

Two American farmers tell us how they're feeling about a trade war that targets the soybean industry's biggest customer: China. Related episodes: How many times can you say uncertainty in one economic report? (Apple / Spotify) Why Trump's potential tariffs are making business owners anxious (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Robert Smith on (#6X2EV)

The Beigie Awards are back to recognize the regional Federal Reserve Bank with the best Beige Book entry. On today's episode, we shine a spotlight on a Midwest food bank. Related episodes: Why Midwest crop farmers are having a logistics problem (Apple / Spotify)How many times can you say uncertainty in one economic report? (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Erika Beras on (#6X1FQ)

Why is it so hard to find a bathroom when you need one? In the U.S., we used to have lots of publicly accessible toilets. But many had locks on the doors and you had to put in a coin to use them. Pay toilets created a system of haves and have nots when it came to bathroom access. So in the 60s, movements sprung up to ban pay toilets.Problem is: when the pay toilets went away, so too did many free public toilets. Today on the show, how toilets exist in a legal and economic netherworld; they're not quite a public good, not quite a problem the free market can solve.Why we're stuck, needing to go, with nowhere to go.This episode was produced by Willa Rubin with help from James Sneed. It was edited by Marianne McCune and engineered by Cena Loffredo. It was fact-checked by Sierra Juarez. Alex Goldmark is our executive producer.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Music: Audio Network - "Smoke Rings," "Can't Walk Away" and "Bright Crystals."

|

|

by Darian Woods on (#6X13W)

President Trump's federal cuts and scrutiny of academic institutions are forcing some U.S. scientists to head for the border. On today's show, an entomologist keeping America's farms safe from pests reconsiders America. And a CEO of a Canadian hospital explains how they are benefiting from the exodus. Related episodes: How much international students matter to the economy (Apple / Spotify) What happens when billions of dollars in research funding goes away (Apple / Spotify) A 'Fork in the Road' for federal employees (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Talib Visram on (#6WZZQ)

Many international students are rethinking their education in the United States as the federal government revokes visas, often over minor infractions. A shift away could carry a heavy economic toll, as international students contributed $44 billion to the U.S. economy last school year. So what happens when a generation of bright-eyed scholars decide to forgo school in the U.S. and take their dollars elsewhere?Related episodes:Do immigrants really take jobs and lower wages? (Apple / Spotify)The long view of economics and immigration (Two Indicators) (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Paddy Hirsch on (#6WZ56)

Stablecoins are the latest digital asset to grab headlines. Congress is considering legislation around the cryptocurrency, and a Trump family-affiliated company is preparing to launch its own Stablecoin. But does this digital currency live up to its own name? Related episodes:What's this about a crypto reserve? (Apple / Spotify) Is 'government crypto' a good idea? (Apple / Spotify) WTF is a Bitcoin ETF? (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Sarah Gonzalez on (#6WZ55)

On today's show: we're ... venting.We at Planet Money are an ensemble show - each with different curiosities and styles. But we recently realized many of us have something in common: We're annoyed consumers.So we're going to get ranty ... but then try to understand the people annoying us. Like stingy coffee shops, manufacturers that don't design things for repair ... and stores that send way too many emails every day.Along the way, we learn a very sad thing about satisfaction and the future of skilled labor in the U.S.(Also, we should all just stop using umbrellas. They have negative consumption externalities. Come on people.)This episode was produced by James Sneed. It was edited by Marianne McCune, fact-checked by Sierra Juarez, and engineered by James Willetts. Alex Goldmark is our executive producer.Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|

|

by Greg Rosalsky on (#6WYD2)

A new study shows how partisan politics has long influenced whether Americans trust the Fed. And how, with Trump's second term, an old pattern may have changed.

|

|

by Darian Woods on (#6WYA3)

As the U.S. goes head-to-head with the rest of the world on tariffs, those countries are trying to figure out their best diplomatic strategy. One dilemma countries have is how close they get with another global superpower: China. On today's show, we hear from Pakistan's Finance Minister Muhammad Aurangzeb about how the country is balancing trade relations with both countries.Related episodes: China's trade war perspective (Apple / Spotify) Dealmaker Don v. Tariff Man Trump (Apple / Spotify) Who's advising Trump on trade? (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Julia Ritchey on (#6WXFR)

For weeks, Target has been the subject of a boycott after its decision to pull back on diversity, equity, and inclusion (DEI) policies. And early data shows it's taken a toll on the company. But in other instances, boycotts haven't made much of a splash. Today on the show, when does a boycott actually make a difference?Related episodes:SPAM strikes back (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Tyler Jones. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Alexi Horowitz-Ghazi on (#6WWE2)

Reporter Alexi Horowitz-Ghazi's Aunt Vovi signed up for 23andMe back in 2017, hoping to learn more about the genetic makeup of her ancestors. Vovi was one of over 15 million 23andMe customers who sent their saliva off to be analyzed by the company. But last month, 23andMe filed for bankruptcy, and it announced it would be selling off that massive genetic database. Today on the show, what might happen to Vovi's genetic data as 23andMe works its way through the bankruptcy process, how the bankruptcy system has treated consumer data privacy in the past, and what this case reveals about the data that all of us willingly hand over to companies every single day.This episode was produced by Sylvie Douglis and edited by Jess Jiang. It was engineered by Harry Paul and Neal Rauch and fact-checked by Tyler Jones. Alex Goldmark is our executive producer. Find more Planet Money: Facebook / Instagram / TikTok / Our weekly Newsletter.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.Music: NPR Source Audio - "Lazybones," "Twirp," and "On Your Marks"

|

|

by Darian Woods on (#6WVTB)

It's ... Indicators of the Week! Our weekly look at the some of the most fascinating economic numbers from the news. On today's episode, we investigate falling foreign travel to the U.S., why student loan default collections are back, and why maaaaaaaybe being so friendly with our AI chatbot pals has a cost. Related episodes: Economists take on student loan forgiveness Is AI overrated? (Apple / Spotify) Is AI underrated? (Apple / Spotify) For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Fact-checking by Sierra Juarez. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6WTZ1)

President Trump has not been afraid to tack on tariffs over and over again. Allies and foes alike are anxiously wondering if the tariffs will stick or whether a trade deal will be made. On today's episode, we take a look behind the curtains of the White House administration and examine the advisors whispering into Trump's ear.Related episodes:Dealmaker Don v. Tariff Man Trump (Apple / Spotify)China's trade war perspective (Apple / Spotify)What keeps a Fed president up at night (Apple / Spotify)For sponsor-free episodes of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org.Fact-checking by Tyler Jones. Music by Drop Electric. Find us: TikTok, Instagram, Facebook, Newsletter.

|

|

by Darian Woods on (#6WTDA)

President Donald Trump has been loudly critical of Federal Reserve Chair Jerome Powell for years now. Since January, the President has accused him of playing politics by keeping interest rates high. Trump has also threatened to oust Powell - which would mark an extraordinary shift away from the independence of the central bank.Today on the show, three Indicators: a short history of the Federal Reserve and why it's insulated from day-to-day politics; how the Fed amassed a ton of power in recent years; and a Trump executive order that took some of that power away.The original episodes from the Indicator were produced by Corey Bridges, Brittany Cronin, and Julia Ritchey. They were engineered by Cena Loffredo, James Willetts, and Gilly Moon, and fact-checked by Sierra Juarez. Kate Concannon is the editor of the Indicator. Follow us wherever you get your podcasts.This episode of Planet Money was produced by James Sneed and edited by Marianne McCune & Mary Childs. Alex Goldmark is our executive producer.For more of The Indicator from Planet Money, subscribe to Planet Money+ via Apple Podcasts or at plus.npr.org. Or, find us: TikTok, Instagram, Facebook.Listen free at these links: Apple Podcasts, Spotify, the NPR app or anywhere you get podcasts.Help support Planet Money and hear our bonus episodes by subscribing to Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney.

|