|

by Graeme Wearden (back again) and Nick Fletcher(12 - on (#EC2P)

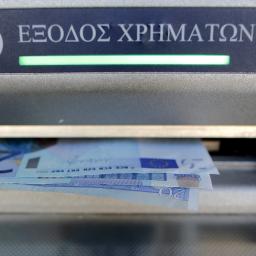

Riot police have clashed with anarchist groups in Athens tonight, as Greece’s PM Tsipras faces rebellion over the country’s bailout plan

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-02-03 18:16 |

|

by Heather Stewartand Helena Smith on (#EE5B)

Embattled prime minister fights to outflank opposition to eurozone agreement as riot police use teargas on demonstrators outside Athens parliamentAlexis Tsipras is fighting for his political life as he seeks parliamentary backing for the severe austerity measures Greece has pledged to take in exchange for a fresh bailout from its eurozone partners.The Greek prime minister urged his Syriza colleagues to support him in the make-or-break vote on Wednesday night, even as the International Monetary Fund – and his own former finance minister and right-hand man Yanis Varoufakis – savaged the deal struck in the early hours of Monday morning.Related: Eurozone bailout deal: what do ordinary Greeks think? Continue reading...

|

by Editorial on (#EE5X)

The government’s proposal takes a legislative sledgehammer to a small problem and will have widespread collateral damageThe government has found another windmill to tilt at, another phantom enemy for its pantheon of society’s imaginary ills to sit alongside threats like NHS tourism and BBC bias. This time, it is a perennial favourite: trade unions and the right to strike. The timing is propitious. Less than a week after the inconvenience of the most extensive tube and train strike for 10 years, millions of commuters in London and the south-east are in unforgiving mood. Parents dread the next round of teaching strikes. The Labour leadership contest offers its customary field day for critics avid to exploit evidence of union influence. It puts the party in the unpopular position of a full-throated defence of trade unions that is not universally deserved. By imposing the requirement to ask every union member to opt in to paying the political levy every five years, it undermines the main source of Labour party funding. But it fails to tackle the big question of paying for politics – something on which all parties had previously sought consensus.There is Conservative political advantage to be had too. It will cheer the CBI, which was unimpressed at being instructed to raise pay rates by the chancellor in the budget last week. It will delight the party’s right as it braces for the EU referendum. It almost seems as if the business secretary Sajid Javid has been studying the playbook of the Republican presidential hopeful Scott Walker. As governor of Wisconsin, in 2011 he withdrew the collective bargaining rights of most of the state’s public sector workers, provoking a sit-in that prefigured the Occupy movement. He came back for more this year, making Wisconsin a “right to work†state, that is ending the mutuality of union membership by entitling all workers, regardless of whether they are due-paying union members, to share in what are the often extensive benefits of membership. The result, research suggests, is lower wages and benefits for all. But Mr Walker’s militant anti-trade unionism is his calling card for the presidency. His intention was to set one group of workers against the rest, in his own words, to divide and conquer. This is partisan politics, and it is lousy policy. Continue reading...

|

by Max Höfer on (#EE00)

Disaster may narrowly have been averted for the eurozone, at the expense of Greece’s political autonomy. But it won’t take much for it all to crash downThe last act of the classical Greek tragedy ends with two outcomes: disaster and catharsis. In the current Greek debt drama, however, there has been no catharsis. The purification has failed to materialise.It would have meant that both sides had seen the error of their ways and come to their senses. Instead, the madness continues: Greece will take on €86bn of debt in addition to the existing €317bn (not including the emergency loans from the ECB). From Angela Merkel through François Hollande to Alexis Tsipras, all eurozone government leaders assert that Greece will emerge from over-indebtedness more quickly this way and will be economically healed in three years. Europe pretends that the bailout will help. And Greece acts as if everything is fine now.The troika is not operating as a trustee, but representing highly selfish interestsRelated: The euro ‘family’ has shown it is capable of real cruelty | Suzanne Moore Continue reading...

|

|

by Patrick Kingsley in Thessaloniki on (#EDY8)

In the city where the party unveiled its manifesto, many of the grassroots feel betrayed by the bailout and blame Greece’s leader for not calling the troika’s bluffIn Thessaloniki this week, some Syriza activists have found brief relief in a bit of gallows humour. You can buy many kinds of local pastries, or bougatsa, in the city – bougatsa with cheese, cream, or mince meat. “Soon we’ll be having bougatsa with memorandum,†smiled Syriza activist Tassos Gkouvas, as he drank coffee on Wednesday with Athina Teskou, a member of the local party’s governing committee.

|

|

by Jennifer Rankin in Brussels on (#EDWF)

Money from an EU bailout fund would enable Athens to meet debt obligations and other expenses of the government such as wagesThe European commission has proposed a €7bn (£4.9bn) emergency loan for Greece from an EU bailout fund, defying the UK and other non-eurozone countries that object being on the hook for a crisis in the currency union.

|

|

by Jana Kasperkevic and agencies on (#EDFD)

Federal Reserve chair Janet Yellen says the increase will happen ‘if the economy evolves as we expect’, while both the euro and oil prices fellUS stock prices held steady on Wednesday as the Federal Reserve chair, Janet Yellen, again suggested there would be an interest rate increase by the end of the year, while the euro fell ahead of a Greek government vote on whether to accept tough terms for a vital third bailout.Oil prices fell on worries of growing supply from Iran following a landmark deal that would lift sanctions that have curbed its oil sales for several years.

|

|

by Jan Svejnar on (#ED6Y)

My research found that the myth of billionaires boosting the economy is untrue – particularly when they amassed their wealth from political connectionsAfter I escaped communist Czechoslovakia in 1970, I enrolled at Cornell University. In my introductory sociology course there, I was taught that becoming a billionaire was impossible – realising the “American dreamâ€, at least at the very top of the income scale, was effectively no longer an option. The last few decades have certainly proved this thesis wrong.This shift has had significant consequences for income and wealth inequality not just in the US, but also in many countries around the globe. In fact, the top 1% globally will soon hold over half the world’s wealth. And their share is growing. This stunning fact makes it all the more important to ask what this means for the rest of us. Given the amazing level of accumulation of wealth at the top, improving our understanding of the economic role of billionaires has certainly become a public policy issue of the highest order.We discovered that billionaire wealth arising from being politically connected has a strongly negative effect on growthRelated: Britain has world's most billionaires per capita Continue reading...

|

|

by Heather Stewart on (#ECVZ)

Prime minister Alexis Tsipras, who has lost a key minister unwilling to support measures, must keep number of rebels to fewer than 40 to pass voteAlexis Tsipras, the Greek prime minister, is preparing for a make-or-break parliamentary vote over the austerity measures Athens must take in exchange for a fresh bailout from its eurozone partners.

|

|

by Rowena Mason Political correspondent on (#ECTM)

Plan is a blow to British PM David Cameron who thought he had secured a ‘black and white’ opt-out from further bailouts for eurozone countriesThe European commission has defied George Osborne, the UK chancellor, by formally proposing an emergency loan for Greece through an EU-wide bailout fund using up to £850m of British contributions.

|

|

by Larry Elliott on (#ECP9)

In a short, sharp and merciless analysis of the bailout terms for Athens, the International Monetary Fund predicts we will all be back here again soonThe timing was impeccable. A day after Greece and the eurozone concluded bailout negotiations, but 24 hours before the hugely contentious deal had been voted on in Athens, the International Monetary Fund dropped a bombshell: the agreement won’t work.In four crisp pages, the IMF’s updated debt sustainability analysis ripped to shreds the notion that Greece will be able to deliver on the promises it has been forced to make in order to keep its banks open and stay in the single currency. Continue reading...

|

|

by Guardian Staff on (#ECHA)

The International Monetary Fund’s devastating critique of the terms facing Athens Continue reading...

|

|

by Phillip Inman Economics correspondent on (#ECG9)

Latest data shows wages increase by more than 3% but jobless rise causes concern that employers have to shell out more due to dearth of skillsBritain enjoyed a bumper pay rise in spring, with average earnings 3.2% higher in the period from March to May 2015 than a year earlier, highlighting the increasing skills shortages forcing employers to offer higher wages.But the better earnings figures, from the Office for National Statistics, came as unemployment rose for the first time in two years, sparking fears that Britain’s booming labour market has lost some of its momentum. Continue reading...

|

|

by Alberto Nardelli on (#ECDJ)

A brutal assessment of the bailout terms facing Athens by the International Monetary Fund calls for substantial debt relief for a further 30 yearsJust hours before the Greek parliament’s crucial vote to push through fresh austerity measures required by the new bailout plan, the International Monetary Fund released a devastating assessment of the beleagured nation’s finances.Warning that Greece will require far more generous debt relief than is currently on offer from its creditors, it predicted that public debt is likely to peak at 200% of its national income within the next two years.Related: Greek crisis: MPs debate bailout after IMF demands debt relief - live updatesRelated: Why the IMF should not aid a Greek bailoutRelated: Alexis Tsipras: bailout a ‘bad deal’ but the best Greece could get Continue reading...

|

|

by Lucy P Marcus and Stefan Wolff on (#EC77)

As well as data, economic deals ultimately depend on the amorphous yet essential qualities of integrity, trustworthiness, and interpersonal chemistryToday’s decision-makers are supposed to embrace the virtues of big data, relentlessly pursue quantitative metrics, and then adhere to the optimal course of action that these powerful tools supposedly indicate. Yet if there is one thing that the Greek crisis has made clear, it is the importance of the human factor in negotiations. People and their personalities, and the way they perceive one another, can make small debts seem unserviceable or large debts disappear with a handshake.

|

|

by Patrick Wintour Political editor on (#EB41)

Business secretary Sajid Javid to criminalise unlawful picketing, and make it harder for workers to strike legally and for Labour to get union fundingThe biggest crackdown on trade union rights for 30 years will be unveiled on Wednesday, including new plans to criminalise picketing, permit employers to hire strike-breaking agency staff and choke off the flow of union funds to the Labour party.It is clear the Tory ​​party ​high ​command intend to make Labour bankrupt by cutting off the main source of fundingRelated: Frances O’Grady: ‘My members are the wealth creators, but don’t get a fair share’ Continue reading...

|

|

by Katie Allen on (#EBTC)

Relief for squeezed households tempered by concerns that stronger pay growth could have knock-on effects for inflation and warrant an interest rate riseOfficial figures are expected to confirm that wage growth continues to pick up in the UK and has hit a five-year high, bringing relief to households after years of squeezed living standards.Economists polled by Reuters have pencilled in a 3.3% annual rise in average pay packets during the three months to May. At the same time, they expect unemployment to be held at a seven-year low of 5.5%. Continue reading...

|

|

by Rafael Behr on (#EBTE)

All week this series looks at the questions Labour will need to answer if it is to win the next election. Today, what is the best size and shape of the state for the 21st century?The Hungarian mathematician George Polya had a rule for dealing with anything that looks intractable: “If you can’t solve a problem, then there is an easier problem you can solve: find it.†This applies in politics too. One of the hardest problems Labour faces is how to rebuild a reputation for economic competence when the Conservatives have successfully painted the opposition as unrepentant budget wastrels. To concede the point feels like surrender on enemy terms: accepting a mendacious account of what caused the financial crisis; signing up to cruel cuts. Yet to dispute the point looks like denial of political reality – blaming the voters instead of listening to them.So, following Polya’s maxim, how does Labour find a solvable problem within the unsolvable one? The trick is to take the Tories (momentarily) out of the equation. Posit super-benign circumstances in which there is no blame for the great crash and even George Osborne says all fiscal paths are equally valid. In this fantasy land the left would still have to confront failings of the Labour state that cannot simply be cast as inadequate funding or corruption by private enterprise.There is a vast political space between monolithic state control and a privatised market free-for-allRelated: Who should Labour speak for now? | John HarrisRelated: Britain won’t recover while its economy is dominated by magical thinking | Aditya Chakrabortty Continue reading...

|

|

by Reuters on (#EB67)

Prime minister tells Greek TV he will not resign and defends his abrupt change of course over debt crisis

|

|

by Graeme Wearden and Nick Fletcher on (#E8BC)

Greek prime minister tells state television that Sunday’s bailout deal was a bad night for Europe, but he won’t walk away.Read today’s Greek news live blog11.59pm BSTWe’ve now got hold of the new IMF report into Greece’s debt sustainability.And a quick perusal shows that the Fund has comprehensively obliterated the notion that this third Greek bailout will work, as it stands.Greece’s public debt has become highly unsustainable. This is due to the easing of policies during the last year, with the recent deterioration in the domestic macroeconomic and financial environment because of the closure of the banking system adding significantly to the adverse dynamics.The financing need through end-2018 is now estimated at €85bn and debt is expected to peak at close to 200 percent of GDP in the next two years, provided that there is an early agreement on a program. Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far.The events of the past two weeks—the closure of banks and imposition of capital controls—are extracting a heavy toll on the banking system and the economy, leading to a further significant deterioration in debt sustainability relative to what was projected in our recently published DSA.Medium-term primary surplus target: Greece is expected to maintain primary surpluses for the next several decades of 3.5 percent of GDP. Few countries have managed to do so. The reversal of key public sector reforms already in place— notably pension and civil service reforms—without yet any specification of alternative reforms raises concerns about Greece’s ability to reach this target11.41pm BSTThis is important. IMF says Greece needs 30yr grace period on its debt. Even bigger debt relief https://t.co/JRbGA8Wyn711.19pm BSTIMF won't take new #Greece programme to board unless there is a solution to debt problem11.19pm BSTTHIS IS IT. The IMF stating as bluntly as it can that Europe must decide between giving Greece a 30-year grace period to repay its debt, and accepting the reality that serious haircuts must be taken:IMF: Greece debt "highly unsustainable" - needs up front haircut or dramatic maturities extension and grace period pic.twitter.com/0YuWG2Va7j11.12pm BSTSome late breaking news: The International Monetary Fund has confirmed today’s leaked report which warned that Greece needs much more debt relief than the eurozone has accepted:Here’s the details;IMF on Greece: €85bn may not be enough due to optimistic surplus and growth targets: pic.twitter.com/6pEmtovW4710.43pm BSTHeads-up: the process of driving Greece’s bailout deal through parliament will start early:#Greece | Prior actions draft bill to be introduced to parliamentary committees and plenary tomorrow 0700 GMT.10.04pm BSTEven if you think Alexis Tsipras has misplayed the crisis, it’s hard not to be impressed by his composure in tonight’s interview.“Last night was a bad night for Europe.â€â€œTo be frank, here, they [eurozone countries] are not only forced to give fresh money, but to give 82 billion, and are accepting the restructure of debt.â€â€œI am fully assuming my responsibilities, for mistakes and for oversights, and for the responsibility of signing a text that I do not believe in, but that I am obliged to implement,â€â€œThe hard truth is this one-way street for Greece was imposed on us,â€That #Tsipras spoke of #Greece suffering post-traumatic stress at moment says all you need to know about what kind of w/e he had #Greece“The worst thing a captain could do while he is steering a ship during a storm, as difficult as it is, would be to abandon the helm.â€So, hats off to @tsipras_eu at last?#Tsipras overarching theme: #Greece backed into corner. Doesn't believe in agreement. Bad night for Europe. But signed "to avoid disaster"9.20pm BSTWhat about the big question ahead of tomorrow night’s vote on the bailout -- might you resign?Tsipras says that “A captain cannot abandon ship†during a storm.

|

|

by Larry Elliott Economics editor and Helena Smith in on (#E9KZ)

Fund’s leaked debt sustainability report shows that Greece’s public debt is likely to peak at 200% of national income within the next two years

|

|

by Nils Pratley on (#EAJB)

Even if the country implements market reforms, VAT increases and pension cuts, its debt will still be too big to service, so why should the IMF contribute to a loan?

|

|

by Letters on (#EAF7)

The Greek bailout saga reminds me of a story from antiquity about discussions (or, euphemistically, negotiations) between representatives of a powerful state, aiming to secure its empire and deter subjugated member-states from future rebellion, and a pesky weaker state, which is offered the choice between total destruction and the acceptance of the stronger state’s demands, viz payment of tribute and loss of sovereignty. The weaker state’s representatives invoke quaint notions such as justice and freedom in their arguments against personal and financial enslavement, but this is met with a lecture on the harsh truths of realpolitik (as we might call it): that questions of justice are only relevant “between those with an equal power to enforce itâ€, and that the sole question of relevance is “one of self-preservation – that is, not resisting those who are far stronger than youâ€. In the hope that they might somehow preserve their independence, the weaker state declines the offer then on the table, that of enslavement, only to be faced with no choice at all: their adult males are killed, their women and children enslaved, and their land and property expropriated.Such was the story told by Thucydides of the treatment of Melos by the imperial state of Athens in 416-15BC. While any parallels with current events must be drawn with caution (who could imagine that a modern European nation would impose collective punishment on its weaker brethren?), it is perhaps worth mentioning as a footnote that the Athenian empire was only to survive its destruction of Melos for little over a decade.

|

|

by John Crace on (#EAEF)

Bank of England governor spoke to MPs about the Greek crisis in a drawl that was so laid-back as to be threatening, while his colleague failed at simple mathsUrbane, tanned, decked out in accessories as featured in this month’s GQ and smooth. Very smooth. Mark Carney is the Milk Tray man de nos jours. While other European bankers have been getting into a sweat over Greece, the governor of the Bank of England gives the impression of a man who has just been on holiday there. Not even an imminent eurozone crisis could shift him from chilling on his sun lounger. Carney is a man who never worries about missing a pedalo, because there’s always another one coming along soon.So when Milk Tray man told the first meeting of this parliament’s Treasury select committee that “eyes would have to be kept open on thisâ€, everyone knew the latest Greek bailout deal would almost certainly end in disaster. To prove his point, Carney raised his hooded eyelids a millimetre. “There are big execution risks,†he said in a Canadian drawl that was so laid-back as to be threatening. Greece might as well hand over the keys of the Parthenon to Germany right now.Related: Back to zero inflation: falling food and clothing prices drag rate back to 0% Continue reading...

|

by Katie Allen on (#EAEH)

David Miles says time to start taking rates back to more normal levels is ‘soon’ and waiting too long could mean sharper increases laterThe time is nearing to raise interest rates in the UK and waiting too long will mean having to increase them more sharply in the end, departing Bank of England policymaker David Miles has said.

|

by Jennifer Rankin in Brussels and Rowena Mason in Lo on (#EACM)

UK chancellor says Britain paying towards bailout help is ‘non-starter’ but European commission considers idea of loan that would include £850m from UK

|

by Andrew Sparrow on (#E8F8)

Rolling coverage of all the day’s political developments as they happen

|

by Helena Smith in Athens on (#E9XG)

The Greek prime minister, Alexis Tsipras, must rely on the support of parties outside his coalition if the measures are to be approved by the house

|

|

by Ian Traynor in Brussels on (#E9T1)

With anti-EU Finns party in coalition, Helsinki may deny its minister mandate to agree to deal – but ECB and European commission could still drive it throughAlthough Greece and its creditors have yet to begin even negotiating Athens’ third bailout in five years – a three-year programme worth up to €86 bn – Finland already represents a problem as Helsinki may deny its pro-European finance minister, Alex Stubb, a mandate to agree to the deal.

|

|

by Kate Connolly in Berlin on (#E9GD)

Opposition politicians claim German chancellor and her finance minister, Wolfgang Schäuble, tried to split Europe on debt crisisAngela Merkel and her finance minister, Wolfgang Schäuble, have come under sharp attack at home for their handling of the Greek crisis talks, with some opposition politicians accusing them of blackmailing Athens.Ahead of a special session of the Bundestag on Friday at which Merkel, the German chancellor, will ask parliamentarians to support negotiations for a third bailout for Greece, some MPs accused her and Schäuble of deliberately trying to split Europe.Related: Greek debt crisis: IMF warns Greece needs deeper debt relief - live updates#BoycottGermany - they owe the Greeks billions - always remember the facts over the pro EU fiction pic.twitter.com/EIwn6U4e82Related: Measured, sober and sceptical: Germany reacts to Greece deal Continue reading...

|

|

by Katie Allen on (#E97Q)

Mark Carney’s remarks to the Treasury select committee had immediate impact on financial markets, while he also commented on Greece’s debt crisisAn interest rate hike in the UK is “moving closerâ€, the governor of the Bank of England told MPs in comments that have fanned market expectations that policymakers could start to tighten borrowing costs before the end of the year.Speaking to the Treasury select committee on Tuesday, Mark Carney also expressed misgivings about the euro project, the sustainability of Greece’s debts and the prospects for the embattled country’s economy in the wake of this week’s deal hammered out by leaders in the single currency union.Related: Back to zero inflation: falling food and clothing prices drag rate back to 0.0% Continue reading...

|

|

by Phillip Inman in London, Helena Smith in Athens an on (#E92F)

Greek prime minister in talks with own MPs amid speculation he could be forced to form a national unity government and sideline leftwing Syriza faction

|

|

by Katie Allen on (#E8W1)

Pressure loosens on Bank of England to raise rates as summer clothing discounts and supermarket price war cuts indexSummer clothing discounts pulled UK inflation back down to zero last month, bringing more relief to households and taking pressure off the Bank of England to raise interest rates any time soon.Official figures showed inflation on the consumer price index (CPI) measure dipped to zero in June, from 0.1% in May. That was in line with the consensus forecast in a poll of economists by Reuters, although some had predicted prices could be down on a year earlier and mark a return to the negative inflation recorded in April. Continue reading...

|

|

by Barry Eichengreen on (#E8QE)

The eurozone should help stabilise Greece and help save Europe - instead the European project is being sacrificed on the altar of German public opinionWhatever one thinks about the tactics of Greek Prime Minister Alexis Tsipras’s government in negotiations with the country’s creditors, the Greek people deserve better than what they are being offered. Germany wants Greece to choose between economic collapse and leaving the eurozone. Both options would mean economic disaster; the first, if not both, would be politically disastrous as well.When I wrote in 2007 that no member state would voluntarily leave the eurozone, I emphasised the high economic costs of such a decision. The Greek government has shown that it understands this. Following the referendum, it agreed to what it – and the voters – had just rejected: a set of very painful and difficult conditions. Tsipras and his new finance minister, Euclid Tsakalotos, have gone to extraordinary lengths to mollify Greece’s creditors.Related: Measured, sober and sceptical: Germany reacts to Greece dealRelated: Greece put its faith in democracy but Europe has vetoed the result | Paul Mason Continue reading...

|

|

by Daniel Hurst Political correspondent on (#E8JP)

Treasurer says Australians can’t afford to be complacent but predicts fallout will be limited from China’s volatile stock market and Greece’s debt dealJoe Hockey is standing by his budget forecasts for China’s economic growth and predicts the upheaval in Greece will have a “minimal†impact on Australia.

|

|

by Katie Allen on (#E843)

Pressure eases on Bank of England to raise interest rates, and early summer discounting on high street could push prices lower than a year agoSummer clothing sales are expected to have pulled UK inflation back down to zero last month, bringing more relief to households and taking pressure off the Bank of England to raise interest rates any time soon.Economists expect official figures published on Tuesday morning to show inflation on the consumer price index (CPI) measure dipping back to zero in June, from 0.1% in May. Some economists in a Reuters poll forecast prices could even be down on a year earlier, especially if there was widespread and early summer discounting on the high street.Related: George Osborne is the master of all he surveys… except the economy | Andrew Rawnsley Continue reading...

|

|

by Press Association on (#E7FW)

Sunshine last month had a warming effect on clothing sales and helped retailers with increases in like-for-like salesA burst of summer sunshine boosted clothing stores last month and helped retailers bounce back as like-for-like sales rose by 1.8%, according to new figures.The year-on-year increase in June comes after a flat month in May and is the best rise in 18 months excluding Easter distortions, according to the British Retail Consortium (BRC) and KPMG’s Retail Sales Monitor. Continue reading...

|

|

by Graeme Wearden (now) and Katie Allen (afternoon sh on (#E5GD)

Analysts believe Alexis Tsipras could lose power amid the backlash over the deep economic reforms, and asset sales, he agreed to in BrusselsFollow today’s Greek debt crisis live as Tsipras meets mutinous MPs11.52pm BSTPS: Another statement from the International Monetary Fund just arrived:“Following on the Managing Director’s participation in the discussions on Greece held in Brussels over the weekend, she briefed the IMF’s Executive Board on the outcome as reflected in the Eurozone Leaders’ statement published earlier today.The IMF stands ready to work with the Greek authorities and the European partners to help move this important effort forward.â€11.48pm BSTAnd finally, here’s our news story on the political fight ahead:

|

|

by Phillip Inman in London, Helena Smith in Athens, a on (#E75G)

Prime minister faces tough task to keep his Syriza party united, as former finance minister Yanis Varoufakis likens bailout proposal to 1919 Versailles treatyAlexis Tsipras was on course on Monday night to sway radical-leftist Syriza MPs to accept the most draconian rescue of a sovereign nation since the second world war, after the Greek prime minister accepted a third bailout programme that one analyst said came after a weekend of “gunboat diplomacyâ€.Related: Measured, sober and sceptical: Germany reacts to Greece dealRelated: Greece put its faith in democracy but Europe has vetoed the result | Paul MasonRelated: #ThisIsACoup: how a hashtag born in Barcelona spread across globe Continue reading...

|

|

by Kate Connolly in Berlin on (#E6XB)

The feeling among many Germans is that the same politicians are likely to find themselves in a huddle over the same issue again a few months down the lineFollowing a marathon 17 hours of talks in which the Greek prime minister accepted a third bailout programme, Angela Merkel emerged in Brussels tired but surprisingly well-tempered and focused.After 27 hours without a wink of sleep, and probably the longest meeting of her chancellorship, she told waiting journalists: “The advantages outweigh the disadvantages. The fundamental principles have been adhered to. I believe that Greeks can get back on to a growth trajectory.â€Related: #ThisIsACoup: how a hashtag born in Barcelona spread across globeRelated: Tsipras and Merkel: polar opposites who depend entirely on each other Continue reading...

|

|

by Paul Mason on (#E6VP)

The EU has humiliated Syriza and ignored its referendum: now the only power the country has left is to implement what the lenders wantThe only thing certain about the aftermath of Sunday’s Euro summit is the disgrace of the political leaderships. The EU’s main powers tried to ritually humiliate the Greek government, but ruthlessness of intent was matched by incompetence when it came to execution. The German finance minister, Wolfgang Schäuble, threw on to the table a suggestion for Greece to leave the single currency for five years. Senior MPs from his coalition partner, the socialist SPD, screamed from the sidelines that they had not agreed to this – yet enough of Germany’s partners did agree to get the proposal into the final ultimatum.The Greeks were negotiating under threat of their banking system being allowed to collapse, a threat made by the very regulator supposed to maintain financial stability.Little did leftwing Greece understand how scant was the power its ministers actually wielded from their offices Continue reading...

|

|

by Editorial on (#E6TY)

The Greek deal is unfair and unlikely to work. Far from easing the pace of austerity, the agreement embeds it

|

|

by Guardian correspondents on (#E6TM)

Rather than celebrate the deal, newspapers and commentators see only losers, while in eastern Europe there is a lack of trust towards AthensThe German press saw little cause for rejoicing in the Greek deal that saw Angela Merkel and Wolfgang Schäuble push through their key demands in Brussels overnight. For many, the lasting damage to Europe has already been done.Related: Greek crisis: Tsipras returns to Athens to gather support for bailout deal - liveRelated: With Europe behind it, Greece is being pushed into further peril Continue reading...

|

|

by Nils Pratley on (#E6V0)

Can these ambitious targets be met? Many economists think economic recovery could be hampered furtherPast Greek bailouts were accompanied by declarations that the deal on the table was realistic, comprehensive and good for both parties. There was confidence that Greece’s debts would soon be cruising back towards the target of 120% of GDP by 2020 and, long before then, the country would be able to finance itself in the markets.The tone is very different this time. The early-morning declaration from Brussels stressed “the crucial need to rebuild trust with the Greek authorities†and stated that “ownership [of the bailout and reform programme] by the Greek authorities is keyâ€. Continue reading...

|

|

by Emma Graham-Harrison in Athens and Patrick Kingsle on (#E58Z)

Last-minute deal to stop the country falling out of the single currency is almost certain to bring more misery, but is welcomed with quiet relief by GreeksGreece’s financial rescue came too late to save Dimitri’s business, but the 40-year-old reserved his anger not for the man who eventually signed off on more economic pain but the creditors who dictated the brutal terms.

|

|

by Phillip Inman and Jennifer Rankin in Brussels on (#E4X9)

After marathon talks to secure third bailout, Greek prime minister prepares for showdown with MPs opposed to deal described as harsher than Versailles treatyRelated: Greece bailout agreement: key pointsAlexis Tsipras is heading for a showdown with his own party and opposition MPs after the Greek prime minister accepted a third bailout programme that will bring further austerity to the debt-stricken country. Continue reading...

|

|

by Graeme Wearden on (#E52D)

After a marathon summit, the 19 eurozone leaders have seen off the prospects of Grexit. Here are the main points that were agreedAfter almost 17 hours of talks in Brussels, Europe’s longest-ever summit, Greece and the rest of the eurozone have finally reached an agreement that could lead to a third bailout and keep the country in the single currency bloc.Alexis Tsipras, the Greek PM, conceded to a further swathe of austerity measures and economic reforms. Here is a summary of where he has had to compromise.Related: Greece and eurozone reach agreement in bailout talks Continue reading...

|

|

by Larry Elliott on (#E69N)

There is not the remotest prospect Athens can raise the money set out in the bailout terms, even with the enforced sale of national assetsKeynes never existed. The General Theory of Employment, Interest and Money was never written. Economic history ended on the day Franklin Roosevelt replaced Herbert Hoover as president of the United States.That’s the gist of the deal that keeps Greece in the euro, an agreement that will deepen the country’s recession, makes its debt position less sustainable and virtually guarantees that its problems come bubbling back to the surface before too long. Continue reading...

|

|

by Helena Smith in Athens on (#E5Y4)

Some members of Greek prime minister’s Syriza party have already denounced bailout accord as harbinger of further catastropheFor the Greek prime minister, Alexis Tsipras, the hard work begins now. The rescue deal hammered out in Brussels may have brought relief to Athens but its battle-hardened government knows that it also comes at enormous cost.Within minutes of Tsipras giving his “victory†speech, some in his Syriza party were denouncing the bailout accord – the third emergency funding programme for the debt-stricken country since 2010 – as the harbinger of further catastrophe.Related: Greece and eurozone reach agreement in bailout talksRelated: Greek bailout: what happens nextRelated: Greece agreement is 'bad but still better than leaving the euro' Continue reading...

|

|

by Jennifer Rankin on (#E5PS)

From the pressing issue of funding to meet debt repayments, to moving legislation through the Greek parliament, the next week holds multiple targetsAfter 31 hours of talks over one bad-tempered weekend in Brussels, European leaders announced they had an agreement on the Greek debt crisis – or ‘aGreekment’ in the unhappy addition to the Grexit lexicon favoured by Donald Tusk, the leader of the European Council.The snappy soundbites glide over the fact the eurozone has simply agreed to open negotiations on a €86bn (£62bn) bailout – a vital step to restore confidence in the euro, but essentially an agreement to have more talks. The deal that emerged on Monday morning must pass the test of the Greek parliament, the German Bundestag and the European financial system.

|