|

by Letters on (#5JK0)

In what we hope was his last budget, George Osborne made a series of false claims about his economic record (Editorial, 20 March). The reality is that his priority is to raise profits for the corporations, top executive salaries and bonuses, at the expense of ordinary working people. His achievement is the slowest ever “recovery†from recession, while ordinary people suffer increasing hardship during the longest continuous fall in living standards since records began. That is the real Tory record of this parliament. All those who have seen their real wages fall understand the real effects of austerity policies, along with people forced into low-paid or zero-hours contracts, families forced into using food banks and everyone suffering rising A&E waiting lists. Austerity policies have not reduced the public-sector deficit to the level its supporters claimed. The limited fall in the deficit is a result of hugely damaging cuts to government investment as well as the windfall of falling global interest rates, which are a sign of economic weakness.Austerity policies have failed everyone but the super-rich, bankers and landlords who have benefited from the government’s tax cuts, bonuses and measures to boost house prices, but not home building. We call for an end to austerity policies. We need to invest in a future for the majority of the population. That’s why we’ll be supporting the People’s Assembly Against Austerity national demonstration and festival against austerity on Saturday 20 June. Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-02-06 16:00 |

by Guardian Staff on (#5JK2)

German chancellor Angela Merkel issues a joint press conference alongside Greek prime minister Alexis Tsipras on Monday. Merkel says her country wants the Greek economy to grow and overcome high unemployment, but this will require structural reforms and solid public finances. She added that the leftist Greek prime minister's new reform proposals would be evaluated by euro zone finance ministers, rather than by Berlin alone Continue reading...

by Ian Traynor Europe editor on (#5JEP)

Leftwing Greek leader makes call for damages at press conference with Angela Merkel as deadlock remains over bailout fundsGreece’s leftwing prime minister Alexis Tsipras stood beside German leader Angela Merkel and demanded war reparations over Nazi atrocities in Greece on Monday night, even as the two leaders sought to bury the hatchet following weeks of worsening friction and mud-slinging.“It’s not a material matter, it’s a moral issue,†said Tsipras, unusually insisting on raising the “shadows of the past†at the heart of German power in the gleaming new chancellery in Berlin. It was believed to be the first time a foreign leader had gone to the capital of the reunified Germany to make such a demand.Related: Greece vows to present reform plan by Monday after Merkel meeting -- live updates Continue reading...

|

by Graeme Wearden on (#5GCV)

Greek prime minister has held talks with the German chancellor in Berlin, as pressure grows to meet its creditors’ demands.

|

|

by Andrew Dobson and Rupert Read on (#5HG6)

The commodification of our lives is creating a time-poor society that damages our happiness and our planet, and will ultimately harm our economy tooWhat are the building blocks of a post-growth politics? And how can we get from here to there?A crucial part of the answer is that we need a deep reframing of the central questions of politics. In the first place, we should talk less about the economy as a machine for producing more goods (many of which turn out to be “badsâ€). We should talk more about what an economy is actually for: satisfying needs, creating a better society and improving our quality of life. Once we do that we see that continuing growth can be counter-productive, as well as impossible in a finite system such as the planet we live on.Related: Growth is not the answer to inequalityRelated: A wave of disruption is sweeping in to challenge neoliberalism Continue reading...

|

|

by Larry Elliott Economics editor on (#5JH9)

CBI industrial trends survey is the latest piece of evidence to suggest that the economy is growing less quickly than in the second half of 2014Order books for UK factories have stagnated as the strong pound and the protracted weakness of the eurozone affect demand for British goods overseas.The CBI said in its monthly health check of industry that export order books stood at their lowest in more than two years following a sharp fall in March. Continue reading...

|

by Matt Thistlethwaite on (#5FZG)

The Abbott government has hesitated over joining the Asian Infrastructure Investment Bank. It shouldn’tIt appears the China-led Asian Infrastructure Investment Bank (AIIB) has become a dilemma for the Abbott government.Cabinet division over the invitation for Australia to be a founding backer of the bank reflects the Abbott government’s uncertainty about our nation’s future in Asia. Continue reading...

|

by Nicholas Watt, chief political correspondent on (#5FHX)

Open Europe thinktank warns Ukip that Britain could lose 2.23% of its GDP by leaving the EU customs union and single marketBritain faces a stark choice after an EU exit of allowing its economy to shrink by £56bn, by shutting down its borders, or agreeing to the continued free movement of European citizens in a new deal with Brussels, according to a leading thinktank.In a challenge to Nigel Farage, who believes Britain can prosper outside the EU by blocking migration, the Open Europe thinktank warns that a unilateral UK exit could lead to a permanent dent in the country’s GDP of 2.23% by 2030. This works out at £56bn a year. Continue reading...

|

|

by Press Association on (#5FHS)

Report warns that people’s complacency over their ability to manage their borrowing could lead to resurgence in bad debtThe average UK household will owe close to £10,000 in debts such as personal loans, credit cards and overdrafts by the end of 2016, which is a new high in cash terms, a report has found.Total outstanding non-mortgage borrowing grew by nearly £20bn or 9% in 2014, to reach £239bn, marking the fastest rate of growth in a decade, according to the report from PwC, Precious Plastic: How Britons Fell Back in Love With Borrowing. Continue reading...

|

|

by Helena Smith in Athens on (#5F7A)

Alexis Tsipras and Angela Merkel are to meet in Berlin for high-stakes talks that could prove to be decisive in the battle over austerity measuresWhen the red carpet is rolled out for Alexis Tsipras in Berlin on Monday, the euro debt drama will come to a potentially decisive turning point.His host will be none other than Angela Merkel, Europe’s mother, its powerbroker par excellence and the queen of austerity, defender of the very policies the leftwing firebrand has vowed to dismantle. For many, it will be the long anticipated moment of truth. Continue reading...

|

|

by Kate Connolly in Berlin on (#5F2M)

Amid demands for wartime compensation from Athens, and for deep economic reforms from Berlin, a majority of Germans now want Greece out of the eurozone

|

|

by Gwyn Topham on (#5EKC)

Analysts expect inflation is likely to have fallen to 0.1% with some predicting that figures could show a negative readingThe British economy is heading for a spell of deflation as official figures are expected to show that inflation dropped to 0.1% last month.Analysts expect the UK’s consumer price inflation (CPI) figure for February, which is released on Tuesday, to fall from 0.3% in January, driven by lower energy and food prices. Some economists think the monthly update from the Office for National Statistics could already show deflation. Continue reading...

|

|

by Larry Elliott on (#5EHV)

For Britain’s industrial areas, recovery is patchier, with weaker jobs growth and less infrastructure spending. The evidence says we never have been in it togetherHartlepool has seen better days. Its port was used to transport coal from the Durham coalfields and manufacturing thrived on the Tees estuary.Heavy industry is still important, although there is less than there was. The council has ambitious plans for regeneration. On the waterfront, there is evidence of previous attempts to turn the town’s fortunes around. The empty office blocks and the shuttered outlet centre show these have not been entirely successful. Continue reading...

|

|

by Reuters on (#5EH5)

IMF and Asian Development Bank tell Beijing conference they are happy to cooperate with Asian Infrastructure Investment Bank, but US urges caution

|

|

by William Keegan on (#5E9Q)

The chancellor’s boastfulness and trickery have not saved him from the criticism of the independent economic watchdogs that he himself set upI keep wondering who George Osborne reminds me of, and it finally came to me, during what I hope – in common, I imagine, with tens of millions of British citizens – will prove to have been his last budget speech.During the austerity years of 1945-51, there was no shortage of demand, but a severe shortage of supply. Also, the country was broke, and there was, to coin a phrase, no alternative to austerity, of which the most obvious manifestation was rationing.Osborne cannot get away from the fact that he has presided over the slowest and feeblest recovery in living memory Continue reading...

|

by Agence France-Presse on (#5DY3)

‘March for dignity’ comes on the eve of a closely-watched regional election in Andalusia in southern SpainThousands of people took part in a “march for dignity†in Madrid on Saturday to protest against austerity measures on the eve of a closely-watched regional election in southern Spain.Sunday’s vote in Andalusia, one of the poorest parts of the country, is seen as a test of the national mood ahead of Spain’s most unpredictable general election in decades. Continue reading...

by Nikos Dimou on (#5DXM)

Berlin is cast by Athens as the fount of its troubles, but Greek politicians must bear part of the blame

by Will Hutton on (#5DXN)

Political conversation has been drained of all vitality, fixated on a narrow set of targets. To breathe new life into it, our politicians should stop talking like accountants and rediscover moral purposeMy father was born in 1919 and died in 2002. For the first 50 years of his life the stock of government debt was very much higher as a share of GDP than it is now. But, strange to say, I never remember him once blaming his parents and grandparents for leaving his generation with such a high debt burden. Or, indeed, ever talking about it all.Nor did the parents of any of my friends – right or left – discuss it. What would be characterised in today’s hysterical terms as overwhelming debts that threaten the life of the nation simply did not figure in any of their conversations, or more widely. If anybody had solemnly declared that the overriding national purpose should be to cap the national debt’s share of GDP at 80%, they would have been considered deranged. Their generation had more important things to talk about – the defence of the realm, for example, the creation of a good society and the need to do whatever Britain had to do to stay great. The politicians of the day traded their competing visions and debated how they would achieve the common good. Continue reading...

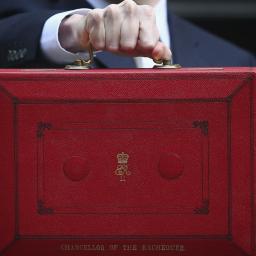

by Observer editorial on (#5DXQ)

For all the Tories talk of hard-working families, the poor will be hit hard in their Britain of the futureThe red box George Osborne brandished on the steps of the Treasury for the last time before the general election did not just contain a budget. Nestled underneath the figures and projections lay a manifesto: a manifesto for a more divided and less humane Britain.When Osborne made his first autumn statement as chancellor five years ago, he declared “those with the broadest shoulders should bear the greatest burden†of the deep fiscal consolidation he set out. His speech was awash with rhetoric: the poorest would be protected from the worst of the cuts. Instead, there would be tax cuts for the lowest paid and the ring-fencing of budgets for local schools and hospitals. Continue reading...

by Alan Posener on (#5DXP)

Athens’ defiance of austerity demands and recalling of wartime atrocities have angered Germans already worried about rising nationalism and economic decline.

by Ian Traynor in Brussels on (#5BGQ)

Angela Merkel wants Alexis Tsipras to present a ‘comprehensive’ reform package, to be endorsed by EU finance ministers, before Greece can access any fundsGreece’s eurozone creditors are considering bringing forward a financial lifeline for Athens by a few weeks after Alexis Tsipras, the Greek prime minister, told EU leaders the country would be insolvent by the end of April without assistance.In a key three-hour meeting in Brussels that ended in the early hours of Friday, Tsipras informed his creditors if they wait until the end of April before releasing funds, it will be too late for Greece. According to an account of that meeting policymakers are now discussing whether they can supply emergency funding earlier than previously agreed. Tsipras was also advised to treat the Eurocrats working in Athens with more respect and ensure their safety. Continue reading...

|

by Graeme Wearden (7am-2pm) and Nick Fletcher on (#5A2Y)

Rolling economic and financial news, as European leaders urge Athens to present details reform plans quickly

|

|

by Nick Fletcher and Phillip Inman on (#5B9E)

UK index of top 100 companies surpasses 7,000, recording its all-time high since the index was introduced in January 1984The FTSE 100 has soared through the 7,000 barrier for the first time in its history, with investors buoyed by the prospect of continuing low interest rates and growing hopes that a solution may finally be found to Greece’s financial crisis.Seventeen years after the leading index hit 6,000, it finally added the next 1,000 points after a number of attempts, notably in 1999 at the height of the dotcom boom. Last year there were predictions that the index would reach new peaks, but after coming close a number of times, it always fell at the final hurdle as new risks – ebola, the Ukraine crisis, the eurozone – emerged. But on Friday, it closed 60.19 points higher at a record 7,022.51, a near-1% rise on the day. Continue reading...

|

|

by Michael J Short on (#5AFT)

Newcastle’s collaborative, ‘future thinking’ regeneration scheme has revived a city that was on its knees after the devastation of 1980s deindustrialisation. But what about near-neighbour Sunderland? Compare its fortunes hereIt comes as no surprise to the Geordies that Newcastle is rated one the UK’s best performing cities. I left in 1990 when the city (and most of the north-east) was on its knees, but the city I see on my visits home is revived, emerging as a poster child for the new north. A recent Centre for Cities report ranked Newcastle eighth among the UK’s largest cities in terms of jobs growth – attracting nearly 30,000 new jobs between 2004 and 2013 (an 8% increase), and belying the report’s overall message of a widening north-south divide.The revived Quayside is testament to the city’s determination to rebuild itself after the devastation of 1980s deindustrialisation. Building on the work of neighbouring Gateshead in promoting its Garden Festival, Sage culture centre and Millennium Bridge, Newcastle published Going for Growth, an ambitious, city-wide regeneration strategy, back in 2000. Seeking to position itself as a competitive, cohesive and cosmopolitan city of international significance, it built partnerships with citizens, communities, companies and government – and even bid to become European City of Culture, achieving a level of exposure overseas despite losing out to Liverpool.To many north-easterners, this part of the world has been ignored for so long that self-reliance is bred into the psycheRelated: City rivalries: Sunderland's reinvention is profound – but its recovery is fragile Continue reading...

|

by Angela Monaghan on (#5ACM)

Government borrowing fell to £6.9bn in February, taking the total this year to £81.8bnThe UK chancellor was handed a pre-election boost after a jump in self-assessed tax receipts triggered the smallest February deficit in seven years, putting him on course to meet his full-year target.British workers paid £4.2bn in self-assessed income tax last month, £1.8bn more than the same month last year, according to the Office for National Statistics. Continue reading...

|

by Larry Elliott and Patrick Wintour on (#58XX)

Thinktank says chancellor must specify how he will reach targets announced in the budget, given that the poor had been hardest hit by benefit changesGeorge Osborne is under pressure from the Institute for Fiscal Studies to specify how he planned to cut welfare spending by £12bn in the next parliament, and warned the poor had lost most from the coalition’s benefit changes of the past five years.Britain’s leading experts on tax and spending also said the pickup in living standards hailed by the chancellor in his budget was the slowest in modern history and “no cause for celebration†– although the IFS did suggest living standards on current projections would be higher in 2015 than 2010, a finding that was hailed by Osborne.Related: Budget 2015: beneath George Osborne’s performance was a party on the defensive | Jonathan FreedlandRelated: Osborne will need unprecedented cuts in welfare to meet targets, says IFS Continue reading...

|

|

by Graeme Wearden on (#57XN)

Greece has agreed to present a new list of reforms plan quickly, after top-level overnight talks in Brussels

|

|

by Nils Pratley on (#59B7)

In the medium-term, Next has nothing to worry about – even if the bottom of Wolfson’s profits range for the current year is £785m, or almost no growthNext shareholders should not despair: their chief executive, Lord Wolfson, may be “very cautious†about the year ahead but that represents only a modest downgrade on his normal mood in March.This time last year, he thought Next’s pre-tax profits would be £730m-£770m. In the event, Wolfson unveiled £782m on Thursday – and that was achieved even with a mild weather-related warning last autumn. Continue reading...

|

|

by Letters on (#5985)

In his budget speech (Report, 19 March) the chancellor, George Osborne, forgot to mention the following eight factors: missed target to eliminate the deficit by end of this parliament; larger debt in the government’s five years than Labour accrued over 13 years in office; tax breaks for millionaires and hedge funds; a million people using food banks; 59% rise in working people forced to claim housing benefit; 1.4 million people on zero-hours contracts; record numbers of people living in poverty; and another £60bn in cuts still to be found before 2020. All seemed to have slipped George’s memory.

|

by Larry Elliott on (#595D)

Andrew Haldane has raised the prospect of a permanent period of weak earnings growth that locks in low wages, low inflation and low interest ratesIt’s a pretty extraordinary prospect. Britain has been out of recession for more than five years, is the strongest growing economy in the G7 and, if you believe George Osborne, is walking tall again.Yet Andrew Haldane, the chief economist of the Bank of England, believes the next move in interest rates may be down rather than up, and in the right circumstances can envisage himself voting to cut official borrowing costs from 0.5%.Related: Interest rates may be cut, suggests Bank of England chief economist Continue reading...

|

by Phillip Inman economics correspondent on (#593X)

Housing benefit and pensions are likely to keep rising, as will tax credits. As the Institute for Fiscal Studies says, it’s time we knew where the cuts will fallAny challenge from the Institute for Fiscal Studies is a hard one for George Osborne to dodge.The tax-and-spending watchdog wants him to explain how he plans to cut welfare spending in the next parliament. Continue reading...

|

|

by Andrew Sparrow on (#57YD)

Rolling coverage of all the day’s political developments as they happen, including George Osborne and Ed Balls’ post-budget interviews, and the IFS post-budget briefing

|

|

by Alan Travis Home affairs editor on (#58H4)

Political parties lobbying for curbs on immigration may be missing the bigger picture – Britain needs foreign workers to avoid deeper cuts and higher taxesGeorge Osborne’s sunny economic forecast and much of his claim that Britain is a “comeback country†have more to do with higher than expected levels of net inward migration than his stewardship as chancellor or the falling oil price.That is not a verdict that you are likely to hear from the Conservatives or from Labour for that matter, both of which like to appear as parties opposed to mass migration, but the Office for Budget Responsibility makes clear that it is one key factor fuelling Britain’s economic recovery. Continue reading...

|

|

by Stephen Hall and Brian Henry on (#58FC)

The UK’s macroeconomic policy is uncoordinated and still unduly influenced by political factors, as the new budget proposals showThe lack of coordination of the different parts of UK macroeconomic policy – Âfiscal, monetary and financial – has caused problems for some time now. Political, not economic, factors have continued to have undue influence. They are much in evidence currently in the chancellor’s proposal to run budget surpluses in the future, in spite of his earlier quite elaborate extensions to both financial and prudential regulation. If these new arrangements work, there is no need to build up surpluses to offset the effects of a future crisis and this calls into question his motives for doing it.There are important lessons to learn from the years before the financial crisis, when financial liberalisation in the UK and elsewhere led to huge increases in private sector debt based on highly speculative collateral requirements. This fuelled a rapid increase in the consumption-to-income ratio, the major engine of growth in the economy then. After two years of fiscal consolidation, Labour also slackened the fiscal stance in the early 2000s. If the Bank of England had been operating independently as planned, it would have tightened monetary policy, which would also have curbed the asset bubble and limited the excessive riskÂtaking in the financial sector, as well as acting simultaneously to offset the fiscal relaxation. This, however, did not happen, either due to a complete failure of the Bank to understand these developments or because it was not actually operating independently. Continue reading...

|

|

by Guardian Staff on (#58BF)

Ed Balls, the shadow chancellor, says the plans laid out in George Osborne's budget cannot be paid for without cuts to the NHS or a rise in VAT. Balls says the chancellor did not explain how he will pay for promises made in the budget on Wednesday. He says Labour would provide a 'better, fairer, more balanced plan' for the economy Continue reading...

|

|

by Suzanne McGee on (#58AC)

The Fed has signalled it’s changing its approach to interest rates – and that means consumers are in for a volatile six monthsThe Federal Reserve isn’t going to be “patient†any more. Dropping that one word from the language surrounding policymakers’ approach to future interest rate hikes may seem minor, but it’s a significant change for savers, investors and borrowers.Last December the Fed signalled that the era of ultra-low interest rates was coming to an end. But it added it would patient about deciding when. Wednesday’s decision to drop the P-word throws open the doors to the first increases in lending rates since 2008, and means that Janet Yellen and her fellow Fed officials will respond to economic data on a meeting-by-meeting basis. Continue reading...

|

|

by Guardian Staff on (#587W)

George Osborne, the chancellor, says his budget offered help for workers, savers and first-time buyers because his government has made difficult decisions. Speaking on Thursday in Tilbury, Essex, Osborne says his decisions have allowed him to protect the NHS and to invest in mental health services. The chancellor says that in the upcoming election voters need to understand that a strong economy is necessary for vital services to be maintained Continue reading...

|

by Rowena Mason Political correspondent on (#583C)

Chancellor dismisses Office for Budget Responsibility’s assessment that he is planning deeper cuts in the next parliamentGeorge Osborne has rejected the Office for Budget Responsibility’s assessment that there will be a rollercoaster of deep cuts in the next parliament but refused to spell out what his plans would actually look like.

|

by Phillip Inman economics correspondent on (#5767)

Thinktank warns that extra £20bn will need to be saved – while protecting pensions – even if austerity targets are relaxed as plannedThe Treasury will need to find “unprecedented†welfare savings over the next three years for the government to achieve its public spending plans, according to an influential thinktank.The Institute for Fiscal Studies said the chancellor’s plans require welfare cuts that have eluded ministers over the past five years.

|

|

by Patrick Wintour, Larry Elliott and Nicholas Watt on (#575G)

Prospect of tough post-election squeeze overshadows £3bn in pre-election budget’s gains for first-time buyers and savers

|

|

by Katie Allen on (#572F)

Robert Chote says consumers will provide momentum in coming term as chancellor’s amended austerity cuts put pressure on state-funded enterprisesPublic services face a “rollercoaster†ride over the next five years, the government’s fiscal watchdog has predicted, after George Osborne trimmed his austerity plans in the budget.The Office for Budget Responsibility has made radical changes to its public finances outlook after Osborne used his pre-election budget to scrap plans that would have meant the biggest squeeze on public spending since the 1930s by the end of this decade. Continue reading...

|

|

by Nicholas Watt Chief political correspondent on (#571S)

In response to budget, Labour leader claims chancellor has hushed up the fact that NHS faces even deeper cuts under the next parliament

|

|

by Letters on (#56Z0)

George Monbiot is right that corruption poses a vast challenge to all economies (Let’s not fool ourselves. We may not bribe, but corruption is rife in Britain, 18 March), but he is wrong to suggest that institutions such as the World Economic Forum are standing idly by waiting for the problem to solve itself. He correctly points out that one of the major problems with tackling corruption is actually measuring it. Here, our annual survey of global executives has been successful in starting debates in countries where it is commonplace. Far better, though, to fix the international system so that loopholes and opportunities for exploitation are not there in the first place.Our eyes are on this bigger prize, which is why we convene leaders from business, civil society and government countless times throughout the year to explore and design ways to build institutions, policies and regulatory regimes that not only promote transparency and ethics but guarantee them. It is why we encourage debate in Davos on income inequality and trust in leadership. This is not lip service: it is action in the interests of every stakeholder. Continue reading...

|

|

by Editorial on (#56ZF)

He poses as a steadfast steward, but the record as well as the budget suggests that he is a man who reliably puts expediency above principleHe is reliably economical with words and in three sparse budget sentences the austerity chancellor reviewed his tenure and set out the Conservative election campaign: “We set out a plan. That plan is working. Britain is walking tall again.†With the UK edging out from the shadows of the great recession, this chancellor’s steadfast stewardship is a powerful election asset – if it is believed.On any objective appraisal, however, steadfast is not a word to apply to George Osborne: review the statistics in the light of all his original promises and he emerges instead as the chancer chancellor. Continue reading...

|

|

by John Crace on (#56VN)

A little good economic news goes a long way in the chancellor’s budget speechRabbit, rabbit, rabbit, rabbit. The Tory backbenchers were starting to get a bit restless. They wanted their pre-election feelgood rabbit but the chancellor just wanted to rabbit. And cluck. Sudden weight loss, sweaty forehead, pallid features and half-dead eyes; George Osborne had been re-reading Trainspotting.“We choose the future, we choose families, we choose the future,†he began. The second future was a different future to the first future: in the second future you also got a fucking big TV thrown in. The chancellor had first tried his line in junky-chic at the Conservative party conference last September and it hadn’t gone down particularly well then, either. A typical Osborne speech works best as aversion therapy and the Tories generally try to limit his public appearances. For the budget, they have to grin and bear it. Continue reading...

|

|

by Dominic Rushe in New York on (#56TK)

Central bank decision to raise interest rates after six years comes after months of impressive jobs growth, but IMF director warns of market ‘temper tantrum’The US Federal Reserve called time on an era of historically low interest rates on Wednesday.In its latest statement on the health of the US economy the central bank moved away from a pledge to be “patient†before deciding to raise interest rates. Economists expect that interest rates could now rise by the end of the summer, the first rise in more than six years. Continue reading...

|

|

by George Arnett on (#56SX)

Part of Chancellor’s speech claims living standards have completely recovered over course of parliament but metric he is using is not so clean cutIn a sharp rebuttal to Labour accusations that living standards have been squeezed over the course of this parliament, George Osborne said the following during his budget speech:“You can use the most up-to-date and comprehensive measure of living standards which is real household disposable income (RHDI) per capita. In other words, how much money families have to spend after inflation and tax. Continue reading...

|

|

by Nick Fletcher on (#56R2)

Chancellor says stability would be greatly threatened if Athens exited eurozone and defends UK joining Asian Infrastructure Investment BankGreece’s financial crisis and the recent plunge in oil prices pose real risks to Britain’s economy, the chancellor warned in his budget speech, even as he unveiled better than expected growth forecasts for the UK.

|

by Tim Jonze on (#56H5)

Satnavs are out; Spotify is in. White emulsion paint is out; non-white is in. 2015’s retail price index contains a revealing set of changesSay what you like about 2014, but at least you knew what we stood for as a nation. We were a proud land of frozen-pizza-eating, satnav-using yoghurt drinkers, with a fondness for white emulsion paint. History recorded it as such in last year’s consumer price index, which collates popular shopping items as a tool to measure UK inflation.It’s hard not to look back now on the 2014 era as a more innocent time.Related: From craft beer to e-cigarettes, inflation basket reflects Britain's changing shopping habits Continue reading...

|

by Heather Stewart and Nicholas Watt on (#5655)

Chancellor also signals end of austerity before the end of next parliament in statement packed with pre-election policiesGeorge Osborne delivered a pre-election budget designed to herald a “comeback Britain†on Tuesday, announcing tax cuts for savers and first-time buyers but prompting accusations that the Tories would be forced to slash public spending to levels not seen since 1938.In an effort to woo voters in middle Britain just 50 days before the general election, the chancellor said 95% of taxpayers would not face any savings tax under his plans for a personal savings allowance. Drinkers were also given 1p off a pint of beer and drivers benefited from another freeze in fuel duty as the chancellor repeatedly stressed that his “economic plan†was working.Related: The Guardian view on George Osborne: the chancer chancellor | EditorialRelated: How was George Osborne’s budget performance? Our columnists' verdict Continue reading...

|