|

by Presented by Olly Mann with Alex Hern. Produced by on (#PTWX)

Robots aren't just after your job, they're after the overthrow of the whole economic system Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-02-03 21:45 |

|

by Heather Stewart on (#PTJS)

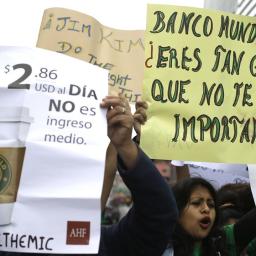

As the International Monetary Fund’s annual talks kick off in Lima, anxiety over global growth is poised to top the agendaThe International Monetary Fund’s annual meeting gets under way against a backdrop of rising concern over the health of the global economy. From the travails of emerging economies to the scale of the Chinese downturn, there is much to debate at the gathering in Lima, alongside tackling longstanding problems such as cracking down on the tax affairs of multinational corporations. Continue reading...

|

|

by Guardian Staff on (#PSS7)

US Democratic presidential candidate Hillary Clinton said on Wednesday she did not support the 12-nation Trans-Pacific Partnership (TPP), rejecting a central tenet of president Barack Obama’s strategic pivot to Asia. Clinton said during a campaign swing in Iowa that she is worried about currency manipulation not being part of the agreement and that ‘pharmaceutical companies may have gotten more benefits and patients fewer’ Continue reading...

|

|

by Letters on (#PS4T)

Zoe Williams (It’s fine to print money, so long as it’s not for the people, 5 October) raises an important question about quantitative easing (QE). In the wake of the global financial crisis, it was adopted by the Bank of England. Capital markets had ceased to function. The banking system was in deep crisis. In the US and Britain, governments were driven to inject equity into the collapsing banking system. These huge outlays had to be funded by the issuance of public debt. The Bank made clear to the prime brokers (mainly the major commercial banks) that they would be offered access to zero-cost funds in order to bid in Treasury auctions. These funds were provided electronically by the Bank into the accounts of those banks held with it.These no-cost credits enabled the prime brokers to purchase the government debt, and by agreement swap back the debt to the Bank at a modest profit. Once this happened, the electronic advances made by the Bank were cancelled. The net effect was threefold. First, the government’s solvency was preserved. Second, the prime brokers were able to secure profit from guaranteed transactions to replace more traditional forms of lending. Third – the odd bit – the Bank ultimately ended up holding the debt of the British government, not the private sector of the economy. Continue reading...

|

by Graeme Wearden and Nick Fletcher on (#PQ15)

Emerging market vulnerabilities, weak liquidity levels and the legacies of the last crisis could all threaten stability, says International Monetary Fund

|

by Larry Elliott Economics editor on (#PRHH)

Fund tells all oil exporters to be braced for prolonged period of disruption as it predicts Gulf state’s deficit will hit 21.6% of GDP this yearThe full extent of the impact of slumping crude prices on Saudi Arabia’s public finances has been highlighted by the International Monetary Fund in a new report telling oil exporters to be braced for a prolonged period of disruption to their budgets.The fund’s half-yearly fiscal monitor report shows that in the past three years a hefty budget surplus in Saudi Arabia has been turned into a deficit of more than 20% of GDP – double the shortfalls seen in the UK and the US during the worst of the global slump of 2008-09. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#PR88)

Threat of instability and recession in emerging economies, and legacy of debt and disharmony in eurozone among ‘triad of risks’ outlined in stability reportThe risk of a global financial crash has increased because a slowdown in China and decline in world trade are undermining the stability of highly indebted emerging economies, according to the International Monetary Fund (IMF).The Washington-based lender of last resort said the scale of borrowing by emerging market countries, whose debts are vulnerable to rising interest rates in the US, mean policymakers need to act quickly to shore up the financial system.Related: Next financial crash is coming – and before we've fixed flaws from last one Continue reading...

|

|

by Heather Stewart on (#PR7Z)

IMF global stability report makes for a sobering read, saying sustainable recovery has failed to materialised and cheap money has led to bubbles and debtThe next financial crisis is coming, it’s a just a matter of time – and we haven’t finished fixing the flaws in the global system that were so brutally exposed by the last one.That is the message from the International Monetary Fund’s latest Global Financial Stability report, which will make sobering reading for the finance ministers and central bankers gathered in Lima, Peru, for its annual meeting.Related: Risk of global financial crash has increased, warns IMF Continue reading...

|

|

by Guardian Staff on (#PQP5)

Join us on Thursday 12 November 2015 to explore the successes and failures of neoliberal capitalism, the emergence of alternative economic models and the potential for grassroots activity to create meaningful changeA growing number of individuals and organisations are questioning an economy based on limitless growth. There are two broad reasons, they argue, why such an economy is doomed to fail: firstly it exploits the people and depletes the resources it relies on to survive; secondly it is accompanied by unacceptable – even unworkable – levels of inequality, financial instability and social unrest.From China’s stumbling stock markets to European austerity, global disruptions are leading to the emergence of new economic movements. The rise of anti-austerity parties such as Podemos in Spain and Syriza in Greece is just one example. Continue reading...

|

by First Dog on the Moon on (#PPWF)

It’s hard to get people angry about a secret and incredibly boring trade agreement so here’s the truth: it will let corporations kill and eat us all Continue reading...

|

by Letters on (#PNR4)

The outrageous views of Jeremy Hunt demonstrate failures of logic and humanity (Hunt: Britons must work like the Chinese, 6 October). I suppose we should not be surprised by his apparent ignorance of psychology, motivation and self-worth, but to suggest (as his pronouncements surely do) that the lives of children currently living in poverty will be improved by making parents work harder flies in the face of the current economic, material and psychological circumstances many of these families endure. It is also sheer wilful arrogance to say this at a time when, for instance, in the north-east another 1,700 families are likely to enter poverty as a result of the closure of the Redcar steelworks. Hunt’s view deserves the opprobrium he receives. For him to protest that his remarks have been (wilfully) misinterpreted is further demonstration of his lack of sensitivity and skill as a communicator. Calls for his resignation would not be out of order.

|

|

by Heather Stewart on (#PND3)

UN’s trade and investment arm says prospects for global growth look bleak unless developed countries can boost growth ratesRich countries must boost public spending and kickstart growth if the world is to avoid a damaging downturn as emerging economies slow, according to the UN’s trade and investment arm, Unctad.In its annual trade and development report, the Geneva-based body warns that developed countries risk sliding into “secular stagnation†– a long period of lacklustre economic growth, driven by weak consumer demand. Continue reading...

|

|

by Graeme Wearden (until 1.45) and Nick Fletcher on (#PK8S)

VW is preparing to scrap non-essential spending as it battles with the emissions scandal

|

|

by Larry Elliott on (#PMEC)

The fund has over-egged its global growth forecasts four years in a row - now it is asking if this weaker performance is temporary or permanentThe International Monetary Fund is worried. That’s not just because it has shaved its growth forecast for 2015 for the second time in six months. It is not even that the world economy is expected this year to post its weakest performance since it completely stalled in 2009.Related: IMF warns of stagnation threat to G7 economies Continue reading...

|

|

by Larry Elliott Economics editor on (#PMEA)

Fund’s latest World Economic Outlook cuts global growth forecasts saying emerging markets slowdown may entrench low inflation and promote stagnation in the westThe International Monetary Fund is warning that the weak recovery in the west risks turning into near stagnation after cutting its global economic growth forecast for the fourth successive year.In its half-yearly update on the health of the world economy, the Washington-based fund predicted expansion of 3.1% in 2015, 0.2 points lower than it was expecting three months ago and the weakest performance since the trough of the downturn in 2009.Related: A worried IMF is starting to scratch its head Continue reading...

|

|

by Simon Allison in Soweto on (#PM5E)

In Soweto to deliver the annual Nelson Mandela lecture, the rock star economist says the country is more unequal than under apartheid. Daily Maverick reportsThomas Piketty is puzzled. To a near-capacity crowd in Soweto, he confesses that South Africa presents him and his fellow economists with a conundrum.

|

|

by Alberto Nardelli and George Arnett on (#PM26)

We check the home secretary’s claims that immigration is pushing thousands out of work, undercutting wages and bringing no economic benefit to the UK

|

|

by Reuters in Hong Kong on (#PKG1)

Recently devalued currency overtakes Japan’s yen in terms of world payments, and now only comes behind the US dollar, euro and sterlingChina’s yuan has become the fourth most-used world payment currency, overtaking the Japanese yen, global transaction services organisation Swift has said.The yuan has surpassed seven currencies in the past three years as a payment currency and now only comes after the US dollar, the euro and the sterling. Continue reading...

|

|

by Daniel Hurst Political correspondent on (#PKCW)

Malcolm Turnbull calls it a ‘gigantic foundation stone for our future prosperity’ but we’ll have to take his word for it until full text of the deal is releasedThe prime minister, Malcolm Turnbull, calls it a “gigantic foundation stone for our future prosperityâ€, but what does the Trans-Pacific Partnership (TPP) mean for Australia?The short answer is that we don’t know for sure, because the full text of the deal has yet to be released.Related: Andrew Robb: Australia and US close to drug patent compromise for TPP dealRelated: Penny Wong backs fight against free-trade clauses that let companies sue AustraliaRelated: Bill Heffernan vows to block any US beef imports under Trans-Pacific PartnershipRelated: Labor, Greens and crossbenchers concerned at Trans-Pacific PartnershipRelated: Trans-Pacific Partnership taking shape behind closed doors, Andrew Robb says Continue reading...

|

|

by Daniel Hurst Political correspondent on (#PJJA)

Australia resists US push for changes to medicine patent rules in 12-nation TPP which government says will deliver ‘enormous benefits’

|

|

by Guardian Staff on (#PHXY)

The United States and 11 Pacific Rim countries announced the most sweeping trade-liberalization pact in a generation on Monday. Australian trade minister Andrew Robb called the Trans-Pacific Partnership a ‘truly transformational’ deal that will help shape the global economy for decades Continue reading...

|

|

by Aditya Chakrabortty on (#PHWH)

The chancellor might have looked in control in 2015, but the UK was badly exposed as the global economy falteredOctober 2017: just hours to go, and still the words wouldn’t come. Other conference speeches had been straightforward. A few easy gags about the Labour leader, some gravelly bits about tough choices and the long-term economic plan and then – whoosh! – a rush of confident promises to zap the deficit and win the global race. The hall’s menagerie of blue-rinses and sixth-formers in suits got the message: George Osborne – a man you can trust with your finances, even if not love with all your heart. But now what was he going to say?Related: George Osborne’s conference speech – the verdict | Tom Clark, Anne Perkins, Jonathan Freedland, Mariana Mazzucato and Matthew d’AnconaRelated: George the Builder and the big Tory plan to fix Britain brick by brick Continue reading...

|

|

by Letters on (#PHPV)

Cutting carbon emissions is but one aspect of the changes needed for the infrastructure and mode of operation of the UK (Osborne reveals deal with former Blair ally, 5 October). On the energy side, we need to increase development and installation of a variety of renewable energy sources. These need to be supported with energy storage schemes. Tidal barrages provide an obvious way to combine both opportunities. We also need to develop and use technology to improve energy efficiency. This involves both more efficient operation of energy use and the reduction in use that is not socially useful. We make many things that add little benefit to life – for instance our overpackaging of many small retail items with moulded plastic. All of this needs to be viewed in ways to make our living more sustainable in the long run in terms of the use of world resources.

|

|

by Simon Bowers on (#PGM8)

Changes aim to stop tax avoidance worth up to $240bn each year but critics say new rules are weak and still offer much scope for non-paymentAn unprecedented international collaboration on tax reform, led by the G20 nations and targeting many of the world’s largest global corporations, will wipe out much of the tax avoidance industry, according to top OECD officials.Related: OECD tax reforms: five key pointsRelated: Revealed: how AstraZeneca avoids paying UK corporation taxRelated: Tax avoidance by corporations is out of control. The United Nations must step in Continue reading...

|

|

by Graeme Wearden (until 2pm BST) and Nick Fletcher ( on (#PFQ3)

All the latest economic and financial news, including disappointing surveys of Europe’s dominant service sector and protests at Air France

|

|

by Joshi Herrmann on (#PHB0)

With their discreet lobbies and Michelin-starred restaurants, the capital’s high-end hotels have become a new green zone of affluence, where the global super-rich book entire floors to do business away from prying eyes

|

|

by Jessica Glenza and agencies on (#PGJY)

Trans-Pacific Partnership – the biggest trade deal in a generation – would affect 40% of world economy, but still requires ratification from US Congress and other world lawmakersTrade ministers from 12 countries announced the largest trade-liberalizing pact in a generation on Monday. In a press conference in Atlanta, trade ministers from the US, Australia and Japan called the the Trans-Pacific Partnership an “ambitious†and “challenging†negotiation that will cut red tape globally and “set the rules for the 21st century for tradeâ€.Related: From cars to cough medicine: why the Trans-Pacific Partnership matters to you Continue reading...

|

|

by Larry Elliott on (#PGCE)

The IFS and Resolution Foundation thinktanks say the chancellor’s welfare overhaul will leave many families worse off. Do the government’s claims add up?Here is what George Osborne said when he was interviewed on the BBC Radio 4’s Today programme on Monday morning: “The typical family with someone working full-time on the minimum wage will be better off, not just a little bit better off but £2,000 a year better off, if you include the lower taxes we are providing through the personal allowance; the childcare for three and four-year-olds. That family is supported.†He also said nine in 10 families would be better off once the whole budget was considered. Continue reading...

|

|

by Katie Allen on (#PG7H)

UK PMI surveys signal weakest economic growth for 2.5 years as fragility spreads to service sectorBritain’s economy is losing momentum, knocked by weaker household spending and worries about the global outlook, according to the latest in a string of downbeat business surveys.Business activity grew at the slowest pace for more than two years in Britain’s dominant services sector last month, according to the closely watched Markit CIPS PMI report.Related: Bosses of UK's top firms report rising uncertainty over global economyRelated: Growth fears as UK and eurozone service sectors slow - live updates Continue reading...

|

|

by Alex Hern on (#PFZ7)

Nothing is being shared when you hire a cleaner to tidy your house or a car to drive you to work, even if you use an app to do itThe “sharing economy†is a meaningless term that was only coined in the first place because of the tech industry’s desire to pretend everything it does is new and groundbreaking.Now, almost a decade after it started seeing use, it’s worse than simply being meaningless: it’s actively obfuscatory, lumping together a hugely disparate bunch of companies, many of which push the definition to its limits, and the biggest examples of which have nothing to do with “sharing†at all. Continue reading...

|

|

by Reuters in Atlanta on (#PEDT)

Despite a compromise on the length of drug monopolies, a last-minute hitch over New Zealand’s demands for access to dairy markets delayed an agreementA dozen Pacific countries have closed in on a sweeping free trade pact after a breakthrough over how long a monopoly pharmaceutical companies should be given on new biotech drugs.

|

|

by Katie Allen on (#PEYT)

Poll of chief financial officers finds many are trimming investment and hiring plans due to Chinese downturn and possible interest rate riseChina’s downturn, the prospect of rising interest rates and uncertainty about the global economic outlook have knocked confidence among bosses of the UK’s biggest companies, according to a survey.Chief financial officers (CFOs) polled by the consultancy Deloitte reported a sharp rise in uncertainty facing their businesses and have scaled back their expectations for investment and hiring over the coming year.Related: How China's economic slowdown could weigh on the rest of the world Continue reading...

|

|

by Zoe Williams on (#PE7B)

Why do those who seem happy enough with quantitative easing recoil if it’s for social investment? Jeremy Corbyn’s idea of people’s QE is not so dangerousIn its broadest sense, the phrase “there’s no magic money tree†is just a variation on “money doesn’t grow on treesâ€, a thing you say to children to indicate that wealth comes not from the beneficence of a magical universe, but from hard graft in a corporeal reality. The pedantic child might point to the discrepant amounts of work required to yield a given amount of money, and say that its value is a social construction.Over time, that loose, rather weak-minded meaning has ceded to a specific economic critique; Jeremy Corbyn – along with anyone who challenges the prevailing fiscal narrative – is dangerous and wrong, since he wants to print money. Money cannot be created from nowhere, because there’s no magic money tree. End of.Related: Corbyn's QE for the people jeopardises the Bank of England's independenceRelated: Jeremy Corbyn has the vision, but his numbers don’t yet add up | Larry Elliott Continue reading...

|

by Larry Elliott Economics editor on (#PDSH)

The preconditions for another boom-bust are already in place thanks to the chancellor’s strategy of heating up the property marketNapoleon was wrong. This is a nation not of shopkeepers but of estate agents. The UK economy ebbs and flows according to the state of the property market, sometimes gently but more commonly with giant waves of speculation followed by an inspection of the wreckage as the tide goes out. Warning: although the sea currently looks calm, the wind is freshening. The economy is sailing into a storm.This course was charted by George Osborne three years ago in order to get the economy out of the doldrums. Back in 2012, the chancellor was a worried man. His budget had flopped, the recovery from the deep recession of 2008-09 had stalled, and his deficit reduction plan was way behind schedule. He was booed at the London Olympics and there was talk of him being reshuffled.Related: Quarter of all stamp duty comes from 10 boroughsRelated: Housing bill needs radical, long-term measures to reform the market Continue reading...

|

by Sean Farrell on (#PDPT)

Despite plans to create a ‘northern powerhouse’, CEBR predicts that the north-south divide will widen over the next decade without more political actionThe economic gap between London and other major cities will widen significantly in the next 10 years, undermining the chancellor’s push to create a “northern powerhouseâ€, according to a report.London’s economy is forecast to grow 27% by 2025 – almost twice the combined rate of growth in northern English cities, the report by law firm Irwin Mitchell and the Centre for Economics & Business Research (CEBR) found. Continue reading...

|

|

by Chris Mullin on (#PDKJ)

The politician’s review of government economic policy during his years in the coalition is lucid, intelligent – and damningThis is the sequel to Vince Cable’s widely praised account of the events surrounding the great crash of 2008. It is a lucid, erudite analysis of the global economy, and Britain’s place in it, in the five years between 2010 and 2015, as viewed from the vantage point of someone who was a senior member of the coalition.It is emphatically not a memoir, although he does offer insights into the tensions between the coalition partners. There are references to “ideologically driven spending cutsâ€. George Osborne is said to possess “a ruthless eye for party advantage†and Cable nails the lie so assiduously peddled, not only by the Tories but by some of his Liberal Democrat colleagues, that the crisis of 2008 was caused by Labour mismanagement of the public finances: “…not trueâ€, he says. Continue reading...

|

by Helen Pidd North of England editor on (#PDGJ)

Thousands of people gather for march past conference venues after ‘unwelcoming committee’ greeted delegates at Piccadilly station

|

by William Keegan on (#PDB0)

George Osborne’s kowtowing to China has landed him on weak ground when it comes to opposing Jeremy Corbyn’s rail policyWhile the Conservatives and many members of the media go on and on about the putative need for Labour to apologise for the deficit that was caused not by Gordon Brown but by the banking crisis, an apology has come from an unexpected quarter.In a recent interview with Margaret Thatcher’s biographer, Charles Moore, for the Policy Institute at King’s College, London, the man who ran Thatcher’s press office for 11 years, my old friend Sir Bernard Ingham, said about Thatcherism: “I’m sorry, desperately sorry, that so many people had to suffer the consequences.†Now, it is true that this admission was made in the context of Ingham’s claim that those years he worked for her “produced very substantial improvement in the country†– a debatable point – but it is interesting that he made the apology. He also had the good grace to add: “I wish some privatisation had been carried out better [sic].†I’ll say! Continue reading...

|

|

by Gabrielle Chan on (#PD8P)

Trade minister says deal is close without revealing whether Australia is standing firm on five-year cap on biologics drug patents against US push for eight yearsThe trade minister, Andrew Robb, has said Australia and the United States are within striking distance of a deal on the monopoly period for biologics medicines which could seal the Trans Pacific Partnership (TPP).Robb was speaking in Atlanta at the current round of negotiations for the TPP, which if signed would create a preferential trade zone between 12 countries covering 40% of the world’s economy.

|

|

by Reuters on (#PCY6)

But the head of the European Parliament, who is a German Social Democrat, said Europe’s biggest carmaker was still likely to survive the crisisThe head of the European Parliament has said the emissions scandal at Volkswagen would hit the German economy hard but Europe’s biggest carmaker was likely to survive the crisis.Germany’s finance and economy ministers have played down the risk of a broader economic danger for Germany from the scandal.Related: VW emissions scandal is a one-off incident, says motor industry bossRelated: The Volkswagen emissions scandal explained Continue reading...

|

|

by Jana Kasperkevic in New York and Phillip Inman on (#P8F9)

Labour department’s lower than expected September jobs data reveals 64,000 fewer jobs than forecast, making a rate rise by Federal Reserve less likely

|

|

by Graeme Wearden and Nick Fletcher on (#P7M0)

Fewer jobs were created than expected in America last month, more people quit the labor force, and wage growth was disappointing

|

|

by George Arnett on (#P8S5)

Killing sprees have occurred almost every day in the US since 2013, but public opinion has still turned against gun controlMass shootings occur almost once a day in the US, yet protecting gun rights seems to concern Americans more than increasing controls on guns.On Thursday, a gunman killed nine people in a community college in Oregon. It was the 994th gun incident in which there were four or more victims (including the shooter) since the start of 2013, according to the website Mass Shooting Tracker. Continue reading...

|

by Jo Michell on (#P8JE)

Most economists support Labour opposition to the ‘economically illiterate’ fiscal charter. John McDonnell and Jeremy Corbyn should frame a clear alternative to austerity, as promised, not backtrackJeremy Corbyn was elected Labour leader on an unequivocal anti-austerity platform. Shadow chancellor John McDonnell’s announcement that the party will back George Osborne’s fiscal charter has therefore caused alarm among Corbyn’s supporters. So what is Labour’s position on austerity and the deficit?MPs will vote on Osborne’s fiscal charter later this year. The charter commits the government to eliminate the deficit by the end of this parliament and to run a surplus in all subsequent years unless economic growth falls below 1%. Continue reading...

|

by Katie Allen on (#P82N)

Companies created jobs for the 28th month running and in September they hired new staff at the fastest pace for three monthsA big pick-up in housebuilding helped the UK’s construction sector enjoy its fastest growth for seven months in September and boosted job creation, according to a survey.All parts of the industry from civil engineering to housebuilders saw output rise in September. That lifted the key measure of business activity for the whole construction sector to 59.9 from 57.3 in August, the latest Markit/CIPS UK construction PMI showed. Continue reading...

|

|

by Mischa Wilmers on (#P7ZB)

Has capitalism had its day? At a Guardian Live/Discuss debate in Manchester, Guardian Members listened to two opposing arguments before voting for or against the motion - the markets will save usThe late Nobel prize-winning economist, Milton Friedman, once described free-market capitalism as “the most effective system we have discovered to enable people who hate one another to deal with one another and help one anotherâ€. Yet since the 2008 financial crash, this understanding has come in for intense criticism from those who believe that unregulated markets are the cause of - rather than the solution to - many of society’s problems.

|

by Daniel Hurst on (#P7Y3)

As the new prime minister tries to reinvigorate the Coalition, the government must grapple with an unpopular higher education policy it still believes inListening – presumably a core skill for anyone wishing to stand for high office – sounds like the new buzzword in Australian politics.Related: Malcolm Turnbull promises new style of leadership after overthrowing AbbottRelated: Tony Abbott broods on his bruises as 'dirty water flows under the bridge'Related: Education minister may seek election mandate for revamped university policy Continue reading...

|

by Katie Allen on (#P6Q8)

The CBI and EEF sceptical about government plan to create 3m apprenticeships in five years, fearing high cost to business and low quality of trainingThe government’s plan to charge a new levy on businesses to help reach ambitious apprenticeship targets is facing resistance from big employer groups who warn ministers not to sacrifice quality of training.Chancellor George Osborne announced the levy in his summer budget as a key part of his bid to show he was on the side of working people. The government has pitched it to business as a way to end years of under-investment in training and solve skills shortages with 3m new apprenticeships by 2020.Related: Apprenticeships: it's quality, not numbers that matterRelated: Cameron pledges to create 50,000 new apprenticeships using Libor fine Continue reading...

|

|

by Julia Kollewe and Katie Allen on (#P4D3)

Sector growth slows in September, prompting manufacturers to lay off workers, against backdrop of uncertain global outlookTough export markets and weaker consumer spending continued to take their toll on UK factories last month, prompting the first job losses for the sector in more than two years, according to a survey that echoed signs of manufacturing weakness around the world.The performance at UK factories was lacklustre in September, when growth slipped to a three-month low. Against the backdrop of warnings about the uncertain outlook for global growth, eurozone manufacturing also lost momentum and output from Chinese factories continued to fall. Continue reading...

|

|

by Heather Stewart on (#P60F)

Finance institute forecasts net capital outflow from emerging markets for first time since 1988 leaving states vulnerable to ‘capital drought’Global investors will suck capital out of emerging economies this year for the first time since 1988, as they brace themselves for a Chinese crash, according to the Institute of International Finance.Capital flooded into promising emerging economies in the years that followed the global financial crisis of 2008-09, as investors bet that rapid expansion in countries such as Turkey and Brazil could help to offset stodgy growth in the debt-burdened US, Europe and Japan.Related: IMF's emerging markets warning is timely Continue reading...

|