|

by Ricky Burdett and LSE Cities on (#VEV7)

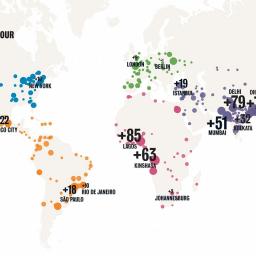

Beneath the crude statistic that the world is heading towards 70% urbanisation by 2050 lie regional differences in demographic, economic and environmental change. LSE Cities’ Urban Age programme takes a deeper look at the dataIn 1950, the fishing village of Shenzhen in south-east China had 3,148 inhabitants. By 2025, the UN predicts, that number will exceed 12 million. Congo’s capital Kinshasa will have gone from 200,000 to more than 16 million, growing over the next decade at the vertiginous rate of 4% a year (about 40 people an hour). Meanwhile Brazil’s economic engine São Paulo will have slowed to less than 1% per annum, nonetheless experiencing a 10-fold expansion over the 75-year period.

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-07 00:45 |

|

by Max Rashbrooke on (#VEJG)

The emergence of a young, monied elite whose inherited wealth is highly visible is a new thing for New Zealand – but how do we respond?When I went on television to launch my new book about wealth inequality in New Zealand, I didn’t expect much of a backlash. The core of my book is straightforward information: new data showing that the wealthiest 10th of New Zealanders own more than half of all assets, while the poorest 50% have just 4%.

|

|

by Matthew d'Ancona on (#VDD5)

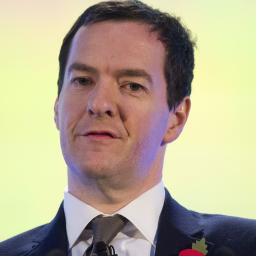

This week’s spending review will be a key test of the Tory party’s values, and is a chance to show it’s moved on from Margaret ThatcherLest you were in any doubt about its purpose before, the Conservative party has left little room for confusion in 2015. The cover of its election manifesto promised “a brighter, more secure futureâ€. In July George Osborne announced “a budget that puts security firstâ€. Its conference slogan in Manchester was: “Security. Stability. Opportunity.â€Related: Spending review 2015: now it's time for George Osborne to face tough choicesRelated: Everything we hold dear is being cut to the bone. Weep for our country | Will HuttonThe chancellor and the Treasury chief secretary truly believe they are enacting a revolution Continue reading...

|

|

by Letters on (#VDD7)

What a thoroughly reactionary article by Simon Jenkins (From militant doctors to angry lawyers, professionals are the new union barons,19 November), supporting government attacks on junior doctors and legal aid lawyers. He peddles the nonsense that the cost of legal aid is 20 times Europe’s average, ignoring the many comparable reports that have found costs to be average. His quaint middle-class idea that representation can simply be resolved by us seeking mediation ignores the role of some legal aid lawyers in supporting campaigns that exposed terrible police practices in cases such as Hillsborough or Stephen Lawrence.His idea that everyone should be denied both a solicitor and a barrister would lead directly to masses of miscarriages of justices, where the police and prosecution would have representation denied to everyone else. It would also lead to a lack of accountability. The last time I was at court was at an inquest for a family of a man who had died in a G4S prison. The prison had skilfully managed to tell the wrong family their son had died. This did not stop them having four representatives at the inquest – but it also did not stop the jury criticising their practices. Decent representation may not be important for the likes of Simon Jenkins, but the majority of society cannot afford to be without it.

|

|

by Larry Elliott Economics editor on (#VCN3)

The UK chancellor has dug a big hole for himself over tax credit cuts with room to manoeuvre limited by the worsening deficit. But he has optionsGeorge Osborne is a lucky man. In different circumstances, the headlines in the 10 days before his autumn statement on Wednesday would have been dominated by the mess the chancellor has made for himself over tax credits.

|

|

by Press Association on (#VCF7)

Chancellor refuses to rule out cuts to policing in Wednesday’s spending review, which will include cuts to many government departmentsThe Home Office has agreed a deal on police cuts that are expected to hit frontline services despite heightened security concerns, George Osborne has revealed.Confirming all government departments have settled their future spending plans for this parliament, the chancellor refused to confirm the exact nature of cuts to British policing.

|

|

by Guardian Staff on (#VC4T)

However belated the report into the bank’s collapse and the new inquiry may be, they remain jobs that were worth doingThe British establishment, it is often said, is capable of decisive and clear-minded action only when it is confronted by a crisis. At other times, it prefers insularity, hates self-analysis and loathes outside criticism.This character trait was seen clearly during and after the great banking crisis of 2007-09. The disaster itself arrived with the run on Northern Rock in September 2007 but only became truly dangerous in October 2008 when HBOS and then Royal Bank of Scotland were on the brink of failure. Continue reading...

|

|

by Heather Stewart on (#VC1Z)

Any five-year-old sees that it’s not fair for poor families to keep falling further behind the rest of us. But the Tories have decided not to measure thatAs I was bundling up a cosy red coat that my five-year-old has outgrown to donate to charity last week, I gently explained to her that while we could just buy ourselves new, warm clothes when winter draws in, not everyone is so lucky.Not for the first time, I was struck by how obvious it seemed to her – not just that other children shouldn’t have to go without, but that we have more than enough, and that that makes others’ deprivation more shocking. No child should go cold and hungry at all, but in a society where plenty is the norm, it seems peculiarly senseless.Family income matters: kids from poorest families are more likely to struggle at school and to suffer health problems Continue reading...

|

|

by Heather Stewart on (#VBC1)

Treasury shadow chief secretary Seema Malhotra announces review of government support for enterpriseLabour will launch a detailed review of the multitude of tax breaks offered to Britain’s businesses, as the party seeks to craft a distinctive Corbynite economic policy, according to shadow chief secretary to the Treasury Seema Malhotra.In an interview with the Observer, Malhotra said business reliefs, which allow companies to reduce how much they owe the taxman, should be subject to the same scrutiny as any other area of public spending. Continue reading...

|

|

by Toby Helm and Heather Stewart on (#VBBM)

Under pressure to halt his tax credit cuts, the chancellor needs to find extra savings to hit his £20bn target – but can he afford to slash the police budget at such a critical time?

|

|

by Heather Stewart on (#VAEJ)

The shadow chancellor’s pro-business deputy has George Osborne’s ‘tax credit fiasco’ firmly in her sights as the autumn statement approachesSeema Malhotra, the shadow chief secretary to the Treasury, could hardly be more different from her boss and constituency neighbour in west London, John McDonnell.While the shadow chancellor – and Jeremy Corbyn’s righthand man – cites Marx as a major intellectual influence, Malhotra, a rising Labour star, is a former management consultant who grew up above a shop in Hounslow, the daughter of Indian immigrants, and speaks in glowing terms of the contribution business can make to society. Halfway through an interview dissecting the Tories’ economic policies, a division bell rings, and she swaps her heels for trainers and bolts off to vote. Continue reading...

|

by John Lanchester on (#V9N5)

When writing Capital, his novel set in a time of financial excess, Lanchester thought things couldn’t get any worse. But 10 years on, amid ever-rising house prices and continuing City scandals, he is dismayed to find they didWhen asked where he got his ideas, the late Terry Pratchett would confidentially tell his audience, “Well, there’s this warehouse called Ideas R Us.†That was a good answer, because it did two useful things: get a laugh and deflect the question. The truth is, it is hard to know where ideas come from.A novel usually begins, in my experience, with a thought or image that won’t leave me alone. In the case of my novel Capital, I became obsessed with a thought I had one day, looking out of the window at the permanent chaos of building work near where I live. In addition to the skips and builders’ vans, the scaffolding and concrete mixers and basement diggers, there was a constant scrum of deliveries and services going to people’s front doors. The thought that struck me was this: that the houses were like living beings, with needs and demands of their own. Instead of being the backdrop to people’s lives, houses had assumed such economic and psychological importance that they had now become principal characters in their own right.The momÂent I thought of as one of supreme obliviousness, an obliviousness that would never return, is back with usRelated: Guardian book club: Capital by John Lanchester Continue reading...

|

by Martin Farrer on (#V8EY)

Former Greek finance minister warns Australia has ‘false sense of well-being’ and needs to change direction to avert crisisAustralia is a “plaything†of forces it cannot control as the world economy heads into another phase of the global financial crisis, according to the former Greek finance minister Yanis Varoufakis.The “remarkable†flow of overseas money into the economy in recent years had created a “false sense of well-beingâ€, he said, but the economy needed to change direction quickly to avert a crisis.Related: Yanis Varoufakis: ‘If I’m convicted of high treason, it would be interesting’Related: EU referendum: Yanis Varoufakis says Britons should vote to stay in unionRelated: In defence of Yanis Varoufakis Continue reading...

|

|

by Larry Elliott Economics editor, and Jon Henley in on (#V80Y)

European Central Bank expected to increase quantitative easing as French consumer spending collapses amid ‘avalanche’ of tourist cancellationsMario Draghi has signalled fresh help from the European Central Bank for the struggling eurozone economy amid signs that the terrorist attacks in Paris have led to a collapse of spending by French citizens and “an avalanche of cancellations†from tourists.With the big Paris department stores, Printemps and Galeries Lafayette, reporting footfall down by between 30% and 50%, Draghi all but confirmed that the ECB would step up its efforts to stimulate growth and lower unemployment. Continue reading...

|

|

by Larry Elliott Economics editor on (#V7DA)

Institute for Fiscal Studies says watering down planned changes would make it impossible for George Osborne to keep welfare spending below £115bnGeorge Osborne is at risk of breaching his self-imposed ceiling on welfare spending if he makes concessions on plans to curb tax credits to hard-pressed families, Britain’s leading thinktank on the public finances has said.The Institute for Fiscal Studies said unless the chancellor could find savings from elsewhere in the benefits bill, it looked likely that he would have to ask parliament to raise the welfare cap announced in the summer budget. Continue reading...

|

|

by Larry Elliott on (#V72T)

Shock deficit figures for October mean the police, courts, local government, business and above all education face 30% cuts in autumm statement, says Resolution FoundationThe police, courts, education, local government and business are facing spending cuts of up to 30% next week as five Whitehall departments bear the brunt of George Osborne’s attempt to put Britain’s public finances back in the black, according to an independent thinktank.The ringfencing of key areas of spending, such as the NHS, coupled with agreements already struck between the chancellor and some of his cabinet colleagues, has left five big areas of spending under threat, says the Resolution Foundation.Related: Shock UK deficit figures dent George Osborne's economic plan Continue reading...

|

|

by Phillip Inman Economics correspondent on (#V6JT)

Surprising figures for October mean the chancellor must find an extra £10bn than envisaged. Prepare for some creative accounting – and more cutsOn the surface, the figures are bad. Government borrowing was 16% higher in October than the same month last year.The deficit was supposed to be going down – and quickly. Forecasts by the Office for Budget Responsibility, which assesses the government’s spending plans, predicted growing tax receipts and lower spending would generate a 23% cut in borrowing over the financial year. It is currently only 11% lower.Related: Shock UK deficit figures dent George Osborne's economic plan Continue reading...

|

|

by Katie Allen on (#V6DR)

Gap between state spending and revenue is worst in October for six years with economists warning chancellor will need further austerity or miss annual targetGeorge Osborne’s deficit-cutting drive has been dealt a blow ahead of next week’s spending review after official figures showed the worst October for the public finances in six years.The deficit, or the gap between what the government spends and takes in, swelled by 16% from a year earlier to £8.2bn in October, according to the Office for National Statistics (ONS). It was a larger shortfall than the £6bn forecast by economists in a Reuters poll.Related: UK deficit figures: expect a new George Osborne conjuring trick Continue reading...

|

|

by Dimitri Zenghelis and Nicholas Stern on (#TTXD)

Ahead of the COP21 UN climate summit, Nicholas Stern and Dimitri Zenghelis argue that the choices cities make today on transport and industry will determine whether the world can benefit from resource-efficient growthCities are home to half the world’s population and produce around 75% of the world’s GDP and greenhouse gas emissions. By 2050, between 65% and 75% of the world population is projected to be living in cities, with more than 40 million people moving to cities each year. That’s around 3.5 billion people now, rising to 6.5 billion by 2050; a huge and singular event in human history.This places cities at the centre of economic activity affecting how economies grow, how resources are allocated, how innovation takes place, whether innovation is used well or badly and, if badly, how much damage it inflicts on others now and in the future. They can also be very exposed and vulnerable to climate risks such as water shortages, floods and heat stress. The mass congregating of people and rising demand for resources, under poor organisation and governance, make cities prime sources of pollution, congestion and waste.

|

|

by Phillip Inman Economics correspondent on (#V4AE)

Why do businesses and households need the Federal Reserve to intervene with higher borrowing costs if they are already restraining themselves?There was never going to be a right time for the Federal Reserve to raise interest rates, yet now, as the US central bank prepares for a December “lift-offâ€, it seems the first move in seven years will be both too early and too late.Too early, because many of the underlying weaknesses of the US economic system are still evident: the low rate of Americans’ participation in the workforce; a lack of above-trend wage growth to drive up shop prices. Then there is the insipid global growth forecasts brought on by a decline in global trade. Continue reading...

|

|

by Jill Treanor on (#V26D)

As the long-awaited report into the troubled emergency takeover of HBOS by Lloyds is published, we look back over the bank’s turbulent 14-year historyMay 2001 Halifax and Bank of Scotland merge to create HBOS, a “new force in bankingâ€.January 2004 Mike Ellis, the then finance director, tells the board the Financial Services Authority (FSA) is concerned the bank is an “accident waiting to happenâ€. This subsequently emerges in the parliamentary commission on banking standards (PCBS) report in 2013.

|

|

by Edward Docx on (#V3Q3)

Unfettered Osbornomics is what we’ll get on 25 November. If we had a financially literate opposition rather than Corbyn’s Labour, things might be differentThere were two oppositions in the last parliament: Labour and the Liberal Democrats. And, this week more than ever, it is worth saying that only the latter made any difference to the real lives of real people. Why? Because they were in government. But thanks to their brutal contraction and the subsequent departure of Don Corbyn de la Mancha for his knight-errant’s tour of windmills, we now have no effective opposition at all (unless you count the House of Lords). And this is about to matter in lots of painful ways to millions of people when the chancellor announces what cuts he plans to make in the spending review in his autumn statement on Wednesday.Related: George Osborne agrees 24% spending cuts with ministersRelated: These children of Thatcher are free to cut, cut, cut – and they’re loving every minute | Polly Toynbee Continue reading...

|

|

by Katie Allen on (#V3AC)

CBI’s snapshot of sector reveals strong pound and jitters over global growth are likely to dent factory outputUK manufacturers have reported the weakest overseas demand for their goods for almost three years as they grapple with a strong pound and a weaker global economy.The latest snapshot of factory order books and output from the CBI also showed companies expected output to fall over the coming three months – despite it having picked up in recent weeks, the business group reported.Related: UK manufacturers urge George Osborne to maintain spending on innovation Continue reading...

|

|

by Larry Elliott on (#TZF1)

An important International Monetary Fund paper looks at how the eurozone should have responded to the problems that affected five of its membersBlanket austerity across the crisis-hit countries of the eurozone was self-defeating. Germany’s analysis of what needed to be done was wrong. The European Central Bank (ECB) was slow to come up with a stimulus package designed to offset the demand-sapping impact of wage cuts.Those were the main messages of an important International Monetary Fund (IMF) intervention into the debate about how the eurozone should have responded to the problems that affected five of its members – Greece, Ireland, Portugal, Spain and Italy. This quintet accounts for 30% of eurozone output.Related: Eurozone recovery loses steam as Germany slows Continue reading...

|

|

by Heather Stewart on (#TXT6)

General secretary Frances O’Grady calls on George Osborne to ditch his planned cuts at next week’s spending reviewGeorge Osborne’s tax credit cuts will hit families in Britain’s poorest regions hardest, according to an analysis by the TUC.It is calling on the chancellor to ditch the plans in next week’s spending review.Related: The young will lose out, again, in George Osborne’s spending review | Tom Clark Continue reading...

|

|

by Graeme Wearden (until 2.15) and Nick Fletcher on (#TTY9)

French plan to boost security spending will not break fiscal rules, says Commission

|

|

by Katie Allen on (#TWHW)

A better educated workforce is also among the welcome findings in the International Labour Organisation’s latest data on the world’s labour marketThere has been a sharp drop in the number of working poor around the world, according to the International Labour Organisation (ILO), which has pulled that and some other welcome findings from its vast database on the global jobs market.The UN agency also highlighted a general improvement in the educational level of the world’s labour force as it released its latest key indicators of the labour market databases.Related: It’s a degree, not a ticket to a job | Kehinde Andrews Continue reading...

|

by Associated Press on (#TWD9)

|

by Alison Moodie on (#TVR2)

‘Gender lens investing’ aims to tackle the marginalization of women by asking investors to make gender equality part of the decision-making processBertha Nzabanita survived the 1994 genocide in Rwanda, but her husband did not. As a single mother, she struggled to make do with the one coffee field and dilapidated house he had left her. Then Nzabanita discovered Musasa, a coffee cooperative that gave her and other widows from the genocide a stable market for their coffee allowing them to increase their income.

|

|

by Larry Elliott Economics editor on (#TVMR)

Unlike headline inflation, the core measure of the cost of living actually rose in OctoberInflation has reached a trough, at least for now. The government’s preferred measure of the cost of living remained unchanged at -0.1% in the year to October, but will turn positive when the data for November is released next month.The reason is that the consumer prices index (CPI) fell by 0.3% in November 2014 as a result of the plunging cost of crude oil. Unless that decline is repeated this November – which it won’t be – the annual inflation rate will mechanically rise.Related: UK inflation remained negative at -0.1% in October Continue reading...

|

|

by Heather Stewart on (#TVB0)

Reading stays below zero for second successive month as falling global commodity prices and strong pound weigh down rateInflation was negative for a second successive month in October, at -0.1%, according to official figures, leaving the cost of living for Britain’s households practically unchanged since January.The Office for National Statistics (ONS) said the rising cost of clothing - the biggest upward contribution to inflation - had been more than offset by declining food prices and the fading impact of costly student fees. It is the first time two successive monthly readings have been below zero since the consumer prices index (CPI) started to be calculated in 1996.Related: UK inflation is negative again, but what does this mean for consumers? Continue reading...

|

|

by Robert Skidelsky on (#TV9E)

Research shows the automatic assumption of a better future for citizens in the west has now goneThe terrorist slaughter in Paris has once again brought into sharp relief the storm clouds gathering over the 21st century, dimming the bright promise for Europe and the west that the fall of communism opened up. Given dangers that seemingly grow by the day, it is worth pondering what we may be in for.Though prophecy is delusive, an agreed point of departure should be falling expectations. As Ipsos Mori’s Social Research Institute reports: “The assumption of an automatically better future for the next generation is gone in much of the west.†Continue reading...

|

|

by Christopher Menon on (#TV9Q)

Low inflation has mixed implications for households – it’s good news for borrowers but consumers with a lot of debts should try to pay them off

|

|

by Anatole Kaletsky on (#TTZW)

The market consensus concerning the dollar’s inevitable rise as US interest rates increase is almost certainly wrongThe US Federal Reserve is almost certain to start raising interest rates when the policy-setting Federal Open Markets Committee next meets, on 16 December. How worried should businesses, investors, and policymakers around the world be about the end of near-zero interest rates and the start of the first monetary-tightening cycle since 2004-2008?Janet Yellen, the Fed chair, has repeatedly said that the impending sequence of rate hikes will be much slower than previous monetary cycles, and predicts that it will end at a lower peak level. While central bankers cannot always be trusted when they make such promises, since their jobs often require them deliberately to mislead investors, there are good reasons to believe that the Fed’s commitment to “lower for longer†interest rates is sincere. Continue reading...

|

|

by Yiannis Gabriel on (#TTWK)

Companies and governments have got us all wrong – it’s impossible to predict what we want and care aboutConsumers today are often cast as god-like figures before whom markets and politicians bow. Everywhere, it seems, consumers are triumphant. Consumers drive production; they fuel innovation; they dictate modern politics; they have it in their power to save the environment or to destroy the planet.The word consumer describes people as having certain experiences and taking certain actions individually or collectively (similar to worker, employee, manager).

|

|

by Jill Treanor on (#TT30)

Investigations into financial crisis conduct show ‘no signs of abating’, warns Moody’sMajor banks have now set aside $219bn (£144bn) to pay fines and legal costs since the financial crisis.Ratings agency Moody’s, which calculated the vast provisions, ranked Barclays, HSBC and Royal Bank of Scotland at high risk from on-going investigations. Continue reading...

|

|

by Phillip Inman on (#TSBZ)

Amazon, Facebook and Google in line of fire after committee backs proposals to force multinational corporations to pay tax where they make their salesMEPs have launched a scathing attack on Facebook, Google and Amazon in the European parliament, accusing them of diverting profits worth billions of pounds to low tax havens.Members of the special committee on tax rulings said they were concerned that major US businesses were paying virtually no tax in the EU countries where they operated, denying governments vital funds. Continue reading...

|

|

by Graeme Wearden and Katie Allen on (#TS92)

Air France and Thomas Cook lead travel and leisure stocks lower amid concerns terror attacks will deter holidaymakersMore than €2bn (£1.4bn) was wiped off shares in European travel and hotel companies , as investors focused on concerns that the Paris attacks will hit tourism and consumer confidence across the continent.Shares in airline Air France-KLM, travel company Thomas Cook and their sector peers were down sharply on Monday, over fears the attacks and the prospect of tighter border controls would deter shoppers and holidaymakers from visiting Paris and other European cities. Continue reading...

|

|

by Graeme Wearden (until 2.30) and Nick Fletcher on (#TQAD)

All the day’s economic and financial news, as Paris investors refuse to panic after Friday’s attacks

|

by Katie Allen on (#TRBY)

Two recessions on from his electoral victory, ShinzŠAbe’s economic recovery plan is doing little in practiceJapan just cannot seem to get its economy growing. The latest drop in GDP marks the country’s fourth descent into recession in five years.It is a blow to the prime minister, ShinzŠAbe, who came to power in 2012 vowing to stamp out deflation and bolster a flagging economy with his so-called Abenomics policies. Continue reading...

|

by Phillip Inman Economics correspondent on (#TR0P)

Economics minister Akira Amari urges Japanese firms to use their record cash holdings to raise wages and increase capital spendingJapan’s recovery is being held back by a shortage of skilled labour, a leading minister has claimed, after the world’s third-largest economy entered its fourth technical recession in five years.Related: Japan 's 'quintuple dip' recession delivers a fresh blow to Abenomics Continue reading...

|

|

by Katie Allen on (#TQWR)

Consumer prices index (CPI) has been dragged down by tumbling global commodity prices and the effects of a strong poundThe UK’s inflation rate is expected to have remained in negative territory when official figures are released on Tuesday, leaving the Bank of England in little hurry to start raising interest rates.Economists expect data for October to show the inflation rate as measured by the consumer prices index (CPI) held at -0.1%, according to the consensus in a Reuters poll. Inflation has been at or close to zero for most of this year and first dipped into negative territory in April when prices fell for the first time in more than 50 years. Continue reading...

|

|

by Alfred de Zayas on (#TQFX)

The investor-state dispute settlement puts companies’ rights ahead of human rights. Its effects are devastating for developing nations – we must abolish itWhen the architects of the international order that took shape after the second world war created the United Nations, they gave the organisation a lofty goal: “Save succeeding generations from the scourge of war.†Through the UN charter – akin to a world constitution – solemnly adopted in 1945 in San Francisco, they also said they were “determined to establish conditions under which justice and respect for the obligations arising from treaties and other sources of international law can be maintainedâ€.Since then and in line with that vow, the UN has put on the world stage not only the Universal Declaration of Human Rights, but also legally binding instruments, including 10 core human rights conventions and countless declarations and resolutions.Related: The lies behind this transatlantic trade deal | George MonbiotThe ISDS cannot be reformed. It must be abolished Continue reading...

|

|

by Martin Farrer and agencies on (#TQ1N)

Global security concerns saw the euro hit a six-month low and stocks were sold off around the region as Japan entered a ‘quintuple dip’ recessionStock markets in Asia Pacific have fallen sharply in the wake of the Paris terror attacks and downbeat economic data.Leading the losers was the Nikkei index in Japan which tumbled nearly 1.3% as official figures showed that the country’s economy had entered recession for the fifth time in seven years.Related: Japan 's 'quintuple dip' recession delivers a fresh blow to Abenomics Continue reading...

|

|

by Reuters on (#TPJH)

The economy shrank for the second quarter in a row for the fifth time in seven years, figures showed, increasing the pressure on Shinzo AbeJapan has slid back into recession for the fifth time in seven years amid uncertainty about the state of the global economy, putting policymakers under growing pressure to deploy new stimulus measures to support a fragile recovery.Related: Abenomics 2.0 – PM updates plan to refresh Japanese economy Continue reading...

|

by Katie Allen on (#TPG3)

Manufacturers’ organisation EEF says firms want a stable, predictable business environmentManufacturers are warning George Osborne that Britain risks squandering years of investment in hi-tech research and business support if he cuts support for innovation at the spending review next week.Against the backdrop of waning global demand and pressure on UK competitiveness from a strong pound, manufacturers’ organisation EEF says its members are worried that Osborne’s new round of austerity will add to their uncertain outlook. The chancellor unveils his comprehensive spending review on 25 November when he will set out tighter budgets for government departments. Continue reading...

|

by Phillip Inman Economics correspondent on (#TND1)

Corporate short-term thinking is holding back investment - governments need to step in nowTrillions of dollars, pounds, euros and yen are stuck in the global financial system with seemingly nowhere to go. Continue reading...

|

|

by William Keegan on (#TMQB)

The sight of the PM complaining about cuts is remarkable. But it underlines how misguided the Tories’ appraisal is of the real threats to the economyYou could not make it up. Our ultra-smooth prime minister has complained to the Conservative leader of Oxfordshire county council about the cuts to local authority services being made in David Cameron’s constituency, which is itself in Oxfordshire. We owe this great story to the Oxford Mail, to which organ a certain exchange of letters, or possibly emails, was leaked.Welcome to the real world, Dave! When a prime minister finally wakes up to the consequences of the ideologically driven austerity policies of his own chancellor, then perhaps he should be tempted to follow the example of his hero, Harold Macmillan, and sack him. Continue reading...

|

|

by Catarina F Martins on (#TKR9)

The female-led Left Bloc party is about to form a government, but now faces shockingly sexist attacksA few days after Bloco de Esquerda (Left Bloc) won 10% of the vote in the Portuguese general elections last month, Joana Mortágua strode through the marble halls of the Portuguese parliament.Mortágua doesn’t resemble most deputies: she doesn’t wears suits, preferring a T-shirt and sneakers. She’s athletic and gathers her hair into a ponytail. Even after a historic result, she looked relaxed and amused, joking with colleagues that she had too many meetings to go to. Fast-forward a few weeks and her diary is fuller; Mortágua has become one of the most powerful politicians in the country. Continue reading...

|

|

by Heather Stewart and Fergus Ryan on (#TK2A)

As exporters feel the pinch, one analyst is suggesting that a surreptitious retreat from globalisation may be provoking the declineFor one Chinese company that depends on global trade, fears over the worldwide economy have come to pass already. “The global economy is pretty bleak at the moment,†says Luo Dong, the owner of Doyoung, a Beijing-based exporter of frozen seafood and fruit. “This is having a big effect on us. Our clients’ sales are a lot slower than they used to be, and as purchasing power overseas drops, our exports are taking a hit.â€Luo’s observations were echoed on a wider stage last week, when the Paris-based Organisation for Economic Co-operation and Development voiced the fear gripping many economists: that the drop-off in trade, driven by China, may be a harbinger of something more worrying – a global recession. Continue reading...

|