by Frances Perraudin and Patrick Wintour on (#QADK)

Former shadow chancellor Chris Leslie says his successor needs to explain last-minute change after angry parliamentary party meeting

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-13 09:01 |

|

by Katie Allen on (#QA2S)

Economists expect inflation to have remained unchanged in September but core inflation predicted to edge upFalling pump prices and a cut in energy bills by British Gas are expected to have kept inflation at zero last month, putting little pressure on the Bank of England to raise interest rates from their record low any time soon.Official figures on inflation due at 9.30am are forecast to show no change in the consumer prices index measure. Against the backdrop of tumbling global commodity prices, from food to oil, inflation in the UK has been at or close to zero since February, well below the Bank’s target of 2%. Continue reading...

|

|

by Daniel Hurst Political correspondent on (#Q9TR)

Proposals include requirement for employers to look for local workers before overseas labour and an increase in mimimum pay for foreign workersThe Turnbull government appears set to reach a deal to secure passage of the China-Australia free trade agreement (Chafta) after it vowed to consider the opposition’s demands “in good faith†in a bid to resolve the long-running political dispute.On Tuesday the federal Labor party signed off on its proposed amendments to the Migration Act, which would form the basis of negotiations with the government aimed at passing legislation necessary to implement Chafta.Related: China free trade agreement must not 'slip through our fingers', official warns Continue reading...

|

|

by Guardian Staff on (#Q9EH)

Democratic presidential candidate Bernie Sanders says on Monday that the creation of jobs is not truly beneficial unless those jobs come with a higher minimum wage. The current federal minimum wage is $7.25. Speaking at the No Labels Problem Solver Convention in New Hampshire, Sanders says people who work two or three jobs should not be living in poverty Continue reading...

|

|

by Katie Allen on (#Q9E2)

British Retail Consortium says like-for-like sales grew at fastest annual pace for six months in September, buoyed by demand for snacks and alcoholDemand for beer and party food for Rugby World Cup watchers and school shoes for the new term helped lift retail sales last month, according to industry figures.In the latest report to indicate consumer spending remains the main driver of economic growth, the British Retail Consortium (BRC) said like-for-like sales grew at the fastest annual pace for six months in September. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#Q7EN)

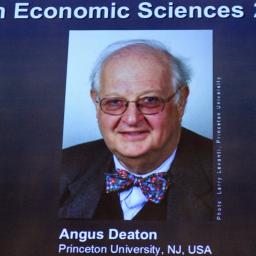

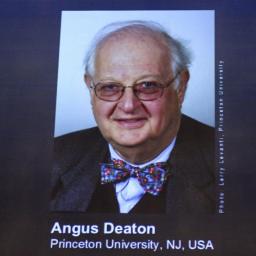

Scottish economist is best known for his work on health, wellbeing, and economic developmentA British-born Princeton professor, Angus Deaton, has won the Nobel prize in economics for his work charting global developments in health, wellbeing and inequality.The Nobel Committee said the economist’s work had a major influence, particularly in public policy where it has helped governments determine how different social groups react to specific tax changes.Related: The Guardian view on tax credit cuts: the chancellor’s sums don’t add up | EditorialRelated: Nobel prize in economics won by Angus Deaton - live Continue reading...

|

|

by Larry Elliott on (#Q7MF)

Nobel prize in economics caps the economist’s long, distinguished and hugely influential academic career which focused on inequality and povertyEconomics is split into two broad camps. In one group are the macroeconomists, who study the big picture. If a chancellor of the exchequer decides to cut VAT on domestic energy, they work out what it will mean for growth and jobs.The other group is made up of microeconomists. Instead of working from the top down, they work from the bottom up. In the event that a government cuts VAT, they will look not at whether consumer spending will go up in aggregate, but at what it means for the poor, the rich, and those on middle incomes.Related: Angus Deaton wins Nobel prize in economics Continue reading...

|

|

by Guardian Staff on (#Q7MD)

Professor Angus Deaton wins the Nobel prize in economics for his analysis of consumption, poverty, and welfare. Speaking on the phone to a press conference in Stockholm on Monday, the Scottish-American economist offers his views on the current refugee crisis.Read: Angus Deaton wins Nobel prize in economicsNobel prize in economics won by Britain’s Angus Deaton - live Continue reading...

|

|

by Jill Treanor on (#Q7FZ)

Senior bankers are moaning about overregulation, but with the government still owning major stakes in banks this is no time to water down the rulesSeven years ago this week, Gordon Brown – the then prime minister – was in full combat mode. Royal Bank of Scotland (RBS) and HBOS were on the brink of collapse and risked bringing down the rest of the financial system with them. Brown was left with little option but to step in with billions of pounds of taxpayers’ money to act as a “rock of stability†to prevent the financial sector collapsing.The intervening years have led to soul-searching through inquiries and changes in the rules about the amount – and type – of capital banks must hold to protect against collapse. Rules about the way bonuses are paid to top bankers have changed: deferral and payment in shares are now the norm for the most senior bankers. Changes are also being made to the way banks are structured following the recommendations by the Independent Commission on Banking, chaired by Sir John Vickers. Continue reading...

|

|

by Matthew d'Ancona on (#Q6QK)

David Cameron has talked up his party’s compassion. He needs to act fast to turn rhetoric into concrete policyIf Conservative modernisation has a founding text, it is generally believed to be the speech delivered at a fringe meeting of the party’s 1997 conference by Michael Portillo, having been recently ousted from his Enfield Southgate seat. To stand a chance of returning to office, he said, the Tories had “to deal with the world as it now isâ€. The public’s recoil from the Conservative party, Portillo insisted, “must be appreciated as a deeply felt distaste, rather than momentary irritation. We cannot dismiss it as mere false perception.â€Another contender text would be Michael Ashcroft’s book. No, not Call Me Dave, but Smell the Coffee, Ashcroft’s collation in 2005 of polling data from the general election campaign of that year. “To the extent that the voters who rejected us in 2005 associate the Conservative party with anything at all it is with the past,†he wrote in the introduction, “with policies for the privileged few and with lack of leadership … the brand problem means that the most robust, coherent, principled and attractive Conservative policies will have no impact on the voters who mistrust our motivation and doubt our ability to deliver.â€Related: Margaret Thatcher told to show compassion for 'unfortunate' in societyRelated: A Tory civil war is brewing, with Europe as the battlefield | Tom Clark Continue reading...

|

|

by Reuters on (#Q6AQ)

US Federal Reserve has ‘global responsibilities’ to ensure that monetary policy is kept loose, says Lou Jiwei ahead of the IMF annual meeting in LimaThe slow recovery of western economies means the US Federal Reserve should not raise interest rates yet, according to the Chinese finance minister.Related: The Fed must ignore accusations of dithering over interest rates Continue reading...

|

|

by Heather Stewart on (#Q62T)

Resolution Foundation says real wages rose at 3.6% thanks to low inflation but warns benefits may be felt mostly by older, more qualified workersBritain’s private sector workers are enjoying the fastest real wage growth in 14 years, with pay deals picking up as inflation hovers close to zero, according to a leading thinktank.Analysis by the Resolution Foundation suggests that private sector wages rose at an annual rate of up to 3.6% in the three months to August, due to rising wages and flat living costs. That would be the fastest growth since 2001 if it is confirmed in official figures to be published on Wednesday. Continue reading...

|

|

by Larry Elliott and Heather Stewart on (#Q5M7)

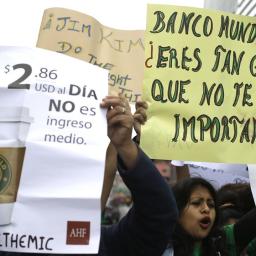

International development secretary Justine Greening called on bank to ‘ensure refugees have chance of getting jobs’Britain is urging the World Bank to put together a long-term plan to meet the needs of refugees following a summer dominated by a migration crisis that has put strains on the European Union.Justine Greening, the international development secretary, told the bank’s annual meeting in Lima that short-term emergency assistance was not enough and that a strategy was needed to provide schools, hospitals and work for those displaced. Continue reading...

|

|

by Joris Luyendijk on (#Q5GX)

The award glorifies economists as tellers of timeless truths, fostering hubris and leading to disasterBusiness as usual. That will be the implicit message when the Sveriges Riksbank announces this year’s winner of the “Prize in Economic Sciences in Memory of Alfred Nobelâ€, to give it its full title. Seven years ago this autumn, practically the entire mainstream economics profession was caught off guard by the global financial crash and the “worst panic since the 1930s†that followed. And yet on Monday the glorification of economics as a scientific field on a par with physics, chemistry and medicine will continue.Related: Nobel Prize in economics announcement - liveRelated: Nobel Prizes in science: strictly a man’s game?Related: How the banks ignored the lessons of the crash | Joris Luyendijk Continue reading...

|

|

by Reuters in Washington on (#Q53B)

Federal Reserve moves to hinge on economic developments amid ‘considerable uncertainties’ in exports, investment and job growth, says Stanley FischerFederal Reserve policymakers are still likely to raise interest rates this year, but that is “an expectation, not a commitment†and could change if the global economy pushes the US economy further off course, Fed vice-chairman Stanley Fischer said.“Both the timing of the first rate increase and any subsequent adjustments to the federal funds rate target will depend critically on future developments in the economy,†Fischer told a group on the sidelines of the International Monetary Fund meeting in Peru. Continue reading...

|

|

by Heather Stewart on (#Q4ZB)

Social networking firm paid average of £210,000 to its staff in Britain, but overall loss in UK of £28.5m meant very little corporation tax was dueStaff at Facebook’s UK arm took home an average of more than £210,000 last year in pay and bonuses, while their employer paid just £4,327 in corporation tax.Facebook made an accounting loss of £28.5m in Britain in 2014, after paying out more than £35m to its 362 staff in a share bonus scheme, according to the unit’s latest published accounts. Operating at a loss meant that Facebook was able to pay less than £5,000 in corporation tax to HM Revenue for the year.Related: What is the ‘Google tax’? Continue reading...

|

|

by Jeffrey Frankel on (#Q4Z4)

In light of vociferous opposition to the trade deal, the TPP that emerged is a pleasant surprise – so much so that some Republicans threaten to oppose itAgreement among negotiators from 12 Pacific rim countries on the Trans-Pacific Partnership (TPP) represents a triumph over long odds. Tremendous political obstacles, both domestic and international, had to be overcome to conclude the deal. And now critics of the TPP’s ratification, particularly in the US, should read the agreement with an open mind.Many of the issues surrounding the TPP have been framed, at least in US political terms, as left versus right. The left’s unremitting hostility to the deal – often on the grounds that the US Congress was kept in the dark about its content during negotiations – carried two dangers: A worthwhile effort could have been blocked; or President Barack Obama’s Democratic administration could have been compelled to be more generous to American corporations, in order to pick up needed votes from Republicans. Continue reading...

|

|

by Larry Elliott Economics editor on (#Q4TV)

The IMF appears fixed on interest rates and QE to boost the global economy but just as homeowners take on larger mortgages when rates are low, governments can also sustain higher deficitsTurn those machines back on. So demands the unscrupulous banker, Mortimer Duke, when he finds he and his brother Randolph have been ruined by their speculative scam in the film Trading Places. Having lost all his money betting wrongly on orange juice futures, Mortimer demands that trading be restarted so that he can win it back.It’s not known whether Christine Lagarde is a secret fan of John Landis movies. As a French citizen, François Truffaut might be more her taste. There is, though, more than a hint of Trading Places about the advice being handed out by Lagarde’s International Monetary Fund to global policymakers.Related: A worried IMF is starting to scratch its headRelated: Europe must learn the lessons of the recent past | Jean-Claude Trichet Continue reading...

|

|

by Phillip Inman Economics correspondent on (#Q4QH)

British professor who made name studying impact of falling wages on consumer demand was cited in more academic papers last year than any other economistA British economist who made his name studying wages, taxes and household spending is among the frontrunners to win the economics Nobel prize when it is announced on Monday.Analysis by Thomson Reuters found that Sir Richard Blundell, the Ricardo professor of political economy at University College London, was cited in more academic papers over the last year than any other economist, indicating that his research on the impact of falling wages on consumer demand has proved hugely influential. Continue reading...

|

|

by Chris Mullin on (#Q4P2)

Two tomes on David Cameron’s first term are compelling enough but share one glaring omission – how he pulled off the lie that Labour caused the financial crisis“I want to be clear,†writes Michael Ashcroft in his introduction to Call Me Dave, “my motivation for writing this book is not about settling scores.†Hmmm, I thought on reading these words, up to a point, Lord Copper.But no, remarkably, and despite the nonsense about a pig’s head, this is a biography almost entirely free of malice. Indeed, apart from a brief introduction and a lengthy appendix summarising the conclusions of his regular opinion polls, which he publishes on his own website, Lord Ashcroft’s fingerprints are largely absent.Related: It’s George Osborne who will shape Tory prospects for 2020 | Gaby HinsliffA picture of Macmillan rather than Thatcher had pride of place in his office when he was leader of the opposition Continue reading...

|

|

by Katrine Marcal on (#Q4K7)

Economists have had it wrong for centuries about the worth of women’s workInvest in girls and growth will take off – this has become a bit of a mantra in the last few years. From the UN to the IMF, international organisations pen beautiful press releases about how women are the key to economic development. Girls can fix the global economy, we hear, and the experts have numbers to prove it.Economists have estimated that each additional year of schooling boosts long-term growth by 0.58 percentage points per year. NGOs repeat such figures in the hope that policymakers will reconsider the current under-investment in girls. Continue reading...

|

|

by Heather Stewart on (#Q4CM)

The Chinese slowdown shows that the global financial system is still failing. New rules would mean a brighter, more stable future, not just for emerging markets but for the whole worldBill Gross, America’s “bond kingâ€, who made his fortune betting on IOUs from companies and governments, is suing his erstwhile employer for $200m, we learned last week. He says his colleagues were driven by greed and “a lust for powerâ€.His chutzpah was a timely reminder of the vast sums won and lost in the world of globalised capital, but also of the power that still lies in the hands of men (they are mostly men) like Gross, who sit atop a system that remains largely untamed despite the lessons of the past seven years. Continue reading...

|

|

by Larry Elliott and Phillip Inman on (#Q3K1)

Lender warns on last day at Lima of the need for ‘continued accommodative monetary policies’ amid rising opposition from critics of ultra-low interestThe International Monetary Fund concluded its annual meeting in Lima with a warning to central bankers that the world economy risks another crash unless they continue to support growth with low interest rates.The Washington-based lender of last resort said in its final communiqué that uncertainty and financial market volatility have increased, and medium-term growth prospects have weakened.Related: A worried IMF is starting to scratch its head Continue reading...

|

|

by Chris Johnston on (#Q2VR)

Environmental groups, charities and opposition parties who organised protest against free trade deal between the EU and US say 250,000 people took partHundreds of thousands of people marched in Berlin on Saturday to oppose a planned free trade deal between the European Union and the United States that is claimed to be anti-democratic and to threaten food safety and environmental standards.The environmental groups, charities and opposition parties that organised the protest claimed 250,000 people took part, while a police spokesman said 100,000 attended. Smaller protests were also held in other cities, including Amsterdam, with a rally due to be held in London on Saturday night at which shadow chancellor John McDonnell is scheduled to speak.Related: What is TTIP and why should we be angry about it?Related: Obama defends controversial TPP deal and dismisses secrecy concernsRelated: TPP or not TPP? What's the Trans-Pacific Partnership and should we support it? Continue reading...

|

|

by Phillip Inman Economics correspondent on (#Q0D4)

Chancellor tells IMF meeting that Britain is not immune from rising global economic risks as he hails China’s ‘enormous’ contribution to growthGlobal economic risks are rising and Britain will not be immune, George Osborne has said in response to warnings from the International Monetary Fund over the potential for another crash.The chancellor said the Greek debt crisis remained a threat to the eurozone alongside the fallout from tumbling commodity prices and high debt levels in some countries. But he said concern about the slowdown in China should not be overdone, since it was still contributing solidly to global growth.Related: Osborne warns UK not immune from rising global risks - as it happened Continue reading...

|

|

by Sam Thielman in New York on (#Q0BS)

Intellectual property rights chapter appears to give Trans-Pacific Partnership countries’ countries greater power to stop information from going publicWikileaks has released what it claims is the full intellectual property chapter of the Trans-Pacific Partnership (TPP), the controversial agreement between 12 countries that was signed off on Monday.TPP was negotiated in secret and details have yet to be published. But critics including Democrat presidential hopefuls Hillary Clinton and Bernie Sanders, unions and privacy activists have lined up to attack what they have seen of it. Wikileaks’ latest disclosures are unlikely to reassure them.Related: Hillary Clinton's TPP deal disapproval is 'a critical turning point'Related: TPP or not TPP? What's the Trans-Pacific Partnership and should we support it? Continue reading...

|

|

by Nick Fletcher on (#Q0BV)

Markets buoyed by suggestions US central bank is unlikely to raise interest rates this year, as oil made best weekly gains for six yearsThe FTSE 100 has recorded its biggest weekly rise for nearly four years, buoyed by optimism that central banks would continue to support the struggling global economy.The leading index recorded its eighth consecutive daily rise as the minutes from the US Federal Reserve’s September meeting released overnight suggested the US central bank was unlikely to raise interest rates this year as many had expected.Related: London Stock Exchange slips on Russell sale price disappointment Continue reading...

|

|

by Phillip Inman Economics correspondent on (#PZFV)

Building sector takes unexpected tumble in August, prompting fresh calls for increase in infrastructure spending and skills trainingConstruction firms say a skills shortage threatens to delay major building projects, after official figures showed the sector contracted sharply in August.Output in the industry fell by 4.3% on the previous month, surprising City economists, who had expected a 1% rise.Related: Housebuilding drives UK construction sector growth in September Continue reading...

|

|

by Phillip Inman Economics correspondent on (#PZ9P)

A £500m rise in cars shipped abroad fails to ease prospects of huge deficit in third quarter fueled by strong pound plus eurozone woes and declining oil industryA rise in car exports helped improve Britain’s trade deficit in August, according to official figures.The monthly shortfall in the trade balance for goods narrowed to £3.3bn from £4.4bn in July. However, the UK was still heading for a huge deficit in the third quarter of the year after an upward revision to July’s shortfall.Related: Global stocks rally as Fed minutes suggest no rush to raise US rates - live Continue reading...

|

|

by Associated Press on (#PX7V)

Minutes of the Fed’s September meeting show they held off because of China’s economic slowdown and its potential to derail US growth and inflationFederal Reserve officials were almost ready to raise interest rates in September but held off because of China’s economic slowdown and its potential to derail US growth and inflation.Minutes of the 16-17 September discussions showed the central bank believed the time for the first Fed rate increase in nine years “might be nearâ€. Continue reading...

|

|

by Katie Allen on (#PX5F)

New evidence emerges that young people looking for work are being disproportionately hurt by the legacy of the global financial crisisMillions of young people continue to struggle to find work with global youth unemployment set to rise further above its pre-downturn level, the International Labour Organisation (ILO) has warned.The UN agency is calling on governments to invest more in education and training as new evidence emerges that young jobseekers are being disproportionately hurt by the legacy of the global financial crisis. Continue reading...

|

|

by Graeme Wearden(until 2pm) and Nick Fletcher on (#PTPD)

IMF praises George Osborne’s infrastructure plans; Britain’s central bank leaves borrowing costs at their record low again.

|

|

by Phillip Inman Economics correspondent on (#PWJV)

Christine Lagarde, pitching for second term as International Monetary Fund chief, says policymakers must cut debt and support growth to prevent slowdownThe boss of the International Monetary Fund has urged global policymakers to build stronger buffers against volatile financial markets in a “rapidly changing and uncertain worldâ€.Speaking at the IMF’s annual meeting in Lima, Christine Lagarde denied the global economy was entering a “dark period†but said debts needed to be cut and greater international cooperation was needed to prevent recovery from being derailed.Related: Lagarde urges global policymakers to support economic growth - as it happenedRelated: Bank of England warns financial institutions over commodities exposure Continue reading...

|

|

by Hugh Miles in Cairo on (#PWHB)

Secret memo reveals King Salman imposing unprecedented austerity on public-sector budget as oil price languishes at under half of break-even levelThe Saudi government has banned official purchases of cars and furniture and slashed travel budgets and infrastructure spending as it faces its gravest fiscal crisis for years because of low oil prices, according to leaked internal government documents.Secret Saudi policy memos issued by King Salman to the finance minister detail the new economic austerity measures to be implemented across all government ministries. Saudi public finances have been depleted this year by tumbling oil prices to such an extent that the kingdom is expected to run a deficit of at least 20% of GDP in 2015.Related: Oil price slump turns Saudi surplus into huge deficit, IMF report shows Continue reading...

|

|

by Severin Carrell Scotland editor on (#PWC3)

Fiscal Affairs Scotland, one of the country’s only independent financial monitoring bodies, is close to folding after failing to find donors, raising anxieties about effective scrutiny of public spending

|

|

by Larry Elliott on (#PW97)

The last interest rate move was in 2009 and nothing at the Bank of England suggests this will change soon – but expect something exciting to happen by late 2016Being a member of the Bank of England’s monetary policy committee is one of the world’s easiest gigs. You turn up, listen to a rundown on what has happened to the global and UK economies over the past month, you cogitate, and then you do nothing. This pattern has now been uninterrupted since July 2012 when, at the height of the eurozone crisis, the Bank pumped £50bn into the economy through its quantitative easing programme. The last interest rate move was in March 2009, which means that none of the nine members of the MPC has actually changed the cost of borrowing.The latest MPC minutes suggest that this period of inactivity is likely to continue. Inflation is now expected to remain lower for longer than the Bank previously thought, staying below 1% until the spring. In the meantime, the headline measure of the cost of living – the all items consumer prices index – is quite likely to go negative when the September inflation data is released next week.Related: Bank of England keeps interest rates on hold Continue reading...

|

|

by Giles Fraser on (#PVZN)

Capital is an economic migrant and its unrestricted movement threatens national sovereignty. Surely people should be just as freeTheresa May won’t be around in the early 22nd century when, according to Star Trek at least, Dr Emory Erickson will have invented the transporter – a device that will be able to dematerialise a person into an energy pattern, beam them to another place or planet, and then rematerialise them back again. In such a world people will be able to move as quickly and freely as an email.The philosopher Derek Parfit has rightly questioned whether such a thing is even philosophically possible: will the rematerialised person be the same person as the dematerialised one, or just a perfect copy. (What would happen if two copies of me were rematerialised? Would they both be me?) Parfit thus raises a fascinating philosophical question about what we mean by personal identity – or what makes me me. Continue reading...

|

|

by Kenneth Rogoff on (#PVN9)

Economically speaking, France is not as French as it first seems but there is a desperate need for it to embrace some structural reformsMore than ever, the French economy is at the centre of the global debate about how far one can push the limits of state size and control in a capitalist democracy. To those on the left, France’s generous benefits and strong trade unions provide a formula for a more inclusive welfare state. To those on the right, France’s oversized and intrusive government offers only a blueprint for secular decline. For the moment, the right looks right.Once nearly the economic equal of Germany, France has fallen well behind over the past decade, with per capita GDP now about 10% lower. France may punch above its weight politically, but it punches far below its weight economically. Continue reading...

|

|

by Staff and agencies on (#PVD4)

Rate stays at 0.5% amid mounting fears for the global economy and signs that ultra-low UK inflation will remain for some timeThe Bank of England has kept interest rates on hold amid signs that ultra-low UK inflation is here to stay for a while longer.Members of the Bank’s nine-strong Monetary Policy Committee (MPC) voted eight to one to leave rates at 0.5%, where they have been since March 2009, in a repeat of voting numbers seen for the past two months.Related: Bank of England votes 8-1 to leave interest rates unchanged - live updates Continue reading...

|

|

by Presented by Olly Mann with Alex Hern. Produced by on (#PTWX)

Robots aren't just after your job, they're after the overthrow of the whole economic system Continue reading...

|

|

by Heather Stewart on (#PTJS)

As the International Monetary Fund’s annual talks kick off in Lima, anxiety over global growth is poised to top the agendaThe International Monetary Fund’s annual meeting gets under way against a backdrop of rising concern over the health of the global economy. From the travails of emerging economies to the scale of the Chinese downturn, there is much to debate at the gathering in Lima, alongside tackling longstanding problems such as cracking down on the tax affairs of multinational corporations. Continue reading...

|

|

by Guardian Staff on (#PSS7)

US Democratic presidential candidate Hillary Clinton said on Wednesday she did not support the 12-nation Trans-Pacific Partnership (TPP), rejecting a central tenet of president Barack Obama’s strategic pivot to Asia. Clinton said during a campaign swing in Iowa that she is worried about currency manipulation not being part of the agreement and that ‘pharmaceutical companies may have gotten more benefits and patients fewer’ Continue reading...

|

|

by Letters on (#PS4T)

Zoe Williams (It’s fine to print money, so long as it’s not for the people, 5 October) raises an important question about quantitative easing (QE). In the wake of the global financial crisis, it was adopted by the Bank of England. Capital markets had ceased to function. The banking system was in deep crisis. In the US and Britain, governments were driven to inject equity into the collapsing banking system. These huge outlays had to be funded by the issuance of public debt. The Bank made clear to the prime brokers (mainly the major commercial banks) that they would be offered access to zero-cost funds in order to bid in Treasury auctions. These funds were provided electronically by the Bank into the accounts of those banks held with it.These no-cost credits enabled the prime brokers to purchase the government debt, and by agreement swap back the debt to the Bank at a modest profit. Once this happened, the electronic advances made by the Bank were cancelled. The net effect was threefold. First, the government’s solvency was preserved. Second, the prime brokers were able to secure profit from guaranteed transactions to replace more traditional forms of lending. Third – the odd bit – the Bank ultimately ended up holding the debt of the British government, not the private sector of the economy. Continue reading...

|