|

by Jana Kasperkevic in New York on (#KEAZ)

The US unemployment rate has reached a seven-year low – but you wouldn’t know it by looking at certain industries who have been forced to reduce workers’ hours in ways that aren’t reflected in jobs reportsThe unemployment rate fell to a seven-and-a-half-year low in August. While the number of new jobs created was less than expected, overall the month-to-month numbers have been positive, allowing the Obama administration to tout economic recovery and the Fed to prepare for a potential interest rate hike later this year.Yet, the monthly numbers do not tell the entire story.Related: Shell cuts 6,500 jobs as oil price slump continues Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-01 17:00 |

|

by Jana Kasperkevic in New York on (#KF67)

Jobs report falls short of expectations as numbers are likely to complicate matters for the Fed, which is expected to raise interest ratesThe US economy added 173,000 jobs in August, less than expected, while the unemployment rate dropped to 5.1%, surpassing expectations.The numbers released by the Department of Labor on Friday are likely to complicate matters for the Federal Reserve, which meets later this month and will discuss raising interest rates for the first time since the recession. This is the last jobs report before the Fed meeting.Businesses have added 13.1 million jobs over 66 straight months of job growth, extending longest streak on record pic.twitter.com/WNofHiebtn Continue reading...

|

|

by Tom Clark on (#KD46)

In the post-slump era, radical ideas can quickly go mainstream and turn economic orthodoxy on its headFifty-five economists have written to the Financial Times to caution that Jeremy Corbyn is out of line with “the mainstream†of their discipline. What is interesting here is not the professors’ conventional statement of the conventional wisdom, but rather why they felt moved to pick up the pen.Related: Jeremy Corbyn wins economists’ backing for anti-austerity policiesRampant inflation seems a remote prospect now, but that would change if the government printed its way out of troubleRelated: Will Atlas shrug in face of Corbynomics? | Letters from Professor Paul Levine and others Continue reading...

|

|

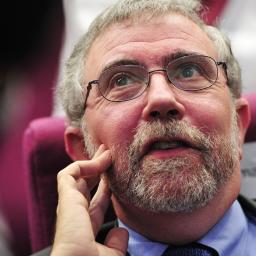

by Greg Jericho on (#KCSN)

In an interview with Guardian Australia, the Nobel prize-winning economist expresses scepticism about the China free trade agreement and a GST increaseAustralia is resilient enough to weather the weakening of the Chinese economy, the Nobel prize-winning economist Paul Krugman has said, but he poured cold water on the benefits of the free trade agreement between the two countries.Related: Confused about the China free trade deal? Here's what you need to knowRelated: The austerity delusion | Paul KrugmanRelated: How Australia weathered the global financial crisis while Europe failed | David Alexander Continue reading...

|

|

by Nils Pratley on (#KBWW)

Mario Draghi has plainly been rattled by China’s economy, and as a result the bank’s €1.1tn quantitative easing scheme may need shoring upThe European Central Bank (ECB) launched its €1.1tn (£800bn) quantitative easing programme only in January. Now, with a full year left to complete the bond-buying spree, QE2 is being prepared.Related: ECB press conference: Markets jump as Draghi hints at more QE - as it happenedRelated: HSBC rules out revival of Midland brand for UK high street banking arm Continue reading...

|

|

by Phillip Inman Economics correspondent on (#KBSC)

ECB president says growth prospects in the single currency area have suffered and could worsen if China’s slowdown bitesThe euro fell sharply and stock markets rose after the European Central Bank boss said he was ready to provide more stimulus to prevent the eurozone’s faltering economy being hit by worries over China.The ECB’s president, Mario Draghi, said the eurozone’s growth prospects had suffered in recent months and could worsen if the slowdown in China and turmoil in emerging markets took a turn for the worse. Continue reading...

|

|

by Graeme Wearden on (#K9JJ)

Shares surge and euro slides as Mario Draghi marks his birthday by cutting the ECB’s growth and inflation forecasts, and suggesting extra stimulus could be needed

|

by Heather Stewart on (#KAKK)

Chancellor confirms nomination and says Robert Chote is ‘undoubtedly best person’ to chair Office for Budget ResponsibilityRobert Chote, chairman of the budget watchdog the Office for Budget Responsibility, has promised to continue shining a light on “the darker recesses of the public finances†after the chancellor gave him another five-year term in the job.The OBR was set up by George Osborne in 2010 to make independent forecasts of economic growth and the public finances, and provide a check on the Treasury’s tax-and-spending plans. Continue reading...

|

by Daniel Howden on (#KAK2)

In the islands near Turkey, such as Kos, the two phenomena have collided, turning the usually lucrative tourist season into a ‘relentless August’One hot afternoon this August, the peaceful waters of Vokaria Bay on the Greek island of Chios were disturbed by a jetski as it headed in a straight line for the shore. As well as the noise, swimmers noticed the passenger hanging on behind the driver. Instead of the usual loudly coloured beach shorts he was dressed in shirt sleeves and suit trousers.Stepping off and thanking his driver, the man trudged up the pebbles to introduce himself to locals in flawless Greek. He was Syrian, he explained, and had studied at Athens law school two decades earlier before returning home where he went on to become a judge. Now in his mid-40s he had lost hope after four years of civil war and fearing for his life, decided to leave.Related: Shocking images of drowned Syrian boy show tragic plight of refugeesFor Greeks weary of their own troubles there has been no summer hiding place from the scale of the influxRelated: We deride them as ‘migrants’. Why not call them people? | David Marsh Continue reading...

|

by Andrew Simms on (#KADZ)

Jeremy Corbyn’s ‘people’s quantitative easing’ for house building was derided by many, but to keep a roof over all our heads in the face of climate change it is time for fresh economic thinkingIf your house was slowly falling down, in serious danger of catching fire or getting repossessed you’d know something was wrong and needed changing. Yet, tens of millions of homes are at risk globally according to Nasa’s latest research on sea level change, because of ice loss from Greenland and the Antarctic, melting glaciers and the thermal expansion of the warming oceans.Oikos, meaning household, and nomos, meaning roughly a set of rules, are the generally accepted Greek roots for the word economics. Hence, stripped of its own wilful obfuscations as a discipline, economics is the art of good housekeeping. But, as the Nasa research shows, economics is failing lamentably at the level of planetary housekeeping, just as it is in the UK at the more prosaic but also important level of the housing market. Continue reading...

|

by Julia Kollewe and Graeme Wearden on (#KA5T)

Hiring and business confidence rises in the eurozone, with Spain and Italy performing stronglyThe eurozone’s private sector is growing at its fastest rate in four years, with business confidence boosted by the easing of the Greek debt crisis despite growing fears over global growth.Improved confidence across the 19-member currency bloc prompted companies to hire more people last month to deal with rising business volumes. Spain was the star performer but growth in France almost ground to a halt, according to the latest PMI (purchasing managers index) surveys from Markit. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#KA1P)

Fall in confidence blamed by some analysts on turmoil in world markets and slowdown in ChinaThe engine of Britain’s economic growth slipped a gear in August after the services sector expanded at its slowest rate for two years.In another sign that the UK economy is losing momentum, the Markit/Cips survey of the services sector, which generates more than three-quarters of Britain’s income, found a broad slackening in activity and a decline in the confidence of businesses in the outlook for the rest of the year. Continue reading...

|

|

by Phillip Inman and Heather Stewart on (#K7Y1)

International Monetary Fund’s downbeat comments come before G20 finance ministers meet in AnkaraThe recent turmoil in financial markets and the struggling Chinese economy could combine to hit global economic growth this year and force central banks to keep interest rates low, the International Monetary Fund has said ahead of a meeting of G20 finance ministers in Ankara this weekend.In a downbeat report that charted the increasing risk of a global slowdown, the IMF said finance ministers attending the conference in the Turkish capital needed to maintain government spending despite the still high public-sector debts left over from the 2008 banking crash.Related: IMF chief warns of slower growth after China shockwaves Continue reading...

|

|

by Graeme Wearden (until 2.15pm BST) and Nick Fletche on (#K5VG)

Investors fret about the state of the world economy, as Australia’s economy falters and Chinese stocks drop again

|

|

by Lorenzo Fioramonti, Enrico Giovannini, Robert Cost on (#K6Z7)

If governments and companies are serious about meeting the Sustainable Development Goals then they’ll need to ditch their bad habitsImagine a country genuinely committed to pursuing the sustainable development goals (SDGs), set to be agreed on by the international community later this month. It would place emphasis on human and ecosystem wellbeing as the ultimate objective of progress. This country – let’s call it the Republic of Wellbeing – and its business sector would need to embark on a profound transformation to achieve durable, long-term change.Around the world today, companies and governments do precisely the opposite: they put more emphasis on short-term economic dynamics, or what Hillary Clinton criticised as “quarterly capitalismâ€. If we are serious about meeting the SDGs then this cannot continue.Related: Climate change is killing us. We must use the law to fight it | Richard Wilkinson and Kate PickettRelated: Sustainable development is failing but there are alternatives to capitalismRelated: Good, natural, malignant: five ways people frame economic growth Continue reading...

|

|

by Heather Stewart on (#K6B0)

Positive PMI data raises hopes that building sector can make stronger contribution to economic growthBritain’s construction industry expanded at a healthy pace in August, according to the key survey of the sector, boosting hopes that economic growth remained resilient into the third quarter.The monthly purchasing managers index, from the Chartered Institute of Purchasing and Supply, jumped to 57.3, from 57.1 in July, well above the 50 mark that signals expansion. Continue reading...

|

by Stephen Koukoulas on (#K5X6)

The Coalition has failed to deliver on its election pledges including a return to budget surplus, cutting government debt and having a pro-business strategyIf the next federal election is fought on economic management and economic outcomes, Labor will romp in. The economy remains moribund, with each hopeful snippet of good news quickly shot down by a flood of mediocre or downright bad news. Consumers, and that means voters, are starting to suffer financial hardship which is one reason the Coalition should find any issue other than economic management to fight the upcoming election on.

|

by Australian Associated Press on (#K8J4)

Quarterly growth figure is half the expected rate, dragged down by reduced mining and construction activity and export woesThe economy stuttered during the three months to the end of June, undermined by reduced mining and construction activity coupled with a decline in exports.

|

by Editorial on (#K4BS)

A mad system in which the west’s workers make up for poor wages with cheap credit from China is drawing to a close. Good riddanceClad as it is in jargon and technicalities, financial meltdowns can often seem like an elaborate spectacle taking place in a foreign country. So it is with the trillions wiped off shares since 24 August’s “Black Mondayâ€. Obviously it’s a huge deal, but beyond the numbers on Bloomberg terminals it’s hard to put into perspective. Yet one way to think about what has happened in China over the past couple of weeks is the drawing to a close of an entire system for running the world economy.Over the past two decades, globalisation has fired on two engines: the belief that Americans would always buy the world’s goods, of which the Chinese would make the lion’s share – and lend their income to the Americans to buy more. That policy regime was made explicit during the Asian crisis of the late 90s, when Federal Reserve head Alan Greenspan slashed US borrowing rates, making it cheaper for Americans to buy imports. And it was talked about throughout the noughties by central bankers fretting about the “Great Wall of Cash†flooding out of China and into western assets. The first big blow to that system came with the banking crisis of 2008, which made plain that the US could no longer afford to continue as the world’s backstop consumer. The latest dent has been made over the past couple of weeks in China. Because the debacle in Asia’s number one economy has blown a hole in a string of hitherto long-held beliefs. Continue reading...

|

by Katie Allen on (#K3PS)

Europe follows Wall Street and Asia in sell-offs amid worries over Chinese slowdown and looming US interest rate riseGlobal stock markets staged a dramatic start to September as rising worries about China’s economic slowdown sparked fresh sell-offs in Asia, Europe and on Wall Street.After suffering their worst month in three years in August, US shares tumbled after Tuesday’s opening bell. At close, the Dow Jones industrial average had dropped 469 points, or 2.8%, to 16,058 and the Standard & Poor’s 500 index fell 58 points, or 3%, to 1,913. News that US manufacturing activity slowed in August added to pressure on share prices.

|

|

by Katie Allen on (#K2YC)

Christine Lagarde thinks Asian economies could continue to lose momentum following recent turmoil on global marketsThe head of the International Monetary Fund has warned that global growth will be weaker than previously expected and that emerging economies should be alert to potential shockwaves from China’s slowdown.

|

|

by Katie Allen on (#K2S4)

Manufacturers reduce headcount for first time in two years amid fears the world’s second-largest economy is running out of steamBritain’s manufacturers cut their headcount for the first time in two years in August amid an uncertain outlook for exports, in the latest sign that China’s economic slowdown is being felt around the world.Global markets have been hit by a shares rout in China amid fears the world’s growth engine is running out of steam. Those worries were fanned overnight by news that the output of China’s factory sector slumped to a three-year low in August. Shares in Europe were sharply lower on Tuesday morning, extending losses made over August, the worst month in years for European stock markets. Continue reading...

|

|

by Vicky Pryce on (#K2R3)

Britain’s economy is likely to grow but so too will house prices and rents, prolonging the country’s crisis of unaffordable housingThe UK enjoyed the fastest economic growth in the developed world in 2014 at 3%. There are signs that lower levels of business investment is beginning to recover and the forecasts are for economic growth of around 2.5% this year and next. But this will be fuelled mainly by higher household spending. High employment levels, a combination of near-zero inflation and accelerating wage growth will help consumer confidence and the willingness to reduce savings and increase borrowings.At the same time the prospects for any significant expansion in affordable housing have been thrown into doubt by the announcement of the extension of the right to buy to housing association tenants. Since the decline of local authority housebuilding in the 1980s, the UK hasn’t seen building enough houses to keep pace with population growth. Continue reading...

|

by Martin Farrer and agencies on (#K2CP)

Shares and the Aussie dollar hit by more China woes as the Abbott government’s ‘jobs and growth’ slogan faces test with economic growth figuresThe Abbott government’s “jobs and growth†slogan will come under further scrutiny on Wednesday with economists predicting sluggish, and possibly negative, growth when the June quarter figures are released.Related: Stock markets hit by weak Chinese factory data - business liveRelated: Financial markets are not free – they're one of the last bastions of socialism Continue reading...

|

by Press Association on (#K29Q)

Rate of expansion edges higher for second consecutive month but impact of Asian crisis could spill over into domestic economy, employers’ group warnsUK growth picked up pace in the three months to August but the economy faces risks from the knock-on effect of turbulence in China, one of the UK’s leading independent employers’ organisations has said.A CBI survey of 754 firms showed the rate of expansion heading higher for the second successive month with expectations for the next three months also buoyant. It said the gap between firms reporting higher output volumes and those saying they were lower was at a positive balance of 31%, up from 20% in the three months to July and the best rate since May. The balance of firms expecting growth in the next three months was unchanged from July at 27%. Continue reading...

|

by Dana Nuccitelli on (#JZ9M)

A report from America’s 3rd-largest bank asks why we’re not transitioning to a low-carbon economy

by Phillip Inman Economics correspondent on (#JX7R)

The Bank of England governor believes the UK economy is well insulated from global shocks, but his forecasts could easily go awryForget the financial turmoil in China and around the world. When it comes to the UK, Mark Carney would have us believe he remains in charge.The Bank of England governor gave a robust defence on Saturday of his position as the UK’s most influential policymaker. That means base interest rates are still going up, perhaps in February or thereabouts, and will be on course to touch 2% by 2018. Continue reading...

|

by Katie Allen on (#JTVG)

As jittery investors brace for more shockwaves after last week’s rout on world markets, we look at the impact, from property to petrol pricesThis was supposed to be the year when normality returned to the global economic landscape. Growth was looking more established and the legacy of the financial crisis was dimming. The US central bank and the Bank of England looked poised to affirm the recovery by finally starting to raise interest rates after keeping them for years at emergency levels. Even the eurozone, having come close to unravelling once again, by this month appeared to have put the latest Greek crisis behind it.All that changed on China’s “Black Monday†last week, when the stock market sell-off that had been rumbling along for weeks turned into a rout. A near 9% fall in the main Shanghai Composite index, its biggest one-day drop since 2007, reverberated around global markets, sending other bourses from Sydney to Wall Street tumbling. In London, dramatic moves on the FTSE 100 were reminiscent of the worst days of the last crash. Continue reading...

|

|

by Guardian Staff on (#JWDT)

Alarming data from China was met with a soothing hint about monetary policy. But treasuries cannot keep pumping cheap credit into a series of asset bubblesLike children clinging to their parents, stock market traders turned to their central banks last week as they sought protection from the frightening economic figures coming out of China. Surely, they asked, the central banks would ward off the approaching bogeymen, as they had so many times since the 2008 crash.The US Federal Reserve came up with the goods. William Dudley, president of the bank’s New York branch, hinted that the interest rate rise many had expected next month was likely to be delayed. Continue reading...

|

|

by Katie Allen on (#JWDW)

More than half of Britain’s graduates are in non-graduate jobs. Apprentice pay is pitifully low. The outlook is becoming truly dishearteningAs the soggy end of summer makes way for autumn and a new academic year, it is traditionally a time for fresh starts and new hopes. Except with rising student debts and pitiful pay for apprentices, September has become a time for brave leaps in the dark.When this year’s cohort of young adults embark on their studies, many will carry with them stories of older friends and siblings, long since graduated but still searching for decent work. Anecdotal evidence of graduates working in bars and as receptionists is well-known. Now it has been backed up by a damning report on the state of Britain’s jobs market. Researchers found that due to a mismatch between the number of university leavers and the jobs appropriate to their skills, more than half of the UK’s graduates are in non-graduate jobs. This is one of the highest rates in Europe. Continue reading...

|

|

by Press Association on (#JVG6)

Bank of England governor tells meeting of central bank bosses in Jackson Hole, Wyoming, that direct exposure of economy to China is relatively modestChina’s economic problems are unlikely to derail plans to raise interest rates in the UK, Bank of England governor Mark Carney has claimed. The Chinese slowdown rattled investor confidence this week, prompting expectations rate increases might be taken off the agenda in both the US and UK, where the cost of borrowing has remained at 0.5% for more than six years.But speaking at an annual get-together of central bank bosses in Jackson Hole, Wyoming, Carney said the current concerns over China were outweighed by the “ongoing domestic strength†of the UK market, credible policy and an “increasingly robust financial systemâ€. “The direct exposure of the UK economy to China is relatively modest,†he told delegates. “Developments in China are unlikely to change the process of rate increases.â€Related: UK interest rates on hold until autumn 2016, City predicts Continue reading...

|

|

by Jamie Doward on (#JV96)

Icelandic study finds link between financial crisis and lower than average birth weightsEconomic woes can be as damaging to a baby’s health as smoking or drinking during pregnancy, according to the first study to establish a causal link between foetal exposure to financial stress in an advanced economy and the health of babies at birth.Research presented at this month’s annual congress of the European Economic Association in Mannheim by Arna Vardardottir, assistant professor at the department of economics at Copenhagen Business School, tracks the unexpected collapse of Iceland’s economy in 2008.The scale of Iceland's collapse, its speed and the fact that it had not been foreseen meant its impact was acute Continue reading...

|

|

by Associated Press in Washington on (#JV6M)

‘The door is definitely open’ to a September rate increase, a senior economist said in response to Stanley Fischer saying factors that kept inflation down are fadingFederal Reserve vice-chairman Stanley Fischer left the door open Saturday for a Fed rate increase in September, saying the factors that have kept inflation below the central bank’s target level have likely begun to fade.Fischer said there’s “good reason to believe that inflation will move higher as the forces holding down inflation dissipate furtherâ€. He said, for example, that some effects of a stronger dollar and a plunge in oil prices – key factors in holding down inflation – have already started to diminish. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#JRR1)

Global investors and the bankers at Jackson Hole might not want to admit it, but China is no longer a powerhouse for global growthThe China slowdown is real and central banks pumping up stock markets with cash and confidence is not going to reverse that situation.At some point, investors from Shanghai to New York, via London, will need to recognise that China is no longer a powerhouse for global growth.Related: How China's economic slowdown could weigh on the rest of the world Continue reading...

|

|

by Jennifer Rankin (earlier) and Katie Allen (now) on (#JPRW)

|

|

by Associated Press in Athens on (#JQG8)

Interim cabinet led by former supreme court chief Vassiliki Thanou will govern until early elections next month, the third time Greeks go to the polls this yearGreece’s new caretaker government was sworn in on Friday as the country prepares early elections next month, the third time Greeks will go to the polls this year.Vassiliki Thanou, a top judge and the country’s first female prime minister, will lead the country until the election, which is expected to take place on 20 September. Continue reading...

|

|

by Katie Allen on (#JQB8)

ONS data shows net trade made its biggest contribution to growth in four years, as 0.7% increase in GDP is confirmedExports and business investment helped the UK economy expand in the second quarter, according to official figures that confirmed a pickup in growth after a sluggish start to the year.The Office for National Statistics said GDP rose 0.7% in the three months to the end of June, unchanged from an estimate made a month ago but a marked acceleration on 0.4% in the first quarter. Further details from the ONS on Friday showed that net trade made its biggest contribution to growth for four years. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#JP0P)

Markets worldwide enjoy better fortunes as Chinese government buys shares to prop up prices and US Federal Reserve suggests it may defer interest rate rise

|

|

by Press Association on (#JNWY)

Business and professional services firms report best ever quarter by value, while those in consumer services report best since May 2014The best performance in 17 years from companies in areas such as accountancy, law and marketing have helped Britain’s dominant services sector bounce back after a weak start to the year, according to the CBI.Business and professional services companies reported their best ever period by value in the three months to August, according to CBI data that goes back to 1998. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#JKS6)

Finance minister hails ‘collaborative’ agreement that sees some of country’s debt written off in exchange for higher interest on outstanding loan

|

|

by Shane Hickey, Graeme Wearden, Rupert Neate, Domini on (#JMZT)

London index climbs 3.5% with Dow up 1.9% and China posts biggest one-day jump since 9 July as stocks rise across AsiaThe FTSE 100 has clawed back almost all its losses this week after it closed 3.5% higher on Thursday following a surge in stocks in China and the US.The London index rose by 212 points to 6,192 – only 14 points shy of its closing level on Friday. The FTSE tracked a rally in New York led by the Dow Jones industrial average which was 305 points or 1.9% higher as the FTSE closed, ending a six-day sell-off sparked by global concerns about the health of the Chinese economy. Germany’s Dax closed 3.2% higher at 10,315.Related: US stock markets surge to end six days of sell-offs Continue reading...

|

|

by Larry Elliott on (#JMZW)

From QE to rate rise delays to Beijing’s stock market interventions, the world’s policymakers have done everything possible to boost asset prices

|

|

by Larry Elliott on (#JMY3)

Agreement gives most troubled economy in Europe some breathing space without solving its problemsThe debt deal Ukraine has painstakingly negotiated with its creditors is welcome and preferable to the alternative: a default that would have put additional pressure on the country’s shaky banks and led to both capital flight and a protracted battle in the courts. But amid all the backslapping a bit of perspective is needed.Related: Ukraine agrees 'win-win' debt restructuring deal Continue reading...

|

by Presented by Tom Clark and produced by Phil Maynar on (#JMKX)

Larry Elliott, Rowena Mason, Seumas Milne and Meg Russell discuss China's financial slump, Jeremy Corbyn's economics and the new peers heading for the House of Lords Continue reading...

|

by Dominic Rushe in New York on (#JMA0)

Economy grew at a 3.7% rate in second quarter to beat forecasts and raise expectations for another bounce-back after days of market turmoilThe US economy picked up pace in the second quarter and beat economists’ estimates as businesses ramped up investment, helping fuel a second-day bounce-back for Wall Street’s battered financial markets.Gross domestic product (GDP), the broadest measure of goods and services produced across the economy, expanded at a 3.7% seasonally adjusted annual rate in the second quarter of 2015, the Commerce Department said on Thursday, up from the initial estimate of 2.3% growth. Economists had forecast a 3.3% rate. Continue reading...

|

by Greg Jericho on (#JJT3)

The impact of the Chinese stock market on Australia will not be great, but its slowing economy and demand for goods will continue to be a drag on our growth

by Sam Thielman in New York, Graeme Wearden in London on (#JF3J)

by Lisa Bachelor and Patrick Collinson on (#JHMS)

Global stock market turmoil and fears about China raises the prospect of historically low borrowing costs staying in place for longer than expectedThe first rise in UK interest rates could be delayed until autumn 2016, according to City expectations, as market turmoil in China raises the prospect of historically low borrowing costs staying in place for longer than expected.

by Larry Elliott on (#JHJX)

The latest turbulence in global markets and fear of doing anything that might send the economy back into recession will stay the Fed’s already wary handCentral bankers have their own lingo. They tend to speak in tortured prose that obscures more than it illuminates. Given the choice, they favour a gnomic utterance over plain speaking.Bill Dudley, the president of the New York Federal Reserve and the second most important US central banker after Janet Yellen, has just provided a masterclass in central bank-speak. Asked what the latest turbulence in the financial markets meant, Dudley replied that recent economic data had been “pretty positiveâ€. Continue reading...

by Tom McCarthy in New York on (#JGXX)

The Trump campaign has not issued an economic policy paper, but from what experts can tell, his flawed proposals could threaten a trade war with ChinaRepublican presidential candidate Donald Trump accused China on Tuesday of “one of the greatest thefts in the history of the world†and said he could fix the problem by drawing on the negotiating skills laid out in his 1987 bestseller The Art of the Deal.“I do great with the Chinese,†Trump told an audience at a campaign rally in Dubuque, Iowa. “And they’re great people. The problem is their leaders are too smart for our leaders. Continue reading...