|

by Agence France-Presse on (#1DW4J)

Investment is set to double in the next five years as wealthy rush to get their money into overseas assets, especially housesChinese nationals have become the largest foreign buyers of US property after pouring billions into the market in search of safe offshore assets, according to a study.

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-08 01:00 |

|

by Katie Allen on (#1DVR3)

Gloomy global outlook prompts church to offload £250m of equities even as it outperforms the marketThe Church of England has said it fears a looming global economic slowdown with governments relatively powerless to shore up growth, as it revealed a decision to offload a portion of its substantial stock market holdings.The church commissioners, who manage the C of E’s £7bn investment fund, said they enjoyed market-beating returns of 8.2% last year but warned they would struggle to keep up that pace in future. Over the past 30 years the fund’s average annual return has been 9.7%. Continue reading...

|

|

by Katie Allen on (#1DVR1)

HR industry group forecasts average pay to increase just 1.7% with retail sector warning shoppers are dwindling and EU referendum denting confidenceWorkers are being warned to expect meagre wage rises until at least 2020, as weak productivity and new costs such as the national living wage curb employers’ readiness to raise salaries.Even though employment is expected to rise, pay growth is forecast to be just 1.7% over the next year, as an ample supply of labour helps employers hold back on wage rises in a “jobs-rich, pay-poor†economy, said the Chartered Institute for Personnel and Development (CIPD). Continue reading...

|

|

by Terry Macalister Energy editor on (#1DTQZ)

Insiders say oil firm’s New Energies renewables arm could grow very big, but not for a decade or moreShell, Europe’s largest oil company, has established a separate division, New Energies, to invest in renewable and low-carbon power.The move emerged days after experts at Chatham House warned international oil companies they must transform their business or face a “short, brutal†end within 10 years.Related: Oil firms have 10 years to change strategy or face 'short, brutish end' Continue reading...

|

|

by Guardian Staff on (#1DT6A)

Bank of England governor Mark Carney speaks on BBC1’s Andrew Marr Show on Sunday, defending his previous warning that leaving the EU could lead to recession. He says the last financial crisis taught us that an independent institution should have responsibility for stability, adding that it was his job to be ‘straight with people’. Earlier in the programme, energy minister Andrea Leadsom accused Carney of ‘dangerous intervention’

|

|

by Rowena Mason Political correspondent on (#1DT1V)

Bank’s governor has destabilised financial markets by warning on possible short-term effects of leaving EU, says Andrea LeadsomThe Bank of England’s warning that leaving the EU could lead to a recession is an “incredibly dangerous intervention†that has increased financial instability, a Tory minister campaigning for Brexit has said.

|

|

by Guardian Staff on (#1DSVP)

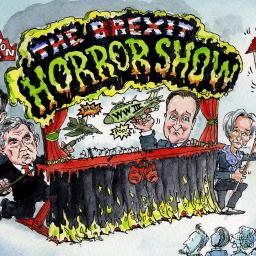

There are very good reasons to be wary of leaving the EU. But what if we stay and the union breaks up?They say that it pays to have friends in high places. As they battle to keep Britain in the EU, David Cameron and George Osborne have been spoilt for ammunition over recent days. Dire warnings on the consequences of Brexit came through thick and fast and, naturally, the Remain camp seized on every one.The Bank of England raised the threat of recession and soaring inflation, the International Monetary Fund warned of tumbling house prices and Gordon Brown formed a rare alliance with Cameron over the prospect of the third world war. Continue reading...

|

|

by William Keegan on (#1DSMW)

A vintage performance by the former PM on the EU referendum was in marked contrast to that of his buffoonish rivalExtraordinary, is it not? The political, financial and media worlds are obsessed by a referendum we could do without, called to sort out problems of Conservative party management that will almost certainly not be resolved, and masterminded by a prime minister who is desperately dependent on the support of the Labour party to avoid humiliation.On a typical day last week we had the menacingly mendacious Alexander (Boris) Johnson being taken far more seriously than he should – what do you make of a man who tells his close friends we must stay in the European Union and then, for nakedly ambitious reasons, goes back on his word? Continue reading...

|

|

by Phillip Inman on (#1DKN4)

Christine Lagarde backs Bank of England governor’s claim that Britain could enter recession after vote to leave EUA vote to leave the EU next month could precipitate a stock market crash and steep fall in house prices, the International Monetary Fund has warned.Christine Lagarde, the IMF managing director, also backed warnings from the Bank of England governor Mark Carney that Britain could fall into recession following a Brexit vote.Related: IMF: Brexit would send shockwaves through UK economy - business liveRelated: EU referendum: barrage of grim forecasts takes aim at our homes Continue reading...

|

|

by Joseph Stiglitz on (#1DMAJ)

Today’s markets are characterised by the persistence of high monopoly profitsFor 200 years, there have been two schools of thought about what determines the distribution of income – and how the economy functions. One, emanating from Adam Smith and 19th-century liberal economists, focuses on competitive markets. The other, cognisant of how Smith’s brand of liberalism leads to rapid concentration of wealth and income, takes as its starting point unfettered markets’ tendency toward monopoly. It is important to understand both, because our views about government policies and existing inequalities are shaped by which of the two schools of thought one believes provides a better description of reality.For the 19th-century liberals and their latter-day acolytes, because markets are competitive, individuals’ returns are related to their social contributions – their “marginal productâ€, in the language of economists. Capitalists are rewarded for saving rather than consuming – for their abstinence, in the words of Nassau Senior, one of my predecessors in the Drummond Professorship of Political Economy at Oxford. Differences in income were then related to their ownership of “assets†– human and financial capital. Scholars of inequality thus focused on the determinants of the distribution of assets, including how they are passed on across generations.Related: Has the global economic growth malaise become the 'new normal'? Continue reading...

|

|

by Larry Elliott on (#1DKS0)

Osborne, Carney and Lagarde are like wartime generals, with a relentless salvo of bad news for Brexiteers. It isn’t working. Targeting house prices might do the trickDifferent location, same story. On Thursday, it was Mark Carney sitting in Threadneedle Street issuing a warning from the Bank of England about the perils of Brexit. Less than 24 hours later it was Christine Lagarde, the managing director of the International Monetary Fund, delivering the same message.The approach being taken by the government to the referendum appears similar to tactics adopted by the British high command on the western front during the first world war: soften up the enemy with a constant and ferocious pounding.Related: IMF: Brexit would send shockwaves through UK economy - business live Continue reading...

|

|

by Katie Allen on (#1DKS2)

ONS says output fell 3.6% in March from previous month, fuelling fears that EU vote uncertainty is hampering economyBritain’s construction sector suffered a sharp slowdown in the opening months of this year, adding to signs the economy is losing momentum as uncertainty around the EU referendum and the global outlook increases.The Office for National Statistics said construction output – which accounts for about 6% of the economy – fell 3.6% on the month in March. It was the biggest drop for more than four years.3.6% fall in construction in March, with both new work and repair & maintenance both falling by 3.6% https://t.co/voiTrqNdBc1.1% fall in construction in Q1, slightly bigger than the 0.9% fall estimated in preliminary #GDP https://t.co/voiTrqNdBc Continue reading...

|

|

by Larry Elliott Economics editor on (#1DG5B)

Chancellor will milk the Bank of England’s dire forecasts but the poor picture painted is as much due to UK structural weakness as EU referendum fearsBritain will make up its mind whether it wants to remain in the European Union in six weeks time, so it was inevitable that the last Bank of England inflation report before 23 June was dominated by the referendum.

|

|

by Larry Elliott on (#1DHE7)

Steel dumping by Beijing has led to anti-Chinese sentiment among EU states, resulting in huge vote against giving country market economy statusThe timing of the steel crisis could hardly have been worse for China. Beijing is desperate to be granted market economy status within the World Trade Organisation but is running into stiff opposition from both the US and Europe.With Chinese steel being dumped on global markets, the European parliament on Thursday voted against the idea that China should be treated the same as the EU or the US by a thumping margin. The decision puts pressure on the European commission to either oppose market economic status outright or include safeguards for specific industries.Related: UK steel boost as MEPs oppose giving China market economy status Continue reading...

|

|

by Katie Allen on (#1DFZ4)

Central bank issues unprecedented warning over EU vote, claiming exit could depress pound and raise unemployment

|

|

by Graeme Wearden on (#1DFAT)

Governor Mark Carney tells press conference that there would be a ‘material impact’ on growth if Britain votes to leave the EU

|

|

by Phillip Inman Economics correspondent on (#1DGF9)

Michel Sapin says remaining member states would be reluctant to allow Britain’s departure to jeopardise the economyEuropean countries would counter the economic shock of a British vote to leave the EU by accelerating plans for closer integration, the French finance minister has said.Michel Sapin said Europe was undergoing a recovery after eight years of almost zero growth and would be reluctant to allow a “shock to the European economy†to jeopardise it.Related: Brexit could lead to recession, says Bank of EnglandRelated: David Cameron opens London summit describing corruption as 'a cancer' – live Continue reading...

|

|

by Peter Bradshaw on (#1DG74)

The Jodie Foster-directed satire about the financial meltdown isn’t especially original, but it’s arguably more honest than Oscar favourite The Big ShortA miasma of pure silliness settles on this movie directed by Jodie Foster, showing here in Cannes out of competition; it deserves a genre of its own: screwball action. Julia Roberts plays a harassed TV producer who has to keep in line her waning star: Lee Gates, played by George Clooney, the ego-crazed, silver-fox presenter of a TV show called Money Monster, giving stock picks and spurious shock-jock-type commentary on the market, celebrating unfettered capitalism by breaking into embarrassingly geriatric hip-hop moves with backing dancers. (He reportedly bears a certain resemblance to a real-life pundit: Jim Cramer, presenter of a programme called Mad Money, on CNBC.)Related: Café Society review – Woody Allen's amiable, if insubstantial, tribute to golden-age Hollywood Continue reading...

|

|

by Graeme Wearden (until 12.15) and Nick Fletcher on (#1DB7C)

The crisis in Britain’s steel industry has helped to drive manufacturing output down by 1.9% in the last year

|

|

by Phillip Inman Economics correspondent on (#1DBKQ)

Factory output was down in two consecutive quarters as the steel crisis helped drag down the sector’s overall outputGovernment hopes of rebalancing the UK’s service-sector-dominated economy have been dealt a blow with the latest official data showing industry slipping into its third downturn within a decade.A slight pickup in activity in March was not enough to offset sharp falls in output earlier in 2016 and meant production dropped for the second successive quarter – the definition of a recession.Related: UK factory output suffers biggest fall since 2013 - business live Continue reading...

|

|

by Severin Carrell Scotland editor on (#1DCC3)

Nicola Sturgeon will split finance secretary job in two to create economy secretary to tackle poor productivity and job creationNicola Sturgeon is to create a new cabinet post to focus on Scotland’s struggling economy following a slump in job creation and amid faltering productivity.The first minister, who retained power after the Scottish National party’s emphatic victory in the Holyrood election last week, will split the post of finance secretary into two separate roles in a cabinet reshuffle next week. Continue reading...

|

|

by Sir Keith Burnett on (#1DCA8)

Even if the global economy produces all you need, it will not give you a pay packet to buy things with, argues Sir Keith BurnettIt’s time to tell it like it is. Immigrants aren’t taking your job. Free market ideologues took it years ago. Why have we lost so many of the higher paying jobs that factories gave? Is it the price we have to pay for believing in democracy and capitalism? Is it because we are in the EU?No, it’s because we have been led by a misguided capitalist sect that treat free markets as a gift of God, rather than a tool for human beings. So let’s think about how things have gone wrong, as illustrated by the latest manufacturing figures.Related: UK industry falls back into recessionRelated: CBI calls on government to back manufacturing sector strategy Continue reading...

|

|

by Larry Elliott Economics editor on (#1DC6J)

Research blames 2008 recession for lower real salaries rather than rise in foreign workers, adding they paid more into UK economy than they took outThe rapid increase in migration from other EU countries has not had an adverse impact on the wages and job prospects of UK-born workers, according to research by the London School of Economics.The study found areas of Britain that have seen the biggest rises in workers from the rest of Europe have not suffered sharper falls in pay or seen a bigger reduction in job opportunities than other parts of the country.Related: Brexit ‘unlikely to mean deep migration cuts but may lead to 2p tax increase’ Continue reading...

|

|

by Angela Monaghan on (#1DBMF)

Proportion finding it hard to get by has fallen while more are satisfied with their income, says Office for National StatisticsFinancial pressure on Britain’s young people has eased slightly since the depths of the financial crisis, according to the Office for National Statistics.The proportion of people aged 16-24 finding it difficult or very difficult to get by fell to 8% in 2013-14, from 15% in 2009-10, the ONS said. Over the same period, young people’s satisfaction with their household income increased to 56% from 51%.Related: Young people are right to be angry about their financial insecurity Continue reading...

|

|

by Larry Elliott Economics editor on (#1D89V)

Gap between exports and imports in the first three months of 2016 widened by £0.7bn to nearly £24bnBritain’s trade deficit with other European Union countries is running at a record high level ahead of the referendum next month, official figures show.The latest healthcheck from the Office for National Statistics on goods coming in and going out of the UK reveal that the gap between exports and imports in the first three months of 2016 widened by £0.7bn to £23.9bn.Related: Business support for EU membership has fallen in run-up to voteRelated: EU referendum: top economic thinktank warns of post-Brexit shocks Continue reading...

|

|

by Alan Travis Home affairs editor on (#1D8HQ)

Economist Jonathan Portes says Brexit is likely to cut net migration to UK by only 100,000 but reduction will cause financial harmIt will be “extremely difficult†to deliver deep cuts in immigration if Britain leaves the European Union, a leading British economist has warned.If cuts of 50% were achieved, the long-term consequences would lead to a 2p increase in income tax, according to Jonathan Portes, a former chief economist at the Cabinet Office.Related: EU referendum: top economic thinktank warns of post-Brexit shocks Continue reading...

|

|

by Graeme Wearden (until 2pm) and Nick Fletcher on (#1D812)

Athens and its creditors have until 24 May to reach a deal to unlock bailout funds and start debt relief

|

|

by Phillip Inman and Angela Monaghan on (#1D963)

NIESR forecasts sterling to plunge 20% with prices to soar, pay and growth to fall steadily but immigration unlikely to be cut sharplyThe pound would plunge 20% immediately after a Brexit vote in June, according to a leading economic thinktank.The National Institute of Economic and Social Research (NIESR) has also forecast that prices will soar and Britain’s growth rate will be 1% lower next year if there is a vote to leave the EU.Related: Brexit 'unlikely to mean deep migration cuts but may lead to 2p tax increase'Related: Business support for EU membership has fallen in run-up to vote Continue reading...

|

|

by Helena Smith in Athens on (#1D7TH)

Greece faces its toughest austerity measures yet, with €5.4bn of budget cuts backed by the leftist government of Alexis TsiprasIn his tiny shop in downtown Athens, Kostis Nakos sits behind a wooden counter hunched over his German calculator. The 71-year-old might have retired had he been able to make ends meets but that is now simply impossible. “All day I’ve been sitting here doing the maths,†he sighs, surrounded by the undergarments and socks he has sold for the past four decades.“My income tax has just gone up to 29%, my social security payments have gone up 20%, my pension has been cut by 50 euros; they are taxing coffee, fuel, the internet, tavernas, ferries, everything they can, and then there’s Enfia [the country’s much-loathed property levy]. Now that makes me mad. They said they would take that away!â€Related: Greek MPs approve toughest austerity measures yet amid riotingRelated: What do Greeks think of the latest austerity measures?Related: The choice for Europe: rescue Greece or create a failed state | Paul Mason Continue reading...

|

|

by Katie Allen on (#1D7AC)

Cold weather and more cautious shoppers dent sales as spending further shifts from goods to experiences, says the British Retail ConsortiumBritish retailers suffered the sharpest drop in sales for eight months in April as more cautious shoppers reined in spending and cold weather affected sales of spring and summer clothing, industry figures show.The British Retail Consortium (BRC) said like-for-like sales fell 0.9% in April on a year earlier, the biggest drop since last August. The weak April performance compounded pressure on retailers after a sales drop of 0.7% in March.Related: Inflation rate three times higher for millennials than for pensioners Continue reading...

|

|

by Graeme Wearden on (#1D5QN)

Eurozone ministers have agreed to aim for a deal on Greece’s bailout, and a debt relief plan, by 24 May

|

|

by Jennifer Rankin on (#1D6XF)

Measures such as tweaking repayment terms over the next three years are being considered, but a write-off is off the tableEurozone finance ministers have promised to examine how to ease Greece’s colossal debt burden, with writing off bad loans remaining off the table.

|

|

by Larry Elliott on (#1D6CF)

The Greek debt pile is larger than ever – and the solution seemingly ever more remoteIt’s that time of year again. Greece is running out of money. There are violent protests in Athens. Eurozone finance ministers are gathering in Brussels in an “emergency†conclave to decide what to do next.The International Monetary Fund has already made it clear what it thinks should happen. It says Europe should cut Greece some slack by easing the terms of its bailout agreement and offering a solid dose of debt relief.Related: Greek crisis: no deal on debt relief expected today - live updates Continue reading...

|

by Roy Greenslade on (#1D6AQ)

As the EU referendum looms, a discussion on the reporting of the financial crisisAfter the financial crisis, governments in the UK and elsewhere in Europe adopted austerity policies to reduce public sector deficits.

|

by Katie Allen on (#1D690)

Policies to integrate migrants into labour market will help counter effects of ageing population, organisation saysThe International Monetary Fund has urged Germany to do more to help find work for the hundreds of thousands of refugees in the country, saying such moves would help counter the effects of an ageing population.Related: Germany unveils integration law for refugees Continue reading...

|

|

by Graeme Wearden on (#1D57F)

Crunch meeting will consider Greece’s bailout progress today after MPs approved a €5bn package of austerity reforms

|

|

by Katie Allen on (#1D5PB)

Rate was 0.9% for under-30s in March but was just 0.3% for over-65s, says a report into financial pressures on young adultsYoung adults in the UK are facing inflation rates three times higher than those for pensioners, according to a new analysis that highlights the pressures of the cost of living on millennials.The widening generational inflation gap is being driven by under-30s spending proportionally more on things that are getting more expensive, such as education, dining out, rent and household bills, according to Fidelity International. At the same time, those in the demographic spend less of their budget on groceries compared with older generations, so they have not enjoyed the same boost from falling food prices.Related: 'I’d rather chill in and relax': why millennials don't go clubbing Continue reading...

|

|

by Gareth Hutchens on (#1D5QP)

Central bank officials see problems arising from ‘leverage speculation’, a document released under freedom of information showsReserve Bank officials have become unwitting players in the 2016 federal election after a freedom of information request revealed that they believe any policy which discourages negative gearing may be good for Australia’s financial stability.The revelation contradicts the dire warnings of the Turnbull government that any changes to negative gearing would destroy confidence in the economy and send house prices plummeting.Related: How negative gearing replaced the great Australian dream and distorted the economy | Greg Jericho Continue reading...

|

|

by Gareth Hutchens on (#1D54C)

Central bank officials see problems arising from ‘leverage speculation’, a document released under freedom of information showsReserve Bank officials have become unwitting players in the 2016 federal election after a freedom of information request revealed that they believe any policy which discourages negative gearing may be good for Australia’s financial stability.The revelation contradicts the dire warnings of the Turnbull government that any changes to negative gearing would destroy confidence in the economy and send house prices plummeting.Related: How negative gearing replaced the great Australian dream and distorted the economy | Greg Jericho Continue reading...

|

|

by Helena Smith on (#1D479)

Crucial meeting of eurozone finance ministers will be held on Monday amid backdrop of violence in Athens over cuts worth €5.4bnGreece’s leftist-led coalition will turn to the lightning rod issue of debt relief on Monday at a crucial meeting of eurozone finance ministers following the late-night approval in Athens of laws overhauling the country’s tax and pension system.Amid violence on the streets and a three-day general strike that had brought much of the country to a halt, the embattled government pushed the legislation through parliament with the backing of its 153 MPS. Addressing the 300-seat House, prime minister Alexis Tsipras said: “We are determined to make Greece stand on its two feet at any cost.â€Related: Europe's liberal illusions shatter as Greek tragedy plays on Continue reading...

|

|

by Agence France-Presse on (#1D5QQ)

Former Saudi Aramco chairman vows to strengthen kingdom’s position as ‘the world’s most reliable supplier of energy’The new energy minister of Saudi Arabia, the world’s biggest oil exporter, on Sunday pledged continuity in the kingdom’s oil policy, after being named in a major government overhaul.“Saudi Arabia will maintain its stable petroleum policies,†Khalid al-Falih said a day after King Salman appointed him to replace longtime former oil minister Ali al-Naimi.Related: Saudi Aramco – the $10tn mystery at the heart of the Gulf state Continue reading...

|

|

by Agence France-Presse on (#1D3K3)

Former Saudi Aramco chairman vows to strengthen kingdom’s position as ‘the world’s most reliable supplier of energy’The new energy minister of Saudi Arabia, the world’s biggest oil exporter, on Sunday pledged continuity in the kingdom’s oil policy, after being named in a major government overhaul.“Saudi Arabia will maintain its stable petroleum policies,†Khalid al-Falih said a day after King Salman appointed him to replace longtime former oil minister Ali al-Naimi.Related: Saudi Aramco – the $10tn mystery at the heart of the Gulf state Continue reading...

|

|

by Katie Allen on (#1D5QR)

A recent run of bad news on the economy may have chipped away at Mark Carney and other policymakers’ certainty on the path for interest ratesThe Bank of England’s interest rate setters meet against a gloomy economic backdrop this week that could prompt at least one policymaker to push for a cut in borrowing costs to shore up stalling growth.

|

|

by Katie Allen on (#1D3GE)

A recent run of bad news on the economy may have chipped away at Mark Carney and other policymakers’ certainty on the path for interest ratesThe Bank of England’s interest rate setters meet against a gloomy economic backdrop this week that could prompt at least one policymaker to push for a cut in borrowing costs to shore up stalling growth.

|

|

by Larry Elliott on (#1D5QS)

Millions of Americans think they have been left behind in the recovery and the billionaire has managed to tap into this discontentThe experts said it could never happen. There was no way in which Donald Trump could win the Republican nomination for the US presidency. Could a billionaire who had never held office, was distrusted by the party hierarchy, lacked a political machine and seemed to take delight in upsetting large chunks of the electorate really survive the primaries and have a shot at the White House? Well, really.The smart money now says that Trump has no chance in a head-to-head presidential race with Hillary Clinton, who looks nailed-on as the candidate for the Democrats. Opinion polls suggest that Clinton would beat Trump by a margin of 10 percentage points were the election to be held now. Continue reading...

|

|

by Larry Elliott on (#1D3AB)

Millions of Americans think they have been left behind in the recovery and the billionaire has managed to tap into this discontentThe experts said it could never happen. There was no way in which Donald Trump could win the Republican nomination for the US presidency. Could a billionaire who had never held office, was distrusted by the party hierarchy, lacked a political machine and seemed to take delight in upsetting large chunks of the electorate really survive the primaries and have a shot at the White House? Well, really.The smart money now says that Trump has no chance in a head-to-head presidential race with Hillary Clinton, who looks nailed-on as the candidate for the Democrats. Opinion polls suggest that Clinton would beat Trump by a margin of 10 percentage points were the election to be held now. Continue reading...

|

|

by Phillip Inman on (#1D5QT)

A succession of windfalls from privatisations, pensions and bank fines have created an illusion of prosperity in the chancellor’s Britain. It can’t lastGeorge Osborne has a fairy godmother who, with a wave of her wand, showers money over much of the population. It hardly seems possible in this age of austerity, but it happens all the time and soothes the anger of many who might otherwise protest at the closure of local amenities and cuts to welfare budgets.This godmother comes in several guises, but essentially always does the same thing: she steals from the future to pay for things today. Continue reading...

|

|

by Phillip Inman on (#1D364)

A succession of windfalls from privatisations, pensions and bank fines have created an illusion of prosperity in the chancellor’s Britain. It can’t lastGeorge Osborne has a fairy godmother who, with a wave of her wand, showers money over much of the population. It hardly seems possible in this age of austerity, but it happens all the time and soothes the anger of many who might otherwise protest at the closure of local amenities and cuts to welfare budgets.This godmother comes in several guises, but essentially always does the same thing: she steals from the future to pay for things today. Continue reading...

|

|

by Guardian Staff on (#1D366)

The US economy is running at a sluggish pace, so there may be pressure for the Bank of England to lower interest rates even further this weekThe last time the Bank of England cut interest rates was in March 2009 and the decision was, in the modern idiom, a bit of a no-brainer. Official figures released later that month showed unemployment rising above two million for the first time since 1997, and the economy was in freefall.It was the nadir of the global slump and Threadneedle Street’s monetary policy committee had no hesitation in reducing the cost of borrowing to 0.5%, comfortably lower than it had ever been in the history of the Bank, which stretches all the way back to 1694. Continue reading...

|

|

by Jana Kasperkevic in New York on (#1D1FJ)

Obama has overseen a remarkable turnaround in the jobs market, but with layoffs reaching a seven-year high, many have subscribed to Trump’s narrative

|