|

by Reuters on (#1ATK4)

Fund’s steering committee calls for more forceful stimulus and warns monetary policy alone is not enoughThe International Monetary Fund’s steering committee has urged member countries to boost “growth-friendly†spending to help deal with slowing global growth.The IMF managing director, Christine Lagarde, said that calmer markets since February had reduced the stress level at the IMF and World Bank spring meetings, but the outlook was still fraught with downside risks from weak demand, a potential UK exit from the European Union and low oil and commodity prices.Related: The bad smell hovering over the global economy Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-04 03:45 |

|

by Larry Elliott on (#1AT10)

Attempts at economic stimulus have left a bad smell. Central banks are starting to think the unthinkable – helicopter moneyAll is calm. All is still. Share prices are going up. Oil prices are rising. China has stabilised. The eurozone is over the worst. After a panicky start to 2016, investors have decided that things aren’t so bad after all.Put your ear to the ground though, and it is possible to hear the blades whirring. Far away, preparations are being made for helicopter drops of money onto the global economy. With due honour to one of Humphrey Bogart’s many great lines from Casablanca: “Maybe not today, maybe not tomorrow but soon.â€Related: Helicopter money is closer than you think Continue reading...

|

|

by Rupert Neate in Washington, and Katie Allen in Lon on (#1AMRW)

Chancellor says that the cost of home loans is likely to rise if voters decide to leave EU in 23 June referendumGeorge Osborne has issued a stark warning that mortgage rates will rise if Britain leaves the European Union.The chancellor said he thought it was likely interest rates, and therefore the cost of home loans, would rise if Britons vote to leave the EU in the referendum on 23 June. But Brexit campaigners accused Osborne of panicking and resorting to intimidating voters.Related: Alistair Darling: Brexit would risk collapse of confidence in UK economyRelated: Bank of England stages Brexit dress rehearsal Continue reading...

|

|

by Graeme Wearden (until 12.30) and Nick Fletcher on (#1AJZB)

|

|

by Phillip Inman Economics correspondent on (#1AMWG)

Michael Saunders believes that even a referendum vote to quit the EU would not alter his view that interest rates are on an upward pathMichael Saunders has a reputation as a hawk, who in recent years believed the economy to be in rude health and in need of higher interest rates to suppress inflationary pressures.Last year he argued that the Bank of England’s outlook for growth and inflation was overly gloomy and interest rate rises would arrive sooner than the monetary policy committee (MPC) forecast. The year before he said much the same.Related: Bank of England appoints Michael Saunders to MPC Continue reading...

|

|

by Katie Allen on (#1AMMJ)

Citigroup economist will replace Martin Weale on the monetary policy committeeMichael Saunders, an economist at the investment bank Citigroup, has been appointed to the Bank of England’s interest rate setting committee.Saunders, a respected commentator on economics after more than 25 years at Citigroup, will replace Martin Weale whose term on the monetary policy committee (MPC) ends in August. Weale joined the nine-strong committee in 2010 having previously headed the National Institute of Economic and Social Research.Michael Saunders appointed as external member of Monetary Policy Committee@bankofengland https://t.co/y6pdT07D1W pic.twitter.com/FaVCTgwWRgPleased to appoint Michael Saunders to Bank’s MPC – an economist with a wealth of experience on UK + global economy https://t.co/5IElFQ1xiBBank of England welcomes the appointment of Michael Saunders to the Monetary Policy Committee https://t.co/aA8hl2nWvn Continue reading...

|

|

by Robert Skidelsky on (#1AM90)

Britain has much to fear from an acrimonious divorce, as it will inevitably be swept into its turbulent wakeThe European Union has never been very popular in Britain. It joined late, and its voters will be asked on 23 June whether they want to leave early. The referendum’s outcome will not be legally binding on the government; but it is inconceivable that Britain will stay if the public’s verdict is to quit.Over the years, the focus of the British debate about Europe has shifted. In the 1960s and 1970s, the question was whether Britain could afford not to join what was then the European Economic Community. The fear was that the UK would be shut out of the world’s fastest-growing market, and that its partnership with the US would be at risk as well: The western alliance would consist of two pillars, and Europe, not a shrunken Britain, would be one of them.Related: Will Obama’s Brexit intervention make a difference? | Simon Jenkins Continue reading...

|

|

by Katie Allen on (#1AKT5)

Private housebuilding rose to its highest level since records began in 2010Housebuilding in Britain picked up to a record high in February but the rest of the construction sector struggled amid signs that uncertainty over the EU referendum and public spending cuts are denting activity, according to official figures.The Office for National Statistics said private housebuilding rose 3.9% from January, the fastest growth for 10 months and taking it to the highest level since records began in 2010. Continue reading...

|

|

by Rupert Neate in Washington and Simon Bowers in Lon on (#1AHER)

George Osborne agrees to cooperate with France, Germany, Spain and Italy on exposing shell firms and overseas trusts

|

|

by Julia Kollewe on (#1AK62)

Begbies Traynor says number of firms in trouble rose by 20%, with concerns Brexit vote could tip companies over the edgeThe number of British manufacturers who are struggling financially has risen by 20%, with food and drinks companies hardest hit – despite the weak pound making UK exports cheaper abroad.Data from the insolvency firm Begbies Traynor showed that 21,061 UK manufacturers, many of which rely heavily on exporting, ended the first quarter of this year in a state of significant financial distress – 20% more than a year ago. Continue reading...

|

|

by Jill Treanor and Sean Farrell on (#1AHCG)

PwC report estimates 70,000-100,000 fewer jobs in 2020 compared with estimated number if Britain stays in EUUp to 100,000 financial services jobs could be lost if Britain votes to leave the European Union, according to a report compiled for a lobbying group that will stir debate about the short-term impact of Brexit.The report for TheCityUK by PricewaterhouseCoopers follows a warning from the accountancy firm in March that a British exit from the EU would cause a serious shock to the UK economy that could lead to 950,000 job losses.Related: Bank of England stages Brexit dress rehearsal Continue reading...

|

|

by Graeme Wearden (now), Julia Kollewe and Angela Mon on (#1AEVW)

Institute of Directors urge oil giant not to ignore its shareholders, after almost 60% reject its pay plans

|

|

by Rupert Neate in Washington and Katie Allen in Lond on (#1AH1H)

Christine Lagarde’s warnings of the impacts of Brexit are echoed by the World Bank head and the Bank of EnglandThe managing director of the International Monetary Fund has made an impassioned plea for Britain to stay in the EU, saying Brexit would spell the painful breakdown of a “long marriage†with grave risks for the global economy.Christine Lagarde said uncertainty created by the 23 June referendum was already dragging down the UK economy, and a decision to leave the bloc would make matters worse. Continue reading...

|

|

by Presented by Tom Clark with Juliette Garside, Holl on (#1AGDE)

Juliette Garside, Holly Watt and Aditya Chakrabortty join Tom Clark to discuss a rash of politicians publishing their tax returns. Plus: Guttorm Schjelderup explains how Norway’s system of tax openness works in practiceIn the tax year of 2014-2015, George Osborne’s family firm paid him a dividend of over £40,000 while his savings earned him just £3 of interest. Meanwhile, Jeremy Corbyn’s tax return was handed in late and he had to pay a £100 fine. All this has become public knowledge after a rush at the top of British politics for tax transparency following the leak of documents from the Panamanian law firm Mossack Fonsesca.Joining Tom Clark to discuss it are Juliette Garside, Holly Watt and Aditya Chakrabortty.

|

by Fred Pearce for Yale Environment 360, part of the on (#1AG6A)

Yale Environment 360: Surprising new statistics show that the world economy is expanding while global carbon emissions remain at the same level. Is it possible that the elusive ‘decoupling’ of emissions and economic growth could be happening?The statistic is startling. In the past two years, the global economy has grown by 6.5 percent, but carbon dioxide emissions from energy generation and transport have not grown at all, the International Energy Agency (IEA) reported last month. CO2 emissions in Europe, the United States, and — most stunningly — China have been falling. What is going on?

|

by Larry Elliott on (#1AG49)

In two months’ time the MPC may have to respond to a vote to leave the EU. First off, they would cut interest ratesIt is Tuesday 27 June, five days after Britain has voted to leave the European Union. The pound is falling on the foreign exchanges and share prices are tumbling. Deep inside Threadneedle Street, the nine members of the Bank of England’s monetary policy committee have gathered for an emergency meeting.The result of the referendum has come as a surprise, intensifying the market turmoil. Polls had suggested a tight race but the assumption had been that the don’t knows would eventually opt for the status quo. The pollsters were wrong.Related: Bank of England warns Brexit could do serious harm to UK economy Continue reading...

|

|

by John Redwood on (#1AG4B)

My budget shows that leaving the EU would transform this country’s finances – in particular the NHS, disability benefits and the property marketI want to end austerity. Voters want prosperity, not austerity. It’s a sobering thought that the reductions in planned spending made by the coalition and the current government are not as big as the total sums we have sent to the EU and not received back over the same time period. If we leave the EU we will regain control of our own money. We could increase existing budgets and end the upcoming reductions.The sums involved are set out clearly in the 2015 government account of our contributions and the sums we receive back. Our total contribution is £19.5bn, minus a £5bn rebate, thanks to Margaret Thatcher’s renegotiation. We received £4.5bn back in payments to farmers, universities and other grant recipients form the EU, leaving £10bn of contributions that are spent elsewhere on the continent.We should make £1.1bn available to avoid the cuts to disability benefitsRelated: What would Brexit mean for everyday life in the UK? Continue reading...

|

|

by Larry Elliott on (#1AFRR)

Office for National Statistics says rise previously reported did not reflect how family incomes had changed in cash termsThe political debate in the UK about living standards has been given a fresh twist by new figures from the Office for National Statistics showing a decline in household incomes last year.The ONS said that a previously announced 2.5% rise in real, inflation-adjusted incomes in 2015 - the biggest increase since 2001 - had been the result of estimates of the non-cash benefits households receive from being owner occupiers.Related: Soaring pensions lift UK living standards to pre-recession levels Continue reading...

|

|

by Katie Allen on (#1AFMT)

Interest rates kept at 0.5% as latest MPC minutes reveal significant concerns about effect on the economy of leaving the EUA vote to leave the EU could harm economic growth and have a serious impact on the pound and other UK assets, the Bank of England has said, as it took steps to prepare for June’s referendum.Minutes to the Bank’s latest policy meeting showed its nine-strong monetary policy committee voted unanimously to leave interest rates at their historic low of 0.5%. The committee said uncertainty ahead of what was expected to be a close EU vote appeared to be weighing on investment decisions, and policymakers said economic growth could slow as a result in the second quarter of the year. Continue reading...

|

|

by Angela Monaghan on (#1AFG3)

Consumer goods giant says growth is weakening across emerging markets and negative in EuropeUnilever has said it is operating in a fragile consumer environment with deflation weighing on its performance in Europe and slowing growth in emerging markets.The consumer goods company behind well-known brands such as Persil, Marmite and PG Tips, said sales in Europe fell by 0.6% in the first quarter as the impact of eurozone deflation and aggressive price discounting took its toll. Continue reading...

|

|

by Nicholas Watt Chief political correspondent on (#1AF65)

UK chancellor George Osborne to tell IMF that 10m people a year could die without radical actionAntimicrobial resistance to antibiotics will present a greater danger to humankind than cancer by the middle of the century unless world leaders agree international action to tackle the threat, according to George Osborne.The British chancellor will tell a panel of experts at an IMF meeting in Washington that 10 million people a year could die across the world by 2050 – more than the number of people lost to cancer every year – without radical action. Continue reading...

|

|

by Simona Foltyn on (#1AEQW)

From fruit stalls to petrol stations, war in the world’s youngest nation has caused businesses to falter, with dire repercussions for the populationOn a good day, people have to wait for hours to get fuel in Juba. Most of the time, however, petrol stations in South Sudan’s capital stand deserted amid a deepening currency crisis that has reduced imports to a trickle and sent prices through the roof.

|

by John Harris on (#1ACK8)

The idea of a universal basic income is about to leap from the margins to the mainstream, bringing promises of a happier and healthier population

|

by Graeme Wearden (until 1.00) and Nick Fletcher on (#1AAHG)

Better-than-expected trade figures from China sent stock markets soaring across Europe, the US and Asia

|

|

by Larry Elliott Economics editor on (#1ABNV)

Urgent action to sort out eurozone banks called for in financial stability report warning market turmoil may recurThe International Monetary Fund has highlighted risks of a new financial crisis, warning that global output could be cut by 4% over the next five years by a repeat of the market mayhem witnessed during the 2008-09 recession.The IMF used its half-yearly global financial stability report to call for urgent action on the problems of banks in the eurozone, a third of which it said faced “significant challenges†to be sustainably profitable.Related: IMF homes on the eurozone's weakest link: Italy Continue reading...

|

|

by Terry Macalister Energy editor on (#1AC39)

World’s biggest privately owned coal company was caught out by slump in prices but the fuel remains popular in AsiaThe collapse of the biggest privately owned coal company in the world is a significant event. But it is not the end of the coal era, however much those of us who value the planet might like to see that.Peabody Energy has been felled predominantly by a 75% slump in coal prices rather than tightening environmental regulation, though it will emerge out of bankruptcy protection to a world where coal will never again be king.Related: World's largest coal producer files for bankruptcy protection Continue reading...

|

|

by Phillip Inman on (#1ABPZ)

Bad loans in Italy account for more than a third of the €900bn total of non-performing loans on the books of eurozone banksWhen financial regulators say the European banking system is safe from another major crash they are talking about the funds banks can use to offset their losses.The 31 biggest banks hold an aggregate €1tn (£700bn) of shareholder funds, and account for about 75% of the European banking system by assets. Across all banks, it’s fair to say the total equity reaches €1.35tn.Related: IMF warns of fresh financial crisis Continue reading...

|

|

by Larry Elliott Economics editor on (#1AB5Q)

Organization for Economic Cooperation and Development says official development assistance rose nearly 7% to $131bn last yearA doubling of spending on refugees led to an increase in aid spending by the world’s richest countries in 2015, the Organisation for Economic Cooperation and Development has announced.The OECD’s annual update on development assistance showed that aid budgets totalled $131.6bn (£92bn) last year – a 6.9% increase on 2014.Related: Big aid donors failing to lift the lid on how they spend their cash Continue reading...

|

|

by John Crace on (#1A8JK)

Former foreign secretary shows his passion for Britain and the EU, despite having left them for New York at the first opportunity“This is my starting point,†David Miliband declared, 12 minutes into a speech on why Britain should remain in the EU. It was said without the hint of a smile. In some politicians, the deadpan is used for comedic effect. For Miliband, it is his default position. Reaching your starting point via several dozen extended parentheses is par for the course for the former foreign secretary.It still wasn’t entirely clear if this was Miliband’s actual starting point or just a pre-qualifying starting point, but the point he seemed to be trying to make was that the remain campaign had so far been soulless and prosaic, and he had come to inject some much-needed passion and patriotism into the cause. That he was best known as a rather dull technocrat, rather than a charismatic, conviction politician, seemed to have escaped him. As had the irony of a man who stropped off to New York when he lost the Labour leadership contest coming back to the UK to lecture the Brits on patriotism. Continue reading...

|

|

by Graeme Wearden (until 12.30) and Nick Fletcher on (#1A6E1)

|

|

by Katie Allen and Anushka Asthana on (#1A7FF)

Exit from EU ‘could do severe regional and global damage’ by disrupting trade relationships, says International Monetary FundA British vote to leave the EU risks causing severe economic and political damage to Europe and will spill over into to weaken an already febrile world economy, according to the International Monetary Fund.The IMF listed a potential Brexit vote in June’s EU referendum as a key risk in its latest World Economic Outlook (WEO) triggering an immediate political reaction in the UK with Brexit campaigners accused the international institution of talking Britain down.Related: From boom to doom – the IMF paints a vastly different picture from 2006Related: Brexit would be political arson, says David Miliband Continue reading...

|

|

by Sam Thielman in New York on (#1A7KC)

Money was spread across 171 transactions in 42 states, with New York City being the largest recipient, according to the National Committee on US-China RelationsChinese investment in the US has increased rapidly to more than $15bn, according to the National Committee on US-China Relations. The new record, set at the same time economic growth in China slowed to a 25-year low of 6.9%, is likely to be beaten again in 2016, according to the report.The $15bn was spread across a mere 171 transactions in 42 states, with New York City being by far the largest recipient – $5.2bn in Chinese investment came to the country’s largest city in 2015.Related: IMF cuts global forecasts; UK inflation hits 15-month high – business live Continue reading...

|

|

by Larry Elliott on (#1A7FD)

Ten years ago, the World Economic Outlook forecast good times for ever – now deep pessimism reigns, with a possible Brexit only the most immediate threatCast your mind back 10 years. It is April 2006 and finance ministers from around the world are gathering in Washington for the spring meeting of the International Monetary Fund. Gordon Brown is Britain’s chancellor of the exchequer. Alan Greenspan has just retired as the chairman of the Federal Reserve and is considered to be the greatest central banker who ever lived. The blossom is out and the mood is upbeat. The global economy is having its fastest burst of prolonged growth since the early 1970s.A lot has changed since. The venue is the same. The occasion is the same. But the atmosphere is completely different. Back in 2006, the IMF saw no reason why the boom could not go on for ever. Its flagship half-yearly World Economic Outlook expected activity to keep humming along. It saw no sub-prime crisis, no collapse of Lehman Brothers, no Great Recession.Related: IMF says Britain leaving the EU is a significant risk Continue reading...

|

|

by Phillip Inman on (#1A6TJ)

Air travel, hotels and restaurants pushed up cost of living up in MarchInflation jumped to 0.5% in the year to March after a rise in the cost of air fares over Easter and more expensive spring and summer clothing ranges hitting stores.The higher cost of booking a hotel and restaurant table also pushed inflation beyond the 0.3% seen in February, according to official figures.

|

|

by Katie Allen on (#1A5HR)

British Retail Consortium says like-for-like sales fell 0.7% from last year, raising fears that economic recovery is losing steamBritish retailers saw sales drop last month as unsettled weather hit demand for clothes while takings at grocers were hurt by lower food prices and Easter closures, industry figures show.The British Retail Consortium (BRC) said like-for-like sales fell 0.7% in March on a year earlier, the biggest drop since last August. Sales were flat on a year ago in total terms, which does not adjust for the effect of new store openings. Continue reading...

|

|

by David Smith, Washington correspondent on (#1A5EY)

Issue is back in the spotlight after massive leak, but Christine Lagarde warned that a proposal by Oxfam to establish a UN global tax body faces obstaclesThe head of the International Monetary Fund (IMF) has said it is time to “think outside the box†on global tax but warned that a proposal by Oxfam to establish a UN global tax body faces huge obstacles.The British-based charity first put the idea forward last year, arguing that powerful countries write the rules on tax and take advantage of loopholes and offshore tax havens. It suggested that an independent entity could give everyone – rich and poor – an equal say. Continue reading...

|

|

by Letters on (#1A4SA)

Labour MEPs share many of the concerns expressed by Lord Owen about the potential threat to the NHS (Brexit is necessary to protect NHS from TTIP, says David Owen, theguardian.com, 6 April) and our public services, and have already taken action to ensure that negotiators address them in any EU-US TTIP trade deal.The European parliament has a veto on all EU trade deals. Labour MEPs have taken a strong stand against the investor state dispute settlement (ISDS), in which multinationals can sue governments in separate investment courts, and are pushing for a full and comprehensive exclusion of all public services in the TTIP negotiations. The very concerns Lord Owen raises have already been addressed by MEPs and are now being considered by the negotiators.Related: Panama Papers: Act now. Don't wait for another crisis | Thomas Piketty Continue reading...

|

|

by Jana Kasperkevic in New York on (#1A4J0)

The settlement holds the bank accountable for its ‘serious misconduct’ in falsely assuring investors that securities it sold were backed by sound mortgagesGoldman Sachs will pay $5.06bn for its role in the 2008 financial crisis, the US Department of Justice said on Monday. The settlement, over the sale of mortgage-backed securities from 2005 to 2007, was first announced in January.Related: Goldman Sachs profit drops after $5bn mortgage-backed bond settlementRelated: Morgan Stanley to pay $3.2bn over mortgage-backed securities Continue reading...

|

|

by Graeme Wearden and Nick Fletcher (from 9.15) on (#1A2KJ)

|

|

by Larry Elliott on (#1A45S)

Lending forecast at £25bn for 2016 as developing countries struggle to cope with weakening global economyDemand for loans from the World Bank has reached levels unsurpassed outside of financial crises as developing countries struggle to cope with the weakness of the global economy.Ahead of its half-yearly spring meeting in Washington later this week, the Bank said it expected to lend more than $150bn (£105bn) in the four years from 2013 – a period when global economic activity repeatedly failed to match expectations.Related: IMF expected to cut growth forecasts in latest outlook Continue reading...

|

|

by Katie Allen on (#1A090)

Update likely to reprise warnings about emerging markets slowdown, China’s downturn and lower commodity pricesThe International Monetary Fund will sound fresh alarm over the state of the global economy this week when it reveals its latest forecasts for growth against a backdrop of slower world trade and jittery financial markets.The expected warning over risks to financial stability and economic growth will underscore fears in the UK that its own economy has slowed in recent months, unable to shake off global pressures. A report from the British Chambers of Commerce on Monday points to low business confidence and a weaker sales performance across UK manufacturing and services companies.Related: IMF expected to cut growth forecasts in latest outlook Continue reading...

|

|

by Clár Nà Chonghaile on (#1A2G5)

Activists and some African countries fear big corporations and the OECD club of rich nations are not going to fix the tax system any time soonThe Panama Papers have pulled back the curtain, revealing how tax wizards push and pull the levers of the global system to benefit elites. The fact that tax havens and offshore accounts are used by powerful individuals and corporations to wriggle out of tax obligations is no surprise; some developing countries and activists have long called for reforms, and their fight is gaining momentum.Poor countries lose huge sums of money every year – more than $100bn (£70bn) in corporate tax alone – because of discrepancies in the global tax system. They say a worldwide shift in how and where tax policies are decided is urgently needed. Continue reading...

|

|

by Katie Allen on (#1A0D4)

Jubilee Debt Campaign warns that developing countries are struggling to make debt payments as revenues deteriorateThe collapse in global commodity prices and a stronger US dollar have depleted the public coffers of some of the world’s poorest countries and will leave them as much as $61bn (£43bn) worse off this year, a report has warned.

|

|

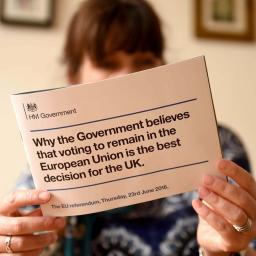

by Katie Allen on (#19ZRV)

Leaving or remaining in the union is about politics, history and much more. Yet we keep on consulting economistsHouseholds in England can look forward to a 14-page booklet landing on their doormat this week, making the case for Britain’s remaining in the EU. Responding to criticism of the £9m publicity drive, which will eventually reach the whole of the UK, the government said a survey had shown that 85% of people wanted more facts about the referendum.If it is facts we get, fair enough. Voters are being asked to decide on something that until recently they knew little about, and probably cared even less. Now, with less than three months to go to the poll, it’s little surprise people want a crash course in the pros and cons of EU membership. Understandably, many simply want to know whether they will be better or worse off if we leave. Continue reading...

|

|

by Thomas Piketty on (#19Y73)

Financial secrecy represents a huge threat to the fragile global system, and we won’t solve the problem by politely asking tax havens to stop behaving badlyThe question of tax havens and financial opacity has been headline news for years now. Unfortunately, in this area there is a huge gap between the triumphant declarations of governments and the reality of what they actually do.

|

|

by Katie Allen on (#19W40)

TUC finds young women earn on average only £8.50 an hour against £10 for men – a wider pay gap than for workers with academic qualificationsYoung women with vocational qualifications earn 15% less than their male peers, a significantly bigger pay gap than for those with academic qualifications, according to new research.Men aged between 22 and 30 with a vocational qualification above GCSE level earn on average £10 an hour, the Trades Union Congress (TUC) found in an analysis of official figures. Women with the same qualification level earn only £8.50 per hour.Related: The gender pay gap: how much would a feminist cupcake cost you? Continue reading...

|

|

by Editorial on (#19V8P)

The secretive wealth of public power has been exposed as never before. This poses a serious test for politicians, which Barack Obama passed but David Cameron failedSunlight, according to a cliche favoured by David Cameron, is the best disinfectant. Well, this week, the comparison might instead be with dangerously concentrated bleach. After a five-day outpouring of secrets from an obscure office in Panama, a prime minister is out in Reykavik, a president is on the ropes in Buenos Aires and the censors are putting in serious overtime in Beijing. A new regime in world football has been tainted with old-fashioned sleaze, Vladimir Putin has been moved to dismiss a paper trail linking his friends with billions of dubious dollars as a plot, and some big names from showbiz have discovered that they share a lawyer with the associates of gold bullion robbers.Considering a few of the stories that didn’t make the front pages – but could have done in any ordinary week – reaffirms the breathtaking volume of scandals that Mossack Fonseca kept discreetly under wraps. The lobbying and the tip-offs, for example, that HSBC provided to try and prevent the emerging Syrian war from separating President Bashar al-Assad’s cousin and intelligence chief, Rami Makhlouf, from his money. Then there were the disguised London property purchases and the hidden foundation planned for the daughters of Azerbaijan’s president, with the direct involvement of the minister of taxes in the latter scheme lending it a flavour of pre-revolutionary France. And don’t forget Petro Poroshenko, the Ukrainian president whose promise to “wipe the slate clean of business interests†was swallowed by the west, but who it transpires was – at the very hour of his troops’ gravest danger – concentrating instead on setting up offshore firms. Continue reading...

|

|

by Larry Elliott on (#19TAC)

Japan’s currency has gained 12% against the dollar this year, increasing pressure on the Bank of Japan to take actionFears that Japan’s anti-deflation strategy is unravelling have intensified after a sharp rise in the value of the yen against the dollar prompted a concerted attempt by policymakers in Tokyo to talk down the value of the currency.Related: Japan's economic plan 'backfiring' as yen surges Continue reading...

|

|

by Angela Monaghan on (#19S3J)

|

|

by Kenneth Rogoff on (#19SVV)

Bernie Sanders’ and Donald Trump’s calls to cut free trade is not the way to reduce inequality in the US. Far better to improve the tax systemThe rise of anti-trade populism in the 2016 US election campaign portends a dangerous retreat from the United States’ role in world affairs. In the name of reducing US inequality, presidential candidates in both parties would stymie the aspirations of hundreds of millions of desperately poor people in the developing world to join the middle class. If the political appeal of anti-trade policies proves durable, it will mark a historic turning point in global economic affairs, one that bodes ill for the future of American leadership.Republican presidential candidate Donald Trump has proposed slapping a 45% tax on Chinese imports into the US, a plan that appeals to many Americans who believe that China is getting rich from unfair trade practices. But, for all its extraordinary success in recent decades, China remains a developing country where a significant share of the population live at a level of poverty unimaginable by western standards.Related: Central banks are still the only game in town Continue reading...

|