|

by Angelique Chrisafis in Paris on (#11W63)

Twenty people arrested, with teachers, farmers and air traffic controllers also taking industrial action across country

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-10 01:15 |

by Graeme Wearden (until 2.15) and Nick Fletcher on (#11VZM)

Bank of England governor says “certain developments†could mean UK assets are seen as riskier, as EU referendum approaches

|

by Rose Hackman on (#11WTY)

Journalist and policy analyst Farai Chideya tackles how to survive in a time of broadening inequality and dwindling job market prospectsOn the frontlines of economic upheaval, author Farai Chideya tackles the conversation of a generation head on, and asks the big question: how can all of us establish a life of relative financial security at a time of broadening inequality and dwindling job market prospects?In her latest book, The Episodic Career, the journalist and political analyst offers a guide for American workers operating in an age of disruption and new career rules. Continue reading...

|

|

by Chris Matthews in Accra on (#11VY0)

Soaring prices for electricity, water and fuel have triggered protests amid concern that politicians are mishandling Ghana’s economic downturnDressed in the red and black clothing traditionally worn at funerals, waving anti-austerity placards and accompanied by drums and bellowing horns, thousands of Ghanaians descended on the Kwame Nkrumah Circle in Accra in mid-January.These workers marching through the capital and other cities were showing their dismay at recent price hikes and taxes, which have increased the cost of electricity by 59%, water by 67% and fuel by 28%.Related: Ghana’s cocoa farmers turn to smuggling as profits dwindle | Mark Anderson and Billie Adwoa McTernanRelated: Ghana’s plea to IMF a sad recognition of the perils of prosperity | Monica MarkRelated: Ghana’s big business and informal traders alike hit by crumbling economy | Billie Adwoa McTernan Continue reading...

|

|

by Katie Allen on (#11SVG)

Credit Suisse analysts predict leaving EU would cause snap recession, hit share and house prices and knock up to 2% off GDPA UK vote to leave the EU would trigger a snap recession, prompt a fall in share prices and house prices and knock as much as 2% off GDP, according to analysts at the investment bank Credit Suisse.Wading into the debate over the upcoming referendum, they predict the UK will probably vote to stay in the bloc. But were the public to opt for Brexit, the consequences would be “drastic and long lastingâ€, say the analysts.Related: We are perfectly positioned within Europe. Why change it?Related: Unilever says its 7,500 UK jobs will not suffer in case of Brexit Continue reading...

|

|

by Katie Allen on (#11SBA)

Demand in January fell faster than in December although companies are keener to invest and recruitUK manufacturers have suffered a further drop in orders this month, according to a poll that suggests the slowing global economy is hurting demand for exports.The latest snapshot of industry from the CBI showed order books deteriorated again in January, at a faster pace than December and more sharply than City economists had been predicting.

|

|

by Andrew White on (#11RT4)

With growing numbers of jobs threatened by automation, reviving old ideas of an unconditional income may be the best way to protect workersAt a time of global economic insecurity, an insightful commentator identified the existential threat that technology poses to work:Related: Dutch city plans to pay citizens a ‘basic income’, and Greens say it could work in the UKRather than lamenting what automation robs us of, why not use it to generate greater opportunities? Continue reading...

|

|

by Reuters on (#11RHX)

Japan’s Nikkei and the Shanghai Composite Index nudge up nearly 1% helped by expectations central banks will ease monetary policyShares in Chinese and other Asian markets began the week on a firmer note, extending gains from Friday after a rally in battered oil prices prompted a rise in global equities.

|

|

by Costas Lapavitsas on (#11RE1)

Alexis Tsipras has embraced wholesale the austerity he once decriedToday marks a year since a radical left government was elected in Greece; its dynamic young prime minster, Alexis Tsipras, promising a decisive blow against austerity. Yanis Varoufakis, his unconventional finance minister, arrived in London soon after and caused a media sensation. Here was a government that disregarded stuffy bourgeois conventions and was spoiling for a fight. Expectations were high.Related: The crucifixion of Greece is killing the European project | Seumas MilneRelated: Greek general strike: Petrol bombs and teargas during anti-austerity protest - as it happened Continue reading...

|

|

by Katie Allen on (#11QQ9)

Centre for Cities urges the government to address the geographical divide by continuing to increase investment in regional economiesAlmost half of the UK’s biggest cities have low-wage, high-welfare economies, according to a healthcheck on urban Britain that underscores the challenges for the government’s benefit-cutting agenda.George Osborne used his first budget of the Conservative government last summer to advocate a “higher wage, lower tax, lower welfare countryâ€. But a report published on Monday warns that his vision will take several parliaments to create, given current shortfalls in education, a housing crisis and inefficient jobs programmes.

|

|

by Saeed Kamali Dehghan on (#11Q3C)

Sanctions have been lifted but uncertainty over US authorities’ stance means banks are reluctant to handle paymentsA week after the lifting of sanctions against Iran, major European banks are still reluctant to handle Iranian payments as they remain wary of being the first to test the reaction of US authorities.

|

|

by Tobias Jones on (#11PQY)

Ever since Thomas More wrote Utopia 500 years ago, visionaries from William Morris to Ursula K Le Guin have dreamed of ideal worlds. But beneath the fig-leaf of fiction, the results are often bland – or bloodyA quarter of a century ago, the whole idea of utopia seemed irredeemably sullied. At the start of the 1990s, the largest social experiment in human history – the USSR – imploded, and with it went the notion that imagining a radically different society was a serious activity. It seemed that the rewards of such experiments were always so enticing that genocide inevitably ensued.That was the lesson drawn from any totalitarian regime informed by the highest (or lowest) idealism: the Khmer Rouge, the Videla regime in Argentina, Nazi Germany, you name it. Back then, it was thought best not to fantasise too much about a better world, but to learn to live in this one. The academic and political atmosphere in the 1990s was decidedly pragmatic, rather than optimistic. It was an era in which the liberal democracies celebrated (prematurely, of course) “the end of historyâ€. The story of humanity was a march to freedom, we were told, and we had arrived. This was as good as it got, and the idealists and unrealists should stop fantasising, because it was a dangerous hobby.Related: Utopias, past and present: why Thomas More remains astonishingly radical Continue reading...

|

|

by Katie Allen on (#11PHT)

Data expected to show modest growth in 2015’s last quarter but this could be constrained by fears over China’s economy and EU referendumThe resilience of the British economy in the face of stuttering global markets will be tested this week, with the publication of official UK growth figures due on Thursday.The first snapshot of GDP in the final months of 2015 is expected to show that growth held up at a modest pace, helping the UK outperform other advanced economies during last year as a whole.Related: Why is the global economy suffering so much turbulence?Related: UK unemployment falls but wage growth weakensRelated: Sluggish economies are the new western norm. But we can act to lift the gloom | Gavin Kelly Continue reading...

|

|

by Guardian Staff on (#11NXK)

After a few wild days for share prices, investors should keep an eye on oil prices, China’s slowdown and the US Fed’s interest rate to gauge the world’s economyBlink and you missed last week’s turmoil on the financial markets. On Wednesday, billions were wiped off share prices; on Thursday and Friday they were wiped back on. The FTSE 100 index ended the week higher than it started. Just a bout of new year jitters? Can investors now settle back and enjoy a period of calm?Probably not. It is easy to laugh, or groan, at markets’ ability to swing from gloom to optimism, but volatility tends not to appear out of thin air. Take a step back from this week’s excitement and remember that London’s blue-chip index has lost about 1200 points since its closing peak of 7104 in April last year. The factors driving that 17% decline are unlikely to disappear quickly. Last week’s brief panic suggests investors fear it wouldn’t take much to intensify the pressure. Continue reading...

|

|

by Sean Farrell on (#11NXN)

Despite the plunging oil price, no one wants to rock the boat with the powerful Anglo-Dutch firmIt’s nine months since Shell announced it was buying BG Group in an agreed £47bn deal and almost everything has changed. Back in April, the oil price appeared to be recovering from its fall below $50 a barrel but the price has since plunged below $30. The International Energy Agency warned last week it could fall further in a world “awash†with oil.Shell and BG shareholders vote on the takeover this week but, despite the industry’s dire state, they will approve the deal, now worth £35bn to reflect Shell’s depressed share price. This is partly due to faith in the ability of Shell’s chief executive, Ben van Beurden, to make it work. It’s also because most big shareholders don’t want to rock the boat in public with a company as powerful as Shell. Only Standard Life has broken ranks by declaring it would vote against. Continue reading...

|

|

by William Keegan on (#11NQ8)

Being in the EU but outside the euro and Schengen is highly advantageous - and far better than anything that could be achieved by leaving and renegotiating‘We should miss Britain a lot. But Britain would miss the European Union even more.†The speaker was a senior member of the Italian government, in response to a question about the attitude of Italians to the thorny issue of Brexit. The occasion was the annual Venice Seminar, where members of the Italian government speak frankly, but not for direct attribution, on the political and economic scene.For many years the views expressed at those seminars about the Italian economy have been a triumph of hope over experience. For example, the Italian economy managed, after the initial impact of the great recession of 2008-10, to contract further in 2011 and 2012 when even the British economy was beginning to recover. Continue reading...

|

|

by Gavin Kelly on (#11N2V)

We’re no longer likely to enjoy 2-3% growth, but cheap borrowing should provoke a surge in public investmentWhen the Chinese New Year falls next month, it will become the year of the monkey, though, to date, 2016 has without doubt been all about the bear. Stock markets are feverish, the Chinese slowing economy is thought to be weaker than official statistics suggest and there’s widespread jumpiness about the US Federal Reserve’s decision to raise interest rates. From a UK perspective, this downbeat mood doesn’t neatly tally with our domestic scene. Sure, some forecasts have been notched downwards, but growth is steady. Employment is at a record high. Wages are sluggish but rising.But look back over the past decade and things start to look different. There has been no surge in GDP as would normally be expected following a deep recession; the decline in pay has been extraordinary; productivity has been comatose. Indeed, 2016’s market volatility has so captured the economic zeitgeist in part because there is already an underlying angst about the medium term growthoutlook for advanced economies – including the UK.Demographic forces are powerful, but they aren’t destiny Continue reading...

|

|

by Katie Allen on (#11N3D)

A tumbling oil price and see-saw financial markets are clear symptoms of economic instability. But what’s the cause?The new year kicked off with a global stock market and commodities rout over worries about the global economic outlook and China’s economy in particular. Plunging prices recovered at the end of last week, partly on reassurances of more stimulus to come from the European Central Bank, but traders are bracing for more volatility. At one point, oil prices fell below $28 per barrel – a 25% drop since the start of the year – on the combined effects of a supply glut and waning demand. Investors have dumped riskier stocks in favour of safe-haven assets, such as gold and government bonds. The FTSE 100 index of London-listed shares bounced back but is still down more than 5% since the start of the year. Continue reading...

|

|

by Jamie Doward, Larry Elliott in Davos, Rod Ardehali on (#11N3F)

Plummeting oil prices and fears about China turned screens red in trading rooms around the world. Although things may have stabilised, some fear we are on the verge of another global recessionThey were studying the snow forecasts in Davos on Friday. But the 3,000 bankers and CEOs who had flown to the Swiss ski resort for the annual gathering of the global business elite were not interested in what conditions would be like on the slopes this weekend. Rather, they were focused on the monster blizzard stalking the US.At the end of a week in which the price of oil had fallen to a 12-year low, the price of the black stuff was finally moving north again, breaching the symbolic $30 mark. The reason? Traders were betting that demand for fuel would increase as the big freeze gripped large parts of the US. Continue reading...

|

|

by Graeme Wearden in Davos on (#11K8Y)

Rolling coverage of the final day of the World Economic Forum in Davos

|

|

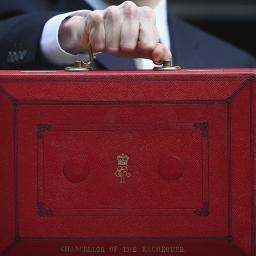

by Phillip Inman and Katie Allen on (#11HR2)

But chancellor tells Davos he will stick to ‘plan A’ as March budget loomsGeorge Osborne’s hopes of riding out the global downturn suffered a twin blow after retail sales tumbled last month and his plan to slash government borrowing appeared to be off track, despite higher tax receipts in December.Speaking in Davos on Friday, the chancellor said he would stick to ‘plan A’ despite facing calls to relax his austerity measures and fund investment to boost growth. He said he would ignore clamours to loosen the government’s purse strings and pledged to maintain the path of deficit reduction set out in his autumn statement. Continue reading...

|

|

by Julia Kollewe and Katie Allen on (#11FVW)

Shares recover from week’s heavy losses, with shares boosted by rising oil prices and ECB meetingGlobal stock markets bounced back at the end of a tumultuous week as policymakers sought to play down fears the world was on the brink of a fresh financial crisis.US, European and Asian markets all rallied after weeks of losses as oil prices rose and policy makers pledged more support for the economy. Continue reading...

|

|

by Joris Luyendijk on (#11H9M)

The Big Short explains the role of top bankers in the 2008 crash, but nothing much has changedThe UK release this week of the Oscar-nominated The Big Short, based on Michael Lewis’s book of the same name, is a fitting bookend to a time when we still believed that the broken financial system might be fixed. But the banks have won. Not a single “top banker†has been jailed and few, if any, have had to return undeserved bonuses. Measures taken since 2008 are being watered down before our eyes and, most dangerous of all, the deeper causes of the crash remain essentially intact. The Occupy movement should call a reunion so we can have a ceremony to bury all remaining hope.Related: The Big Short review – Ryan Gosling and Christian Bale can't save this overvalued stockIn the new set-up of the 80s and 90s bonuses stayed but the risk of being ruined personally was quietly shelved Continue reading...

|

|

by Ian Black in Riyadh on (#11GSG)

In the third in our series, we ask whether Saudi Arabia’s response to changing times will also lead to political transformationIn the Faisaliyah mall in central Riyadh, the call to midday prayers brings down the shutters on shops selling luxurious global brands and the basement mosque fills up. Customers are routinely searched at the entrance – a woman guard in a niqab, black abaya and white gloves sits by the metal detector. Cafes and restaurants have mixed “family sections†to ensure privacy. Harvey Nichols is having a holiday sale.Business seems slow, though visitors look in vain for any serious sign of Saudi Arabia’s gathering economic crisis, born of the lowest oil revenues in decades and subsidy cuts to reduce a $98bn budget deficit – 15% of the country’s GDP. The price of petrol has just gone up by 60%, though it is still dirt cheap, and VAT and other taxes are planned – significant novelties in a country where most people have not known such things in their lifetimes.Related: Saudi king's son drives reforms and war in a year of anxiety and changeRelated: Saudi Aramco – the $10tn mystery at the heart of the Gulf stateRelated: Saudi Arabia and Isis: Riyadh keen to show it is tackling terror threat Continue reading...

|

|

by Katie Allen on (#11G8F)

Mild weather and extended discounts blamed for worse than expected 1% decline in sales values from previous yearSpending in UK shops dropped last month, as mild weather and deep discounting dented takings for retailers over the key Christmas period. Official figures show that sales values fell at the fastest pace for more than six years, down 1% in December compared with the same time in 2014.Mixed reports from big retailers since Christmas had pointed to weakness in UK retail sales, but the decline was sharper than City economists had forecast, contributing to fears of a slowdown in the wider economy at the end of 2015.Related: Fears grow of repeat of 2008 financial crash as investors run for coverRelated: The Guardian view on Marks & Spencer: challenge of the demand for choice | Editorial Continue reading...

|

|

by Phillip Inman Economics correspondent on (#11G8H)

George Osborne’s hopes of meeting deficit target in April given slight boost, but analysts say finances are not yet on trackA smaller than expected shortfall in government finances in December has given a slight boost to George Osborne’s hopes of meeting his deficit target at the end of the financial year.Borrowing of £7.5bn last month was lower than the £10.1bn expected, but analysts warned that this level failed to put the government’s finances back on track to meet the April target.Related: UK unemployment falls but wage growth weakens Continue reading...

|

|

by Larry Elliott Economics editor on (#11FXQ)

Davos audience hears ECB president play down fears of global downturn and says EU can boost growth if it copes together with the refugee influxMario Draghi, the president of the European Central Bank, has said coping with the refugee crisis will be a boost for growth and brushed aside fears that the turmoil in global markets heralds the start of a recession.Draghi said it was important that Europe worked together to turn the challenge of coping with refugees into an opportunity and said one knock-on impact would be higher public spending.Related: Davos 2016: Refugee crisis will change Europe, says Draghi - live Continue reading...

|

|

by Gaby Hinsliff on (#11FFW)

For millions of us, the idea of planning for the long term no longer makes sense. We’re living for the moment, and the implications are terrifyingOnce upon a time there was a Frenchwoman who made it her life’s mission to save two of everything. Not just a spare for every possible eventuality – filling every cupboard to bursting, littering her cellar – but a twin for every object she owned, right down to table lamps.This hoarding made no sense at all, until it emerged that her grandfather once saved his family’s lives during the war by producing a spare reel of thread for a German soldier who needed to repair his uniform. Without that favour, they could have died. And so even as an adult, she could only feel safe so long as she had one of everything in reserve. Continue reading...

|

|

by Larry Elliott, Jill Treanor and Graeme Wearden in on (#11ETZ)

Chancellor’s Davos speech to UK business leaders stresses importance of completing promised economic reform around worldGeorge Osborne has issued a call for international action to bolster growth in the face of a “hazardous mix†of risks to the global economy.In an speech to be delivered to UK business leaders attending the World Economic Forum in Davos, the chancellor said it was important to complete the economic reforms promised by political leaders around the world.Related: IMF demands EU debt relief for Greece before new bailout Continue reading...

|

|

by Tom Phillips in Tangshan on (#11EQX)

The full effect of China’s economic decline on the world is unclear, but for the steel city of Tangshan the future already looks decidedly bleakA billboard on the motorway into China’s steel capital evokes the golden era of the country’s blistering economic rise. “Gathering great wealth!†it boasts. “Business wins the future!â€But at the Fufeng steel plant on the outskirts of Tangshan, a once booming industrial hub about 200km south-east of Beijing, there is scant sign of those glory days.

|

|

by Ha-Joon Chang on (#11E6X)

In truth the west failed to learn from the 2008 crash. Any economic ‘recovery’ was built on asset bubblesThe US stock market has just had the worst start to a year in its history. At the same time, European and Japanese stock markets have lost around 10% and 15% of their values respectively; the Chinese stock market has resumed its headlong dash downward; and the oil price has fallen to the lowest level in 12 years, reflecting (and anticipating) worldwide economic slowdown.According to the dominant economic narrative of recent times, 2016 was the year when the world economy would recover fully from the 2008 crash. The US would lead this recovery by generating growth and jobs via fiscal conservatism and pro-business policies. Reflecting the economy’s robust growth, the US stock market reached new heights in 2015, although disrupted by the mess in the Chinese stock market over the summer. By last October, US unemployment had fallen from the post-crisis peak of 10% to 5%, bringing it back close to the pre-crisis low. In a show of confidence, last month the US Federal Reserve finally raised its interest rate for the first time in nine years.Related: ‘Living within our means’ makes no economic sense. Labour is right to oppose it | Ha-Joon Chang Continue reading...

|

by Nils Pratley on (#11E5D)

British voters do not have much affection for investment bankers – many will see vague threats to go elsewhere as arrogantHere comes Wall Street, answering David Cameron’s call for the voice of business to be “heard in Britain and across the whole continentâ€. Jamie Dimon, the chairman and chief executive of JP Morgan, suggests his bank would quit the UK if Britain exits the European Union. “Britain’s been a great home for financial companies and it’s benefited London quite a bit. We’d like to stay there but if we can’t, we can’t,†he said.“Can we have that in writing?†some UK voters may respond. Overpaid investment bankers, especially Wall Street types, are not held in high general esteem in the UK. Vague threats to leave the country will be viewed in many quarters as arrogant and may well be counterproductive for the Remain camp. Continue reading...

|

by Larry Elliott, Graeme Wearden and Jill Treanor in on (#11E2N)

In talks with Tsipras about struggling economy, Lagarde sets out fresh conditions for further financial aid

|

by John Longworth on (#11E10)

We need a renewed focus on fixing the fundamentals to create a business environment that supports continued expansionThis week the great and the good have converged on Davos for the annual World Economic Forum. As they seek to divide and conquer the world between them, it is worth sparing a thought for businesses that are the backbone of the economy, fighting to grow and thrive.Amid an increasingly uncertain global outlook, a softening domestic economy and some disappointing policy decisions here at home, it is these bedrock businesses –not just the global elite – who should be front of mind. Confidence is essential to economic growth. Low interest rates and stable governments over the last few years have helped to reassure both UK firms and external investors that it is safe to invest, take risks, and pursue new opportunities.Related: David Cameron told to put fixing UK economy ahead of networking in Davos Continue reading...

|

by Letters on (#11E0M)

Isn’t it about time something serious was done about the global lottery that the various stock markets have become, where share trading is just an upmarket form of gambling (Panic selling grips markets as fears for global economy grow, 21 January)? Of course, under capitalism, the basics of what the stock market does (or used to do) are part of the system but now, with trading done every second of every day, the deals have almost nothing to do with the real world. And I haven’t mentioned micro-trading, which happens between computers and faster than any human can witness.How about, for a start, making all deals last for, say, 24 hours? You buy shares and must keep them for a day. Then we could get on to some serious reform, say holding shares for a week at a time, then quarterly? I won’t go quite as far as Jonathan Swift in Gulliver’s Travels, who suggested we should all have to carry all our possessions with us all of the time, but we surely need some sanity and not this perpetual doom and boom stuff we have had this last half century or more. Continue reading...

|

|

by Katie Allen on (#11DT2)

European Central Bank chief Mario Draghi announces plans to boost EU economies after day of turmoil in global tradingThe European Central Bank brought respite to volatile financial markets after indicating it is ready to inject fresh stimulus into the eurozone as soon as March.

|

|

by Associated Press in New York on (#11DGH)

Stocks are having their worst start to a year in history, partly because of a plunge in the price of oil, but few economists see a repeat of the 2008 crisis aheadWall Street is drowning in oil. Stocks are having their worst start to a year in history in part because of a rapid plunge in the price of oil. The price of crude is down 28% this year already, which in turn has dragged down energy company shares in the Standard & Poor’s 500 index by 13%, which has helped pull the overall index down 9%.This even though low oil prices and the cheap prices for gasoline and other fuels that result are wonderful for consumers and many companies.Related: No global economic crisis yet, but the ingredients are there Continue reading...

|

|

by Jon Day on (#11CZR)

It’s not just the mania for Keep Calm and Carry On … Britain’s most provocative writer on architecture targets the fashionable revival of mid-20th century aestheticsThe writer and critic Owen Hatherley has become something of a sage of modernism in recent years. Casting his gaze over the built and pop-cultural landscapes, he sorts the echt from the phoney with all the moral certainty of a Ruskin or a Carlyle. His latest book – his sixth – is a short, stimulating polemic against a suite of aesthetic and political motifs united under the promising term, “austerity nostalgiaâ€.For Hatherley, austerity nostalgia is exemplified by the fetishisation of mid-century Danish furniture; by the coveting of the ex-council flat over the suburban maisonette; by the design aesthetic of the home goods shop Labour and Wait. Austerity nostalgia announces itself in san serif fonts. It glories in the stripped-down design of the underground network and the homely experimentalism of the GPO film unit.Related: Keep Calm and Carry On – the sinister message behind the slogan that seduced the nation Continue reading...

|

|

by Frances Ryan on (#11CS7)

The DWP placed sanctions on a schizophrenic man when he fell into difficulties. It was an aggressive and destructive way to treat someone so vulnerableLuke Alexander Loy was not one of George Osborne’s “hard-working peopleâ€. The 42-year-old had schizophrenia and was unable to work (or “do the right thingâ€, as David Cameron now ominously terms being employed . But Luke’s story – his life – is one worth talking about.Luke lived with his mother in their two-bed council house in Birmingham and had built a stable rhythm: carving wood sculptures as art therapy in their front room, going for walks five times a day, and shopping for his elderly neighbours.Under austerity, Britain’s welfare state appears to be sliding into survival of the fittestRelated: Death has become a part of Britain’s benefits system | Frances Ryan Continue reading...

|

|

by Larry Elliott on (#11CE0)

Ban Ki-moon unveils global project after UK development secretary lobbied for greater opportunities for girls and womenThe UN has called for a “quantum leap†forward in the empowerment of women at the launch of a global campaign to fully mobilise the untapped economic potential of half the world’s population.Ban Ki-moon, the UN secretary general, announced in Davos on Thursday that he was creating his organisation’s first high-level panel on women’s economic empowerment, which will come up with a plan of action later this year. Continue reading...

|

by Julia Kollewe in London and Justin McCurry in Toky on (#11BED)

Gloom takes hold despite China’s central bank pumping £64bn worth of liquidity into financial systemShares in Asia experienced further turmoil after an earlier rally petered out, extending the rout on global stock markets prompted by growing fears over the global economy.

by Guardian Staff on (#11BRG)

The chief economist at the International Monetary Fund, Maurice Obstfeld, speaks on China’s slower growth, the fall in commodity prices such as oil and predicts global economic growth will rise from 3.1% in 2015 to 3.4% in 2016 and 3.6% in 2017. As world and business leaders gathered for the annual World Economic Forum in Davos, Switzerland, the FTSE 100 was gripped by panic selling, especially of mining and oil companies that have been hit hard by the global slowdown in manufacturing and trade Continue reading...

by Jeff Sparrow on (#11BH9)

It’s easy for progressives to be cynical in the face of global inequality. But cynicism won’t protect the poor in the coming slump

|

by Phillip Inman Economics correspondent on (#11AFD)

As leaders gathered in Davos, FTSE 100 was gripped by panic selling and entered bear market with Dow Jones also plungingFears that the global economy could be heading for a repeat of the 2008 financial crash have sent shockwaves through financial markets – prompting a rush to safe havens by investors.Oil prices fell to a fresh 12-year low on Wednesday and metal prices tumbled in response to warnings that China’s slowdown could derail the global recovery at a time when central banks, which came to the rescue in the credit crunch, have only limited firepower.Related: If this market turmoil forces a US rate cut, the outlook will truly be grim Continue reading...

|

|

by Denis Campbell Health policy editor on (#11ASP)

King’s Fund study ranks UK 13th out of 15 original EU members and casts doubt on ministers’ claims they are giving the NHS generous cash settlementsBritain’s spending on its health service is falling by international standards and, by 2020, will be £43bn less a year than the average spent by its European neighbours, according to research by the King’s Fund.The UK is devoting a diminishing proportion of GDP in health and is now a lowly 13th out of the original 15 EU members in terms of investment, an analysis for the Guardian by the thinktank’s chief economist shows.Related: What would you like to see from the NHS' mental health services?Related: NHS has the west's most stressed GPs, survey reveals Continue reading...

|

|

by Graeme Wearden in Davos, and Nick Fletcher in Lond on (#11857)

There’s a gloomy feeling in the air as world leaders and business chiefs gather at the World Economic Forum in Davos

|

|

by Nick Fletcher and Phillip Inman on (#118CM)

Dow ends day down 248 points while slumping oil price and gloom at Davos sends FTSE 100 tumbling officially into bear market territory• Dow suffers steep falls as FTSE 100 enters bear market – live updatesGlobal shares tumbled again on Wednesday as fears of an economic slowdown escalated and the oil price hit lows not seen since 2003.European markets collapsed following more sell-offs in Asia. In New York the Dow Jones Industrial Average had lost over 550 points by 1pm ET but staged a late rally and ended the day down 248 points, 1.55%.Ugly, very, very ugly, describes current equity markets, with momentum swinging negative yet again and the bears firmly in control. The fledgling hope from yesterday that markets were on the turn has been quashed by sharp overnight falls in Japan and Asia, which has seen European markets fall aggressively. With every upturn being followed by deeper falls, investors are increasingly wary as it becomes more and more difficult to determine what might happen next.Oil prices remain under pressure, but the consumer benefits of lower energy prices and higher disposable income have yet to filter through to the wider equity market, which remains unremittingly negative in the face of further prospective asset sales by oil exporting countries’ sovereign wealth funds. Continue reading...

|

by Nils Pratley on (#11AFE)

A global economy in robust health ought to be able to withstand action by the Fed at the same time as a market correction. But it’s not clear that it canThis time last month stock markets were starting an end-of-year rally, cheerfully regarding the US Federal Reserve’s small increase in interest rates as evidence of the underlying strength of the global economy.Now, says William White, former chief economist of the Bank for International Settlements, the situation is as bad as in 2007, the onset of the banking crash. Continue reading...

|

by Phillip Inman economics correspondent on (#11AES)

Chancellor says former French finance minister is an outstanding leader who has the vision ‘to help steer the global economy through the years ahead’George Osborne has backed Christine Lagarde’s attempt for a second term as managing director of the International Monetary Fund.The chancellor nominated the former French finance minister for another four years as head of the Washington-based organisation, saying she was an outstanding leader who had the vision “to help steer the global economy through the years aheadâ€. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#118JF)

Jobless rate of 5.1% is lowest since 2006 but slowdown in pay growth likely to further delay any interest rate rise amid signs the UK recovery is cooling fastWage growth slowed in November to its lowest rate since February 2015 in the latest signal that the pace of Britain’s recovery is rapidly cooling down.Wages grew at 2% in the three months to November, down from 2.4% in the previous month, after breaking through the 3% barrier in the summer.Related: Unemployment rate falls to lowest figure for a decade - Politics liveRelated: Young and older people 'experience age discrimination at work'Related: George Osborne has tied a knot of fear and optimism – but is it unravelling? | Polly Toynbee Continue reading...

|