|

by Larry Elliott Economics editor on (#10834)

Donor countries are increasingly dipping into their aid budgets to deal with the migration crisisSweden is one of the most generous countries in the world when it comes to international aid. Along with other Scandinavian countries, it has given bounteously to less fortunate nations for many years. With a population of under 10 million, it also takes more than its fair share of asylum seekers - an estimated 190,000 last year, with a further 100,000 to 170,000 expected to arrive in 2016.

|

Economics | The Guardian

Economics | The Guardian

| Link | https://www.theguardian.com/business/economics |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Copyright | Guardian News & Media Limited or its affiliated companies. All rights reserved. 2026 |

| Updated | 2026-02-27 10:00 |

|

by William Keegan on (#106TP)

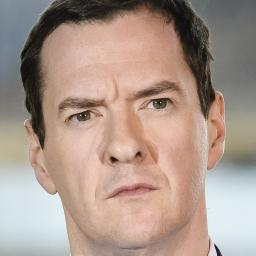

George Osborne is now warning of ‘dangerous complacency’ just months after his notably complacent performance in the autumn statementDangerous cocktails were in evidence in many a bar during the Christmas and New Year holidays. I do not know how many the chancellor might have sampled, but his demeanour appears to have been transformed from one of blatant complacency in his autumn statement to pre-budget nerves. He now warns of “a dangerous cocktail of new threats†and, yes, “creeping complacency†in the British economic and political debate.This is not, of course, anything to do with him and the complacency he was fostering as recently as before Christmas. No, this is mainly because of threats to the global economic recovery emanating from a manifest slowdown in China and the impact the collapse of oil prices is having on the economies and finances of oil-producing nations – with the obvious exception of the oil-producing country known as the United States, whose “fracking†boom has made no small contribution to oversupply and falling prices in energy markets. Continue reading...

|

|

by Josh Bivens on (#106CF)

The economic fundamentals will remain perilous if low- and middle-income workers continue to endure poor payThe US economy ended 2015 with improvement in the labour market. Jobs grew by 284,000 each month on average in the last quarter and if you squint pretty hard at the data you can see a mild acceleration in the pace of nominal wage growth.There will be plenty who will claim this justifies the Federal Reserve’s decisions to raise short-term interest rates for the first time since 2007, and who will argue further that the economic concerns raised by the great recession and its aftermath can now be reshelved. They would then conclude that the focus can return to policy perennials like the need to reduce deficits and ensure that wage and price inflation do not spiral out of control. Continue reading...

|

|

by Larry Elliott on (#10573)

Some see China’s share collapse as merely a symptom of middle-class prosperity. Others take a darker view – and if they are right, the global threat is realRarely have financial markets had a more traumatic start to the year. Shares plunged, the price of oil clattered to its lowest level in 11 years, trading on the Chinese stock market was halted twice, and the World Bank warned that a “perfect storm†might be brewing.George Osborne chose his moment well to go public with his concern that the UK faces a “cocktail of threatsâ€. In addition to the $2tn wiped off global stock markets, the North Koreans claimed they had exploded a hydrogen bomb and relations between Saudi Arabia and Iran worsened markedly. Continue reading...

|

|

by Katie Allen and Tom Phillips in Beijing on (#102P1)

Anxiety grips markets as sharp drops on world’s biggest stock exchanges mirror tumbling shares in BeijingA punishing week has left global stock markets nursing losses of more than $2tn in the first week of the new year after worries about China’s faltering growth and turmoil on its stock exchanges reverberated around the world.Almost £85bn was wiped off the FTSE 100 in its worst opening week to a year since 2000, when the dotcom bubble burst. The blue-chip index closed at 5,912.44 on Friday, down 0.7% on the day and 5.3% on the week. Continue reading...

|

|

by Letters on (#102JD)

So George Osborne tells us we face a “dangerous cocktail†of global risks to the economy (Report, 7 January). The Middle East, China, oil prices, US interest rates, terrorism … But I remember he told us that it was just Gordon Brown.

|

|

by Martin Farrer in Sydney, Graeme Wearden and Nick F on (#ZZXD)

Investors have been buoyed by the People’s Bank of China’s decision to boost the yuan for the first time in nine days. US jobs showed stronger than expected growth, prompting rate hike talk

|

|

by Owen Hatherley on (#1025T)

It is on posters, mugs, tea towels and in headlines. Harking back to a ‘blitz spirit’ and an age of public service, ‘Keep Calm and Carry On’ has become ubiquitous. How did a cosy, middle-class joke assume darker connotations?To get some sense of just what a monster it has become, try counting the number of times in a week you see some permutation of the “Keep Calm and Carry On†poster. In the last few days I’ve seen it twice as a poster advertising a pub’s New Year’s Eve party, several times in souvenir shops, in a photograph accompanying a Guardian article on the imminent doctors’ strike (“Keep Calm and Save the NHSâ€) and as the subject of too many internet memes to count. Some were related to the floods – a flagrantly opportunistic Liberal Democrat poster, with “Keep Calm and Survive Floodsâ€, and the somewhat more mordant “Keep Calm and Make a Photo of Floodsâ€. Then there were those related to Islamic State: “Keep Calm and Fight Isis†on the standard red background with the crown above; and “Keep Calm and Support Isis†on a black background, with the crown replaced by the Isis logo. Around eight years after it started to appear, it has become quite possibly the most successful meme in history. And, unlike most memes, it has been astonishingly enduring, a canvas on to which practically anything can be projected while retaining a sense of ironic reassurance. It is the ruling emblem of an era that is increasingly defined by austerity nostalgia.I can pinpoint the precise moment at which I realised that what had seemed a typically, somewhat insufferably, English phenomenon had gone completely and inescapably global. I was going into the flagship Warsaw branch of the Polish department store Empik and there, just past the revolving doors, was a collection of notebooks, mouse pads, diaries and the like, featuring a familiar English sans serif font, white on red, topped with the crown, in English:Few images of the last decade are quite so riddled with ideology, and few ‘historical’ artefacts are so utterly falseRelated: Keep Calm and Carry On: The secret historyAt Jamie’s restaurants you can order pork scratchings for £4 and enjoy neo-Victorian toilets Continue reading...

|

|

by Larry Elliott Economics editor on (#101WW)

The creation of 300,000 jobs last month sounds great but wages and manufacturing data are just as important, and both point to weaknessIt seems just like the good old days. Almost 300,000 jobs were added to payrolls in America in the last month of 2015, continuing the upward trend of recent months. The US is once again living up to its reputation for being a gigantic jobs machine.Well, perhaps. Jobs are certainly being created at a good lick and the US has an unemployment rate – 5% – that the eurozone, at 10.5%, would die for. There are signs that people who had given up hope of finding work are being encouraged back into the labour market.Related: China closes 2% higher while US job figures beat forecasts – live Continue reading...

|

|

by Julia Kollewe in London and Tom Phillips in Beijin on (#10195)

Chinese ‘national team’ of state-owned banks buy yuan sending signal that Beijing is not seeking to devalue currencyOil prices have rebounded and global stock markets recovered after Beijing mustered what analysts called its “national team†to intervene and boost the yuan.The price of Brent crude, the global benchmark, rose more than 2% and later traded 1.8% higher at $34.36 a barrel. On Thursday, it had hit $32.16, the lowest since April 2004.Related: Chinese stock market closes 2% higher after 'national team' intervenes – live Continue reading...

|

|

by Phillip Inman Economics correspondent on (#1016F)

Analysts say narrowing trade gap from £3.5bn to £3.2bn was powered by a big drop in oil imports and UK exports are not improvingBritain’s trade gap remained alarmingly high in November after exports fell to their lowest value since July.Official figures showed the deficit in goods and services narrowed to £3.2bn compared with £3.5bn in the previous month, but this was only after a drop in oil imports and a £2.4bn fall in the value of “unspecified goodsâ€, mainly gold, brought into the country.Related: George Osborne’s ‘cocktail of threats’ will leave us with a hangover | John McDonnell Continue reading...

|

|

by John McDonnell on (#10122)

The chancellor promised 2015 would be the year government borrowing would hit zero, but we’re facing a noxious economic brew of his own makingGeorge Osborne yesterday warned us about a “cocktail of threats†brewing in the world economy. All the ingredients are there for a noxious brew. The emerging markets debt bubble. The ongoing stock market turmoil in China. Recession in Brazil and Russia, and the slowdown in India. The collapse in global commodity prices.I’ve warned about the danger signs elsewhere before. But curiously, Osborne didn’t talk up these “threats†in last year’s autumn statement. He didn’t raise them at the summer budget. They were hardly a centrepiece of his election campaign.Related: George Osborne warns UK economy faces 'cocktail of threats'I doubt even Osborne believes his own stories any more. That’s why he’s getting his excuses in firstRelated: I’m backing George Osborne’s Project Fear – if it helps keep us in Europe | Martin Kettle Continue reading...

|

|

by Katie Allen on (#100HW)

Treasury select committee chair said ONS lacked intellectual curiosity, was prone to silly mistakes and was unresponsive to consumer needsAndrew Tyrie, the chairman of the Treasury select committee, has redoubled his criticism of the Office for National Statistics (ONS) for falling behind its international peers and jeopardising policy decisions with poor quality data.

|

by Editorial on (#ZZS6)

The high street giant was built on high-volume sales to a mass market, but that business model is bustMarks & Spencer is not dying: it owns more than a thousand stores, often in prime high street sites. Last year, it made more than £600m profit. Its revenues are huge: over £10bn, which is about the equivalent of the GDP of a country the size of Malta. So there is plenty of life in it yet. But it is wounded, and trying to heal it is turning out to be much harder than even Marc Bolland, the smooth-talking Dutch chief executive expected. On Thursday, along with disappointing clothes and homeware sales figures, he announced his unexpectedly early departure.If restoring this behemoth of the retail economy to robust good health was going to be easy, it would have happened years ago. Mr Bolland is well-regarded. The company’s share price has been on an erratic but generally upward trajectory ever since he took over more than five years ago. He appears to have cracked the worst glitches in the digital sales business, and the food side continues to grow at a steady rate. But the old staples of knickers and knitwear are floundering and the search for the perfect homeware offer goes on. Retail analysts think his successor, Steve Rowe, will have an easier task than Mr Bolland did. There are plenty of reasons why he won’t. Continue reading...

by Graeme Wearden on (#ZX2A)

Markets slide around the globe after Chinese regulators are forced to halt trading for the second time this week

|

by Katie Allen and Graeme Wearden on (#ZZ10)

Decision to abandon mechanism came after it was tripped for a second time in a week when market fell 7% within minutes of openingChinese authorities sought to bring an end to new year stock market turmoil with a dramatic U-turn on a new mechanism that Beijing had hoped would prevent sharp selloffs.On Thursday, in a tacit admission that the new circuit breakers introduced only this week were having the opposite effect to that intended, China’s main stock exchanges said they were suspending the mechanism. The move came after the breaker was tripped for the second time in a week as the market fell 7% within half an hour of opening.Related: China share trading halted after market plunges 7% in opening minutes Continue reading...

|

|

by Letters on (#ZYZ4)

I see clutter (Suzanne Moore, G2, 7 January) more as a “symptom†than a “problemâ€. Clutter and consumerism are symptoms of excessively cheap products with the true price being paid somewhere else down the line in the form of exploitative labour practices, environmental degradation or excessive use of fuel. The explanation is simple: our homes are full of “tat†because all that stuff is so cheap to buy. The solution is to put an end to the perpetual shopping spree that is modern life. If we created the economic conditions (using taxation, tariffs and regulation) so that far more everyday items were manufactured closer to home, this would quickly declutter everyone’s homes because, when you pay the full cost of locally produced shirts (for example), rather than sweatshop-produced ones, you demand higher quality, you buy far fewer, you appreciate them more and you wear them longer. The result: your clutter disappears.

|

|

by Larry Elliott on (#ZYXS)

Chancellor’s ominous speech to business leaders in Cardiff suggests he knows some nasty piece of news we don’t – possibly about the budget deficitBritain faces a “dangerous cocktail†of threats. There is a culture of “creeping complacency†that the economy is problem free. The biggest risk is that people forget about the recession and assume that it is “job doneâ€.Business leaders who turned up to listen to George Osborne in Cardiff on Thursday could be forgiven for wondering what’s happened to the chancellor who delivered such an upbeat autumn statement six weeks ago.Related: Lies, damned lies, national statistics: Bean accounts for the counters Continue reading...

|

by Katie Allen on (#ZYWR)

Billionaire investor-turned-philanthropist says China’s struggle to find a new growth model is spreading problems to the rest of the worldBillionaire speculator George Soros has added to the gloom in global markets by claiming the world risks a return to the turmoil of the 2008 financial crisis.Soros, who famously helped to force the pound out of the exchange rate mechanism on Black Wednesday in 1992, highlighted China’s struggles to find a new growth model and said its currency devaluation was spreading problems to the rest of the world. Continue reading...

by Guardian Staff on (#ZYWS)

Chancellor George Osborne warns of threats faced by Britain’s economy, including stock market falls, and problems abroad with China’s market slowing and economic instability in Russia and Brazil. Despite the challenges ahead, Osborne says that 2016 is the year ‘we can get down to work and make the lasting changes Britain so badly needs’

|

by Andrew Sparrow on (#ZX9D)

Rolling coverage of all the day’s political developments as they happen

|

|

by Graham Ruddick on (#ZYFB)

Motorists purchased 2.63m new cars last year, which represents a 6.3% increase compared with 2014New car sales reached an all-time high in Britain in 2015 as improving consumer confidence, wage growth and low-interest finance deals from manufacturers boosted the market.

|

by Frances Perraudin on (#ZY9M)

Shadow chancellor John McDonnell says he warned his opposite number about threats to UK economy more than three months ago

|

by Suzanne McGee on (#ZXQ7)

Put human beings in close proximity to money, and it’s inevitable that the greed impulse will flare out of control. The question is: what do we do about it?Bernie Sanders has a problem. Sometimes greed is good.Imagine, for a minute, that your employer tells you that he’s going to pay you 25% more a year and give you an extra week of vacation. In exchange, all you have to do is agree to come in an hour earlier every day, leave an hour later every day, and make you responsible for finding a way to cut your division’s annual budget by 5%. Do you take the offer?

|

|

by Terry Macalister on (#ZXPJ)

Slowdown in Chinese economy and rising US output plunges price to new low with huge knock-on effects for UK’s North Sea oil industryThe price of North Sea oil has fallen to just above $32 per barrel, 72% lower than the peak of $115 reached in the summer of 2014.The value of Brent crude was hit for the fourth day in a row, this time by figures from the US showing oil production had risen even higher despite the enormous supply glut.Related: Oil prices could continue to slide with Saudi sights set on shale Continue reading...

|

|

by Polly Toynbee on (#ZXN7)

The chancellor says global storms justify a course of continued austerity. Yet he crows about British economic recovery. He needs to get his story straightThe chancellor teeters along a tightrope in a high wind. Weeks ago it was all glory and gloat: best ever, greatest success in EU and on track for his long term plan. But today in Cardiff he tips the other way: mission not accomplished, dangerous cocktail of threats and: “The biggest risk is that people think that it’s ‘job done’.â€Which is it? What’s up? There is truth (and some lies) in both postures. No one doubts the global storm, with China again suspending trading in its stock market after another precipitous fall, and jitters reverberating round the world. Continue reading...

|

|

by Hilary Osborne on (#ZXM3)

National average house price now 5.58 times earnings, in sign of continued lack of homes for sale to meet demandUK house prices rose by 9.5% in 2015, figures from the country’s biggest mortgage lender show, in the biggest increase since 2006, before the financial crisis.Halifax’s latest monthly report showed the average price of a home in the UK rose by 1.7% in December 2015, to hit a new high of £208,286.Related: Number of unbuilt homes with planning permission hits record levels, LGA says Continue reading...

|

|

by Oluseun Onigbinde in Lagos on (#ZXJ8)

The visit of International Monetary Fund chief Christine Lagarde has placed an uncomfortable spotlight on the fiscal woes of Africa’s biggest oil producerWhen Christine Lagarde, the managing director of the International Monetary Fund, visited Nigeria this week, she called for more flexibility on the exchange rate, encouraging those who believe the naira could be devalued again very soon.Her visit placed an uncomfortable spotlight on the fiscal woes of Africa’s biggest oil producer. Many Nigerians feel we are in a tough corner, and concern is growing over what President Muhammadu Buhari will do to plug the foreign exchange gap, boost revenues and diversify an economy that Lagarde said is too reliant on oil. Continue reading...

|

|

by Larry Elliott on (#ZW6X)

Chancellor to urge Britain to address its ‘creeping complacency’, after new year already hit by oil price and markets turmoilGeorge Osborne has warned of the risks to the UK from the shaky global economy, saying 2016 has opened with a “dangerous cocktail of new threatsâ€.The chancellor was using a speech in Cardiff to say that the turmoil in financial markets that saw 5% wiped off oil prices on Wednesday should act as an antidote to the “creeping complacency†that Britain is immune from what is happening in the global economy.

|

|

by Press Association on (#ZX68)

Dealers to announce record sales of 2.6m cars in 2015 with commercial vehicles set for 15% annual rise fuelled by surge in online shopping deliveries

|

by Phillip Inman economics correspondent on (#ZW6Z)

British Chambers of Commerce says sector ‘close to stagnation’ after domestic and export sales fall to below pre-recession levelsManufacturing exports slumped at the end of last year, and will continue to suffer in 2016, leaving Britain with a two tier economy that relies on consumer spending to drive growth, a leading business group has warned.The British Chambers of Commerce said a survey of 7,500 firms found that manufacturing fared worse than the services sector and was “close to stagnation†after domestic and export sales fell to below their pre-recession levels in 2007. Continue reading...

|

by Rupert Neate in New York and agencies on (#ZVPT)

Minutes reveal some policymakers remained concerned about stubbornly low inflation but economists believe rate hike will be first of several to come in 2016The Federal Reserve’s decision to raise interest rates in December – the first rate rise in almost a decade – was a “close call†for some policymakers, according to minutes of the Fed’s meeting released on Wednesday.

|

|

by Jill Treanor on (#ZW0Z)

Reports say investigation into gilts trading is not industry-wide despite recent criticism of regulator for dropping review into culture at major banksThe City regulator is investigating whether traders at Lloyds Banking Group manipulated the price of government bonds, in a sign that the authorities are continuing to seek out rigging of key markets.Following a series of fines across the industry for rigging interest rates and foreign exchange markets, the Financial Conduct Authority has been asking Lloyds for information about trading in gilts. Continue reading...

|

|

by Larry Elliott on (#ZVGW)

Simultaneous slowdown in Brics economies would jeopardise chances of pick-up in global growth this year, report saysThe risk of the global economy being battered by a “perfect storm†in 2016 has been highlighted by the World Bank in a flagship report that warns that a synchronised slowdown in the biggest emerging markets could be intensified by a fresh bout of financial turmoil.The Bank said the possibility that Brazil, Russia, India, China and South Africa – the so-called Brics economies – could all face problems simultaneously would put in jeopardy the chances of a pick-up in growth in the coming year. Continue reading...

|

|

by Jill Treanor on (#ZV89)

Thousands of customers could be affected by move eight years after B&B was rescued by taxpayers during 2008 banking crisisThousands of customers of Bradford & Bingley face the prospect of having their mortgages sold off to another lender as the government prepares £17bn of home loans for sale.The vast package of mortgages is in government hands because B&B had to be rescued by taxpayers during the 2008 banking crisis. The mortgages could be sold off in parcels or as one giant bundle of loans.Related: MPs to look into £13bn sale of Northern Rock mortgages to Cerberus Capital Continue reading...

|

|

by Phillip Inman Economics correspondent on (#ZTK8)

Weaker yuan revives fears of a currency war, a global conflict by other means that directly affects millions of workersThe phrase “currency war†speaks to a seemingly phoney battle between the world’s major trading powers over the price of exports. It has all the attributes of an illusory conflict because no one ever agrees that a genuine dispute has taken place. And as long as everyone denies they have drawn swords to slash their currency to compete with rival powers, talk of a war fizzles and dies.There is a fringe constituency of analysts who have long argued that, much like the hundred years’ war of intermittent battles between England and France, currency wars make headlines only when there is a lurch in policy, which is the equivalent of deploying archers and unleashing the cavalry.Related: Oil hits 11-year low as weak Chinese data spooks markets - business live Continue reading...

|

|

by Phillip Inman Economics correspondent on (#ZSP8)

Expectations for business activity over next 12 months slumps to near three-year low in the face of growing uncertaintiesThe impact of government spending cuts, jittery world markets and the prospect of an EU referendum vote have dragged down expectations of UK services growth this year.The sector, which accounts for more than three-quarters of economic activity and ranges from shops and hotels to banking, maintained its solid growth in the run-up to Christmas, but a survey found that expectations for business activity over the next 12 months was the weakest for almost three years. Continue reading...

|

|

by Tess Riley on (#ZRW6)

From 1970s sci-fi to modern-day India via postcapitalism and work slaves, check out our recommended reading for the coming yearCapitalism took a bashing in 2015: Corbynomics, the rise of anti-austerity parties Podemos and Syriza, Hillary Clinton slamming our culture of short-termism, COP21 protests and more. Capitalism – and more specifically its failings – is likely to be as brashly and uncompromisingly in the headlines this year as it has been over the past 12 months.To prepare you, we’ve put together a reading list of books we’ve loved and learned from. It’s not easy to narrow down a list of must-reads to just six, but we’ve done our best. Please add your own recommendations in the comments below.

|

|

by Catherine Colebrook on (#ZPB9)

Indebted households without asset wealth are particularly vulnerable to deflationary dynamics - and the UK has a lot of themThis time last year the Institute for Public Policy Research (IPPR) made a compelling case for keeping interest rates at their historic lows, arguing that although the recovery looked to be on an increasingly sure footing, we were some way off generating inflation through domestic wage pressure, and that if anything, the global growth slowdown meant inflation looked set to fall below 1% in the coming year.That view now looks prescient, to say the least. Consumer price inflation spent another month at near-zero levels in November, with prices by the CPI measure a mere 0.1% higher on average than a year ago. This makes it a virtual certainty that 2015 will be a year of zero or near-zero consumer price inflation: the first time this will have happened in the CPI’s 27-year history. Continue reading...

|

|

by Martin Farrer and agencies on (#ZMPA)

Banks and energy companies take the hit as investors face global headwinds from slowing Chinese economy and depressed commodity pricesAustralian shares have closed down sharply as uncertainty about the direction of the Chinese economy and markets saw volatile trading across Asia Pacific.

|

|

by Phillip Inman Economics correspondent on (#ZM8M)

Manufacturing output declines in China, India and US, leading investors to turn to gold investmentsFigures from China showing that factory output contracted for a 10th straight month in December pointed to a continuation of 2015’s global economic slowdown and the likelihood of worse to come.Related: Jitters over China manufacturing slowdown wipe £38bn off FTSE 100Related: Investors nervous as China looks set to repeat mistakes of last summer Continue reading...

|

by Dominic Rushe on (#ZM3X)

The Dow Jones Industrial Average took a New Year’s dip as world stock markets fell on news China’s manufacturing sector continues to shrinkUS stock markets got the post-New Year’s blues on Monday, opening with their worst performance since 2008, driven down by a slowdown in China’s economy and more trouble in the Middle East.

by Dominic Rushe on (#ZM0Z)

The Dow Jones Industrial Average took a New Year’s dip unseen since 1922 after a survey of China’s manufacturing sector showed it continues to shrinkUS stock markets got the post-New Year’s blues on Monday, opening with their worst performance in decades, driven down by a slowdown in China’s economy and more trouble in the Middle East.

|

by Phillip Inman Economics correspondent on (#ZKWM)

New orders also disappoint in December as firms blame continued slowdown on falling demand for consumer goods and machine toolsUK factories entered 2016 in a “state of near stagnation†following a decline in output growth and new orders during December.Firms blamed the weaker than expected growth on falling demand for consumer goods and machine tools, which have experienced a long slowdown in growth since a peak in 2014 apart from a recovery in the summer.Related: Recovery 'too reliant on consumer debt' as BCC downgrades forecastRelated: Factories forecast to shed tens of thousands of jobs in 2016 Continue reading...

|

|

by Katie Allen on (#ZJAC)

UK stocks tumble as renewed concern over global economy spooks marketsThe FTSE 100 index had £38bn wiped off its value as global stock markets started the year with a rout sparked by fresh fears over the Chinese economy.Investors returning after the Christmas break were greeted by turmoil on stock exchanges, with Germany’s share index posting its worst start to a new year on record and London’s FTSE 100 putting in its second-worst start. As European markets closed, Wall Street looked set for the sharpest new year losses since the 1930s. Continue reading...

|

|

by Helena Smith in Athens on (#ZKV9)

Last year was deeply tumultuous for the troubled country but with growing fears of social unrest, 2016 could be even more unpredicatableWhen Stavros Staikos thinks of the year ahead, he expresses dread. Although stoic in demeanour, the retired merchant seaman struggles to be upbeat about his country and his own circumstances. “It’s hard to be optimistic,†he says, waiting his turn for financial advice in the central Athens branch of the Union of Consumers and Borrowers. “Who’d have thought it would come to this? Who’d have thought that at the age of 63, I’d be worried sick about losing my home.â€Like an odyssey without end, Greece’s great economic crisis goes on and the predicament of people such as Staikos is igniting new fears of social unrest. Continue reading...

|

|

by Nick Fletcher (until 2.45pm) and Katie Allen on (#ZHTR)

Share trading in China halted as survey renews fears of economic slowdown.Eurozone manufacturing improves, but UK and US below expectations.Around £38bn wiped off FTSE 100.5.38pm GMTSo it’s been a not-so-happy new year start on stock markets.Any investors hoping 2016 would bring some fresh market forces will have been spooked by a very familiar pattern today, as weak manufacturing data from China again provided much of the (downward) momentum.5.01pm GMTTime for a round-up of European stock markets at the close and on many exchanges it’s clearly been the worst start to the year for many years.The FTSE 100 has lost almost 2.4% on the first day of trading in 2016, that’s a drop of 149 points to 6093. The bluechip index is now at its lowest since 22 December and today marked the biggest one-day drop since a 2.5% fall on 28 September 2015. It is also the second worst opening day on record, says RBS.FTSE 100 posts 2nd worst opening day on record, down 2.6%. (h/t/ @asentance for eagle eyes on chart) pic.twitter.com/ctqs8uXj3jIf the Dow closes where it is now, down 2.2%, it will be its worst opening day performance since 1932, when it fell 8.1% on Jan 4 that year.Dow's worst starts to a year over the past century: -8.1% in 1932 -2.3% in 1922 -1.8% in 1983 -1.7% in 1930, 1980 and 2008 Currently -2.5%4.33pm GMTJust when you thought it might be safe to bet on a rising oil price, Brent crude has turned negative.It had rallied to a session high of $38.99 a barrel earlier on the back of predictions supply could be hit by tensions between Iran and Saudia Arabia. But the price fell back on worries about slower demand after news of a further factory slowdown in China and releases from the US showing its construction and manufacturing sectors had lost steam.4.23pm GMTMeanwhile, former Bank of England policymaker David Blanchflower has been scouring the skies for omens....Just saw my first adult bald eagle of 2016 not sure what it means as stocks plunge but I couldn't see any vultures circling though4.18pm GMTSweden’s central bank has come a step closer to intervening in currency markets to weaken the crown, which it worries is keeping inflation from rising back to more normal levels.Against the backdrop of negative interest rates, a quantitative easing programme and a Swedish inflation rate in negative territory at -0.1%, the Riksbank’s governor Stefan Ingves said last week the central bank was ready to start currency interventions to stop the crown from strengthening.“Since the last monetary policy meeting in mid-December, the Swedish krona has appreciated against most other currencies. If this development were to continue, it could jeopardise the ongoing upturn in inflation.â€3.51pm GMTWith global downturn fears prompting such a rocky start to the new year for global markets, what perfect timing for the IMF’s new economist to share his predictions for 2016.

|

|

by Phillip Inman economics correspondent on (#ZJKT)

Surprise announcement that Treasury’s most senior civil servant will quit role in April triggers search for his successorSir Nicholas Macpherson, the Treasury’s most senior civil servant, will step down in April after 10 years advising successive chancellors of the exchequer.The surprise announcement will trigger a search for a new permanent secretary, most likely from the ranks of the Treasury’s senior staff, although the No 10 adviser Tom Scholar was cited by some insiders as a possible successor.

|

|

by Hilary Osborne on (#ZKKH)

Figures show consumer credit rose by 8.3% in the year to November, with borrowing on credit cards up by £411mConsumer borrowing on credit cards, loans and overdrafts is growing at its fastest rate since before the financial crisis, according to Bank of England figures that brought further warnings over the state of UK household finances.Unsecured consumer credit was up 8.3% in the 12 months to November 2015, the Bank’s figures show, with consumers borrowing an additional £1.5bn in November. This was compared to an average increase of £1.2bn over the previous six months. The growth rate was the highest since February 2006.This will fuel concern that consumers are borrowing more and saving less to finance their spending Continue reading...

|

by Dana Nuccitelli on (#ZJ6R)

A survey of economists with climate expertise finds a consensus that climate change is expensive and carbon pollution cuts are needed