|

by Jana Kasperkevic in New York and agencies on (#13J1M)

Wall Street unimpressed after Fed chief refuses to rule out return to modest increases should financial market turmoil blow overThe chair of the Federal Reserve has dropped the broadest of hints that it has put future US interest rate increases on hold following the plunge in global stock markets since the start of the year.In testimony before Congress, Janet Yellen admitted that the selloff in shares on Wall Street had affected the growth prospects for the world’s biggest economy and left investors in little doubt that the US central bank had no intention of following last December’s increase in the cost of borrowing with a second increase in March.Related: There wasn't much Yellen could say that wouldn't have spooked the marketsRelated: Global markets fall after US jobs report raises prospect of interest rate riseRelated: Federal Reserve keeps interest rates unchanged while monitoring markets Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-13 07:15 |

|

by Nils Pratley on (#13J1P)

Below-zero interest rates may prove a threat to the whole financial sector if they last for too longDeutsche Bank’s shares rose 10% on Wednesday. Is the panic over Germany’s biggest bank over? Well, a quick bounce in the share price is a useful start but any other reaction would have been alarming given the force of the verbal counter-offensive.Chief executive John Cryan had declared Deutsche to be “absolutely rock-solid†and Wolfgang Schäuble, the country’s finance minister, was obliged to lend a hand by saying he had “no concerns†about the bank. Even after these proclamations, Deutsche’s shares are still down 33% since the start of the year and the bank is priced at half its book value. So, no, the crisis is not over – not for Deutsche and not for the wider banking sector. Continue reading...

|

|

by Phillip Inman and Hilary Osborne on (#13HYZ)

QE and low interest rates have handed extra wealth to richest households by propping up stock markets and supporting booming house prices, says reportBank of England policies to help Britain’s economic recovery have made inequality worse and increased the wealth gap between young and old, according to a leading credit ratings agency.A study by Standard & Poor’s has found thatthe low interest rates and quantitative easing used to rescue the economy after the 2008 crash have handed extra wealth to the richest households by propping up stock markets and supporting booming house prices.Related: If there is a fresh banking crisis, taxpayers deserve to be protected Continue reading...

|

|

by Letters on (#13HX3)

“Nonetheless, any progress in reducing the trade deficit is likely to be extremely slow in the near term, leaving the recovery reliant on domestic demand.†So said an analyst quoted in your report on the UK goods trade gap having reached a record £125bn last year (Financial, 10 February). So, if I go out and exchange my four-year-old car for an expensive one that I cannot afford, apparently I shall have “recoveredâ€.In fact, though the chancellor might be happy in the short term because of the VAT he would harvest, I should be feeling decidedly queasy wondering how I was going to service the debt I had taken on to make the purchase. But no, according to current economic theory, I would be in recovery. Makes you wonder, doesn’t it?

|

|

by Larry Elliott on (#13HVT)

The Fed chair’s testimony to Congress in the wake of the controversial interest rate rise had to be circumspectInterventions by central bank governors to soothe troubled financial markets come in two forms: the ones that have a modest, transitory effect and the much rarer ones that make a real difference.Mario Draghi’s “whatever it takes†speech in London in July 2012 fell into the second category. When the president of the European Central Bank said he was prepared to take on the speculators attacking Italy and Spain, the markets got the message: the ECB was prepared to use unlimited firepower to act as a lender of last resort. The speculators backed off immediately. Continue reading...

|

by Guardian Staff on (#13HSG)

The chair of the Federal Reserve, Janet Yellen, appears before Congress on Wednesday to report on the state of the US economy, and says that she anticipates further rises in interest rates despite global stock market upheaval. Highlighting the growth in employment rates and wages, Yellen says the Federal Open Market Committee expects ‘gradual adjustments in the stance of monetary policy’, but suggests these hikes could come at a slower pace than anticipated if the economy were to underperform over the coming year Continue reading...

|

by Tom Clonan on (#13H8F)

As the international poster child for austerity, Ireland isn’t equipped to deal with the rise in serious gun crime that has links to ex-terrorists and drug traffickersIs Dublin in the grip of a vicious crime war? Two execution-style gangland murders in the space of a week – one at a crowded boxing event at a hotel in the Irish capital – have caused widespread shock and just weeks before a general election, political consternation.Ireland’s homicide rate is broadly similar to its EU neighbours. It stands at about 1.1 per 100,000 citizens on an annual basis. This is slightly higher than the UK, with a homicide rate of 0.96 per 100,000. France is slightly higher again at 1.2 persons per 100,000. Ireland’s central statistics office states that a total of 1,068 Irish people died by homicide between 2004 and 2014.Related: Dublin boxing weigh-in shooting death linked to gangland feudUp to now, Irish criminal gangs have typically used small caliber handguns such as Glock automatic pistolsRelated: Dublin gang wars: council advises estate residents to move out for safety Continue reading...

|

|

by Patrick Butler on (#13GM5)

Mary Cameron has signed a petition against the closure of children’s services in Oxfordshire. The austerity programme is set to lead to rebellion by rural ToriesThe prime minister’s mother, Mary Cameron, has signed a petition against the planned closure of children’s services in Oxfordshire, the Tory-run council that covers her son David’s Witney constituency. There is a delicious piquancy to her act of rebellion – cue Twitter fantasies that her wayward son faces a maternal dressing down over Sure Start cuts, and might even be sent to the “naughty stepâ€.Related: David Cameron's mother signs petition against cuts to children's servicesRelated: David Cameron hasn’t the faintest idea how deep his cuts go. This letter proves it | George Monbiot Continue reading...

|

|

by Larry Elliott Economics editor on (#13GGD)

Christine Lagarde says it is hard to see the programme continuing ‘without substantial effort’ to improve governanceThe International Monetary Fund has warned it will halt its $40bn (£28bn) bailout programme to Ukraine unless the conflict-torn eastern European country takes immediate action to tackle corruption.The IMF’s managing director, Christine Lagarde, said on Wednesday that “without a substantial new effort†to improve governance, it was hard to see how the Washington-based organisation could continue to provide financial help. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#13GAC)

‘Dismal’ December figures cap bad year for UK industry, which had shown signs of recovery in 2013 and 2014Britain’s industrial production fell by 1.1% in December after warm winter weather forced a sharp decline in energy output and the low oil price hit North Sea oil producers.The manufacturing sector experienced a further fall from an already weak November, while mining and quarrying also dropped, fuelling concerns that the slowdown in the US and turmoil on global markets is undermining confidence across the UK’s major export industries.Related: UK's productivity plan is ‘vague collection of existing policies’ Continue reading...

|

|

by Phillip Inman and Rob Davies on (#13FHX)

China, emerging markets, the eurozone, oil and commodities all pose a threat to the banking sector this yearBanking shares have come under pressure this week as investors express fears that the sector will be badly hit by a global economic downturn. Financial institutions have strengthened their balance sheets since the 2008 financial crisis, but they could be in for a turbulent year if potential flashpoints such as emerging markets or the energy sector produce a cascade of debt defaults. Here are the five biggest threats to the banking sector:

|

|

by Graeme Wearden (now) and Nick Fletcher on (#13C24)

The London stock market hits lowest level since July 2012, after a 5% plunge in Japan overnight, while US markets are volatile

|

by Editorial on (#13E74)

As Janet Yellen heads to Capitol Hill, it may be tempting to vow she will stick with her plan. She would do better to keep her options wide open in a world of financial fluxThe way to earn authority is, very often, to say that something is going to happen before it does. In December, the chair of the Federal Reserve, Janet Yellen, was lauded for raising interest rates just when everyone expected it. The Fed also gave hints about the pace and scale of further rises later on. And if the future unfolds in line with the plan, the words of Ms Yellen will acquire extra weight – weight that is undoubtedly useful when you are steering the world’s largest economy.It may thus be tempting, and not only for reasons of pride, for Ms Yellen to pretend that not all that much has changed since the end of last year when she faces two committees on Capitol Hill on Wednesday and Thursday. But it is a temptation she should resist. For if nothing burnishes authority like foretelling the future, nothing breaks the spell of command like responding to changing facts with denial. The Fed rightly held back from rushing to conclusions about the recent wild swings in the markets last month. But it is now safe to conclude one thing: just how much there is that the powers that be don’t know. Continue reading...

|

by Jill Treanor on (#13E4D)

Deutsche boss forced to reassure staff that bank is rock solid as volatile markets focus on sector’s ability to weather low interest ratesGrowing anxiety about whether banks can withstand continued low interest rates and fears of a re-run of the 2008 financial crisis continued to stalk markets when shares fell to a three-year low and bank shares remained volatile.As shares in Deutsche Bank plumbed new depths on Tuesday and the bank’s chief executive had to reassure its 100,000 staff that it was “rock solidâ€, concerns mounted about the health of the global banking sector.Related: Global woes will delay UK interest rate rise until 2020, say analysts Continue reading...

|

|

by Jill Treanor on (#13CY8)

John Cryan emails 100,000 staff to reassure them about financial health of Germany’s biggest lender after shares fall 14.5% in two daysGerman’s finance minister and the chief executive of Deutsche Bank have both attempted to allay concerns about the health of Germany’s biggest lender as its shares kept falling on another day of financial market turmoil that left London’s stock market at its lowest level for more than three years.Wolfgang Schäuble said on Tuesday he had “no concerns†about Deutsche Bank, speaking shortly after John Cryan, who was appointed to run Germany’s biggest bank seven months ago, sent an email to his 100,000 staff to assure them the bank was “absolutely rock solidâ€. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#13DM7)

Landmark event marks first time in decade that investors have been prepared to pay for privilege of lending to G7 governmentA rush to “safe-haven assets†has sent the interest rate on Japanese 10-year bonds plummeting below zero, the first time in the history of government debt that the yield on a G7 country’s 10-year bonds has been negative.The interest rate on the 10-year Japanese government bond (JGB) touched minus 0.01% in trading on Tuesday. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#13CH0)

Drop in chemical exports and North Sea oil’s decline not offset by aircraft and car salesBritain’s trade deficit worsened in the final quarter of 2015 amid global market turmoil and a slowdown in emerging market growth that has hit exports.The shortfall between exports and imports widened from £8.6bn in the third quarter to £10.4bn, fuelling concerns that UK’s deteriorating trading position will be a drag on GDP growth this year.

|

|

by Barry Eichengreen on (#13DAK)

The moment when China could have made a smooth transition from pegged currency to a flexible exchange rate has now passedChina’s exchange rate policy has been roiling global financial markets for months. More precisely, confusion about that policy has been roiling the markets. Chinese officials have done a poor job communicating their intentions, encouraging the belief that they do not know what they are doing.But criticising Chinese policy is easier than offering constructive advice. The fact is that the government no longer has any good options. No question, the country would be better off with a more flexible exchange rate that eliminated one-way bets for speculators and acted as an economic shock absorber. But the literature on “exit strategies†– on how to replace a currency peg with a more flexible exchange rate – makes clear that the moment when China could have navigated this transition smoothly has now passed.Related: What's holding back the world economy?Related: The perils of China's currency devaluation Continue reading...

|

|

by Nick Fletcher on (#13D3A)

The FTSE 100 has fallen 9% so far this year along with most markets around the world – but some countries are still performing wellGlobal stock markets have been in turmoil since the start of the year, falling sharply as investors worry about the economic outlook, the slump in oil prices and concerns that central banks could run out of ammunition to cope with a downturn.Commodity companies are under pressure after a slowdown in China, while banks have been hit by the arrival of negative interest rates and fears about their exposure to struggling sectors of the economy.Related: Market turmoil: FTSE 100 hits three-year low as rout continues - business live Continue reading...

|

|

by Mark Blyth on (#13D2H)

Financial markets no longer know what is good or what is bad for them – so how can they know who to blame when things go wrong?One of the oddest things about 2016, so far at least, is how economic common sense is being twisted in all sorts of ways to explain what’s going on in the global economy.By the end of 2015 market commentators were clamouring for an interest rate rise from the Federal Reserve to restore confidence. Normally, the only reason to raise rates is if there is inflation in the economy and you want to squeeze it out.

|

by Phillip Inman Economics correspondent on (#13CYJ)

Weak global economy and sharp slowdown in UK growth will prevent any rise from 0.5% for at least four years, says EIUAnxiety in global markets and a weakening US economy will force the Bank of England to delay UK interest rate rises until at least 2020, according to a leading firm of analysts.The Economist Intelligence Unit (EIU) forecast, which will cheer mortgage borrowers and disappoint savers, extends by at least three years the timeline for the central bank’s first increase from the historically low 0.5%.Related: Market turmoil: European markets fall again after Japan's 5% rout – live updates Continue reading...

|

by Ian Thomson on (#13C3E)

Our role as obedient customers is put under the spotlight in an ambitious 600-year history of global economicsJG Ballard’s last published novel, Kingdom Come, unfolds in a fictional London suburb called Brooklands, where a vast shopping mall fosters a bovine social docility. In the book’s wayward conceit, consumerism is a totalitarian device used to control people and their artificial wants. Fired up by dreams of wealth, Brooklanders indulge in Black Friday-style bargain hunting in their local Metro-Centre.Ballard was not the first to see shopping as a secular religion. Émile Zola, in his 1883 novel The Ladies’ Paradise, tells the rise of a department store in late 19th-century Paris and its role in the new mass consumption. With its silk counters and perfume department, the store looks forward to our age of indiscriminate purchase and credit binge. Far from aiding the French economy, Zola’s cathedral of commerce heralds a new retail Europe of consumer anxiety, boom and bust.Atlantic slavery was one of the most nearly perfect commercial systems of modern times Continue reading...

|

by Graeme Wearden (now) and Nick Fletcher on (#138JQ)

Worries over the world economy and the outlook for banks have sent global stock markets tumbling again

by Nils Pratley on (#13AH9)

With the US and the world economy looking much weaker than two months ago, Janet Yellen must signal that a March rate rise is off the agendaShare prices are tumbling. Bank shares are being clobbered. There is talk of a US recession, induced by a strong dollar that is already causing havoc in China, much of the rest of Asia and Latin America. In the good – or bad – old days, we could predict what the chair of US Federal Reserve would do in these circumstances. Alan Greenspan would cut interest rates, or hint at his intention to do so.Is Janet Yellen, Greenspan’s successor but one, of similar mind? If she is, she has an opportunity to say so on Wednesday when she begins two days of testimony before Congress. This event has suddenly assumed an importance that seemed unlikely when the Fed raised interest rates last December for the first time since 2006.Related: Fears over weak growth cause global stock markets to fall Continue reading...

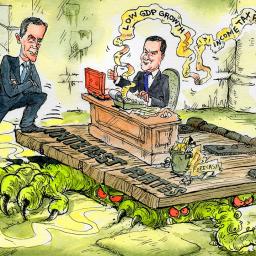

by Editorial on (#13AG3)

The chancellor has made his name by talking tough. But a new audit of his stern promises reveals that they are less than they seemMore than seven years have passed since George Osborne stood up, at the depth of the financial crisis, and pronounced that “the cupboard is bareâ€. He had previously been the young Tory moderniser, pledged to match New Labour’s social spending, but when hard times came, he recast himself as an old-fashioned bank manager, who would not shrink from telling Britain how broke it was.The same solemn pose has served Mr Osborne well ever since. It allowed him, first, to cling on at the Treasury, which wasn’t a given during the stagnation that dogged much of the first Cameron administration. It contributed, too, to his party’s stunning success last year in coming back at the end of a five-year term of shared power, during which average living standards had fallen, with a mandate to govern alone. Spelling out hard truths has proved a winning trick even when these turned out not to be, well, true. It did Mr Osborne no damage at all when his defining promise to pay down the deficit in the course of a single parliament gradually collapsed into a 10-year plan. It did him no harm, either, when he sternly committed in 2014 to the grim necessity of rolling back the size of the state to prewar proportions, before deciding that this was not after all quite necessary just before polling day, and then indulging in a second post-election rethink, deciding that he could now afford to throw a shield over the police and the army. Continue reading...

|

by Larry Elliott and Jill Treanor on (#13AF4)

London, New York, Frankfurt and Paris all experienced declines, with much of the focus on the banking sectorStock markets around the globe have plunged into the red, amid fears that weaker growth will leave banks exposed to a fresh economic slowdown.Investors dumped shares and piled into the safe havens of gold and government bonds in a resumption of the panic conditions that marked the start to trading in 2016. Continue reading...

|

|

by Larry Elliott and Phillip Inman on (#13AEE)

Share price falls, low oil prices, Brexit and volatile tax receipts just a few factors that may force chancellor into deeper spending cuts or tax rises to reach budget surplus

|

by Phillip Inman Economics correspondent on (#13A63)

The IFS says the chancellor’s plan to turn a deficit into a surplus is good politics but bad government, especially given the reliance on tax receipts and oil pricesThe last time the government showed a determination to turn a budget deficit into a surplus it was the mid-1990s. Ken Clarke was the chancellor and it was, he said, the responsible thing to do in the wake of the debts racked up following the 1990 recession.George Osborne also wants to achieve surplus, and one trend that could help him is the low oil price. If there was one overriding feature in the 1990s that kept the global economy growing and the tax receipts rolling in, apart from the giddy tech boom, it was oil at $12 a barrel.

|

by Joseph Stiglitz on (#139W2)

QE and low interest rates have disproportionately created wealth in the financial sector and inflated asset bubbles. It has done little for the real economy. The rules of the market need to be rewrittenSeven years after the global financial crisis erupted in 2008, the world economy continued to stumble in 2015. According to the United Nations’ report World Economic Situation and Prospects 2016, the average growth rate in developed economies has declined by more than 54% since the crisis. An estimated 44 million people are unemployed in developed countries, about 12 million more than in 2007, while inflation has reached its lowest level since the crisis.More worryingly, advanced countries’ growth rates have also become more volatile. This is surprising, because, as developed economies with fully open capital accounts, they should have benefited from the free flow of capital and international risk sharing – and thus experienced little macroeconomic volatility. Furthermore, social transfers, including unemployment benefits, should have allowed households to stabilise their consumption. Continue reading...

|

|

by Larry Elliott Economics editor on (#138YT)

Thinktank’s ‘green budget’ says the chancellor may have to cut spending or raise taxes to reach surplus by 2019-20

|

|

by Sean Farrell on (#138NS)

Former Standard Chartered chief says eliminating €500, $100, SFr1,000 and £50 notes would prevent corrupt payments

|

|

by Denis Campbell Health policy editor on (#136ZH)

Health minister reveals Barts set to run up £134.9m deficit, as NHS sources say trusts cannot balance books due to poor fundingThe biggest hospital trust in the country is set to run up a £134.9m deficit this year – by far the largest ever overspend in the history of the NHS.Related: This is the NHS - sign up to follow the projectRelated: NHS could save £5bn a year on running costs and 'bedblocking', finds reportRelated: Hospitals told to cut staff amid spiralling NHS cash crisis Continue reading...

|

|

by Chris McGreal in Butte, Montana on (#13697)

The death rate for white Americans aged 45 to 54 has risen sharply since 1999, but Montana officials wrestle to explain why the state has the highest rate of suicide in the US at nearly twice the national average – and it’s risingKevin Lowney lies awake some nights wondering if he should kill himself.“I am in such pain every night, suicide has on a regular basis crossed my mind just simply to ease the pain. If I did not have responsibilities, especially for my youngest daughter who has problems,†he said.Related: The Guardian view on American mortality: the price of a ruthless economy | EditorialI’m a very strong Catholic and I practice those values. No way is this from any immorality on my partIt’s to keep our head above water, to keep our kids in clothes and hot lunches. We make too much money to get helpRelated: America's poorest white town: abandoned by coal, swallowed by drugsThe power this traditional white male used to have is decreasing and they aren’t at the root of power anymore Continue reading...

|

by Larry Elliott Economics editor on (#13652)

A brief burst of Keynes prevented a 1930s-style collapse that might have led to a more fundamental rethink of the status quoKeynes’s General Theory of Employment, Interest and Money is to economics what Joyce’s Ulysses is to literature: a classic that lots more people start than finish. The same applies to two other seminal works from the dismal science: Adam Smith’s Wealth of Nations and Karl Marx’s Capital.It is a fair bet, though, that a good chunk of the Keynes devotees at last week’s British Academy celebration of the 80th anniversary of the publication of the General Theory in February 1936 had ploughed their way through Postulates of the Classical Economy to Notes on Mercantilism, while only occasionally thinking they would rather be reading Tinker Tailor Soldier Spy. Continue reading...

by Suzanne McGee on (#13643)

Goldman Sachs’ CEO Lloyd Blankfein inadvertently pushed young people closer to Democratic underdog who speaks their language of ‘economic angst’Congratulations, Lloyd Blankfein, on giving the presidential bid by Vermont senator Bernie Sanders a big boost! Oh, that wasn’t what you meant to do? Whoops …Whether or not the Goldman Sachs CEO intended to further undermine the appeal of Democratic party contender and his former paid speaker, Hillary Clinton, in eyes of a key voter bloc, that’s precisely what his description of Sanders’ campaign as having “the potential to be a dangerous moment†accomplished. And if either of them want to know why, it’s the economy stupid!Related: I worked on Wall Street. I am skeptical Hillary Clinton will rein it in | Chris ArnadeRelated: Millennials 'heart' Bernie Sanders: why the young and hip are #FeelingtheBern Continue reading...

|

by Guardian Staff on (#135TW)

The chancellor faces lower GDP and lower tax receipts as a result. So it’s vital that consumers’ desire to keep spending isn’t hit by a nasty shock from the BankGeorge Osborne might be running out of friends when next month’s budget arrives. Like every chancellor before him, he likes to distribute goodies to lift the spirits of his backbench colleagues. More than that, he will want to offset the worst effects of the Treasury’s austerity measures.This he did in spectacular fashion at last November’s autumn statement when higher GDP growth forecasts for the next five years allowed him to scrap planned cuts in tax credits. Continue reading...

|

|

by William Keegan on (#135KW)

The corridors of power contain sceptics about everything from Europe to austerity. But nothing flickers on the imperturbable Treasury facadeOne of the key negotiators of the terms of UK entry to the European Economic Community in the early 1970s went down in history as a loyal servant of prime minister Edward Heath, but himself had doubts about the entire venture.The man in question, who is, as they say, no longer with us, would no doubt have been of great interest to the present band of Eurosceptics whom David Cameron is trying, if not exactly to win over, at least to pacify. His view was simple, and could be broadly paraphrased as: “Why did we fight the second world war if we end up doing this?†Continue reading...

|

|

by Guardian Staff on (#131KJ)

The United States added 151,000 new jobs in January, much less than expected and nearly half the figure for December. The sectors with the most growth were retail, food services and healthcare while manufacturing saw a downturn, with some pointing to the cold start to the year as a cause Continue reading...

|

|

by Jana Kasperkevic in New York and Katie Allen on (#130FW)

US jobless rate dips below 5% for first time since February 2008 to overshadow news that January jobs report was weaker than expectedGlobal stock markets fell on Friday after the news that US wages picked up and unemployment fell to an eight-year low raised the prospect of another interest rate rise in the world’s biggest economy this year.The US jobless rate dipped below 5% for the first time since February 2008 to come in at 4.9% in January, the US Department of Labor reported. That fresh dip in unemployment and news that employers had increased hours for workers helped to overshadow a weaker than expected rise in new jobs in January.Related: US economy created 151,000 new jobs in January as jobless rate hits 4.9% - business live"We've recovered from the worst economic crisis since the 1930s." —@POTUS: https://t.co/oAm205Zui1 https://t.co/sdy9UTqLXiRelated: Stock markets suspect Federal Reserve has interest rate jitters Continue reading...

|

|

by Graeme Wearden and Nick Fletcher on (#12ZJZ)

America’s jobless rate has fallen to 4.9% after US companies took on 151,000 new hires in January, fewer than expected

|

by Larry Elliott on (#130R4)

Weaker than expected rise of 151,000 new jobs backs evidence that the US economy is heading for a bumpy rideHindsight is a wonderful thing. It’s easy to be wise after the event and say a decision was a mistake. But it’s hard to imagine that the Federal Reserve would have raised interest rates in December had it known then what it knows now.News that employment growth as measured by the increase in non-farm payrolls was up by 151,000 is just the latest piece of evidence to suggest that the US economy is going through a tough period. Growth in the fourth quarter was weak, sales of durable goods suggest that businesses are reluctant to invest, and consumers are saving rather than spending the windfall from lower oil prices.Related: US economy adds 151,000 jobs amid rising concern about loss of momentum Continue reading...

|

by Julia Kollewe on (#12ZRG)

Deputy governor says no signs yet that looming vote has hurt company investment plans but Bank of England is keeping a close eyeThe Bank of England has not seen any signs that UK companies are scaling back their investment plans because of uncertainty caused by the looming EU referendum, a top Bank official said.Deputy governor Ben Broadbent was asked how the referendum on Britain’s membership of the European Union, likely to be held in June, was affecting the economy.Related: Brexit could slash sterling by 20%, warns Goldman Sachs#Brexit campaign has its biggest lead (9pts) after voters reject Cameron deal on EU reforms. @YouGov for @thetimes pic.twitter.com/EenrkKvNjj Continue reading...

|

|

by Timothy Garton Ash on (#12ZD7)

Economics is not a hard science, and mathematical models won’t explain why people behave as they do. A much broader perspective is neededThe Guardian recently asked nine economists whether we’re heading for another global financial crash and they gave many different answers. Yet still we turn to economists as if they were physicists, armed with scientific predictions about the behaviour of the body economic. We consumers of economics, and economists themselves, need to be more realistic about what economics can do. More modesty on both the supply and the demand side of economics will produce better results.Following the great crash that began nearly a decade ago, there has been some soul-searching about what economics got wrong. Probably the self-criticism should have been more far-reaching, both in academia and banking, but it’s there if you look for it. In particular, the economic thinkers loosely clustered around George Soros’s Institute for New Economic Thinking (Inet) have produced a telling account of what went wrong.Related: Are we heading for a crash? | Albert Edwards, Aditya Chakrabortty, Linda Yueh, Ruth Lea, Fred Harrison, Vicky Pryce, Dambisa Mayo, Yanis Varoufakis, Mariana MazzucatoThe dominant strain of academic economics failed to see the crisis coming, and actually contributed to it Continue reading...

|

|

by Philip Soos on (#12Y77)

Australia’s household debt is among the highest in the world, so why is there so much focus on our relatively low government debt?Contrary to the concerns about government delivering numerous budget deficits, it is the growth and acceleration of private debt we, alongside policymakers, should be worried about - not public debt, which amounts to little more than a neo-con scare campaign. This is because private debt drives asset price inflation (bubbles). These bubbles always burst, causing economic destruction and financial disruption.Just ask the Americans, Irish or Japanese. Yet, all we hear from the Coalition and ALP is the need to transition the budget back to surplus as this represents “fiscal responsibilityâ€, while treating private debt as a no-go zone. Why? Because Australia’s household sector is the most indebted in the world and nobody wants the value of their homes and investment properties to sink. Continue reading...

|

by Nils Pratley on (#12Y36)

Hints that the Fed won’t raise interest rates in March are proving to be good news for miners and oil producers’ share pricesDid you miss Thursday’s super soaraway stock market? OK, it was a local affair that wasn’t obvious in the headline figures – the FTSE 100 index advanced a trifling 60 points, or 1%. But look what happened to some very large companies. Anglo American up 20%, Glencore 16% higher, BHP Billiton 11% dearer, even the Shell colossus advanced 6%. These are huge moves. What happened?The short answer is that the market suspects the US Federal Reserve is having second thoughts about increases in interest rates. Nor is the idea wildly speculative. William Dudley, a top Fed official, said on Wednesday that monetary conditions had tightened since December’s quarter-point rise and rate setters would have to take note. Further strengthening in the dollar, added Dudley, could have “significant consequences†for the health of the US economy. Translation: the Fed probably won’t raise in March. Continue reading...

|

by Sean Farrell on (#12XX6)

Bank, which is being investigated by SFO over its fundraising during financial crisis, had argued that documents were protected by client-lawyer privilegeBarclays has agreed to hand over internal documents to the Serious Fraud Office in a change of approach towards the SFO’s investigation into its rescue fundraising during the financial crisis.The bank will give the SFO communications linked to the inquiry into whether Barclays and its leaders made false and misleading statements about a £7bn deal with Middle Eastern investors. Continue reading...

|

|

by Graeme Wearden on (#12VSS)

Rolling coverage of Mark Carney’s press conference, after the Bank of England cuts its UK growth forecasts and warns that the global economy is weakening

|

|

by Guardian Staff on (#12XPC)

Protesters in Athens throw petrol bombs and stones at police during a demonstration against pension reforms on Thursday. Police fired rounds of teargas and stun grenades to repel the protesters. The main rally was largely peaceful with 50,000 Greeks marching to the parliament to demand an end to austerity reforms Continue reading...

|

by Nouriel Roubini on (#12WZH)

Countries around the world should get used to pattern of unfamiliar inflation, growth, monetary policies and asset pricesSince the beginning of the year, the world economy has faced a new bout of severe financial market volatility, marked by sharply falling prices for equities and other risky assets. A variety of factors are at work: concerns about a hard landing for the Chinese economy, worries that US growth is faltering at a time when the Federal Reserve has begun raising interest rates, fears of escalating Saudi-Iranian conflict and signs – most notably plummeting oil and commodity prices – of severe weakness in global demand.And there’s more. The fall in oil prices, together with a lack of market liquidity, the rise in the leverage of US energy companies and that of energy firms and fragile sovereigns in oil-exporting economies, is stoking fears of serious credit events and a systemic crisis in credit markets. And then there are the seemingly neverending worries about Europe, with a British exit from the European Union becoming more likely, while populist parties of the right and the left gain ground across the continent.Related: Is stagnation the 'new normal' for the world economy? Continue reading...

|

by Sarah Marsh on (#12WRV)

Proving your social prowess these days is not about ostentatious displays of wealth but green credentials, a report suggests. Tell us how you make friends and influence peopleHow do you keep up with the Joneses in the modern age – buy a flashy car? Show off your tan (from an exotic holiday, of course)?If your answer is any of the above then you are probably a bit out of touch. That is, according to Ryan Murphy, author of a paper from the Adam Smith Institute titled The New Aristocrats. He claims that attempting to impress your neighbours with ostentatious displays of wealth is now out of fashion. Continue reading...

|