|

by Larry Elliott, Jill Treanor and Graeme Wearden in on (#11A9K)

As shares tumble across global markets, the reaction at the World Economic Forum has varied from pessimism to stoicismI think we’re witnessing a collision of events which has provoked an immediate sense of crisis. Whether it’s commodities, China, oil prices, terrorism, geopolitical turbulence – all have landed particularly in the month of January, and there is an immediate impact which is reflected in the stock market. At the moment what is being discounted are some of the positives that come out of low oil prices in economic terms. It is only being looked at in the lens of bad news. Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-09 21:53 |

|

by Larry Elliott on (#11A7M)

The days when one country’s economic woes could be insulated from the wider world have long gone. China’s problems could have a fearsome domino effectAnother day, another financial spasm. In London, New York, Shanghai and Frankfurt the story was the same: shares dumped and the oil price crashing to its lowest level since 2003 on fears that the China is heading into a recession that will drag the rest of the world economy down with it.Despite the fresh sell-off in financial markets on Wednesday, this is far from a done deal. For the doomsday scenario to materialise, China would need to have a hard landing, rather than simply a bumpy one, the rest of the world would have to be ripe for its own crisis, and there would need to be a transmission mechanism for delivering a problem centred on east Asia to the rest of the global economy.Related: Beware the great 2016 financial crisis, warns leading City pessimistRelated: China economy grows at slowest pace in 25 years, latest GDP figures show Continue reading...

|

|

by David Blanchflower on (#119WH)

Commodity prices are falling, crude oil is tumbling, market confidence is crashing... yet the monetary policy committee seems determined not to raise interest ratesThe credibility of the Monetary Policy Committee of the Bank of England in general, and that of its governor, Mark Carney, in particular, is now seriously in question. The concern is that they may have already missed a significant downturn. Brent crude has just fallen below $28 a barrel. Commodity prices are tumbling and global markets are approaching bear territory – and there is no sign of a floor. The US and the UK are both slowing fast. But the MPC has been asleep at the wheel.Related: UK unemployment falls but wage growth weakensThe US and the UK are both slowing fast. But the Monetary Policy Committee has been asleep at the wheelRelated: Davos 2016: FTSE 100 in bear market as global economic fears grow - live Continue reading...

|

|

by Julia Kollewe on (#119GC)

There are growing fears for the health of the global economy, as shown here in graphs charting the fall of commodity prices and stock market valueGlobal stock markets suffered further heavy losses and crude oil prices continued their unrelenting slide, as world leaders and business chiefs gathered at the World Economic Forum in Davos.Related: What is a bear market? Continue reading...

|

|

by Larry Elliott on (#118YC)

Labour market data shows that despite strong employment the growth in average earnings is half the rate of pre-crash eraCast your mind back 10 years. It is early 2006 and everything seems to be going well. Unemployment is around 5%, the Bank of England prides itself on keeping inflation at or close to its 2% target, earnings are going up by 4% a year.As we now know, this was the equivalent of the Edwardian summer – the calm before the storm. Since the financial and economic crisis of 2007-09, things have never been the same again.Related: UK unemployment falls but wage growth weakens Continue reading...

|

by Larry Elliott on (#118MS)

World economy was growing when organisers put together programme but mood is more sombre nowThe organisers of the World Economic Forum were clearly tempting fate when they made the theme of this year’s Davos the onset of the 4th Industrial Revolution.The message was clear. After years in which business leaders and policymakers had agonised over the state of the global economy, the recession of 2008-09 was history and it was time for some big picture stuff. Continue reading...

|

by Julia Kollewe on (#118G6)

Migration into Europe could lift GDP via greater state spending and long-term boost to jobs market with negative effects short-lived, says reportThe recent influx of refugees into Europe is likely to raise economic growth slightly in the short term – mainly in Austria, Germany and Sweden – and could deliver a bigger long-term economic boost to the EU if refugees are well integrated into the job market, according to the International Monetary Fund.Related: Davos 2016: Global economic fears grow as stock markets dive - live Continue reading...

|

|

by Martin Farrer and agencies on (#117YC)

US crude oil fell under $28 a barrel, its lowest point since 2003, as investors took fright at increasingly negative sentiment about the global economyAsia Pacific stock markets have been pummelled as investors took fright at a continued slide in oil prices and mounting bearish sentiment about the global economy.Related: Why are we looking on helplessly as markets crash all over the world? | Will Hutton Continue reading...

|

|

by Sean Farrell on (#116XF)

International Labour Organization predicts joblessness will surpass 200 million by end of 2017 for the first time on recordMore than 3 million people will become unemployed worldwide in the next two years, making existing jobs vulnerable and fuelling potential social unrest as the global economy slows, a report warns.

|

by Editorial on (#116RH)

Now it’s official. China’s economic binge is slowing, and the effects will be felt across the world in developed and emerging markets alikeChina’s economy is slowing. For any other country, an annual growth rate of 6.8% would be exceptional: for China it was the weakest rate of expansion in 25 years. Developments in what is now the world’s second biggest economy are the reason financial markets have started 2016 in such turmoil.That threat is not lost on the global elite gathering in Davos, where the fear is that phase one of the global financial crisis was caused by the US housing market, phase two was caused by the eurozone and phase three will now be a meltdown in China. The risk is certainly there. For a start, China’s growth rate may be only about half that suggested by official statistics which are so unreliable that even members of the politburo take them with a large pinch of salt. Li Keqiang, the Chinese premier, is so sniffy about the official data that he looks at rail freight, electricity production and bank loans to judge how well the economy is actually doing. Continue reading...

|

by Nils Pratley on (#116Q8)

Some of the emerging markets where the food-to-detergent firm is big are sliding, but through it all the Unilever ship has sailed onPrepare for volatility, says Unilever’s chief executive, Paul Polman. If you’re running a global consumer goods company, this seems a sensible basis on which to plan. The price of oil and other commodities is slippery. Some of the emerging markets where Unilever is big are sliding, as are their currencies. Last year’s backdrop of “intensifying geopolitical instabilityâ€, as Polman puts it, remains in place.Investors, on the other hand, will be struck by the lack of volatility in Unilever’s business, taken as a whole. Sales growth last year, measured at the underlying level, was 4.1%, which was within a percentage point of the average over the past decade. Price increases accounted for slightly less than half that increase, suggesting brands such as Dove and Magnum retain clout with consumers. Core earnings per share improved 11% at constant currencies, completing half a decade of steady improvements. Continue reading...

|

by Graeme Wearden (in Davos) and Nick Fletcher (doing on (#114GR)

US vice-president tells the World Economic Forum that we need a quantum leap to fight cancer

by Steve Bell on (#116QA)

Continue reading...

|

by John Crace on (#116CP)

Chancellor George Osborne is very pleased with himself at Treasury Questions – everyone’s a winner in his fantasy Britain. Apart from the losers, of courseParallel worlds, parallel lives. Where most of the UK sees a decline in manufacturing, lay-offs in the steel industry and widespread insecurity about the global economy, George Osborne sees only sunlit uplands, smiling faces and Hovis adverts. Yesterday belongs to him and we are so lucky to have him.“The redundancies at Tata Steel are deeply regrettable,†the chancellor said at Treasury questions, in a voice that expressed more a sense of acceptable collateral damage than regret. “But … †But George was in charge. A force for good and a force for change. While lesser mortals prepared to quake and quail at the World Economic Forum in Davos, the Übermensch knew no fear. Everything he touched turned to gold.Related: Who doesn't want to see Jeremy Corbyn elected? It would be a glorious six-day reign | Frankie Boyle Continue reading...

|

|

by Jill Treanorand Larry Elliott in Davos on (#116AN)

PwC survey finds that two-thirds of chief executives see more threats facing their businesses than three years agoThe falling price of oil, the slowing Chinese economy and the risks of terrorist attacks are conspiring to make the chief executives of major companies around the world more concerned about the prospects for economic growth.Related: The Guardian view on the global economy: China sends a shiver through Davos | EditorialRelated: Davos 2016: eight key themes for the World Economic ForumRelated: IMF cuts global growth forecasts Continue reading...

|

|

by Sean Farrell on (#115J7)

International Energy Agency predicts increase in supply after lifting of sanctions against Iran, pushing prices down furtherThe world could find itself drowning in oil this year and prices could fall further as new Iranian output cancels out production cuts elsewhere, according to the International Energy Agency.An increase in supply and weakening demand growth will ensure there is an overabundance of oil until late 2016 at the earliest, the IEA said in its January report. It said the result would be the third successive year when supply exceeded demand by 1m barrels a day, and the system would struggle to cope.Related: IMF cuts global growth forecasts Continue reading...

|

|

by Phillip Inman, Larry Elliott and Patrick Collinson on (#115CV)

Currency traders react to Mark Carney’s downbeat assessment by selling pound to $1.42, its weakest since March 2009The Bank of England governor has sent the pound into a nosedive after he ruled out an early rise in interest rates, saying UK growth was still too weak and pointing to recent turmoil in the global financial markets.Speaking in London as the International Monetary Fund (IMF) downgraded its forecast for global growth this year, Mark Carney said the UK faced “a powerful set of forces†that prevented policymakers from raising rates. “The world is weaker and UK growth has slowed,†he added.Related: No set timetable for rate rise, says Carney, as UK inflation hits 11-month high - liveRelated: IMF cuts global growth forecasts Continue reading...

|

|

by Guardian Staff on (#115R5)

In a speech at Queen Mary University of London on Tuesday, the Bank of England governor, Mark Carney, says there’s no reason to raise interest rates from their record low of 0.5%, given a collapse in oil prices, volatility in China and weak UK growth. Photograph: Frank Augstein/Getty Images

|

by Larry Elliott Economics editor on (#115J6)

A rate rise in the second half of 2016 is becoming a more remote possibility by the monthMark Carney is halfway through his five-year term as governor of the Bank of England. Judging by his latest remarks on the state of the economy, he could go back to Canada in the summer of 2018 and still not have raised interest rates.

|

by Guardian staff, Guardian readers on (#114XC)

The Guardian is looking at the future of international news, and examining the issues that will shape our world over the next five years

|

|

by Guardian Staff on (#114WE)

GDP figures showing China’s economy grew at 6.8 percent in the final quarter of 2015 indicate a worrying downward trend, says an analyst on Tuesday. ‘It does herald a very severe slowdown in the Chinese economy’, said Enzio Von Pfeil, an investment strategist at Private Capital Limited in Hong Kong. Photograph: Reuters/Bobby Yip

|

|

by Larry Elliott Economics editor on (#114V2)

Latest World Economic Outlook report cuts growth by 0.2% in 2016 and 2017 and calls on states to step up public investment or risk derailing recoveryThe International Monetary Fund has added to concerns about the health of the global economy by cutting its growth forecasts for the next two years and warning that recovery from the financial crisis could be derailed altogether if key challenges are mishandled.The Washington-based body said world output would be 0.2 points lower in 2016 and 2017 compared with forecasts made just three months ago – and that the risks to its predictions were to the downside.

|

|

by Justin McCurry in Tokyo and agencies on (#113YN)

World’s second-largest economy posts figures that add to fears of a slowdown that will affect financial markets across the worldChina’s economy grew at its slowest rate in a quarter of a century in 2015, data released on Tuesday showed, increasing pressure on Beijing to address fears of a prolonged slowdown and ease the jitters affecting global markets.The full-year growth of 6.9% was only just short of government expectations of 7% but by contrast, growth in 2014 stood at 7.3%.Related: Why are we looking on helplessly as markets crash all over the world? | Will HuttonRelated: China sees 'many challenges' in 2016 as trade slumps on weak external demandRelated: Australian consumer confidence falls again amid Chinese economy worries Continue reading...

|

|

by Justin McCurry in Tokyo on (#114B3)

The business world has been awash with fears for China’s economy for some time, but what do Tuesday’s economic figures really show?

|

|

by Graeme Wearden on (#1116R)

All the latest economic and financial news, as world markets continue to gyrate amid fears over China’s economy

|

by Larry Elliott Economics editor on (#11318)

Monetary policy committee member Gertjan Vlieghe says debt, demographics and distribution of income could all depress interest rates for years to comeThe prospect of ultra-low interest rates persisting for years to come has been conjured up by a leading Bank of England policymaker after a further fall in oil prices and shares in London sinking to their lowest level since late 2012.Gertjan Vlieghe, one of the nine members of Threadneedle Street’s monetary policy committee, the body that sets the official cost of borrowing, said debt, demographics and distribution of income could all depress interest rates.

|

by Saeed Kamali Dehghan Iran correspondent on (#112JD)

Masoumeh Ebtekar tells the Guardian that success of nuclear talks raises hopes for peaceful resolution to Syria conflict, but warns of rival forces stoking ‘Iranophobia’The lifting of sanctions on Iran on Saturday marks a new era in bilateral relations between Tehran and Washington, one of the country’s vice-presidents has said, adding that further rapprochement is contingent on how the US goes about fulfilling its commitments under last summer’s nuclear accord.In an interview with the Guardian, Masoumeh Ebtekar warned against what she said were new attempts in the region to create a sense of “Iranophobiaâ€, though she did not single out by name Tehran’s regional rival, Saudi Arabia. Continue reading...

|

|

by Guardian Staff on (#112C6)

Nick Bryer, Oxfam’s head of UK policy, discusses a report published on Monday by the charity that shows that 62 billionaires are as wealthy as the poorest half of the world’s population put together, 3.6 billion people. He says that worldwide the richest 1% own more than the other 99% put together

|

|

by Katie Allen on (#1129J)

Unipart boss John Neill reckons he has the answer to the UK’s industrial doldrums. So he’s off to Davos to tell everyone, George Osborne includedAs George Osborne heads down to breakfast in Davos this week, he should brace himself for a lecture along with his muesli.John Neill, the businessman who spread the Japanese concept of “lean manufacturing†around Britain, wants a word with the chancellor about the UK’s woeful productivity record. He is on a mission to change the way Britain works, from restaurants to the NHS, and plans to corner Osborne when they are both at the World Economic Forum.Related: Global economic turmoil to dominate Davos discussionsRelated: Inside the Bank of England | Jill Treanor and Larry ElliottRelated: This is the NHS: live from the frontline at St George's hospital in south London Continue reading...

|

|

by Joris Luyendijk on (#1126F)

The biggest compliment you can get in the City is ‘professional’. It means you do not let emotions get in the way of work, let alone moralsAmid all the misunderstandings about global finance, the idea that bankers are a bunch of coke-snorting evildoers on the model of Gordon Gekko or the Wolf of Wall Street is probably the most widespread. It is also largely wrong. Worse: this stereotype stops us from seeing the real issue in finance and the publicly listed corporate world generally.When interviewing around 200 bankers and banking staff about finance and morality in the City of London for the Guardian, I was struck by the language they used. Not so much the profanities, though there were many, nor the technical stuff and the three-letter acronyms (TLAs). Most striking were terms that seemed designed to sidestep any possibility of an ethical discussion. When talking of their bank’s use of loopholes in the tax code to help big corporations and rich families evade taxes, bankers used words such as “tax optimisation†or “tax-efficient structuresâ€.Related: Michael Lewis: the scourge of Wall StreetIn most conversations the word ‘ethic’ came up only in combination with ‘work’Related: Why working fewer hours would make us more productive Continue reading...

|

|

by Larry Elliott Economics editor on (#110CB)

Charity says only higher wages, crackdown on tax dodging and higher investment in public services can stop divide wideningThe vast and growing gap between rich and poor has been laid bare in a new Oxfam report showing that the 62 richest billionaires own as much wealth as the poorer half of the world’s population.Timed to coincide with this week’s gathering of many of the super-rich at the annual World Economic Forum in Davos, the report calls for urgent action to deal with a trend showing that 1% of people own more wealth than the other 99% combined.Related: Number of female billionaires increases sevenfold in 20 yearsRelated: Givers that keep on giving: the world's top philanthropists Continue reading...

|

|

by Jill Treanor on (#1118E)

Survey on future of working life predicts white collar and administrative roles to see the greatest job lossesMore than 7m jobs are at risk in the world’s largest economies over the next five years as technological advances in fields such as robotics and 3D printing transform the world of work.According to a report into the impact of the so-called â€fourth industrial revolutionâ€, women will lose out in the workplace as they are less likely to be working in areas where the adoption of new technology will create jobs.Related: Robots rub up with Davos delegates Continue reading...

|

|

by Damian McBride on (#11119)

I used to think a rerun of 2008 would undoubtedly benefit the anti-capitalist left. Now I’m not so sureFive months ago this week, I invited some good-natured mockery by warning people that the only way to survive the looming economic crisis was to take a large notepad and go and watch The Revenant. We’d all be living in the wilderness soon enough, so it was time to learn how.Well I didn’t go quite that far, but I did state my profound belief that this crash would be much worse than the 2008 banking crisis, and – given how close we came to the collapse of the financial system then – it’s a reasonable fear that we won’t get so lucky twice.Related: George Osborne warns UK economy faces 'cocktail of threats'Related: George Osborne’s ‘cocktail of threats’ will leave us with a hangover | John McDonnell Continue reading...

|

|

by Katie Allen on (#10ZAZ)

Business leaders and policymakers at the World Economic Forum will focus on Chinese downturn, a commodities rout and stock market turmoilThe fragility of the global economy will take centre-stage this week with the International Monetary Fund poised to warn of growing economic risks as business leaders and policymakers gather for the annual World Economic Forum in Davos.The IMF will update its forecasts for global growth on Tuesday and is widely expected to paint a bleaker picture for the year ahead amid the deepening Chinese downturn, a commodities rout and turmoil on global stock markets.Related: Why the falling oil price may not lead to boomGlobal markets off $3.83 trillion, including U.S. $1.87 trillion (S&P 500 $1.41T) and non-U.S off $1.95 trillion18 months ago a barrel of #oil bought you a bottle of Pol Roger 2004 champagne. Today it gets you Tesco Finest. pic.twitter.com/ROxaaTmW3HWe no longer expect #BankofEngland rate hike in May but we believe MPC may well act in Aug. Interest rates likely to end 2016 at just 0.75% Continue reading...

|

|

by Katie Allen on (#10YT4)

Iranian president hails end of sanctions as western economies and companies such as Airbus stand to benefitGlobal oil prices will remain under pressure this week after Iran said it was ready to add half a million barrels a day to crude exports just hours after international sanctions were lifted this weekend.Iran’s president, Hassan Rouhani, hailed a “glorious victory†as his country relished reconnecting to the global economy following the formal announcement late on Saturday that sanctions were ending thanks to moves by Tehran to scale back its nuclear programme.

|

|

by Larry Elliott Economics editor on (#10YRK)

An economic boom usually follows a big drop in the oil price but this time maybe different – indicative not of oversupply but weakness in demandThere was a time when Blue Monday meant a song by New Order. These days it is the third Monday in January, allegedly the most depressing day of the year.Whether there is any scientific basis for this claim is debatable, but for what it’s worth the argument is that people feel miserable because Christmas is over, the credit card bills are arriving, it’s dark when you go to work in the morning and it’s dark when you head home.Related: Janet Yellen and Fed left with face full of egg after interest rate rise blunder Continue reading...

|

|

by Terry Macalister on (#10YN2)

Standard Chartered last week warned of oil at $10 a barrel. What impact would that have on North Sea oil, the consumer and the UK economy?Up to 65,000 jobs have already been lost from the British offshore oil industry since the cost of crude fell from a peak of $115 per barrel in June 2014 to its latest level of $30. A further decline to $10 would clearly turn a cull into a massacre, not least because the North Sea is a high-cost place to operate, with the break-even price for many fields around $60.Related: Saudi Aramco – the $10tn mystery at the heart of the Gulf stateRelated: Spend, spend, spend – it’s what the chancellor is praying for Continue reading...

|

|

by Phillip Inman on (#10YGP)

Personal debt and the booming property market have become the main drivers of growth in Osborne’s economyGeorge Osborne has already put in place legislation to prevent future governments racking up more debt, but consumer borrowing? Well, that’s another matter. Consumers who spend all their wages and then a bit more on top are George Osborne’s best friend.Figures last week from the Finance & Leasing Association (FLA) documents a 17% surge in new consumer borrowing during the year to November 2015. The data covered credit cards, store cards, car loans and the dreaded second mortgage, which was so popular that the value of new loans jumped 31% during the year. Continue reading...

|

|

by Guardian Staff on (#10YGR)

Since the last crisis, countless opportunities have been missed to clean up banking and address structural problems in the world economyWhen the big names from business, government and central banking meet over the champagne flutes in Davos this week, the official theme is “mastering the fourth industrial revolutionâ€. The World Economic Forum has asked participants to chew over the rise of the robots and what it means for every aspect of human lives from jobs to the environment. No doubt their conversations will be fascinating.But while Davos delegates chat about hypotheticals between canapes, beyond the mountain resort some very real problems are playing out. Wild swings on stock markets, a plummeting oil price and patchy economic news frrom the world’s two biggest economies, China and the US, have raised the spectre of a fresh financial crisis. Continue reading...

|

by Andrew Sparrow on (#10W1B)

Rolling coverage of the Fabian conference in London, with Jeremy Corbyn’s keynote speech

|

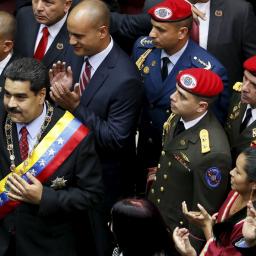

by Sibylla Brodzinsky on (#10VEG)

Nicolás Maduro wants broad powers to tackle the deep recession crippling the oil-dependent country but he faces a tough battle from the oppositionVenezuelan president Nicolás Maduro has declared an economic emergency, seeking broad powers to address a crippling recession in the oil-dependent country after official figures showed that inflation has spiralled to 141%.The vaguely worded decree would grant Maduro extraordinary powers for two months to rule on economic matters but must be approved by the National Assembly, now under control of the opposition, where he gave his state of the nation address late Friday.Related: Venezuela frees Pepsi workers it arrested for not making enough Pepsi Continue reading...

|

|

by Agencies and Guardian Staff on (#10V6Q)

Analysts predict the dollar may fall further before recovering towards the end of 2016 while stocks also suffered renewed sellingThe Australian dollar has dropped to its lowest level in almost seven years in overnight trading, falling to US68.62c.Related: How Australian households became the most indebted in the worldRelated: Gold is the bright spot in commodities rout but 2016 forecasts are divided Continue reading...

|

|

by Rupert Neate in New York on (#10T1T)

Losses followed worldwide declines due to concerns about health of the Chinese economy and falling oil price and extend US markets’ worst ever start to the yearUS stock markets suffered further heavy losses on Friday with the Standard & Poor’s 500, the index of America’s biggest companies, falling 2.2% to 1,880 points – the lowest since August 2014.The losses, which follow declines across the world due to concerns about the health of the Chinese economy and the plunging price of oil, extend the US markets’ worst-ever start to the year. The Dow Jones, which fell by more than 500 points at one point before ending the day down 391 points to 15,988, has fallen by 8.24% so far in 2016. Continue reading...

|

|

by Jana Kasperkevic in New York on (#10T9H)

Fight for 15 advocates want to make sure that when the Democratic presidential candidates debate on Sunday America’s low wages are discussedFast-food workers are flocking to Charleston, in an attempt to make sure that when the Democratic presidential candidates debate on Sunday, they do not forget about America’s low wages.Related: After Sanders criticism, Donald Trump flip-flops: US wages 'are too low'Related: Economy is resilient but Americans still need a raise, says US labor secretary Continue reading...

|

|

by Larry Elliott on (#10T6G)

Four weeks and one market meltdown later, US central bank’s decision to opt for early rate hike no longer looks so cleverTurn the clock back a month. It is the week before Christmas and the Federal Reserve has just raised interest rates for the first time in almost a decade.The mood in the markets is upbeat. A so-called Santa rally is in full swing. Dealers say the US central bank has played a blinder by keeping Wall Street sweet. If there were Oscars for central bankers, Janet Yellen would be picking up the golden statuette.Related: US stock markets take a major fall as Dow reaches lowest level since 2014 Continue reading...

|

|

by Owen Bowcott Legal affairs correspondent on (#10SWH)

Rise of 3% considered necessary due to problems recruiting and retaining senior judges in BritainHigh court judges are to receive an inflation-busting 3% pay increase next year – well above the government’s own public sector pay recommendations – taking their annual salary to £183,328.The rise, proposed by the Ministry of Justice to the senior salaries review body, is said to be necessary because there are problems with recruitment and retention of senior judges.Related: Top judge says justice system is now unaffordable to most Continue reading...

|

|

by Phillip Inman Economics correspondent on (#10SMF)

Output fell 0.5% in November, against expected rise of 0.5%, with ONS saying bad weather may have had impactBritain’s builders suffered an unexpected drop in output in November, signalling a faster slowdown in GDP growth during the final three months of 2015 than most City forecasts.Construction output fell 0.5% on a monthly basis in November, according to the Office for National Statistics, against expectations for a rise of 0.5% in a Reuters poll of economists.Related: UK housebuilding held up by lack of bricklayers, says report Continue reading...

|

by Reuters on (#10R7D)

Poor Chinese lending figures spark a sharp selloff on the country’s stock markets amid fears that monetary stimulus has not had the desired effectAsia Pacific stock markets have suffered another punishing day after continued falls in the price of oil and poor Chinese bank lending figures undermined confidence.Related: Gold is the bright spot in commodities rout but 2016 forecasts are divided Continue reading...

|

by Philip Soos on (#10QP1)

The rapid rise of capital city house prices in the past two years has propelled Australia past Denmark with a ratio of 123.08% debt to GDP, analysis showsThe results are in: Australian households have more debt compared to the size of the country’s economy than any other in the world.Related: The latest job figures are promising – but can they last amid the economic gloom? | Greg Jericho Continue reading...

|

|

by Phillip Inman Economics correspondent on (#10PTS)

Berlin recorded its fastest growth since the early days of the eurozone debt crisis, while oil prices rose marginally after Wednesday’s dip to below $30 a barrelA solid performance by the German economy and hints of a delay to the next US interest rate rise calmed nerves in London and New York after a week of panicked stock market trading that has left many investors counting huge losses.The Dow Jones index of leading US corporations climbed 225 points on Thursday while the FTSE 100 reversed a 130 loss in early trading to finish 42 points lower at 5918. Continue reading...

|