|

by Larry Elliott Economics editor on (#12WQ2)

It is now clear that interest rates won’t rise for some time, perhaps two years, but the Bank’s mixed messages dent its credibilityThe Bank of England goes to considerable lengths to explain its thinking. Once a quarter, it publishes an inflation report (pdf) running to almost 50 pages and the minutes of the latest meeting of the Bank’s monetary policy committee. When inflation is more than one percentage point away from the target, as it is now, it also releases an exchange of letters between the Bank’s governor, Mark Carney, and the chancellor, George Osborne.It is not really necessary to wade through all the analysis, though, because the late, great David Bowie summed things up in six words: always crashing in the same car. Wages and growth forecasts have been cut. Once again, the MPC has pushed back its estimate of when inflation will hit the 2% target. Carney is readying himself to send more missives to Osborne throughout the course of the year. Threadneedle Street thinks that the next move in interest rates will be up, but it is not 100% sure. The Bank’s sole hawk, Ian McCafferty, has given up the fight for the time being.Related: Bank of England cuts growth forecasts and leaves rates on hold - live updatesRelated: Has the Bank of England governor been caught bluffing on interest rates? Continue reading...

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-10 01:15 |

|

by Katie Allen on (#12WES)

Prospect of UK rate rise recedes further as Bank cuts forecasts for economic growth, wages and inflationThe prospect of a UK interest rate rise has receded further after the Bank of England cut its forecasts for growth, wages and inflation. However, the governor, Mark Carney, warned borrowers against getting too comfortable with rock-bottom rates.

|

|

by Julia Kollewe on (#12W42)

US bank predicts decision to leave would interrupt foreign capital inflow and put pressure on current account deficitAnalysts at Goldman Sachs are warning that sterling could fall by up to 20% if Britain votes to leave the European Union.The US investment bank believes Britain will remain in the EU, but its macro markets strategy team has looked at what would happen to the pound if the vote goes the other way.Related: UK better inside EU, says GlaxoSmithKline chief Continue reading...

|

by Larry Elliott Economics editor on (#12SF0)

Dow Jones industrial average falls sharply, adding to gloom about US economy and worries over global stock marketsFresh evidence of a slowdown in the US economy has added to the jittery mood of global stock markets and sent share prices tumbling on both sides of the Atlantic.Trading on Wall Street opened sharply lower on Wednesday after a survey conducted by Markit showed activity in America’s service sector growing at its weakest rate for 27 months.Related: Markets fall on weak US services industry data – as it happened Continue reading...

by Nick Fletcher on (#12QXT)

Rolling coverage of the world economy and the financial markets, as investors continue to worry about the state of the global economy

|

by Julia Kollewe on (#12RDJ)

PMI rises to 55.6 in January, but expectations for next 12 months fall to three-year lowBritain’s service sector surprised the City with stronger growth last month, but worries about financial market turmoil and the possibility of “Brexit†pushed business confidence to a three-year low.The Markit/Cips services purchasing managers’ index edged up to 55.6 in January from 55.5 in December, confounding expectations of a dip to 55.3. The figures come ahead of the latest Bank of England interest rate decision on Thursday, which is expected to see rates kept at the current level. Many economists do not expect a rate rise any time soon, while traders on money markets have pushed back their expectations to early 2018.

|

|

by Larry Elliott on (#12P7K)

Blanchflower and Machin argue labour market must tighten further before pay growth picks up, something Bank of England consistently fails to acknowledgeEven a stopped clock is right twice a day so there will come a point when the Bank of England’s forecasts for rising wage inflation will be vindicated. But not for a while.That’s the main conclusion of the latest paper from Danny Blanchflower and Steve Machin, which argues that the labour market will need to tighten substantially further before pay growth starts to pick up.Related: UK's productivity plan is ‘vague collection of existing policies’ Continue reading...

|

|

by Owen Jones on (#12MV1)

Labour’s plans for a 1p income tax hike in Scotland would provide an alternative to austerity and help the party reclaim the torch of social justice from the SNPPolitics is often as much about sentiments as substance. Few political forces understand this better than the Scottish National party. It has successfully portrayed the Scottish Labour party as the establishment, even though the SNP booted Labour out of power in 2007. It has cultivated an image of being firmly on the left and opposing cuts even though – with the commendable exception of limited land reform – it has thus far failed to redistribute wealth and power. The independence referendum politicised Scotland, and the SNP has harnessed that energy: the party is exciting and inspires its supporters. Its fired-up grassroots base passionately defends its record from all criticism, including, undoubtedly, this one.Related: Labour pushes 1p tax rise in Scotland Continue reading...

|

|

by Graeme Wearden (until 2pm) and Nick Fletcher on (#12GCE)

Rolling coverage of the latest economic and financial news, as China’s factory sector contracts again and European growth slows

|

|

by Jana Kasperkevic in New York on (#12HDX)

Former US secretary of state speaks on impact of Syrian refugee crisis as IMF chief Christine Lagarde adds she does not think world is entering new recessionTackling issues such as global inequality and the Syrian refugee crisis is difficult, former US secretary of state Madeleine Albright said on Sunday – even more difficult than fighting the cold war.Albright, who served as ambassador to the United Nations and was secretary of state under Bill Clinton, spoke as part of a panel at Wellesley College. The divisions brought out by the Syrian refugee crisis, she said, highlighted the issue of global inequality.Related: Obama outlines rules for closing gender pay gap and giving women 'fair shot' Continue reading...

|

|

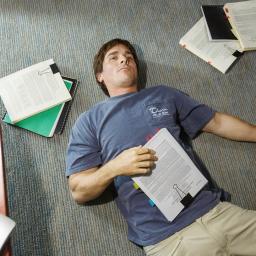

by David Cox on (#12H2G)

Filmgoers who try to pursue Michael Burry’s route to wealth, as portrayed in Adam McKay’s Oscars frontrunner, might end up morally and financially bankruptAre you as greedy, selfish and nasty as the financial wizards somehow portrayed as heroes in The Big Short? If so, now could be the time to emulate your role models.Related: The Big Short review – Ryan Gosling and Christian Bale can't save this overvalued stockRelated: How historically accurate is The Big Short?Related: The Big Short: how Wall Street's crimes have been portrayed by Hollywood Continue reading...

|

|

by Katie Allen on (#12GWB)

Headline PMI hit 52.9 in January on the back of a rise in domestic ordersBritish factories enjoyed a pick-up in activity last month but the flagging global economy took its toll on exporters and the manufacturing sector shed more jobs.A closely watched measure of manufacturing, the Markit/CIPS Purchasing Managers’ Index, beat economists’ expectations and rose to a three-month high. The headline index hit 52.9 in January, up from 52.1 in December and well above the 50-mark that separates expansion from contraction. Economists had forecast a slowdown and a reading of 51.7, according to a Reuters poll.Markit/CIPS UK Manufacturing #PMI at 3-month high of 52.9 in Jan'16 (52.1 in Dec'15) https://t.co/W0Jm2mDC8j pic.twitter.com/Fu05AiuxkH Continue reading...

|

|

by Anatole Kaletsky on (#12GWD)

A process known as ‘reflexivity’ is a powerful force in financial markets, especially during periods of instability or crisisJanuary is usually expected to be a good month for stock markets, with new money gushing into investment funds, while tax-related selling abates at the end of the year. Although the data on investment returns in the United States actually show that January profits have historically been on only slightly better than the monthly norm, the widespread belief in a bullish “January effect†has made the weakness of stock markets around the world this year all the more shocking.But the pessimists have a point, even if they sometimes overstate the January magic. According to statisticians at Reuters, this year started with Wall Street’s biggest first-week fall in more than a century, and the 8% monthly decline in the MSCI world index made January’s performance worse than 96% of the months on record. So, just how worried about the world economy should we be?Related: Why is the global economy suffering so much turbulence? Continue reading...

|

|

by Reuters on (#12FNK)

January figures in benchmark purchasing managers’ index are weaker than expected and mark a sixth straight month of contractionActivity in China’s manufacturing sector contracted at its fastest pace in almost three-and-a-half years in January, missing market expectations, an official survey showed on Monday.The official purchasing managers’ index (PMI) stood at 49.4 in January, compared with the previous month’s reading of 49.7 and below the 50-point mark that separates growth from contraction on a monthly basis. It is the weakest index reading since August 2012. Continue reading...

|

|

by Katie Allen on (#12FH9)

Business secretary Sajid Javid’s 2015 plan is ‘not worthy of the name’, says Commons committeeA committee of MPs has attacked the government’s productivity plan for lacking clear goals and original ideas on how the UK can catch up with other advanced economies.Productivity, often measured as the amount produced for every hour worked, has grown only slowly since the financial crisis, placing Britain even further behind its peers.Related: How to boost British productivity and save the NHS all at onceRelated: UK economic growth slows in 2015: what the economists are sayingRelated: Are we heading for a crash? | Albert Edwards, Aditya Chakrabortty, Linda Yueh, Ruth Lea, Fred Harrison, Vicky Pryce, Dambisa Mayo, Yanis Varoufakis, Mariana Mazzucato Continue reading...

|

|

by Julia Kollewe on (#12FGR)

In open letter to PM, more than 120 leading economists including former UN and World Bank officials say UK can do far moreMore than 120 leading economists, among them former government, UN and World Bank officials, have lambasted the UK government’s response to the refugee crisis, calling it seriously inadequate, morally unacceptable and economically wrong.In an open letter to David Cameron, the economists argue that as the world’s fifth-largest economy, the UK “can do far more†and are calling on the government to take a “fair and proportionate share of refugees, both those already within the EU and those still outside itâ€.Related: Syrian children need an education – rich countries must give $1.4bn to fund it | Malala Yousafzai and Muzoon AlmellehanRelated: Europe’s immigration bind: how to act morally while heeding the will of its people | Kenan Malik Continue reading...

|

|

by Phillip Inman Economics correspondent on (#12EEP)

Mark Carney has been dealt a weak hand and his forecast that borrowing costs would soon rise exposed as a bluff. A move into negative rates are more likelyIt will probably be “no change†at the Bank of England this week, with policymakers expected to keep interest rates at their historic low again.The monetary policy committee meets on Thursday and in all probability will sit on its hands for the 83rd straight month. Most likely the MPC will keep the base rate at 0.5% for the rest of the year.Related: Is it a bird? Is it a plane? No, it’s Super Thursday Continue reading...

|

|

by Simon Goodley on (#12DPP)

The Bank of England’s monthly interest rate announcement is all a lot more exciting than it used to be. Not that rates are very likely to be raised this monthThe fusing of the Bank of England’s announcement of its decision on interest rates with the unveiling of its quarterly inflation report is a relatively new phenomenon.It has been dubbed “Super Thursday†by economists who don’t have much else to get excited about, and has been structured in this way to either (a) allow the Bank to “take a deeper look at inflation prospects and give it a fresh perspective on the monetary policyâ€; or (b) because there’s been so little to say about rates for seven years that the Bank’s press office has got a bit embarrassed. Continue reading...

|

|

by Katie Allen on (#12DPR)

British productivity is still in the doldrums. What if the simple reverse application of Parkinson’s Law could solve it?‘It is a commonplace observation that work expands so as to fill the time available for its completion.†So wrote C Northcote Parkinson in jest about postwar bureaucracy in 1955. But his musings resonated far and wide, and now, 60 years on, what became known as Parkinson’s law is worth exploring in a country where productivity remains mired in the doldrums.What if solving the productivity puzzle is simply a case of fitting the same work into a shorter time? Continue reading...

|

|

by Will Hutton on (#12CWR)

Societies must learn to use economics to help provide purpose and fulfilmentReal men don’t eat quiche. Real economists don’t ask questions about happiness. The economy pumps out goods and services, all of which create jobs and incomes. There is no value judgment in such a statement, no view of what constitutes the good life. Even to invite such a question of an economist is to risk ridicule. The task of economists – a value-free quasi-science – is to make sure that as little as possible gets in the way of turning inputs into more outputs.But around the developed world consumers seem to be losing their appetite for more. Even goods for which there once seemed insatiable demand seem to be losing their lustre. Last week, mighty Apple reported that in the last three months of 2015 global sales of the iPhone stagnated, while sales of iPads tumbled from 21m units in 2014 to 16m in the same three months of 2015. In the more prosaic parts of the economy – from cars to home furnishings – there are other warnings that demand is saturated. Continue reading...

|

|

by Matthias Kroll on (#12B6T)

We need an estimated $1tn per year to stay below a global temperature rise of 2C. Creating new money might be the only way to meet this financial challengeThe international community has agreed on an ambitious agenda to curb climate change. Some 195 countries have decided to try and cut greenhouse gas emissions to a level that will limit the rise in average global temperatures to well below 2C. The question we now face is: how are we going to finance the changes needed to reach this goal? Quantitative easing – creating new money – might just be the answer.Related: Wanted: unprecedented collaboration to solve poverty and climate changeA percentage of that spent to bail out private banks could pay for investments needed to stabilise the world’s climateRelated: UN urges business leaders to double investment in green energy by 2020Related: $100bn? A drop in the ocean, says environment minister Amina Mohammed Continue reading...

|

|

by Phillip Inman Economics correspondent on (#129V4)

Institute for Fiscal Studies report urges governments to scrap corporate tax system and write new rules for multinationalsGoogle’s £130m tax deal with the UK reveals the need for a radical overhaul of the international tax system, according to Britain’s leading authority on tax and spending.The Institute for Fiscal Studies (IFS) said governments should consider going back to the drawing board to develop a tax system that accommodates multinationals which currently escape making corporation tax payments in some countries.Related: Google's tax deal with the UK: key questions answered Continue reading...

|

|

by Justin McCurry, Dominic Rushe and Katie Allen on (#129K4)

2016 has seen some dramatic falls already, but Bank of Japan’s negative interest rates put some hope back into the global economyGlobal markets have ended a difficult month on a stronger note after the Bank of Japan stepped in to boost its economy with negative interest rates.However, weak economic growth figures in the US underscored the scale of a global slowdown that has rattled investors. Continue reading...

|

|

by Phillip Inman Economics correspondent on (#129MV)

Stock markets rally thanks to Bank of Japan interest rate cut but the signs are the global economy is still feeling fragileIt would be easy to think that the worst is over, at least for the time being. Watching world stock markets rally after the Bank of Japan cut interest rates gave a sense of relief to many in the financial community. Oil prices, which slumped to just $27 (£19) a barrel a fortnight ago, stood at $34, up 40 cents on the day.Yet the reverse is true. If anything, investors are worried that governments and central banks have failed to realise how weak the global economy still is, seven years after the crash. Dangerous levels of private debt in China, bad debts lurking in Europe’s banking system, nervous consumers everywhere: it’s a nuclear device that needs careful handling.Related: Investors love cheap money – and hate optimistic central bankers Continue reading...

|

|

by Julia Kollewe in London (now) and Martin Farrer in on (#1275Y)

Markets also boosted by Bank of Japan’s surprise move to negative interest rates. French economy slows in fourth quarter while Spain powers ahead.

|

|

by Jill Treanor on (#128KN)

Threadneedle Street wants banks and building societies to be able to continue lending in times of stressBritain’s biggest lenders will be required to hold more capital than smaller rivals to ensure they can keep credit flowing into the economy, under proposals from the Bank of England.In the latest effort to avoid another taxpayer bailout of the banking system, Threadneedle Street will require the divisions of banks involved in lending to businesses and individuals to keep some capital in a “systemic risk bufferâ€. Continue reading...

|

|

by Saeed Kamali Dehghan on (#128GT)

Deals worth nearly €40bn were struck during the Iranian president’s four-day visit to Europe after the lifting of sanctionsAimed at renovating its ageing air fleet struck by years of sanctions, Iran Air has ordered 118 commercial passenger planes including 12 Airbus A380s, the world’s largest jet airliner. Other models on the list include 21 A320ceo, 24 A320neo and 27 A330ceo jets. Continue reading...

|

|

by Dominic Rushe and agencies on (#128D6)

US economy slowed to just 0.7% growth in the final three months of 2015 as Americans spent less and businesses cut back on investmentsThe US economy barely grew in the final three months of 2015, rising at an an anaemic 0.7% annual rate amid signs of a global economic slowdown.Related: US economic growth slows sharply in fourth quarter – live Continue reading...

|

|

by Phillip Inman Economics correspondent on (#128BM)

Big business will not invest in extra production without assurance that the yen will stay low for the time beingJapan’s exporters need all the help they can get – 25 years of stagnation have taken their toll. So a drive to push down the value of the yen, making it easier to export, can be expected to raise a cheer in the sake bars of Kyoto.And that’s just what the Bank of Japan did when it imposed a 0.1% charge on deposits. It’s not the official policy objective – fighting inflation is. Conversely, the central bank emphasises the negative impact on saving and therefore the incentive for corporates to spend their large cash piles. Continue reading...

|

|

by Sean Farrell on (#1288M)

Country’s battle with deflation enters new phase with central bank hoping to avoid pitfalls of unconventional interest rate moveThe Bank of Japan (BoJ) has imposed negative interest rates on banks to encourage them to lend to businesses, instead of hoarding cash, to support the flagging economy and the country’s battle to break free of deflation.Related: Stock markets rebound after Japan's shock move to negative interest rates – liveRelated: Bank of Japan shocks markets by adopting negative interest rates Continue reading...

|

|

by Phil Maynard on (#127VK)

A slowdown in China, plummeting stock prices, debt worries in emerging markets and low oil prices point to a bumpy patch in the global economy. Could we be on the verge of another major crisis, as some analysts warn? We look at the reasons to be fearful and cheerful about the economy in 2016 Continue reading...

|

|

by Eoin Flaherty on (#127KG)

Two things are clear: radical new ways of getting rich have been invented, and things have probably never been this unequal since before the second world warOxfam’s latest report claims that income inequality has reached a new global extreme, exceeding even its predictions from the previous year. The figures behind this claim are striking – just 62 individuals now hold the same wealth as the bottom half of humanity, compared with 80 in 2014 and 388 in 2010. It appears that not only have the global elite weathered the financial crisis, but their fortunes have collectively improved.Related: We’ve been conned by the rich predators of Davos | Aditya ChakraborttyRelated: Inequality isn’t inevitable, it’s engineered. That’s how the 1% have taken over | Suzanne Moore Continue reading...

|

|

by Justin McCurry in Tokyo on (#1270M)

The central bank has imposed a 0.1% fee on deposits in an attempt to force more borrowing as way out of the deflationary spiralJapan’s central bank has made a shock decision to adopt negative interest rates, in an attempt to protect the flagging economy from market volatility and fears over the global economy.In a 5-4 vote, the bank’s board imposed a 0.1% fee on deposits left with the Bank of Japan (BoJ) – in effect a negative interest rate. Continue reading...

|

by Albert Edwards, Aditya Chakrabortty, Linda Yueh, R on (#1276X)

Economists can’t agree if gyrating financial markets mean we face a global meltdown. We asked leading analysts to debate the question … Continue reading...

|

by David Hellier on (#1267J)

Lender believes claim made by instigator of £3.5bn deal with Abu Dhabi client to be ‘misconceived and without merit’The dealmaker who played a key role in finding backers for Barclays’ emergency fundraising during the 2008 financial crisis has filed a lawsuit against the lender and is reportedly seeking nearly £1bn.A spokesman for Amanda Staveley confirmed the existence of the claim but declined to put a figure on the total being sought by the financier and her firm, PCP Capital Partners. However, the Financial Times reported that Staveley is suing for almost £1bn. Continue reading...

|

|

by Terry Macalister on (#1263J)

Price of oil temporarily leaps 8% as Russian energy minister says February discussions with Opec members will address topic of production cutsThe price of oil jumped 8% at one stage on Thursday after Russian officials said they would discuss production cuts with Saudi Arabia and other Organisation of Petroleum Exporting Countries (Opec) at a meeting next month.Brent blend almost hit $36 per barrel before sinking back to just over $34 as Saudi sources played down suggestions it had already considered reining in crude volumes. Continue reading...

|

|

by Sean Farrell on (#1240F)

The City regulator is to re-examine events surrounding near-collapse of HBOS group and whether its bosses should face actionCity regulators are to investigate the role of HBOS’s senior management in the near-collapse of the bank during the financial crisis more than seven years ago.

|

|

by Nils Pratley on (#124S5)

The chancellor may blame the markets for cancelled share sale, but a stock like Lloyds is a weathervane for health of UK economyGeorge Osborne has discovered that share prices can go down as well as up. The chancellor has postponed his plan to flog £2bn of Lloyds Banking Group shares to the public because stock markets are deemed too “turbulentâ€, by which he means that Lloyds shares sit at 64p, well below the state’s break-even price of 73.6p.Spring had been the deadline for the sale – now it’s not. The scheme can be resuscitated at a later date but there is a simple moral to this tale: don’t make promises on timing, because markets can make you look foolish.Related: George Osborne postpones sale of last publicly owned Lloyds Bank sharesRelated: Oil prices to stay near current level throughout 2016, World Bank saysRelated: FCA orders new inquiry into HBOS chiefs Continue reading...

|

|

by Frances Perraudin and Rajeev Syal on (#125EZ)

George Osborne’s ‘northern powerhouse’ policy questioned as branch closure in Sheffield casts doubt on chancellor’s pledge to revitalise English citiesThe Department for Business, Innovation and Skills (BIS) is to close its largest office outside London, prompting accusations that the chancellor’s “northern powerhouse†project was empty rhetoric.Plans to close the BIS office in Sheffield by 2018 were announced on Thursday by the department’s permanent secretary, Martin Donnelly, who told the centre’s 240 staff that all those faced with job losses would be provided with “comprehensive supportâ€. Continue reading...

|

|

by Katie Allen on (#1242W)

Manufacturing and construction sectors falter as Brexit fears, market turmoil, China slowdown and falling oil price prompt cloud economic outlookBritain’s economy picked up pace at the end of 2015 but GDP growth for the year as a whole was down markedly, as both the manufacturing and construction sectors struggled with an uncertain outlook.Official figures published on Thursday showed GDP expanded 0.5% in final three months of 2015, up from 0.4% growth in the previous quarter and in line with the consensus forecast in a Reuters poll of economists. On a year earlier, GDP was up 1.9%, after growing an annual 2.1% in the third quarter. This latest quarter marks the slowest annual expansion rate since early 2013.Related: HBOS probe launched; UK growth hits 0.5% - business live0.5% growth in #GDP in Q4, up from 0.4% in Q3 https://t.co/HtgUwDgHlyLatest stats show economy grew at 0.5%. Shows UK continues to grow steadily & despite turbulence in global economy we're pushing ahead Continue reading...

|

by Phillip Inman Economics correspondent on (#124H9)

Rising house prices do not offset the fact that manufacturing and construction shrank in the last three months of 2015Last summer, a brief recovery in the manufacturing sector was already running out of steam. The construction sector followed the same path. Affected by a slowdown in global trade, the high value of the pound, and possibly the government’s determination to impose another five years of austerity, businesses became more circumspect about expanding output.Now, official figures for GDP growth in the final three months of 2015 show that these backbone of the economy activities, the stuff of making and building things, actually shrank.Related: UK economic growth slows in 2015: what the economists are saying Continue reading...

by Katie Allen on (#124E8)

Leading economists assess outlook for 2016 after figures show GDP growth rate falling from 2.9% in 2014 to 2.2% last yearThe UK economy expanded 0.5% in the final months of 2015 as expected, but for the year as a whole, growth was down markedly.Official figures show GDP grew 2.2% last year after rising 2.9% in 2014. That slowdown came against the backdrop of a waning global economy.Given the difficult international background, it is not surprising that the UK failed to sustain the more impressive economic growth seen in 2014. Services remains the main driver of the economy, while production and construction are down.The GDP figures demonstrate that the recovery remains fragile. While the services sector continues to grow, production is close to stagnation and the construction sector is now in recession. Every effort must be made to support both these sectors as we seek to rebalance the economy.Despite some global headwinds, the UK economy continued to deliver solid growth of 0.5% in the fourth quarter of 2015, close to its long-term trend rate. As in previous quarters, this reflected the strength of domestic demand and private services sectors, while manufacturing and construction output were broadly flat.Looking ahead, strong job creation, low energy prices and positive real income growth should keep consumer spending growth at a decent rate of about 2.5% in 2016. This should allow the UK economy as a whole to deliver continued steady growth of just over 2% this year, despite recent financial market volatility.Manufacturing ended the year on a flat note, rounding off a disappointing year for the sector. However, the picture remains very much a sectoral story, with those sectors exposed to oil and gas struggling, while those consumer facing, such as automotive, are faring much better on the back of a healthy labour market and strong wage growth.While we expect the sector to grow this year, the risks are mounting. Along with the oil price remaining low, slower growth in emerging markets, especially China, is likely to hamper export prospects.Our Deputy Chief Economist Zach Witton comments on today's #GDP and #manufacturing figures from @ONS #ukmfg pic.twitter.com/XflbvV73sDAfter volatility in the financial markets during the first few weeks of the year, these GDP figures should settle nerves about the health of the real economy. Growth of 0.5% a quarter is far from remarkable, but with services continuing to power the recovery, and housebuilding expected to undergo something of a revival as the year progresses, this expansion looks sustainable.Across the economy, high levels of debt remain a concern – especially at this point in the cycle. This debt bubble can still be deflated with effective monetary policy, and it would be wise to take action before it becomes unmanageable.The upturn masks an unbalanced economy and a slowing pace of expansion, with the annual rate of growth slipping to the weakest for almost three years. Survey data also point[s] to a further loss of momentum in December.Uncertainty over ‘Brexit’, weak overseas growth and financial market volatility are all creating an unsettling business environment and point to downside risks to the economy in 2016. The coming year could easily see the pace of economic growth slow further from last year’s 2.2% expansion, and the chances are growing that we will see yet another year in which interest rates are left at their record low of 0.5%.UK GDP +0.5% in Q4, but driven (once again) entirely by services according to ONS pic.twitter.com/dxJHKsitv5The figures mean that GDP in 2015 as a whole rose by 2.2% – respectable, but still a fairly significant slowdown from 2014’s 2.9% rate. And the economy faces a number of headwinds this year, potentially including the EU referendum and rising inflation and interest rates. So we doubt that we will see a strong pick-up in growth this year. Nonetheless, we don’t expect a further slowdown either. And we are still more optimistic than most about the prospects for growth next year.Sub-trend growth suggests one of Carney's conditions for rate rise - growth set to use up remaining slack - not met pic.twitter.com/ckqWdvfLiEIt’s a big concern how fragile the recovery still looks, and how unbalanced it is, with growth almost entirely dependent on services.We need a stronger recovery that’s built to last and that reaches all sectors of the economy. The weakness of manufacturing and construction is no surprise given the government’s lack of a proper industrial policy to boost the economy and protect crucial industries such as steel.This morning’s UK GDP figures provide a timely counterweight to some of the recent economic pessimism ... Although this was in line with median expectations, given the singular focus on the downside risks in recent weeks, many in the market were no doubt braced for a weaker outturn.Today’s data provides welcome confirmation that the economy continued to grow broadly in line with its trend. It remains to be seen whether this resilience can be maintained in the wake of the recent market turmoil. Given the strength of the labour market, exceptionally loose monetary conditions and the positive impact on consumer and business spending of the fall in oil prices, we believe it will.The outlook for the UK in 2016 remains fragile and we expect a slowdown in growth compared with last year. The public could easily vote to leave the European Union in a referendum later this year, if the latest opinion polls give an accurate picture of voting intention.While the longer term implications of ‘Brexit’ are debatable and depend on a wide range of factors, the short-term implications would undoubtedly be messy. If Brexit happens, Cebr envisions a sharp fall in the value of sterling, as well as further volatility in other financial markets. There would also be negative impacts on overseas demand for property and foreign direct investment – in the short term at least.Monetary policy will remain highly accommodative for most of the year and help sustain or even accelerate consumer credit growth – already at decade highs – and boost consumption.In addition, consumer confidence remains elevated and stable, with the negative effects of continuing economic and financial market turbulence being offset by record high employment levels and continued increases in house prices. Finally, further falls in the price of oil and strong competition in the supermarket sector are driving down the cost of basic necessities such as food and oil, freeing up household income to spend on other goods and services. Continue reading...

|

by Stewart Wood on (#124CV)

Google, crony capitalism and zero-hour contracts are just some of the things fuelling public anger. We need to channel that rage into reformGeorge Osborne did something foolish last weekend. On Saturday morning at 8.15am, possibly as his guard was down while munching on some rösti over breakfast in Davos, he tweeted: “#Google tax bill is a victory for the action we’ve takenâ€.Related: Google £130m UK back-tax deal lambasted as ‘derisory’ by expertRelated: The Big Shortfall: how UK taxpayers are cheated by business lobbyists | Simon Jenkins Continue reading...

|

|

by Graeme Wearden (now) and Nick Fletcher (2pm-7pm) on (#11ZQN)

Latest: US central bank leaves borrowing costs unchanged and reveals it is watching markets closely

|

|

by Editorial on (#1220F)

The debate about prevention and cure needs to break out of the confines of the seminar room and into the political debateThe Federal Reserve on Wednesday shrewdly declined to draw firm conclusions about recent mercurial swings of the markets. But investors are at least wary about a new global downturn. Citizens are similarly apprehensive: on Wednesday, Ipsos Mori’s confidence index gave the gloomiest reading in three years. Meanwhile, the economics profession has still only done a fraction of the difficult thinking demanded by the last crash. Sure, there is more understanding than in 2008 about banks keeping rainy-day funds aside, and more realism, too, about complex financial products, which exist to conceal rather than to manage risks. But the deeper questions about a more sustainable prosperity, less prone to disruptive vicissitudes, remain unanswered. So, too, does the immediate question about how to resuscitate the economy when it next falls to the floor.The nasty end to the Nice decade – the years of non-inflationary, continuous expansion – came so abruptly in 2008 that practice had to move faster than theory. Interest-rate cuts broke all records and, before the austerity turn, there was a fiscal stimulus too. Quantitative easing, which nobody had heard of until it started happening, entered the language. The same excuse for lack of preparedness is not going to cut it again. And yet – as a sobering Resolution Foundation report lays bare on Thursday – we are in some respects even less well-placed to respond. Continue reading...

|

|

by Guardian staff and agencies on (#121XJ)

US stock markets fell again Wednesday as the central bank left rates unchanged but pledged to monitor developments in the global economyUS stock markets fell again on Wednesday as the Federal Reserve announced it would keep key interest rates unchanged while pledging to closely monitor developments in the global economy and financial markets.In December the central bank made the decision to raise rates for the first time since the recession. Stock markets have been turbulent across the world since the move, and all the US markets entered negative territory again after the announcement.Related: Market panic’s over – but ingredients are there for more thrills on the rollercoaster Continue reading...

|

|

by Alex von Tunzelmann on (#121N9)

Adam McKay’s subprime meltdown drama is fast, witty and furiously righteous. But when it comes to the real events behind the story, is it a good bet?Director: Adam McKay

|

|

by Sarah Butler on (#120JR)

More than 200,000 Chinese holidaymakers visited in first nine months of 2015 and £2,700 spend per head is among highest, says VisitBritainThe number of Chinese tourists visiting the UK soared 37% in the first nine months of last year, taking the total to more than 200,000 in 2015.Chinese visitors collectively spent just 4% more than in 2014 – or £435m – according to the tourism body VisitBritain. However, that was a bounce back from a 1% fall in the same period a year before, after a 68% surge in 2013.Related: VisitBritain aims to attract Chinese tourists with new names for landmarks Continue reading...

|

|

by Anne Perkins on (#120H2)

The Labour leadership is recruiting Mariana Mazzucato and Thomas Piketty to revolutionise thinking about the way the UK economy should workFord is trying a bold new strategy to persuade the car-buying classes that, without quite going for the Ratner strategy of rubbishing its own product, it is now building something of novel and world-beating excellence. #Unlearn is a smart way of selling the idea of a change of direction.My interest in cars expires with a recognition of the strategy, so I’ve no idea whether the product matches the claim. But I like the idea. Labour could use some of this. In fact, it is on it already.Related: The Guardian view on the UK economy: the foundations are looking shaky | EditorialRelated: How Labour will secure the high-wage, hi-tech economy of the future | John McDonnell Continue reading...

|

|

by Alberto Nardelli on (#11ZSQ)

Measures in pound’s volatility reach levels that close in on last year’s pre-general election confusion, with buyers keen to seek protection from a slide in valueInvestors’ jitters over the Brexit referendum have reached levels not seen since the 2015 general election as financial institutions seek protection from a fall in sterling, according to market data.Measures of volatility in the value of sterling indicate mounting fears that Britons may vote to leave the EU and further weaken the British pound. Continue reading...

|