|

by Katie Allen on (#1677P)

Signs of improvement in industry after dismal 2015, according to manufacturers’ organisationUK manufacturers are hopeful they can eke out some growth this year after the 2015 slump, but worries about the world economy will continue to weigh on hiring and investment plans, a survey of the sector found.

|

| Link | http://feeds.theguardian.com/ |

| Feed | http://feeds.theguardian.com/theguardian/business/economics/rss |

| Updated | 2026-03-07 09:33 |

|

by Jill Treanor City editor on (#1677M)

Rules designed to hold executives to account come into effect alongside new offence of failing to prevent bank collapseThe City’s top regulator has said a new system designed to hold bank executives to account is “not about trying to get heads on sticksâ€.The new regulatory regime, which came into force on Monday and holds top executives responsible for failures in banks, has been watered down since it was first proposed, though Tracey McDermott, the acting head of the Financial Conduct Authority, insisted it would still have a major impact.Related: Jeremy Corbyn claims City firms treat ordinary workers like 'cash cows' Continue reading...

|

by William Keegan on (#165BB)

David Cameron is under fire from the press and Tory MPs. It would become him to act more courteously to the pro-Europeans on the other side of the houseThe cuts are getting closer to home. Last weekend, an 86-year-old near neighbour died in a house fire when he might have been rescued had the fire brigade not been suffering from a programme of cutbacks.One can never be sure in such cases, but the London secretary of the Fire Brigades Union, Paul Embery, pointed out the fire engines were significantly later on the scene than they should have been. Thanks to the cuts to local authority budgets which are an integral feature of George Osborne’s austerity policy, and reductions in the fire service being energetically pursued by the mayor of London, the borough of Islington has reportedly lost 60% of its fire cover in the past three years. The Islington Tribune – a newspaper David Cameron says he regularly subscribes to – reports that this leaves “just two engines for a borough with a population of more than 200,000â€. Continue reading...

by Australian Associated Press on (#164KV)

Oil price rose 4% after Australian market shut on Friday, while gold and iron ore both lifted by about 1% and Wall Street closed higherThe Australian share market is expected to open up to 40 points higher on Monday on the back of strong surges in oil and base metal prices.And all eyes will be on interest rate signals at home and abroad over the coming week.Related: Commonwealth bank admits failing customers over heart attack claimsRelated: ANZ to ‘vigorously defend’ interest rate rigging case Continue reading...

|

by Katie Allen on (#162H4)

We look back over seven years of ultra-loose monetary policySeven years ago on Saturday (5 March), the Bank of England slashed interest rates to a record low of 0.5%. At the time, the cut and plans to pump billions of pounds of electronic money into the economy seemed like an emergency measure to cushion the UK from the global financial crisis. But borrowing costs are still at their record low and amid warnings that a new global slump is around the corner, Bank policymakers show no signs of raising rates any time soon.We look back over seven years of ultra-loose monetary policy: Continue reading...

|

|

by Michael Paarlberg on (#161QT)

There is a disconnect between what indicators say and what workers feel. A hard look at the numbers shows all isn’t well

|

by Katie Allen on (#1614G)

Share index turnaround of 12% since February contributes to mood of cautious optimism in CityWas that it? The year began with warnings to sell up and hunker down for another financial crisis. But now investors have been left scratching their heads after the FTSE 100 enjoyed its third week of gains to soar back to where it started 2016.The index rallied 1% on Friday to close at 6,199.43, just shy of the 6,242.32 level at which it opened the year and above the 6,093 where it closed on the first trading day of the year. Continue reading...

|

by Graeme Wearden on (#15Z1M)

America’s non-farm payroll beats forecasts, but slight fall in average earnings ‘taints’ the picture

|

|

by Katie Allen on (#15XDF)

Service sector slowdown caused by financial market turmoil and fears of Brexit are likely to keep rates at historic lowThe UK is set for another year of record low interest rates, economists have predicted, following news that the dominant services sector suffered a sharp slowdown last month.Worries about the EU referendum, turmoil on financial markets and a faltering global recovery all took their toll on confidence among the UK’s services businesses and knocked their growth to a three-year low, according to a closely watched survey.

|

|

by Katie Allen on (#15X0R)

GDP fell 3.8% in 2015 as collapse in oil prices, rising inflation and political turmoil took tollBrazil’s economy suffered its worst slump for quarter of a century last year as a global commodity rout, a domestic political crisis and rising inflation forced businesses to slash spending and jobs.Related: Brazil: Moody's becomes third rating agency to label country's debt junk Continue reading...

|

|

by Nathan Schneider on (#15WST)

As his candidacy falters, where can that rapturous energy be channelled? Into building an economy that serves ordinary people, and excludes the 1%On Tuesday night I attended a Democratic caucus in a ballroom at the University of Colorado Boulder, where hundreds of college students rallied for the man they hope will become the oldest president in history. Speeches for Hillary Clinton received polite applause, while any reference to Bernie Sanders caused a short period of rapture.

|

|

by Katie Allen on (#15VP6)

Business activity and new work are weakest for nearly three years, mirroring gloomy reports in China and eurozoneWorries about the EU referendum, turmoil on financial markets and a faltering global recovery have hit confidence among the UK’s services businesses and knocked their growth to a three-year low.A closely watched survey of companies in the UK’s biggest sector, which covers hairdressers to insurers, showed business activity and new work both expanded at the slowest rate since March 2013.Related: UK service companies anxious about year ahead Continue reading...

|

|

by Press Association on (#15TBG)

Labour leader tells business leaders it was ‘extractive’ banks that drove the economy to the ‘point of collapse’ in 2007Jeremy Corbyn is to accuse City firms of treating ordinary workers like a “cash cow†as he calls for more state investment.In a speech to business bosses, the Labour leader will say it was the “extractive†banking industry rather than the government that drove the economy to the “point of collapse†in 2007.Related: What the bank results tell us about their and UK economy's healthRelated: Why on earth would HSBC leave a country that gives banks an easy ride? | Prem Sikka Continue reading...

|

by Greg Jericho on (#15SGF)

Despite the end of the boom, resources is still the most important sector, ably supported by building houses and buying things to put in themThe early signs for the GDP figures were not good – capital expenditure was weak and the outlook terrible, and on Tuesday the latest balance of payments figures showed that net exports would contribute nothing to GDP growth in the December quarter.But then the figures came out on Wednesday showing that in seasonally adjusted terms the economy grew by 0.6% in December and a very solid 3.0% for the year. Continue reading...

by Graeme Wearden (until 2.pm) and Nick Fletcher on (#15QBE)

All the day’s economic and financial news, as markets suffer another volatile day

|

by Hilary Osborne on (#15S2E)

Loose monetary policy has ‘annihilated’ returns on cash, but mortgage borrowers and investors have benefitedSeven years of quantitative easing (QE) and record low interest rates have cost savers an estimated £160bn, but supported strong increases in the prices of property, stocks and bonds.Analysis by financial firm Hargreaves Lansdown suggests that up to £106bn is being held in accounts paying no interest, as loose monetary policy has “annihilated†returns on cash. Continue reading...

|

by Ian Williams on (#15RX0)

What are the subtexts behind the doom-laden reports about the state of the NHS? Continue reading...

|

by Julia Kollewe on (#15RQ0)

World’s largest asset manager says vote to leave EU could trigger lower growth and investment in BritainThe world’s largest fund manager, BlackRock, has warned that a Brexit vote would damage Britain’s economy by leading to lower growth and investment, and possibly higher unemployment and inflation.In a gloomy analysis, the US asset manager said a decision to leave the EU would also hit the pound and UK equities, as well as damaging Britain’s financial industry, the London property market and the fashion industry. Continue reading...

|

by Nouriel Roubini on (#15RET)

Two dismal months for financial markets may give way in March to a relief rally for assets such as global equitiesThe question I am asked most often nowadays is this: are we back to 2008 and another global financial crisis and recession?My answer is a straightforward no, but that the recent episode of global financial market turmoil is likely to be more serious than any period of volatility and risk-off behaviour since 2009. This is because there are now at least seven sources of global tail risk, as opposed to the single factors – the eurozone crisis, the Federal Reserve “taper tantrum,†a possible Greek exit from the eurozone, and a hard economic landing in China – that have fuelled volatility in recent years. Continue reading...

|

by Martin Farrer and agencies on (#15PN9)

Dollar rises after output expanded by a better than expected 0.6% in the December quarter to give strong annual growthAustralia’s economy has weathered the end of the mining boom more strongly than expected after official figures showed that it grew by 3% in 2015.Related: Australia's investment figures stink, but one area smells a bit sweeter | Greg Jericho Continue reading...

|

|

by Julia Kollewe on (#15PGM)

Sales of super-yachts rose 40% last year despite number of millionaires and ultra rich falling, according to wealth reportThe global super rich continued to splash out on super-yachts and luxury goods last year, despite a decline in their overall wealth in the wake of financial market turmoil.According to the latest wealth report from estate agents Knight Frank, published on Wednesday, sales of super-yachts – boats longer than 24 metres – soared 40% in 2015, with the rich roaring off to ever more far-flung destinations, such as the Antarctic and outposts in Asia, rather than their traditional ports of call in the Mediterranean and the Caribbean.Related: World's 20 richest people are $70bn poorer, says Forbes Continue reading...

|

|

by Phillip Inman Economics correspondent on (#15NV0)

Factory output contracted in China and UK last month, while growth slowed in other major economies including USChina’s factories have stumbled through last month’s new year celebrations to join a broad decline in manufacturing across Europe and the US, adding further evidence of sharp downturn in the global economy since the beginning of the year.Factory output contracted in China and the UK during February while growth slowed in France, Germany, Italy and the US to indicate that businesses and consumers remain wary of committing themselves to large orders while the direction of global trade remains uncertain.

|

|

by Letters on (#15NP6)

The debate on the EU referendum has thus far repeated that of the Scottish independence referendum – unlike parliamentary elections, where debate is (or can be) on policy built on evidence, a single-issue referendum on a constitutional/economic issue risks descending into an exchange of guesswork built on anecdote (Boris has just launched his latest myth, 27 February).I suggest that it would better if both sides provide a manifesto with policy detail and projected consequences for our country five and/or 10 years from now. The out campaign manifesto should, among other things, clarify which model is proposed for UK-EU relations (eg the Norway model? Or a trading relationship as with a comparably-sized economy like, say, South Korea? Or a new and unique model – to be specified?); and which specific EU laws would be repealed with newly re-established exclusive sovereignty, and with what effect? Continue reading...

|

|

by Graeme Wearden (until 2pm) and Nick Fletcher on (#15KEZ)

All the day’s economic and financial news, as manufacturers across the globe suffer a poor February

|

by Phillip Inman and Graeme Wearden on (#15N1F)

Factories suffered decline in growth of domestic orders in February coupled with a second month of falling exportsBritain’s factories suffered a decline in growth of domestic orders in February which, coupled with a second month of falling exports, saw them register their worst performance in almost three years.The weakening picture, which also saw a second month of declining employment, comes after George Osborne warned of a cocktail of threats and gathering storm clouds in the world economy wreaking havoc on global trade.Related: March of the makers remains a figment of Osborne's imagination Continue reading...

|

by Michelle McGagh on (#15M7J)

The average British person is consuming fewer things. Perhaps we are slowly beginning to realise that less really is moreBritain has fallen behind most of Europe when it comes to consumption, but it shouldn’t be seen as a negative; we could be at the forefront of a positive trend for more thoughtful purchasing.Recent data from the Office for National Statistics shows the average person is consuming fewer resources than they were a decade ago, recording a fall from 15 tonnes of material in 2001 to 10 tonnes in 2013. We also use less material per person than any other European country bar Spain.Related: UK consumes far less than a decade ago – 'peak stuff' or something else?Related: Why I'm buying nothing for a year – no clothes, no holidays, no coffee ... Continue reading...

|

|

by Katie Allen on (#15KWW)

Usdaw calls for talks with British Retail Consortium amid concerns women could bear brunt of predicted 900,000 job lossesFemale workers will be disproportionately hit if a prediction of almost 1 million job losses from the UK’s retail sector becomes a reality, the industry’s trade union has warned.Related: UK retail sector predicted to cut 900,000 jobs Continue reading...

|

|

by Katie Allen on (#15HW8)

Bloc slips into negative inflation for third time in a year prompting fears eurozone is heading for deflationThe European Central Bank is under growing pressure to step up support for the eurozone’s flagging economy after the bloc slipped back into negative inflation in February.The surprise drop in prices marked the third time in a year that inflation has turned negative, fanning fears that the eurozone is headed for all-out deflation – a sustained period of falling prices. The news cemented market expectations that the ECB would use its meeting next week to inject fresh cash into the single currency bloc and to cut a key interest rate further into negative territory.Related: Central bankers on the defensive as weird policy becomes even weirder Continue reading...

|

|

by Katie Allen and Graeme Wearden on (#15HTZ)

The People’s Bank of China has loosened rules on banks’ cash reserves for the fifth time in a year in the hope cheaper loans will be made availableChina’s central bank has stepped up action to bolster its cooling economy by loosening the rules on banks’ cash reserves in the hope that they will offer cheaper loans.By cutting the reserve requirement ratio (RRR) – the amount of cash that banks must hold as reserves – the People’s Bank of China has in effect injected $100bn (£72bn) of long-term cash into the economy, experts said.Related: Chinese shares slump 6% as Beijing tries to reassure markets ahead of G20 Continue reading...

|

|

by Uki Goñi in Buenos Aires on (#15HK3)

Country’s default on $82bn foreign debt in 2001 sparked long-running saga with creditors led by US hedge fund Elliott ManagementArgentina’s new president, Mauricio Macri, struck a $4.65bn agreement with the US creditors on Monday, ending a 15-year debt dispute between Argentina and a number of holdouts led by US billionaire financier Paul Singer.Related: Argentina's former president suspected of role in peso inflation scheme Continue reading...

|

by Patrick Collinson on (#15GFS)

From crops to energy and metals, average material consumption fell from 15 tonnes in 2001 to just over 10 tonnes in 2013The amount of “stuff†used in the UK – including food, fuel, metals and building materials – has fallen dramatically since 2001, according to official government figures.The Office for National Statistics data released on Monday reveals that on average people used 15 tonnes of material in 2001 compared with just over 10 tonnes in 2013.Related: Why I'm buying nothing for a year – no clothes, no holidays, no coffee ... Continue reading...

|

by Graeme Wearden (until 2.20) and Nick Fletcher on (#15FKD)

All the day’s economic and financial news, as UBS says sterling would suffer a sharp correction if Britain votes to leave the EU

|

|

by Rowena Mason Political correspondent on (#15GYR)

Labour leader says former Greek finance minister is helping the party ‘in some capacity’The former Greek finance minister Yanis Varoufakis is giving advice to the Labour party, Jeremy Corbyn has revealed.In an interview with his local newspaper, the Islington Tribune, the Labour leader disclosed that Varoufakis was helping “in some capacityâ€. Continue reading...

|

|

by Joanna Elson on (#15G32)

People are less likely to seek help if they fall behind on household bills, but this has become a bigger issue than loans, overdrafts and credit cardsFor many people, being in debt and being financially excluded are two sides of the same coin. Debt can be both a consequence and a cause of financial exclusion.It is easy to see how households can become trapped in a vicious cycle. To understand how we can help them out of it, it is important to understand just how quickly the UK’s personal debt landscape is changing.

|

|

by words: Lucy Jolin; graphics: James McLeman on (#15FGJ)

Deciding where to base your enterprise can affect its chances of success. From funding opportunities to local talent, we look at the cities that come out on top

|

|

by Katie Allen on (#15ERG)

Treasury select committee chair Andrew Tyrie calls for shakeup of Office for National StatisticsAndrew Tyrie, the chairman of the Treasury select committee, has called for sweeping changes to how the UK produces official statistics to improve the quality of economic data.Chancellor George Osborne should use March’s budget to launch a shakeup of the Office for National Statistics (ONS), urged Tyrie, who recently criticised the body for falling behind its international peers and jeopardising policy decisions with “rubbish†statistics. Continue reading...

|

|

by Katie Allen on (#15ERJ)

Resolution Foundation thinktank says 5m extra hours a week are needed to free up part-time roles for new entrants and the economically inactiveMillions of UK workers are stuck in the wrong job or working fewer hours than they would like, according to a report warning that this army of underemployed people are blocking opportunities for those outside the labour market.The Resolution Foundation thinktank said that 5m extra hours of work a week are needed to soak up employees’ demands for more work. Moving those underemployed into longer hours would free up their part-time roles for new entrants, including those currently defined as economically inactive – many of whom have health problems or caring responsibilities. Continue reading...

|

|

by Heather Stewart and Anushka Asthana on (#15EHY)

Brexiters play down the difficulties of renegotiating trade and other deals, but the process of withdrawal could take yearsFor the first half century of its existence, joining the club of nations that became the European Union was, in legal terms at least, forever. Once inside, there was no way out.But the Lisbon Treaty, which came into force in 2009 to streamline the EU’s working practices after it had expanded to include the former communist states of eastern Europe, also signposted the exit for the first time. Continue reading...

|

|

by Editorial on (#15E5W)

The people of the republic have suffered. Now it is the politicians’ turnThe voters don’t do gratitude, self-pitying politicians are wont to moan. For technocratic admirers of Dublin’s outgoing Fine Gael/Labour coalition, the Irish election of 2016 has proved the point. In 2011, a near-bankrupt and recently bailed-out republic turned to Enda Kenny as a new broom, and his government enjoyed a record majority. Five years on, the economy is growing at quite a pelt, an unemployment rate which had been at 15% is back down in single figures, and after years of retrenchment the government has – finally – got its own debt back down below 100% of GDP. Europe’s economic authorities, who have had precious few austerity success stories to point to, have clung on to Ireland as a case that shows the medicine can work.But by routing Mr Kenny with unexpected ferocity, the voters have revealed that they do not see things this way at all – and don’t assume that they are wrong. For several years into the technical recovery, living standards continued to slide. While protesters against stiff new water charges were briefly locked up, the bankers who led Ireland into the mire still walk free. Wages remain insecure, and public services – which were always patchier in Ireland than the UK – have become less adequate. The bill for the crisis was passed to citizens who had nothing to do with its cause, and now the people are justly seething. Continue reading...

|

|

by Katie Allen on (#15CSN)

George Osborne has been determined to pursue cuts even as the economy struggles. But continued austerity now could be truly damagingSeven years ago this week, the Bank of England cut interest rates to 0.5% – the lowest since the central bank was founded in 1694. In a drastic bid to stem the fallout from the global financial crisis, then governor Mervyn King and his fellow policymakers also kicked off the process of pumping tens of billions of pounds into the economy.Unsurprisingly, Labour chancellor Alistair Darling welcomed the flood of money. The economy had been battered by recession, house prices were falling and unemployment was high.Related: George Osborne warns of further cuts as 'storm clouds' gather Continue reading...

|

|

by Press Association on (#15CP2)

The former Bank of England governor says in his new book that imbalances in the global economy makes a crash inevitableAnother financial crisis is “certain†and will come sooner rather than later, the former Bank of England governor has warned.

|

by Martin Farrer and agencies on (#15A5J)

Finance ministers warn about danger of Britain leaving EU and pledge to use all policy tools to lift global growthBritain’s possible exit from the European Union could pose a risk to the world economy, the G20 finance ministers’ summit in China has agreed, according to the chancellor, George Osborne.

|

by Jill Treanor on (#1590S)

RBS, Lloyds, HSBC and Standard Chartered insist they are strong enough to withstand another global downturn, but is that what their figures reveal?Four of Britain’s biggest banks reported annual results this week and insisted they were robust enough to withstand another global downturn. But what did the results for HSBC, Standard Chartered and the bailed-out duo of Lloyds Banking Group and Royal Bank of Scotland tell us about the industry and the wider economy?Related: British bank annual results – interactive Continue reading...

|

|

by Nicholas Watt Chief political correspondent on (#158Q6)

Chancellor says he will address gloomy economic outlook in budget and ‘this country can only afford what it can afford’George Osborne has warned he may have to impose bigger than expected cuts to public spending towards the end of the current parliament as the “storm clouds†in the global economy hit economic growth.In a move to prepare the ground for a sharp deterioration in the public finances in the budget next month, the chancellor said the recent fall in nominal GDP numbers showed the British economy was smaller than expected.Related: IMF urges G20 to take 'bold action' on global economyRelated: It’s the £30bn cut you’ve never heard of. And women are bearing the brunt | Gaby Hinsliff Continue reading...

|

|

by Edward Helmore and agencies in New York on (#158B6)

New figures revising economic growth upward suggest US economy may be able to withstand a global slowdown better than many economists anticipatedThe recent economic slowdown in the US may have been less severe than previously estimated, according figures released by the Commerce Department on Friday.

|

by Nick Fletcher on (#156Y7)

|

by Christopher Furlong/Getty Images on (#1584J)

Research shows the band continues to add £81.9m to Liverpool’s economy a year and supports 2,335 jobs Continue reading...

|

|

by Nicholas Watt on (#1576X)

Senior Tory challenges ministers’ warnings about economic dangers for Britain of leaving the European UnionBritain should vote to leave the “flawed and failing†European Union, the former Conservative leader Michael Howard has said.He becomes one of the most senior Tories to reject David Cameron’s EU reform deal.We are the fifth largest economy in the world. Everybody wants access to our marketRelated: David Cameron warns Brexit could cost jobs and force up prices Continue reading...

|

|

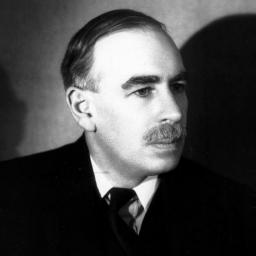

by Robert Skidelsky on (#15773)

The notion that governments can and should prevent depressions is a lasting influence of Keynesian thinkingIn 1935, John Maynard Keynes wrote to George Bernard Shaw: “I believe myself to be writing a book on economic theory which will largely revolutionise – not, I suppose, at once but in the course of the next ten years – the way the world thinks about its economic problems.†And, indeed, Keynes’s magnum opus, The General Theory of Employment, Interest and Money, published in February 1936, transformed economics and economic policymaking. Eighty years later, does Keynes’s theory still hold up?Two elements of Keynes’s legacy seem secure. First, Keynes invented macroeconomics – the theory of output as a whole. He called his theory “general†to distinguish it from the pre-Keynesian theory, which assumed a unique level of output – full employment.Related: Keynes helped us through the crisis – but he's still out of favour Continue reading...

|

|

by George Arnett on (#156W3)

Manual and lower-paid households have been in minority since turn of millennium – spelling bad news for Labour partyThe year 2000 was when Britain became more middle class than working class, according to social grading data.The proportion of households working in non-manual professions (known as ABC1s) was 50.6% at the turn of the millennium. It has since increased further, reaching 54.2% last year.

|